Report Overview

Green Hydrogen Market - Highlights

Green Hydrogen Market Size:

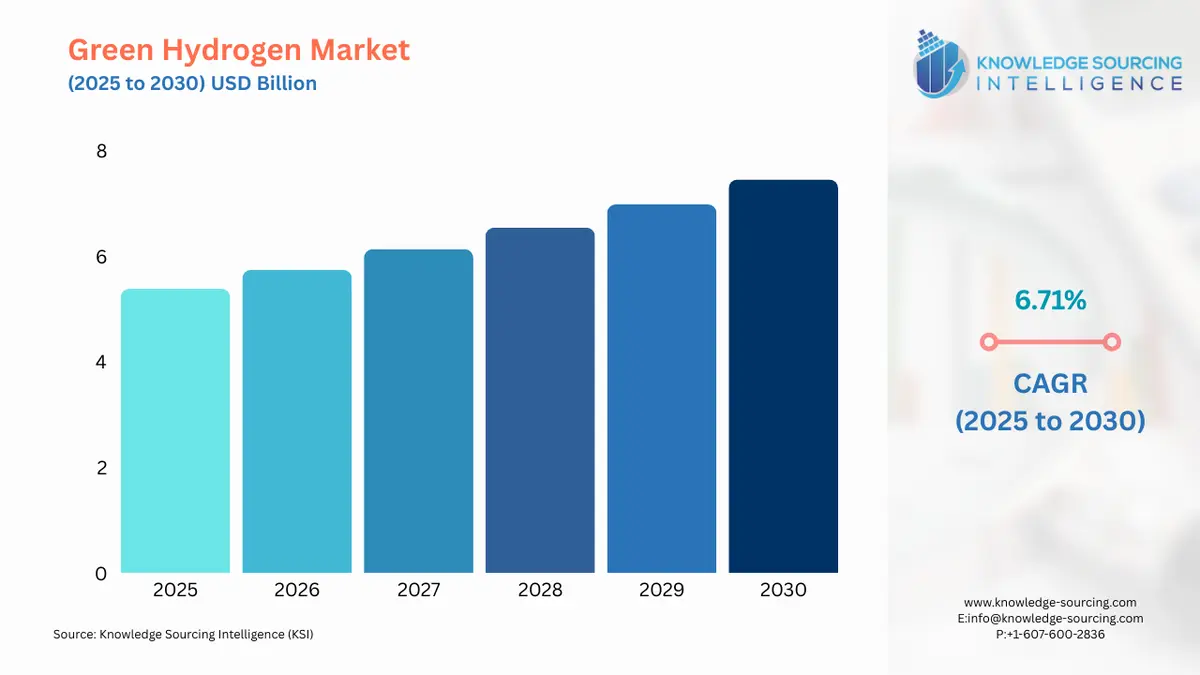

The green hydrogen market is expected to grow at a CAGR of 6.71%, reaching a market size of US$7.446 billion in 2030 from US$5.382 billion in 2025.

During the projection period, it is expected that the green hydrogen market will grow steadily. Green hydrogen is produced using renewable or low-carbon energy sources. Grey hydrogen, which comes from fossil fuels without carbon capture, has far higher carbon emissions than green hydrogen. Cement and iron manufacturing, two industries that are difficult to electrify, can be decarbonized using green hydrogen. The primary component of synthetic fertilizer, green ammonia, is from green hydrogen, which is also being utilized for long-term seasonal energy storage and long-term grid energy storage.

As more people become aware of hydrogen's potential as an energy source, the green hydrogen industry is expected to grow. The market is expanding as a result of rising environmental concerns, which highlights the importance of producing clean, renewable energy to reduce emissions. Additionally, as nuclear power and green hydrogen are being used more often, the green hydrogen market is growing. The demand for green hydrogen is anticipated to be driven by the presence of supportive government policies promoting it and the growing environmental concerns around rising carbon emissions from the use of fossil fuels.

Green Hydrogen Market Trends:

The market is expected to grow with the growing innovations toward renewable sources and the growing shift of policies towards support of environment-friendly energy and decarbonization. The governments globally are working on offering investment funding and incentives with decreased taxation to promote renewable energy like solar, wind, and electrolysers for making the production of green hydrogen a viable process for companies. The growing technological advances in proton exchange membrane electrolysers and solid oxide electrolysers, and an increase in production of alkaline electrolyzers, are also promoting cost-efficient and scalable production. The stringent regulator policies for the adoption of green hydrogen by diverse sectors like chemical and transport are also fueling the market in the coming years.

Green Hydrogen Market Dynamics:

Market Drivers

- Increasing government support

Government around the world plays a key role in developing regulatory and policy frameworks that support the green hydrogen industry and provide it with long-term stability and predictability. Government globally is concentrating on creating targets for renewable energy, setting emission reduction objectives, and putting in place carbon pricing systems, all of which encourage the demand for green hydrogen. Regulations that encourage the integration of green hydrogen into current energy systems, such as supporting fuel cell technology or mixing it with natural gas in pipelines, are another factor driving green hydrogen market growth. - Rising demand for renewable energy solutions

Renewable energy sources are intermittent, and the weather determines how they are produced. Storage of energy becomes essential for balancing the sporadic supply and demand. During times of surplus renewable energy output, green hydrogen is created and stored for later use. It offers a dependable energy storage option and improves grid stability by serving as a feedstock in industrial operations or by being transformed back into power via fuel cells. For converting to renewable energy and lowering carbon emissions, several governments and commercial organizations have established goals. These objectives frequently place a strong emphasis on the creation of green hydrogen as a crucial element of energy transition plans, fueling the green hydrogen market growth. - Increasing investments in R&D activities

The performance and longevity of green hydrogen technologies are the primary goals of research and development. Increased hydrogen production rates and lower maintenance costs are being achieved by extending the lifespan and improving the efficiency of electrolyzers. The efficiency and dependability of hydrogen-powered cars and other uses can also be improved by developments in fuel cell technology. Such investments can reduce the price of producing green hydrogen while addressing the green hydrogen market’s main cost limitation. Furthermore, green hydrogen market growth is fueled due to lower production costs, attracting investment and boosting market acceptance. - Advancement in technology

The worldwide green hydrogen industry is noted to have a wide range of development potential due to specific technical breakthroughs in electrolyzers, renewable energy generation, and decarbonization processes. Technological development helps provide the infrastructure needed for the green hydrogen market. This involves the development of hydrogen refueling stations and pipelines, as well as improvements in hydrogen storage and transportation techniques, such as high-pressure or cryogenic storage. There are greater prospects for the mainstream use of green hydrogen as the infrastructure grows. - Increasing use of green hydrogen in the transportation industry

Green hydrogen is widely employed in transportation due to its many environmental benefits, such as lowering air pollution in metropolitan areas and total carbon dioxide emissions to the atmosphere. Green hydrogen is a viable strategy for an energy-efficient and decarbonized system that can replace fossil fuels in the transportation industry. By 2030, the European Union (EU) would have over 5,000 hydrogen fuelling stations with a combined capacity of roughly 2,615,000 tonnes of green hydrogen to serve hydrogen fuel cell automobiles. Through 2023, China has committed to investing more than US$217 billion in hydrogen-powered transportation, which is surging the green hydrogen market growth.

Market Restraints

- High Cost of Production and Infrastructure: The production of hydrogen is a costly process involving water electrolysis, like SOEC, and the conventional method of hydrogen production is also expensive. The requirement of 100 percent renewable electricity for its production also increases the expenses. this demand for high initial investment in construction of plants, storage spaces, and in shipping solutions, which add to the financial which together, could hamper the market growth.

Green Hydrogen Market Segmentation Analysis:

By Technology

Alkaline Electrolyser is dominating due to its cost-effectiveness and suitability for large-scale applications.

Based on technology, the market is categorized into proton exchange membrane electrolyzer, alkaline electrolyzer, and solid oxide electrolyzer. The alkaline electrolyser segment is expected to hold the largest market share due to its relatively cost-effective nature and has increased scalability and effectiveness on a large scale, and well-established infrastructure. This technology was utilized in applications mainly in industrial developments for hydrogen production, and has grown to become a major technology of green hydrogen, using renewable energy to split water molecules into hydrogen and oxygen sustainably.

Advantages include substantially cheaper capital investments, longer life spans, proven reliability in large volume production, which makes them suitable for baseload operations in combination with stable renewables like hydropower. Applications of alkaline electrolyser range from transportation in fuel cell vehicles, power generation for grid balancing, industrial processes such as chemicals and steel decarbonization, and energy storage.

Additionally, some major players, such as Nel ASA, announced signing a licensing deal with Reliance Industries in May 2024 with the intention of manufacturing Nel alkaline electrolysers in India by Reliance. Additionally, the growing innovations like Shuangliang Group announced the launch of its largest alkaline electrolysers with a manufacturing capacity of 5000Nm³/h unit in October 2024. This type of development will further promote the segment during the projected period.

Green Hydrogen Market Regional Analysis:

By region, the market is segmented into North America, South America, the Middle East and Africa, and Asia-Pacific.

- North America

North America is one of the fastest-growing markets in the green hydrogen industry, with an increase in the reduction of fuel, causing carbon emissions, and promoting friendly energy sources through investments. The United States and America are notably playing a substantial role in the growth of the market. For instance, in January 2025, the USA introduced the Clean Hydrogen Production Tax credit, which is a provision under its Inflation Reduction Act, and is offering an incentive of about 43 per kilogram for clean hydrogen. Similarly, the Canadian government announced the Made in Canada plan in March 2023, which is focused on phasing out fossil fuels. It also proposed the plan to support the domestic production of environmentally friendly and clean green hydrogen. - Europe

Europe's energy transition to a sustainable environment is the key reason driving the regional green hydrogen market. In the industrial, electrical, and transportation sectors, green hydrogen can replace fossil fuels in a variety of ways. It may replace extremely polluting coking coal as a feedstock for creating steel, and natural gas can take its place in the industry of petroleum refining. Germany is moving towards totally carbon-free electrical systems; thus, the need for green hydrogen is set to rise quickly. The National Hydrogen Strategy of the German government of 2023 is focused on the production of green hydrogen with the premise of demand growing in the country by 95-130 terawatt hours by 2030. This strategy is also aimed at setting goals for increasing hydroge production capacity requirements between 2030 and 2045. The increase in demand for green hydrogen is expected to be 90-110 TWh by 2030. - Asia-Pacific

Asia Pacific dominated the green hydrogen market, with growing investment in decarbonization with strict goals for reduction in fossil fuels and in investment for low-cost solar, the rise in electrolyser production and export by China, along with increased incentives and schemes for development of infrastructure and production of green hydrogen by India, are major drivers for the region's position. For instance, the Indian Government launched the National Green Hydrogen Mission under the Ministry of New and Renewable Energy (MNRE) for promoting the domestic production, utilization, and export of green hydrogen and its associated derivatives. It also focuses on making the country a major hub for green hydrogen with strategic incentives like ? 17,490 crore proposed for the production of green hydrogen along with manufacturing electrolyzers by 2029-2030. Moreover, it also outlined ? 400 crore 2025 2026 for green hydrogen infrastructure hubs and other related projects. - South America

The South American region is witnessing a substantial growth in the integration of green hydrogen with the presence of abundant renewable energy like solar and wind, along with several projects in development in regions like Brazil and Argentina. Brazil has large onshore resources, thus leading in the production and export of clean power. Along the supportive government policies across countries like Argentina, Chile, and Colombia for the commitment to decarbonization is also boosting the regional market growth in the years to come. - The Middle East and Africa

The Middle East and Africa are growing at a steady pace due to region's strong renewable energy potential like strong wind corridor, which is essential in production of green hydrogen, the supportive government projects to promote renewable energy production like NEOM project in Saudi Arabia under Vision 2030, this increase in generation of renewable electricity makes it scalable and cost-effective region for the market growth.

Green Hydrogen Market Competitive Landscape:

The green hydrogen market is highly competitive with growing innovations, cost-reductions, and partnerships among companies, the growing focus on the development of green hydrogen production processes with supportive AI and electrolyzer technologies, and regional projects for increasing the global reach of the market players are also promoting he competition. The business re also focusing on innovation in electrolyzers with emphasis on diverse generation technologies such as SOEC. Further, some market players are also focused on collaboration for increasing their presence or global supply chain advancement, while some companies are focused on large-scale green hydrogen projects with the establishment of facilities equipped with advanced operations systems like wind turbines, predictive meteorological modeling, and grid-forming battery storage systems. The increase in partnerships between governments and green hydrogen providers will also work in increasing the market by aligning the focus of the decentralized renewable-powered hydrogen generation to achieve the net-zero target globally, which will also contribute to increasing competition.

List of Key Company Profiled

- Green Hydrogen Systems

- Ohmium

- AES

- ACWA Power

- Acciona

- Siemens Gamesa

- Green Hydrigen International

- Other

Green Hydrogen Market Key Developments:

- Plant Launch: In July 2025, Envision appointed the largest green hydrogen and ammonium production facility, which is equipped with AI AI-enabled off-grid renewable energy system. It is located in China and could produce about 320,000 tons of ammonia annually, and is predicted to start by the fourth quarter of 2025. Further, the company plans to make the plant reach a scale production of about 1.5 million tons of green ammonia annually by 2028.

- Green Hydrogen Pilot Plant: In June 2025, Adani New Industries Limited announced the commissioning of the fully off-grid green hydrogen pilot plant project, which is the first in India. It is located in Gujarat with a capacity of 5MW and is operated with 100 percent solar energy and integrated with a battery energy storage system for ensuring efficient, wholly off-grid operation of the plant.

- Collaboration: In November 2024, the Ministry of Energy and Mineral Resources in Jordan signed an MOU with HDsolar to explore the possibility of producing green hydrogen in the country. The move will utilize the renewable energy resources available in the country for the production of green hydrogen, in line with the commitment made by the nation toward sustainability and energy security. The project will help elevate Jordan as a regional hub for green energy in alignment with the country's goals to increase its share of renewable energy in the national grid.

- Partnership: In November 2024, Denmark and the Netherlands entered into a partnership to intensify cooperation in the green hydrogen area. Denmark and the Netherlands signed a declaration at the Dutch-Danish Forum that formed a prominent green hydrogen cluster in Northwest Europe. Its purpose is to enhance the infrastructure of green hydrogen, increase demand, and get governmental support for competitive sourcing of energy. The collaboration underlines that both nations are committed to innovation and sustainability within the energy sector.

- Production Plant Launch: In October 2024, Swedish company GreenIron plans to start the production of its green metals production plant in Sandviken, utilizing its patented zero-emissions technology that incorporates green hydrogen as a reducing agent. This innovative process aims to minimize carbon emissions linked with the production of metal, with a furnace expected to eliminate an estimated 56,000 tonnes of CO2 annually. GreenIron's approach not only promotes sustainable metal production but also aligns with global efforts to transition to cleaner energy sources and reduce the environmental impact of the Ametals industry.

Green Hydrogen Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 5.382 billion |

| Total Market Size in 2031 | USD 7.446 billion |

| Growth Rate | 6.71% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Technology, Distribution Channel, Application, Geography |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

Green Hydrogen Market Segmentation:

- By Technology

- Proton Exchange Membrane Electrolyzer

- Alkaline Electrolyzer

- Solid Oxide Electrolyzer

- By Distribution Channel

- Pipeline

- Cargo

- By Application

- Power Generation

- Transportation

- Industry Energy

- Industry Feedstock

- Others

- By Geography

- North America

- United States

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- United Kingdom

- Germany

- France

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Israel

- Others

- Asia Pacific

- Japan

- China

- India

- South Korea

- Indonesia

- Thailand

- Others

- North America