Report Overview

Brazil Electronic Health Records Highlights

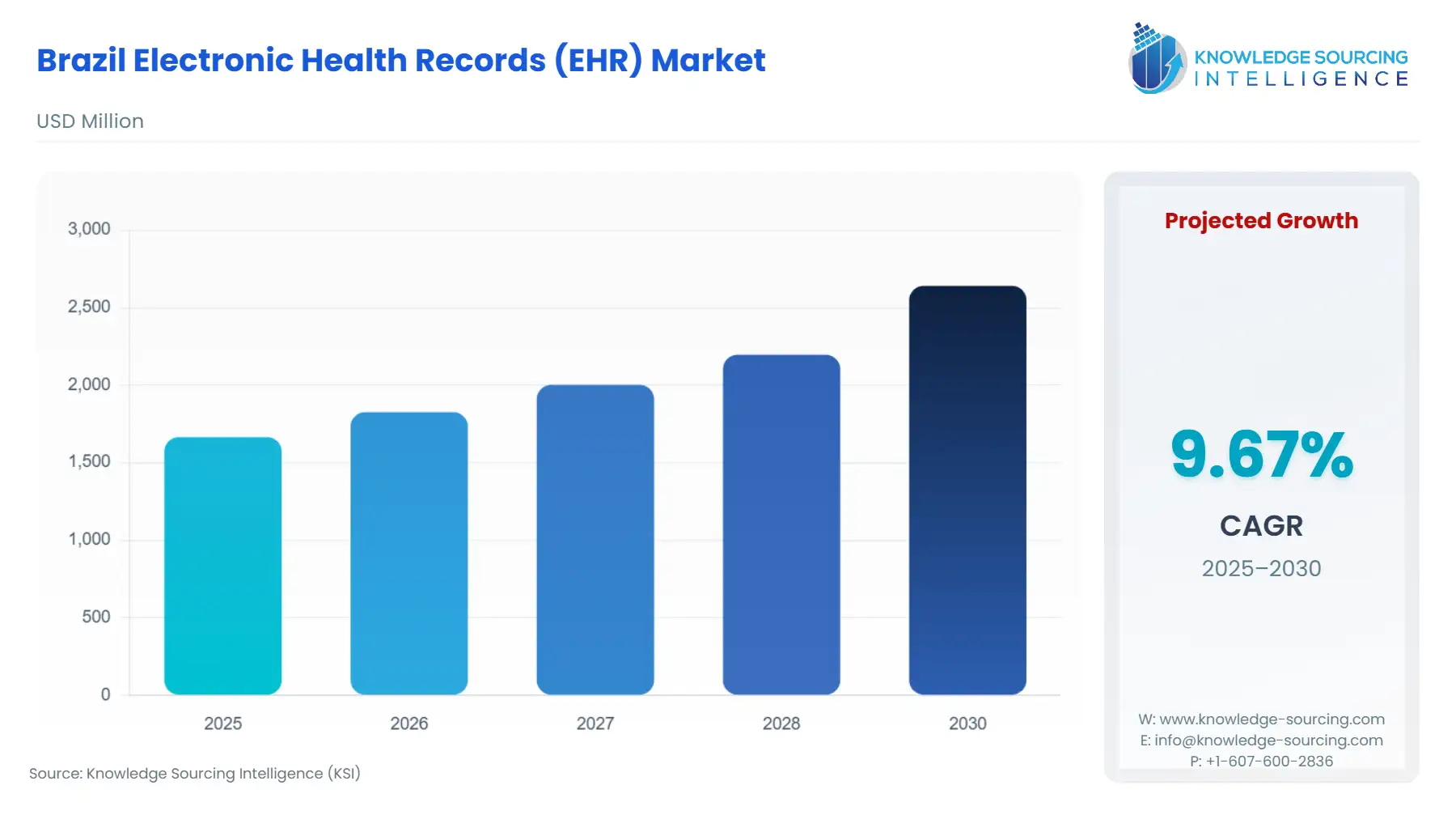

Brazil Electronic Health Records (EHR) Market Size:

The Brazil electronic health records (EHR) market is poised for considerable growth, thereby attaining a market size of US$2.641 billion by 2030, and growing at a 9.66% CAGR from a valuation of US$1.665 billion in 2025.

Brazil Electronic Health Records (EHR) Market Key Highlights:

- National Integration via RNDS - The government's National Health Data Network (RNDS) links hospitals, clinics and labs to allow patient data to be interoperable at a national level while increasing EHR adoption.

- Moving to Cloud - Hospitals and clinics are moving away from on-premise infrastructure and moving to cloud EHR platforms, lessening the infrastructure costs of health care providers without sacrificing accessibility and efficiency.

The Brazilian electronic health records (EHR) market is expected to witness significant growth, primarily driven by the Brazilian government policies and strategy for fuelling the adoption of digital technology like EHR and increasing the digital health transformation in the country. For instance, the “Brazilian Digital Health Strategy (2020-2028)” by the Ministry of Health highlights the government's focus on digitalization and integration of the health data system in the country. The action plan involves seven priorities, which include digitalization of three levels of healthcare that involve fuelling the adoption of the EHR and hospital management systems in the healthcare services and processes across the country.Moreover, the same source reported that Alagoas state was selected for pilot and additional investment to upgrade the provision of healthcare infrastructure for the installation of the EHR software offered by the Ministry of Health for Primary Care, i.e., e-SUS-APS. National Healthcare Data Network (RNDS) and Electronic Health Record for the Citizen (RES) present a central of this transformation in digitalization with the aim to ensure that the clinical data of patients across the country follow the national healthcare system (SUS). The strategy also emphasizes the interoperability and implementation of EHR across all levels of healthcare. This initiative works in accelerating the implementation of EHR for assisting healthcare settings and the provision of medical records and electronic prescription services.

Moreover, the increase in the aging population in Brazil, with the prevalence of chronic disease, is also leading to a growing necessity for efficient data management solutions like EHR in the country for efficient patient record storage, analysis, and sharing, followed by better patient health outcomes. The population aged 65 and above in Brazil was 22.452 million in 2023, which grew to account for 23.424 million in 2024, as pe r the data from Brazil. Similarly, according to IBGE, the elderly people who are 60 and above are expected to rise from 15.6 percent in 2023 to 37.8 percent by 2070 in Brazil.

Brazil Electronic Health Record Market Overview & Scope

The Brazil electronic health record market is segmented by:

- Product: By product, the market is segmented into cloud based EHR and on-premise EHR. Cloud-based EHR is being adopted by vendors and customers due to its advantages, including the ability to access the EHR from anywhere in the cloud and lower costs. The increase in cloud-based EHR also has players focusing on providing more security capabilities, which helps to further foster cloud-based EHR for those end-user customers who have security fears and concerns. On-premise products have value as well, especially for those organisations that want to maintain absolute full control of the EHR.

- Type: By type, acute, ambulatory, and post-acute are the major segments. Acute EHRs are emergency department EHRs for electronic documentation of a patient's medical information in acute care settings. These EHRs are desired because of their real-time updating, integration with other systems, and ability to maintain a workflow. Ambulatory EHRs are effectively outpatient healthcare EHRs. The ambulatory market represents a significant share of the EHR market, in part due to the ambulatory EHR for managing user access to patient interactions through valuable portals and features that track patient billing and coding. The utilisation of post-care EHR is increasing. There is a demand for post-care electronic health records by hospitals, clinics, pharmacies, laboratories, and others. Hospitals are the leading segment of the demand for electronic health records systems because of their volume of demand.

- End-Use Industry: The market is segmented into hospitals, clinics, pharmacies, laboratories, and others. The EHR systems used in hospitals are the most sophisticated because hospitals typically address the most complex and data-centric patient care. EHRs for hospitals incorporate admission, emergency, surgical intervention, lab results, imaging, and discharge information all on one platform. This method provides better continuity of care, minimises redundant tests, and ultimately increases patient safety.

Top Trends Shaping the Brazil Electronic Health Record Market

- Interoperability via National Health Data Network (RNDS)

- Brazil is working towards a single digital health data environment for its health system through the RNDS. RNDS aims to connect both public and private systems, allowing for more efficient data sharing of hospital records, lab results, and primary care information within a singular data repository. This will improve fragmentation throughout the health system and facilitate better health care coordination.

- Cloud-Based EHR Adoption Accelerates

- Cloud-based EHR deployments present the fastest-growing segment of the overall hospital market in Brazil. Hospitals see the advantages of flexibility, scalability, reduced infrastructure costs, and more frequent updates. As a result, there is momentum away from on-premise EHR environments.

Brazil Electronic Health Record Market Growth Drivers vs. Challenges

Drivers:

- Government Policy & Interoperability Push: Brazil's health regulator launched a National Policy for Health Information and Informatics (PNIIS) established in interoperability. This requires all healthcare providers in the public and private sector to connect and enter data into the National Health Data Network (RNDS). They must use standardized terminology and report and maintain data accuracy, and technical confidentiality, this increases digital transition of hospitals and clinics while creating an incentive to purchase, implement and maintain electronic health records (EHR) systems to meet compliance regulations and integrate with the whole health ecosystem.

- Expansion of Unified Digital Health Platforms: Conecte SUS and the Minha Saúde Digital app national implementations integrate citizen health records in real time; they share the patient history, tests, immunisations, and dispensing prescriptions to everyone across all concessioned regions, such as from Amazonas to São Paulo. Creating a demand for EHRs that can connect or export to these programs. The valuable outcome is a better continuity in patient care, stopping duplication, and creating a clear financial incentive for hospitals and clinics to implement or upgrade to EHR tools.

Challenges:

- Fragmented Infrastructure: Accessing care in Brazil is divided into the public and private systems, with both using different technologies and standards. The technological differences further add to the fragmentation of the health system making it difficult to develop interoperable systems across Brazil. Smaller clinics generally have no funding for implementing more advanced electronic health records/social determinants of health dimensions, resulting in unequal access to healthcare and gaps in the integration of national digital health initiatives.

Brazil Electronic Health Record Market Key Development:

- Brazil’s Ministry of Health launched the National Health Data Network (RNDS) as part of its Digital Health Strategy.: In 2020, Brazil's Ministry of Health introduced the National Health Data Network (RNDS), as part of the country's Digital Health Strategy that supports national integration of patient data, interoperability among public and private providers, and access to digital services controlling for vaccination, testing and prescriptions via services including Conecte SUS and the Meu SUS Digital App. The implementation of the RNDS is the first step in Brazil to unify health information systems, allowing for better data access and should continue to stimulate the adoption of computerised health records in hospitals, clinics and practices.

Brazil Electronic Health Record Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Brazil Electronic Health Records (EHR) Market Size in 2025 | US$1.665 billion |

| Brazil Electronic Health Records (EHR) Market Size in 2030 | US$2.641 billion |

| Growth Rate | CAGR of 9.66% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| List of Major Companies in the Brazil Electronic Health Records (EHR) Market | |

| Customization Scope | Free report customization with purchase |

Brazil Electronic Health Record Market Segmentation:

- By Product

- On-Premise

- Cloud-Based

- By Type

- Acute

- Ambulatory

- Post-Acute

- By End-Users

- Hospitals

- Clinics

- Pharmacies

- Laboratories

- Others

Our Best-Performing Industry Reports:

- Healthcare Natural Language Processing (NLP) Market

- Healthcare Compliance Software Market

- Healthcare Data Storage Market