Report Overview

Breathable Lidding Film Packaging Highlights

Breathable Lidding Film Packaging Market Size:

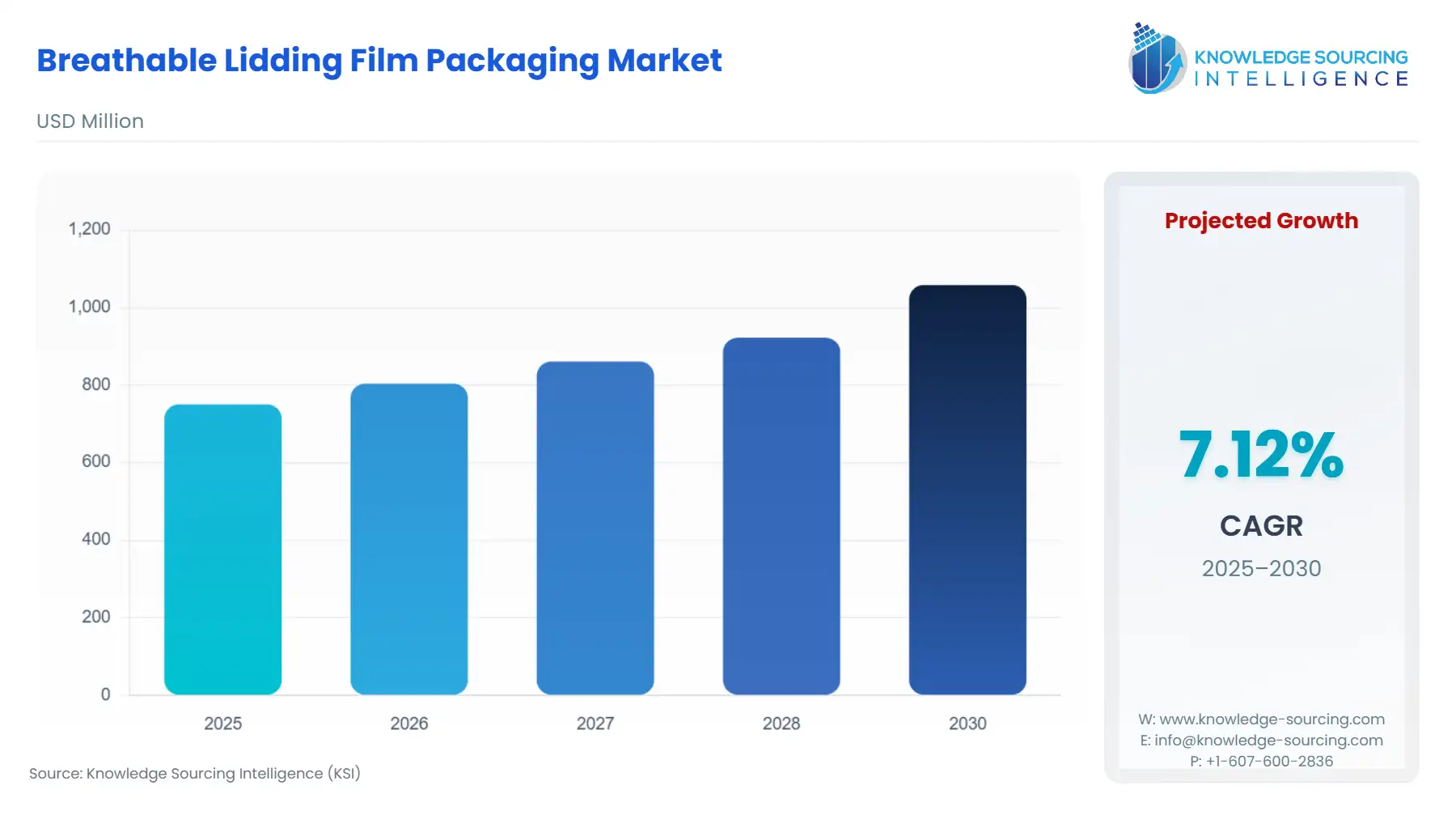

The breathable lidding film packaging market is expected to increase at a 6.91% CAGR, reaching USD 1120.37 million in 2031 from USD 750.480 million in 2025.

Breathable lidding film packaging is a specialized form of packaging used to encase perishable foods or products that require controlled oxygen and moisture levels. This packaging solution incorporates microperforations or specialized materials that allow for the exchange of gases while maintaining product freshness and extending shelf life. It is particularly useful for items like fresh produce, meats, and bakery goods, as it helps prevent spoilage by regulating the atmosphere within the package.

Breathable Lidding Film Packaging Market Introduction:

The breathable lidding film packaging market is a sector within the packaging industry focused on providing specialized packaging solutions for perishable products. This market encompasses films with microperforations or breathable properties that facilitate gas exchange while preserving product quality. It addresses the need for extended shelf life, reduced food waste, and enhanced freshness in various industries, including food and beverage. The demand for breathable lidding film packaging is driven by the growing emphasis on sustainability and maintaining the quality of perishable goods throughout the supply chain.

Breathable Lidding Film Packaging Market Drivers:

Food Preservation and Shelf Life Extension: One of the primary drivers is the capability of breathable lidding films to regulate the exchange of gases like oxygen and moisture. By maintaining optimal conditions within the package, these films extend the shelf life of perishable products. This attribute is crucial for reducing food waste and enhancing the overall efficiency of the supply chain.

Reduced Food Waste: The prevention of spoilage and deterioration through controlled gas exchange significantly reduces food waste. By allowing products to remain fresh for longer periods, breathable lidding films contribute to minimizing the amount of food discarded at various stages of distribution, from production to consumption.

Consumer Preference for Freshness: Changing consumer preferences for fresh, minimally processed, and organic foods drive demand for packaging solutions that can maintain the quality and taste of products. Breathable lidding films help retain the natural attributes of perishable items, meeting the demands of discerning consumers.

Supply Chain Efficiency: Breathable lidding films offer the advantage of longer product lifespans without the need for frequent replenishment. This streamlined supply chain reduces the burden on logistics and distribution, leading to enhanced operational efficiency and cost savings for producers and retailers.

Sustainability Focus: The global push for sustainable practices has spurred interest in packaging solutions that align with environmental goals. Breathable lidding films, by contributing to reduced food waste and spoilage, directly support sustainability efforts by conserving resources and reducing the ecological impact of food production.

Product Differentiation: In a competitive market, product visibility and appeal are crucial for brand differentiation. Breathable lidding films enhance the visual attractiveness of packaged goods, providing an opportunity for branding and marketing that can influence consumer purchasing decisions.

Regulatory Compliance: Stringent regulations on packaging materials and food safety standards require innovative solutions that ensure products meet compliance requirements. Breathable lidding films, by maintaining a controlled atmosphere within packages, contribute to food safety and adherence to regulatory guidelines.

E-commerce Growth: The expansion of online grocery shopping and home delivery has increased the need for packaging that preserves product quality during transportation and storage. Breathable lidding films play a vital role in maintaining freshness and minimizing damage to perishable items in the e-commerce supply chain.

Emergence of Fresh Convenience Foods: The rise in demand for fresh and ready-to-eat convenience foods necessitates packaging solutions that preserve taste, texture, and nutritional value. Breathable lidding films enable the packaging of these products while ensuring they remain appealing and retain their quality.

Innovation and R&D: Continuous research and development efforts in materials science and packaging technology are driving the evolution of breathable lidding films. Innovations in film materials, perforation techniques, and barrier properties are expanding the capabilities and applications of these films, fostering their adoption and growth in the packaging market.

Breathable Lidding Film Packaging Market Products Offered by Key Companies:

Amcor launched its Aclar Fresh line of breathable lidding films that are made from a unique blend of materials that allow moisture and oxygen to pass through while blocking out bacteria and other contaminants. This helps to keep food fresh for longer, while also reducing the need for additives and preservatives.

Positive Growth in the Produce Vegetables Segment:

As consumers increasingly seek nutritious and minimally processed foods, the demand for breathable packaging to extend the shelf life of fruits, vegetables, and herbs is on the rise. This segment's growth is fueled by the need to reduce food waste, enhance product quality, and cater to changing consumer preferences for fresher, healthier options.

Breathable Lidding Film Packaging Market Geographical Outlook:

The European region is expected to hold a significant share:

Europe is expected to dominate the breathable-lidding film packaging market share due to its well-established food industry, stringent regulations on food safety and packaging, and heightened consumer awareness of sustainable and fresh food options. The region's emphasis on quality, sustainability, and minimizing food waste aligns with the benefits offered by breathable lidding film packaging, positioning Europe as a frontrunner in adopting and driving the market for such solutions.

Breathable Lidding Film Packaging Market Key Developments:

In June 2023, British packaging company Parkside launched a sustainable lidding film range, including compostable films, paper-based solutions, and recyclable options. Their ParkScribe laser scoring technology ensures easy peel-and-reseal lids that remain attached during recycling. The range caters to various food applications, highlighting Parkside's commitment to innovative and eco-friendly packaging solutions.

In October 2022, KM Packaging introduced a sustainable lidding film range aligned with APCO National Targets. The range encompasses four sections, extending across their existing K-Peel, K-Seal, K-Foil, and K-Reseal lidding offerings.

List of Top Breathable Lidding Film Packaging Companies:

Mondi Group

Yorkshire Packaging System

Sealed Air Corporation

C-P Flexible Packaging

Eastern Web Handling

Breathable Lidding Film Packaging Market Scope:

Report Metric | Details |

Breathable Lidding Film Packaging Market Size in 2025 | USD 750.480 million |

Breathable Lidding Film Packaging Market Size in 2030 | USD 1,058.529 million |

Growth Rate | CAGR of 7.12% |

Study Period | 2020 to 2030 |

Historical Data | 2020 to 2023 |

Base Year | 2024 |

Forecast Period | 2025 – 2030 |

Forecast Unit (Value) | USD Million |

Segmentation |

|

Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

List of Major Companies in Breathable Lidding Film Packaging Market |

|

Customization Scope | Free report customization with purchase |

Breathable Lidding Film Packaging Market Segmentation

By Material Type

Plastic

LDPE

PP

Paper

Woven Sacks

By Substrate

CPET-based

APET-based

PP-based

PVC-based

PE-based

Others

By Seal Type

Semi-Weld

Weld Seal

Peel Seal

Others

By End-User

Produced Grains

Produced Vegetables

Bakery and Confectionery

Produced Fruits

Others

By Geography

North America

United States

Canada

Mexico

South America

Brazil

Argentina

Others

Europe

Germany

France

United Kingdom

Spain

Others

Middle East and Africa

Saudi Arabia

UAE

Others

Asia Pacific

China

India

Japan

South Korea

Indonesia

Thailand

Others