Report Overview

Canada Shampoo Market - Highlights

Canada Shampoo Market Size:

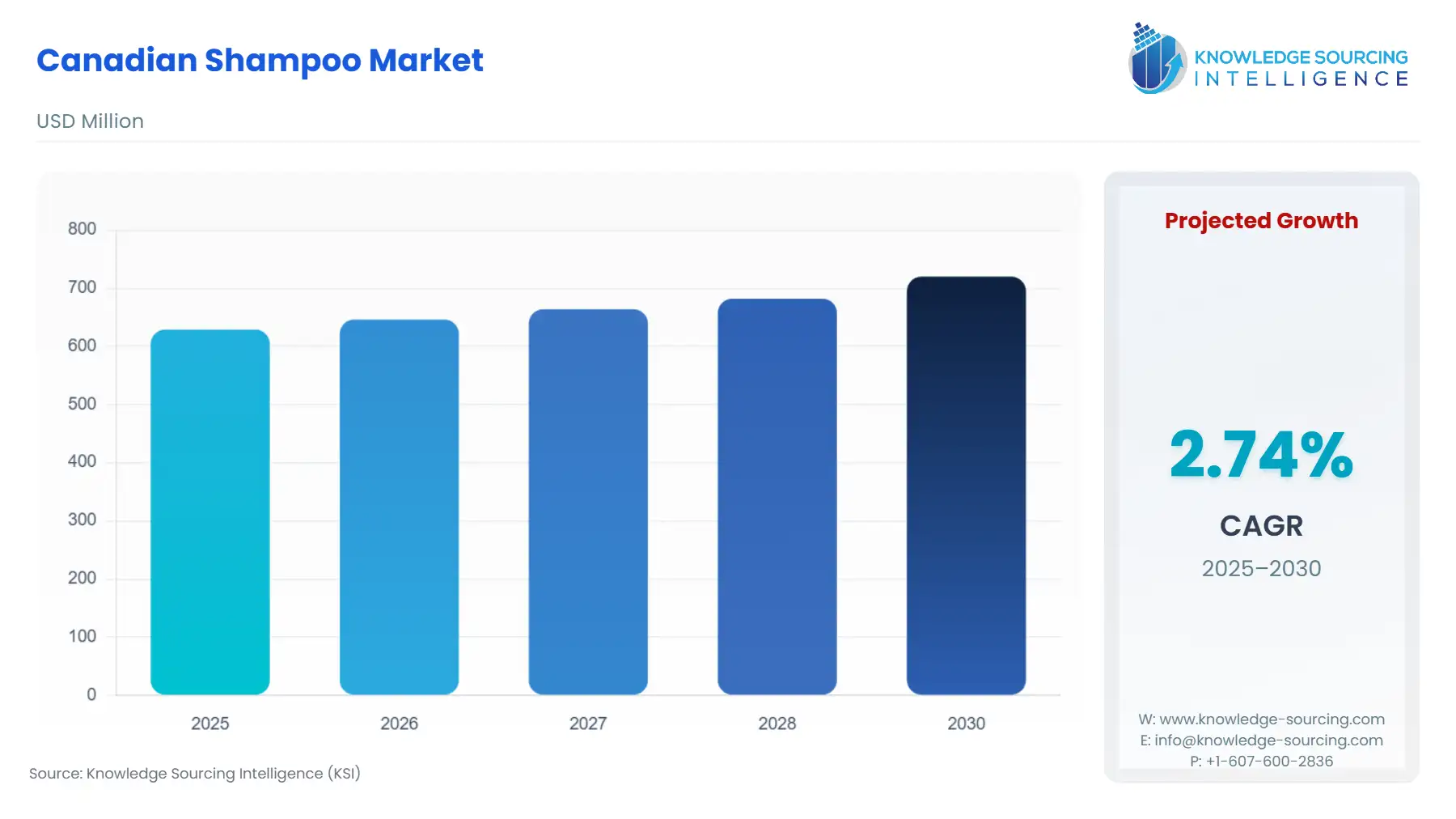

The Canadian shampoo market is projected to grow at a CAGR of 2.74% during the projected period (2025-2030), reaching a market size of USD 0.720 billion by 2030 from USD 0.629 billion by 2025.

There are notable market changes in the Canadian shampoo industry right now, which reflect changing consumer tastes and habits. In this sector, one significant element is the growing awareness of sanitation and personal hygiene among Canadian people. The surge in busy lifestyles has led many people in the country to use dry shampoos as a simple substitute for conventional shampooing techniques. The rise in online browsing has made these products more accessible by allowing consumers to compare brands and make well-informed purchasing decisions. Growing consumer demand for organic and natural products is also having an impact on the market. Canadian people are more inclined to choose shampoos devoid of harsh ingredients because they value healthier and more ecologically friendly options.

Canada Shampoo Market Overview & Scope:

The Canadian shampoo market is segmented by:

- Product: Based on product, the Canadian shampoo market is divided into two segments, medicated/special purpose and non-medicated/regular. The non-medicated/regular segment is expected to hold the largest market share in Canada due to its broad availability and growing acceptability of mass-produced products. Non-medicated shampoos are more extensively used than their counterparts since they are more affordable and easier to locate. Additionally, the increasing availability of counter alternatives at pharmacies and drug stores is driving the utilization of the non-medicated shampoo category.

- Application: The two market types based on application are domestic and commercial. The domestic segment is expected to dominate the market. The reasons driving the growth of the domestic segment include the increasing number of toddlers and babies using baby shampoos and the significant product use for personal hygiene purposes in the home. It is anticipated that the increasing number of companies advertising their hair grooming products on social media through celebrity endorsements would increase demand from Canadian home consumers.

- Distribution Channel: The market is divided into convenience stores, online stores, hypermarkets and supermarkets, and others based on the distribution. The availability of a wide range of products on supermarket shelves allowed hypermarkets and supermarkets to dominate the market. This enables customers to know their alternatives and purchase a specific product or combination of products based on their hair care requirements. The segment's rise was aided by the new trend of buying personal care goods in bulk at department stores and supermarkets.

- Manufacturers: The market is divided into private label, toll manufacturing, and multinational segments based on manufacturers. The multinational segment's growth in the market is propelled by the consistent supply of branded goods, the distribution networks of major multinational corporations, and a strong clientele. Across Canada, these elements made a substantial contribution to the revenue generated by multinational corporations. The segment's growth is driven by expanding projects and capacity-building initiatives carried out by international corporations.

Top Trends Shaping the Canada Shampoo Market

- Growing Convenience Product Demand

Convenient personal care products are becoming popular in Canada. Urban inhabitant's fast-paced lifestyles have contributed to a rise in the popularity of dry shampoos, which provide rapid cleansing without the use of water. Procter Gamble and Unilever, two well-known companies, have benefited from this trend by growing their product ranges to accommodate working parents and professionals.

- Growing Interest in Natural Hair Care Products

The market for natural and organic hair care products in Canada has seen a surge in demand as consumers have become more conscious of the negative effects of certain chemicals, like paraben and aluminum compounds found in hair care products. A large portion of consumers rely on their brand preference for its natural formulation. This has increased the demand in recent years for organic, natural, and safe hair care products. Additionally, it is anticipated that organic hair shampoos that combat dandruff will experience strong growth during the forecast period. The market is anticipated to grow further because of Canada's anticipated significant growth in demand for organic hair care products.

Canada Shampoo Market Growth Drivers vs. Challenges:

Drivers:

- Broad product availability to boost market expansion: Personal grooming with an emphasis on hair care is growing which is making a substantial contribution to product sales. Companies that make hair care products are successfully addressing several hair-related problems, including dandruff, hair thinning, sebum secretions, and severe hair loss, by introducing anti-hair fall and anti-dandruff shampoo. Product sales will rise even more because of this trend's impressive growth. To broaden their portfolios, several well-known companies are releasing new items.

- A greater emphasis on product customization by manufacturers to promote market expansion: A growing number of industry players are moving toward personalization to accommodate a wide range of customer preferences and hair care requirements. Important market players are experimenting with new substances that could improve the quality of their goods. The market for protein- and vitamin-based products with many health advantages grows, and ingredients including biotin, probiotics, and fruit vitamins are being investigated. Personalization and the launch of new products by major companies will therefore probably boost the growth of the Canada shampoo industry.

Challenges:

- Environmental Issues and Regulatory Compliance: The usage of dangerous chemicals and the growing environmental restrictions surrounding plastic trash are posing problems. Businesses like Unilever are responding by pledging to use more environmentally friendly packaging to be more sustainable, but this frequently comes at a higher operational cost. To cut down on the use of virgin plastic, the corporation has also expanded its expenditure on packaging research and development.

Canada Shampoo Market Competitive Landscape:

The market is moderately fragmented, with many key players including Johnson & Johnson Inc., Amway Corporation, L'Oreal SA, Unilever PLC, and Shiseido Company Limited.

- Product Launch: In February 2025, Dove introduced Bio-Protein Care, which strengthens hair using Dove's own technology. With each wash, this potent system strengthens the protein, replenishing and strengthening the interior structure of the hair to make it ten times stronger.

Canada Shampoo Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Canada Shampoo Market Size in 2025 | US$0.629 billion |

| Canada Shampoo Market Size in 2030 | US$0.720 billion |

| Growth Rate | CAGR of 2.74% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | Ontario, Quebec, British Columbia, Alberta, Manitoba, Others |

| List of Major Companies in the Canada Shampoo Market |

|

| Customization Scope | Free report customization with purchase |

Canada Shampoo Market Segmentation:

- By Product

- By Application

- By Distribution Channel

- Hypermarkets/Supermarkets

- Convenience Stores

- Online Stores

- Others

- By Manufacturers

- By Region