Report Overview

France Shampoo Market - Highlights

France Shampoo Market Size:

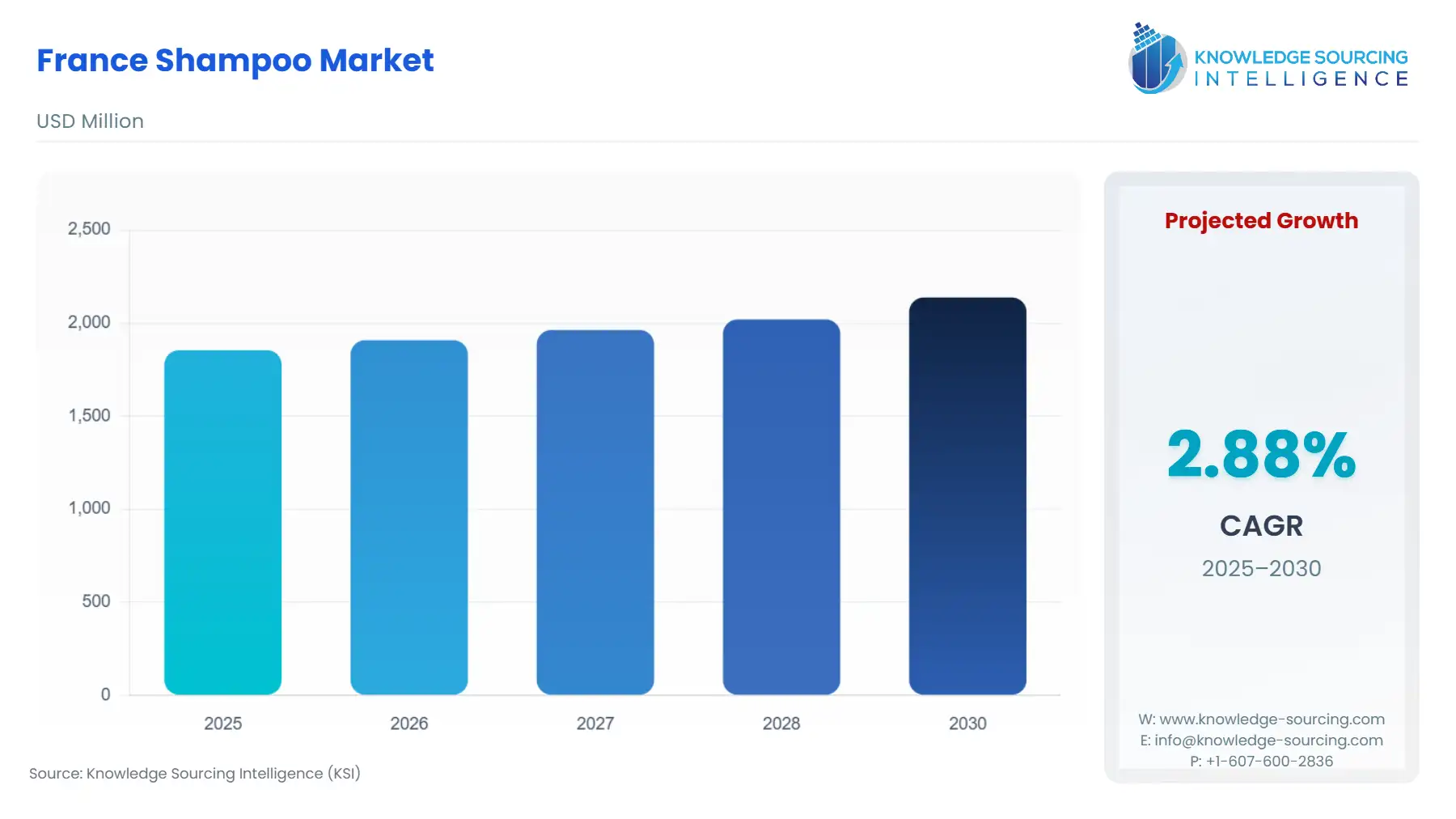

The France shampoo market is projected to grow at a CAGR of 2.88% during the projected period (2025-2030), reaching a market size of USD 2.138 billion by 2030 from USD 1.855 billion by 2025.

Increasing awareness about personal grooming and changing customer tastes are driving significant shifts in the French hair care market. The industry is being impacted by consumers growing awareness about the ingredients in beauty products and their growing interest in natural and organic hair care products. Government initiatives to promote sustainable practices and reduce the use of chemicals in the personal care industry also support this shift. Personalized care is also becoming popular due to the rise in popularity of niche goods like vegan hair care lines and specially made hair solutions for different hair types or issues.

France Shampoo Market Overview & Scope:

The France shampoo market is segmented by:

- Product: The France shampoo market is divided into two segments based on product, non-medicated/regular and medicated/special purpose. The non-medicated/regular segment is anticipated to lead the France shampoo market share due to widespread availability and rising mass-production product acceptance worldwide. Since non-medicated shampoos are easier to find and less expensive than their counterpart’s, non-medicated products are widely used. Additionally, the non-medicated shampoo segment's revenue is driven by the growing availability of over-the-counter versions at pharmacies and drug shops.

- Application: The market is separated into two segments based on application, domestic and commercial. The household segment is anticipated to lead the market because of the wide range of products available. Significant product use for personal hygiene purposes in the home and the growing number of toddlers and babies using baby shampoos are factors propelling the household segment's growth. The growing number of businesses promoting their hair grooming products through celebrity endorsements and social media is expected to raise demand among home customers in France.

- Distribution Channel: The market is divided into convenience stores, online stores, hypermarkets and supermarkets, and others based on the distribution. The availability of a wide range of products on supermarket shelves allowed hypermarkets and supermarkets to dominate the market. This enables customers to know their alternatives and purchase a specific product or combination of products based on their hair care requirements. The segment's rise was aided by the new trend of buying personal care goods in bulk at department stores and supermarkets.

- Manufacturers: The market is divided into private label, toll manufacturing, and multinational segments based on manufacturers. The multinational segment's growth in the market is propelled by the consistent supply of branded goods, the distribution networks of major multinational corporations, and a strong clientele. Across France, these elements made a substantial contribution to the revenue generated by multinational corporations. The segment's growth is driven by expanding projects and capacity-building initiatives carried out by international corporations.

Top Trends Shaping the France Shampoo Market

- Economic Factors Affecting Consumer Choice

The Purchasing decisions are being influenced by economic concerns and rising inflation. Sales of high-end products through traditional retail channels are declining as consumers grow more price-sensitive. Online marketplaces and discount stores are growing in popularity as customers look for less expensive options.

- The evolving function of pharmacies

Pharmacies and para pharmacies have a significant impact on the French shampoo market, even though supermarkets continue to be major sales channels. They are favored by brands that provide therapeutic or problem-solving formulas and are trusted for their scientific and medical repute. When it comes to hair problems like dandruff, hair loss, or sensitive scalps, French customers frequently seek professional help. Pharmaceutical brands such as Bioderma, Ducray, and Vichy are among the first to introduce clean and organic product lines.

France Shampoo Market Growth Drivers vs. Challenges:

Opportunities:

- Concerns About Hair and the Aging Population: The aging population of France is accompanied by a range of hair-related issues, including dryness, sensitivity to the scalp, thinning hair, and hair loss. The need for specific, age-appropriate shampoos is therefore rising. Plant stem cells, keratin, and biotin are used in shampoo to strengthen hair. Argan oil and collagen are used for hydration and nutrition.

- Increasing Diversity and Inclusivity in Hair Needs: Products for textured, curly, and coily hair types have increased in number due to France's multicultural population. Shampoos designed for dry, brittle, or chemically treated hair are becoming more and more common. Diversity has expanded the selection of shampoos that are hydrating, protecting, and curl-enhancing.

- Concern about the Environment and Ethics: In France, sustainability has emerged as a crucial factor for consumers. Shampoo purchasing patterns have changed because of the nation's long-standing environmental movement, EU legislation, and increased public concern about plastic waste and climate change. Preference is given to packaging that is refillable and recyclable. Solid shampoo bars are growing in popularity to cut down water and packaging waste. Demand is more for companies that are carbon-neutral, cruelty-free, and source their products ethically.

Challenges:

- Slow Adoption of New Formats by Older Consumers: While younger French customers are receptive to new shampoo formats (such as solid bars, waterless shampoos, and scalp scrapes), older and more conventional consumers continue to be reluctant to change. The traditional textures and formats (bottled liquid shampoos) are still preferred by many customers. Even though solid shampoo bars are eco-friendly, older consumers still find them to be useless. There is skepticism about online businesses or AI-driven customization, among less tech-savvy demographics.

France Shampoo Market Competitive Landscape:

The market is moderately fragmented, with many key players including L'Oréal SA, Unilever PLC, Procter & Gamble Co., and The Estée Lauder Companies.

- Product Innovation: In July 2024, using their own Lamellar molecule technology, TRESemmé debuted the Lamellar Shine collection. This technique increases shine in all hair types by smoothing the hair's surface. The shampoo, conditioner, and leave-in cream serum in the line are intended to give hair up to seven times more shine right out of the box.

- Sustainable product launch: In May 2024, The Bonacure R-TWO line, which focuses on clean beauty with 100% vegan professional products, was introduced by Schwarzkopf Professional France. The two-step method, which consists of a Resetting Shampoo and a Rescuing Treatment, is designed to strengthen and revive hair, especially in the summer.

France Shampoo Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| France Shampoo Market Size in 2025 | US$1.855 billion |

| France Shampoo Market Size in 2030 | US$2.138 billion |

| Growth Rate | CAGR of 2.88% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | Corsica, Occitanie, Pays de la Loire, Auvergne-Rhône-Alpes, Brittany, Others |

| List of Major Companies in the France Shampoo Market |

|

| Customization Scope | Free report customization with purchase |

France Shampoo Market Segmentation:

By Product

By Application

By Distribution Channel

- Hypermarkets/Supermarkets

- Convenience Stores

- Online Stores

- Others

By Manufacturers

By Region