Report Overview

Brazil Shampoo Market - Highlights

Brazil Shampoo Market Size:

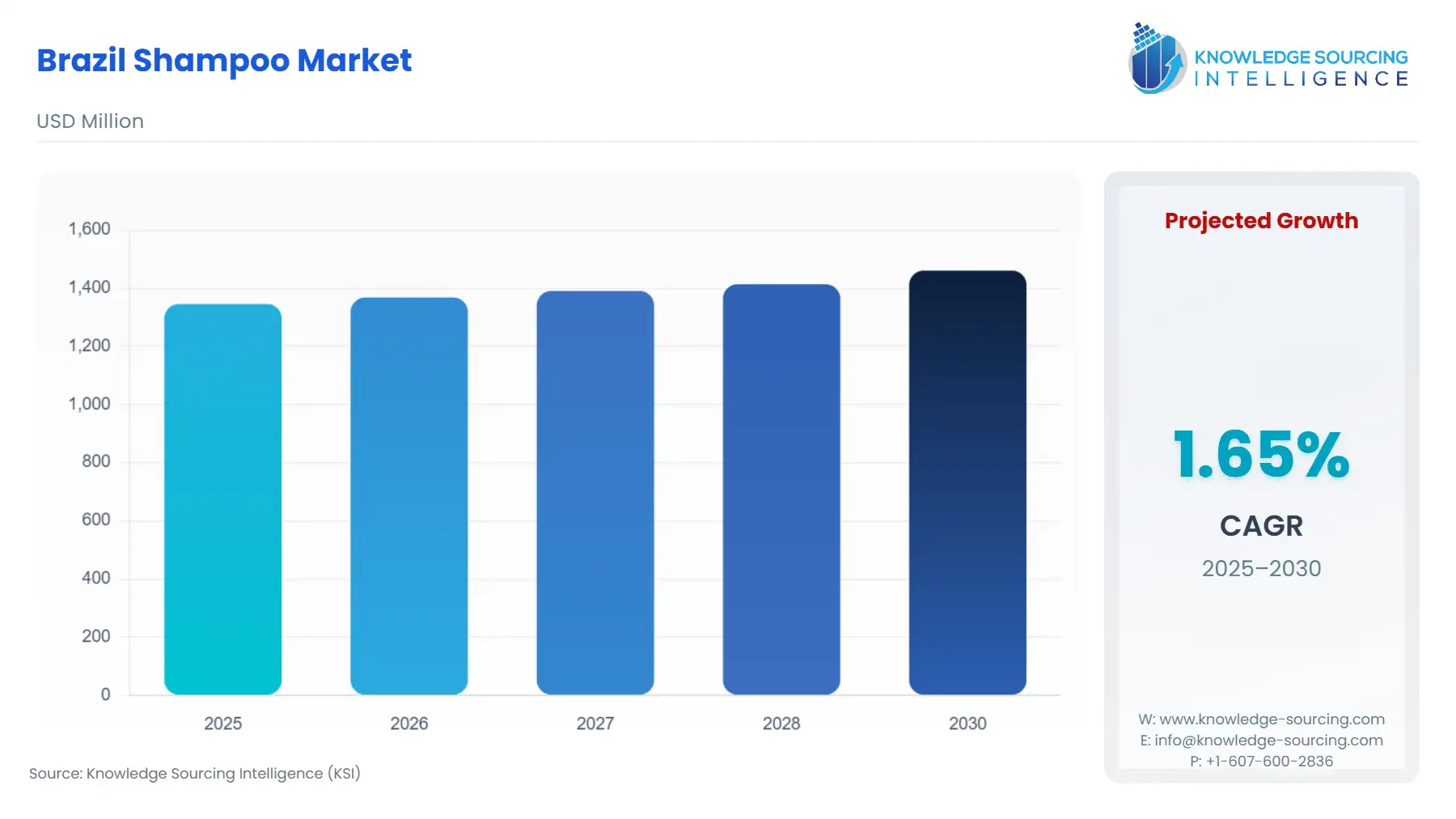

The Brazil shampoo market is projected to grow at a CAGR of 1.65% during the projected period (2025-2030), reaching a market size of USD 1.461 billion by 2030 from USD 1.346 billion by 2025.

The Brazil shampoo market has been greatly impacted by consumers' tendency to use various hair care products. Shampoo, oil, and other products that claim to contain functional ingredients help to maintain hair health, and the growing prevalence of hair problems like hair loss, damage, and other hair-related issues are in demand. Online shopping is becoming a practical way to buy everyday necessities, such as hair care products, as busy schedules and lifestyles increase. Moreover, customers can purchase the product of their choice at a lower cost than in-store due to promotions offered by online retail stores.

Brazil Shampoo Market Overview & Scope:

The Brazil shampoo market is segmented by:

- Product: The Brazilian shampoo market is divided into two segments based on product, non-medicated/regular and medicated/special purpose. The non-medicated/regular segment is anticipated to lead the Brazilian shampoo market share due to widespread availability and rising mass-production product acceptance worldwide. Since non-medicated shampoos are easier to find and less expensive than their counterparts, non-medicated products are widely used. Additionally, the non-medicated shampoo segment's revenue is driven by the growing availability of over-the-counter versions at pharmacies and drug shops.

- Application: The market is separated into two segments based on application, domestic and commercial. The household segment is anticipated to lead the market because of the wide range of products available. Significant product use for personal hygiene purposes in the home and the growing number of toddlers and babies using baby shampoos are further factors propelling the household segment's growth. The growing number of businesses promoting their hair grooming products through celebrity endorsements and social media is expected to raise demand among home customers in Brazil.

- Distribution Channel: The market is divided into convenience stores, online stores, hypermarkets and supermarkets, and others based on the distribution. The availability of a wide range of products on supermarket shelves allowed hypermarkets and supermarkets to dominate the market. This enables customers to know their alternatives and purchase a specific product or combination of products based on their hair care requirements. The segment's rise was aided by the new trend of buying personal care goods in bulk at department stores and supermarkets.

- Manufacturers: The market is divided into private label, toll manufacturing, and multinational segments based on manufacturers. The multinational segment's growth in the market is propelled by the consistent supply of branded goods, the distribution networks of major multinational corporations, and a strong clientele. Across Brazil, these factors made a substantial contribution to the revenue generated by multinational corporations. The segment's growth is driven by expanding projects and capacity-building initiatives carried out by international corporations.

Top Trends Shaping the Brazil Shampoo Market

- Socioeconomic and Cultural Factors Influencing Demand

Brazil is one of the world's biggest users of personal care goods, and hair care plays a big role in this industry. Shampoo companies are under pressure to provide customized solutions for a broad range of hair types due to the diverse population, which includes a significant proportion of people with textured or curly hair. Despite sporadic fluctuations, Brazil's economy has maintained a growing middle class, which has increased demand for both high-end and mass-market hair care products. Shampoo purchases have changed from basic hygiene goods to customized wellness and beauty solutions as more Brazilians look to show their individuality and take care of their hair health.

- Subscription Models, E-Commerce, and Omnichannel Expansion

E-commerce shampoo sales have increased dramatically, even though pharmacies and supermarkets have historically dominated Brazil's retail market. Shampoo delivery via subscription is a new business model that is gaining popularity, particularly among direct-to-consumer (DTC) firms. These companies supply monthly customized services and provide online hair diagnosis tools. Furthermore. legacy businesses are implementing omnichannel strategies, which include influencer events, digital loyalty programs, and AI-powered hair analyzers at point-of-sale (POS) displays.

Brazil Shampoo Market Growth Drivers vs. Challenges:

Opportunities:

- Support from the Industry and Regulations: Through export incentives, subsidies for innovation, and rules about cosmetics, the Brazilian government and trade associations provide support to the personal care sector. Brazil is a center for Latin American cosmetic research and development. The government promotes the investment of international brands in regional R&D and production facilities. Quicker innovation and approval processes for novel shampoo formulas make Brazil a leader in the region for innovative personal care products.

- Growth in Beauty Education and Digital Influence: Brazilian consumer methods for finding, assessing, and buying shampoo products have been changed by social media. Influencers who assess new or specialized products can change consumer demand. Customers are growing more aware of trends and ingredients, owing to this. Additionally, demand for shampoo categories, such as rice water shampoo and biotin shampoo, frequently rises because of viral hair care regimens.

Challenges:

- Logistics & Supply Chain Difficulties: The geographical location of Brazil poses logistical challenges, particularly while shipping goods to isolated or rural regions like the North and Northeast. Inadequate infrastructure (such as bad roads, congested ports, and restricted cold-chain logistics) increases distribution costs and makes last-mile delivery more difficult. Consumers in rural areas may have to pay more at retail or have less access to new or special shampoo options. Particularly for omnichannel distribution, brands pay more for inventory management, transportation, and warehousing.

- Price Sensitivity in Divisions of the Mass Market: The price-sensitive mass-market segment accounts for a large share of Brazilian shampoo sales, despite the country's expanding middle class. Price and familiarity are more important to consumers compared to innovation or quality, which makes it challenging for premium or newer companies to gain market share.

Brazil Shampoo Market Competitive Landscape

The market is moderately fragmented, with many key players including L'Oréal SA, Unilever PLC, Procter & Gamble Co., and The Estée Lauder Companies.

- Sustainable product launch: In July 2024, along with debuts in the UK, Mexico, and Argentina, TRESemmé debuted its Lamellar Shine line in Brazil. Using cutting-edge Lamellar technology, this collection smoothes hair strands and adds shine to all hair types. The parent firm, Unilever, claims that this technology can provide up to seven times greater shine. To fortify hair from the inside out, the line consists of shampoo, conditioner, and a leave-in cream serum enhanced with ceramides and amino acids.

- Product Innovation: In February 2024, Skala Cosméticos, a vegan haircare brand based in Minas Gerais, Brazil, was acquired by Advent International, a global private equity firm. Advent's managed $2 billion funds from the focused budget for Latin American assets.

Brazil Shampoo Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Brazil Shampoo Market Size in 2025 | US$1.346 billion |

| Brazil Shampoo Market Size in 2030 | US$1.461 billion |

| Growth Rate | CAGR of 1.65% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | São Paulo, Minas Gerais, Rio de Janeiro, Bahia, Paraná, Others |

| List of Major Companies in the Brazil Shampoo Market |

|

| Customization Scope | Free report customization with purchase |

Brazil Shampoo Market Segmentation:

- By Product

- By Application

- By Distribution Channel

- Hypermarkets/Supermarkets

- Convenience Stores

- Online Stores

- Others

- By Manufacturers

- By Region

- São Paulo

- Minas Gerais

- Rio de Janeiro

- Bahia

- Paraná

- Others