Report Overview

Cloud Television (TV) Market Highlights

Cloud Television (TV) Market Size:

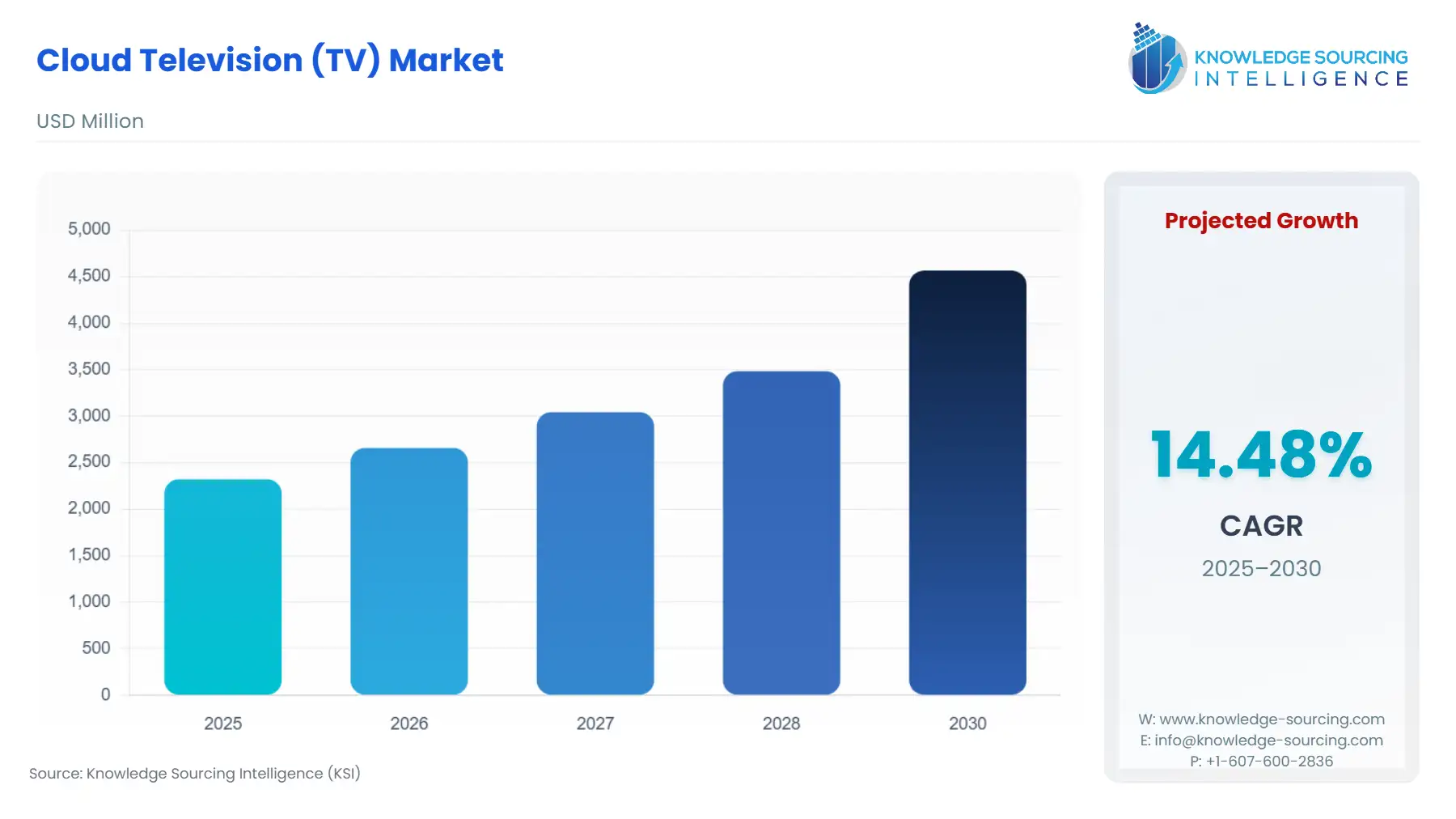

The Cloud Television (TV) Market will grow at a CAGR of 14.48% to be valued at US$4.565 billion in 2030 from US$2.322 billion in 2025.

The cloud television (TV) market is revolutionizing the media and entertainment industry by leveraging cloud streaming to deliver television content, including live broadcasts, video-on-demand (VOD), and interactive programming, through scalable, internet-based infrastructure. Unlike traditional satellite, cable, or terrestrial systems, cloud TV relies on digital TV infrastructure to provide seamless OTT content delivery across devices like smart TVs, smartphones, and tablets. This market encompasses D2C video platforms, enabling broadcasters, pay-TV operators, and content providers to offer personalized, on-demand experiences via scalable video platforms. The integration of cloud-native technologies, such as content delivery networks (CDNs), adaptive bitrate streaming, and AI-driven analytics, enhances viewer engagement and operational efficiency. As consumer preferences shift toward flexible, multi-device content access, the cloud TV market is poised for exponential growth, driven by technological advancements and evolving viewing habits. Further, the cloud television market centers on delivering television services through cloud streaming, utilizing remote servers for content processing, storage, and distribution. This approach eliminates the need for costly physical infrastructure, enabling pay-TV operators and streaming platforms to scale operations dynamically. OTT content delivery supports diverse formats, including live sports, VOD, and free ad-supported streaming TV (FAST) channels, accessible on multiple devices. D2C video platforms allow content providers to bypass traditional intermediaries, offering tailored subscription models and personalized recommendations. Scalable video platforms, powered by providers like Amazon Web Services (AWS) and Microsoft Azure, facilitate efficient digital TV infrastructure, handling fluctuating demand without significant capital expenditure. In November 2024, Comcast Technology Solutions launched a next-generation cloud TV platform, integrating live linear TV, FAST channels, and VOD with advanced personalization and analytics, enhancing OTT content delivery for global broadcasters. The market’s growth is fueled by the convergence of digital TV infrastructure with high-speed internet and smart devices. Pay-TV operators are transitioning to cloud-first models, replacing legacy set-top boxes (STBs) with cloud streaming solutions to reduce costs and enable rapid feature deployment. For instance, Deutsche Telekom’s MagentaTV migrated 4.6 million subscribers to a Broadpeak cloud DVR in 2024, reducing per-subscriber hardware costs significantly. The rise of D2C video platforms like Disney+ and Netflix further drives adoption, offering seamless, multi-device experiences that align with consumer demand for on-demand content. Several factors propel the market’s growth:

- Consumer Demand for OTT Content Delivery: The shift toward on-demand, multi-device viewing fuels demand for cloud streaming and D2C video platforms, especially in North America and Europe.

- Cost Efficiency of Scalable Video Platforms: Cloud TV reduces capital expenditure for pay-TV operators, enabling elastic scaling for live events and VOD.

- Advancements in Digital TV Infrastructure: Innovations in CDNs, 5G, and AI-driven personalization enhance OTT content delivery quality and engagement.

- Cord-Cutting Trends: Consumers increasingly favor D2C video platforms over traditional cable, driving cloud TV adoption globally.

Despite growth, the market faces challenges:

- Dependence on Internet Infrastructure: Limited broadband access in regions like Africa hampers cloud streaming quality and market growth.

- Legacy System Integration Challenges: Pay-TV operators face complexities migrating to digital TV infrastructure, increasing costs and risks.

Cloud television differs fundamentally from traditional TV, which relies on satellite, cable, or terrestrial systems for content delivery. Traditional TV requires extensive physical infrastructure, including broadcast towers and STBs, leading to high capital and maintenance costs. For example, satellite delivery involves expensive transponder leasing, while cloud TV leverages digital TV infrastructure for cost-effective, scalable distribution. Cloud streaming enables on-demand access, multi-device compatibility, and real-time analytics, unlike traditional TV’s fixed schedules and limited interactivity. OTT content delivery supports personalized recommendations and dynamic ad insertion, enhancing viewer engagement compared to traditional TV’s static advertising model. However, cloud TV depends on reliable internet, making it less accessible in regions with poor connectivity, whereas traditional TV operates independently of broadband. Scalable video platforms allow pay-TV operators to launch new channels rapidly, unlike the slow deployment of traditional systems. In 2024, Vodafone adopted cloud TV to bundle OTT content delivery with third-party streaming, offering a hybrid experience that traditional TV struggles to replicate.

Cloud Television (TV) Market Overview & Scope:

Cloud television allows users to customize their choices and choose the program they want to watch from an archive of different programs. The users can also opt for live television. These television programs can be streamed on any device that is connected to the internet. Cloud television essentially is a software program that virtualizes the functionality of the set-top box. It enables the device vendors to serve their customers with advanced user interfaces, superior quality video experience through YouTube, online gaming, video conferencing, and internet browsing. The global market is experiencing a surge in the use of wireless communications and 5G technology. Telecom providers are enhancing cloud television experiences by integrating 5G networks, driven by growing consumer demand for high-speed, high-quality content. This trend is expected to boost the demand for cloud television as 5G adoption increases. The media and broadcasting sector, encompassing film, music, video, audio, and social media, is seeing a surge in the importance of internet-delivered video content. Rapid digitalization in this industry has led to widespread use of cloud television platforms for live broadcasting. The expansion of the media and broadcasting sector is poised to create significant opportunities for the cloud television market. North America is expected to dominate the cloud television market due to its robust high-speed network infrastructure and rapid adoption of cutting-edge technologies. Meanwhile, the Asia-Pacific region is projected to experience the fastest growth, driven by the proliferation of data centers, increasing demand for cloud services among enterprises, growing smartphone penetration, rising internet access, and expanding cross-border trade, all of which will fuel demand for cloud television in the forecast period. Some of the major players covered in this report include Samsung Electronics Co., Ltd., LG Electronics Inc., Sony Group Corporation, Amazon.com, Inc., Google LLC, Apple Inc., Roku, Inc., Alibaba Group Holding Limited, and Huawei Technologies Co., Ltd., among others.

Cloud Television (TV) Market Trends:

- Integration of Multi-Modal Natural Language Processing

The cloud television market is evolving rapidly, driven by advancements in cloud-based content management and content delivery networks (CDNs). CDNs ensure low-latency 5G video streaming, enhancing viewer experiences across smart TVs and mobile devices. In November 2024, Comcast Technology Solutions launched a cloud TV platform integrating cloud-based content management for live TV and VOD, leveraging CDNs for seamless delivery. AI content recommendation systems personalize viewing, with platforms like Jump and Mux enhancing engagement through data-driven algorithms. Edge computing reduces latency, supporting cloud gaming and interactive TV services, as seen in QYOU Media’s expansion of The Q India via CloudTV. 5G video streaming enables ultra-high-definition content, while AI-driven advertising optimizes ad placement, boosting revenue for pay-TV operators. These trends highlight the market’s focus on scalability, personalization, and real-time delivery, transforming the global entertainment landscape.

Cloud Television (TV) Market Growth Drivers vs. Challenges

Drivers:

- Surge in Demand for OTT Content Delivery: The cloud television market is propelled by growing consumer demand for OTT content delivery, enabling seamless access to on-demand video, live TV, and FAST channels across devices like smart TVs, smartphones, and tablets. Cloud streaming supports flexible viewing, driving adoption of D2C video platforms such as Netflix and Disney+. In November 2024, Comcast Technology Solutions launched a cloud TV platform integrating live TV and VOD, leveraging content delivery networks (CDNs) to enhance OTT content delivery for global broadcasters. The rise of 5G video streaming further accelerates this trend, offering high-speed, low-latency access, particularly in North America and Asia-Pacific. This driver fuels market growth as consumers prioritize personalized, multi-device experiences, pushing pay-TV operators to adopt cloud-based content management for competitive differentiation.

Further, The cloud television market is propelled by growing consumer demand for OTT content delivery, enabling seamless access to on-demand video, live TV, and FAST channels across devices like smart TVs, smartphones, and tablets. Cloud streaming supports flexible viewing, driving adoption of D2C video platforms such as Netflix and Disney+. In November 2024, Comcast Technology Solutions launched a cloud TV platform integrating live TV and VOD, leveraging content delivery networks (CDNs) to enhance OTT content delivery for global broadcasters. The rise of 5G video streaming further accelerates this trend, offering high-speed, low-latency access, particularly in North America and Asia-Pacific. This driver fuels market growth as consumers prioritize personalized, multi-device experiences, pushing pay-TV operators to adopt cloud-based content management for competitive differentiation.

- Adoption of Scalable Video Platforms by Pay-TV Operators: Pay-TV operators are increasingly adopting scalable video platforms to reduce infrastructure costs and enhance service flexibility, driving the cloud television market. Cloud streaming enables operators to deliver live TV, VOD, and interactive services without costly physical set-top boxes (STBs). In 2024, Deutsche Telekom migrated its MagentaTV subscribers to a Broadpeak cloud DVR, streamlining operations and cutting hardware costs. Scalable video platforms support dynamic scaling for high-demand events like live sports, leveraging edge computing for low-latency delivery. This trend is prominent in Europe and North America, where operators use digital TV infrastructure to deploy new features rapidly, enhancing viewer engagement through AI content recommendation. The shift to cloud-based solutions strengthens market growth by enabling cost-efficient, agile service delivery.

In addition, Technological advancements in AI content recommendation, content delivery networks (CDNs), and edge computing are key drivers for the cloud television market. AI-driven advertising optimizes ad placement, boosting revenue for D2C video platforms, while AI content recommendation enhances personalization, improving viewer retention. For example, QYOU Media expanded The Q India on smart TVs via CloudTV, leveraging CDNs and AI content recommendation for seamless cloud streaming. 5G video streaming further improves quality, supporting ultra-high-definition content and cloud gaming. Brightcove’s ad monetization update integrated AI-driven advertising, enhancing OTT content delivery for global platforms. These innovations drive market expansion by enabling high-quality, interactive experiences, particularly in tech-savvy regions like Asia-Pacific.

Challenges:

- Dependence on Robust Internet Infrastructure: The cloud television market faces significant challenges due to its reliance on high-speed, reliable internet for cloud streaming and OTT content delivery. Limited broadband access in regions like Africa and parts of South America hampers the quality and accessibility of cloud TV services, restricting market growth. For instance, inconsistent connectivity affects 5G video streaming and edge computing performance, leading to buffering and reduced viewer satisfaction. While CDNs mitigate latency, they cannot fully compensate for poor infrastructure. The Broadband Strategies Group noted that legacy connectivity issues limit cloud TV adoption in emerging markets, where traditional TV remains dominant. This restraint challenges pay-TV operators and D2C video platforms seeking to expand globally, requiring significant infrastructure investments to overcome.

Cloud Television (TV) Market Regional Analysis:

- North America: North America is expected to dominate the cloud television market due to its robust high-speed network infrastructure and rapid adoption of cutting-edge technologies.

- Asia-Pacific: The Asia-Pacific region is projected to experience the fastest growth, driven by the proliferation of data centers, increasing demand for cloud services among enterprises, growing smartphone penetration, rising internet access, and expanding cross-border trade, all of which will fuel demand for cloud television in the forecast period.

Cloud Television (TV) Market Competitive Landscape:

Some of the major players covered in this report include Samsung Electronics Co., Ltd., LG Electronics Inc., Sony Group Corporation, Amazon.com, Inc., Google LLC, Apple Inc., Roku, Inc., Alibaba Group Holding Limited, and Huawei Technologies Co., Ltd., among others.

- Product Launch: In August 2025, Capgemini announced its intent to acquire Cloud4C, a specialist in automation-driven managed services for hybrid and sovereign cloud environments. This acquisition is designed to reinforce Capgemini's position in the cloud managed services market by integrating Cloud4C's AI-ready platforms and industry-specific frameworks. The deal is expected to enable Capgemini to offer enhanced solutions for cloud management, migrations, and generative AI-powered platforms.

- Product Launch: In January 2024: At the Consumer Electronics Show (CES) in 2024, Samsung unveiled its new lineup of Neo QLED and OLED TVs, centered around its new NQ8 AI Gen3 Processor. This processor is engineered to enhance cloud TV experiences with features like 8K AI Upscaling Pro and AI Motion Enhancer Pro, which leverage deep learning to improve content quality and handle fast-moving scenes. The new TVs also include an updated Tizen OS, which is designed to streamline the home TV experience and offer personalized content.

Cloud Television (TV) Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | US$2.322 billion |

| Total Market Size in 2031 | US$4.565 billion |

| Growth Rate | 14.48% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Platform, Deployment Model, Service Model, Geography |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

Cloud Television (TV) Market Segmentation:

- By platform type

- Smart TVs

- Set-Top Boxes

- Gaming Consoles

- Mobile Devices

- Desktop/Laptop Streaming

- By Deployment Model

- Public Cloud

- Private Cloud

- Hybrid Cloud

- By Service Model

- Subscription Video on Demand (SVOD)

- Advertising-Based Video on Demand (AVOD)

- Transactional Video on Demand (TVOD)

- Live TV Streaming

- Cloud DVR & Time-Shifted TV

- By Application

- Residential Entertainment

- Hospitality

- Healthcare

- Education

- Corporate

- By End-User

- Individual Consumers

- Enterprises

- Government & Public Sector

- Healthcare Institutions

- Educational Institutes

- By Region

- North America

- United States

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- United Kingdom

- Germany

- France

- Italy

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- Japan

- China

- India

- South Korea

- Taiwan

- Others

- North America