Report Overview

Consumer Drones Market Size, Highlights

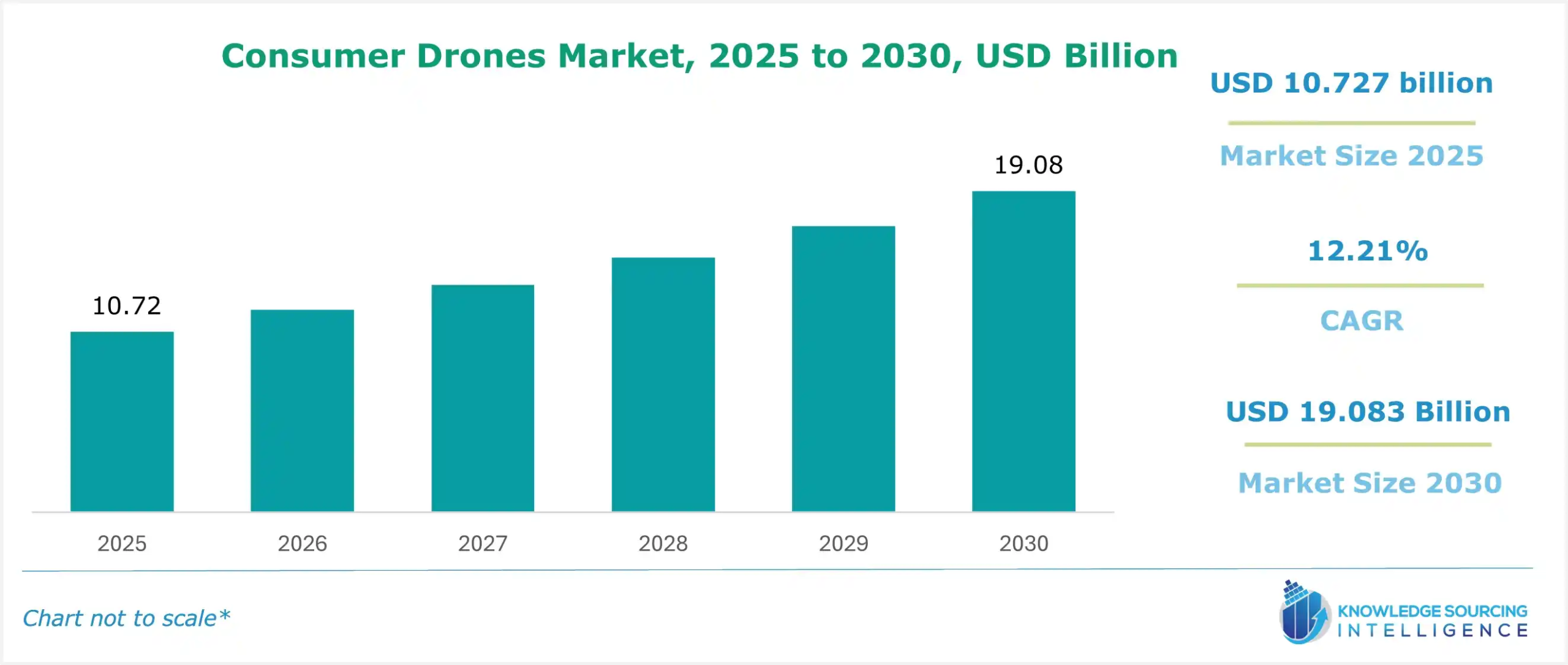

The Consumer Drones market is expected to grow at a compound annual growth rate (CAGR) of 12.21% from US$10.727 billion in 2025 to US$19.083 billion in 2030.

Consumer Drones are UAVs used in industrial sectors for various applications such as mapping, transporting or cargo delivery, and security surveying. Favorable regulations across different countries or regions pave the way for a wider application of drone technology worldwide. Businesses across various end-user industries use drones for multiple commercial applications besides basic surveillance and photography. For instance, in the agricultural sector, drones are used to perform timely crop monitoring activities, which helps in preventing yield loss. In the retail sector, drones are being increasingly used for delivery services by retail stores. The ongoing investment and contract establishment by the government & defense with drone manufacturers has provided further market growth opportunities.

Motor drivers, angles, locations, charging sensors, chargers, and controllers are all included in consumer drones to ensure optimal control systems and power efficiency. These consumer drone components have superior efficiency and consume little power, which influences consumer purchasing choices effectively. The growing popularity of drone racing and photography contests, as well as other efforts that encourage drone flight as a recreational activity, is also contributing to the market’s growth.

Additionally, as per Federal Aviation Administration data for the U.S. in February 2024, the number of drones registered was 7,81,781, while commercial drone registration was 3,75,226, and recreational drones registered was 4,00,858. Recreational activities, mapping terrain, taking aerial photos, and drone racing are among the majority of the uses for consumer drones, which are utilized by hobbyists, photography enthusiasts, and gamers.

Further, in December 2023, Dronewatch launched ChatUAV, the world’s first AI-powered drone knowledge base, providing answers to various drone-related questions, from hobbyist information to professional regulatory issues. The growing popularity of drones for aerial photography and gaming will have a positive impact on the consumer drone market.

What are the drivers of the Consumer Drones Market?

- Growing popularity of aerial capturing and integration of artificial intelligence is projected to propel the Consumer Drones market expansion.

A significant increase in consumer awareness regarding the use of drones for aerial capturing is being witnessed. Therefore, the growing availability of consumer drones has been complemented by its latest technological advancements. The most recent drone model specifications include increased accuracy, faster speeds, tracking systems that can be linked to the user's phone, and efficient, secure, and effective control systems. Hence, this has increased its demand among its targeted audience.

Moreover, the UN Tourism estimate of international tourist arrivals worldwide shows a boost to 117 million in 2022 from 41 million in 2021. Tourists are attracted to capturing stunning aerial images and videos, reflecting the potential for an increase in demand for consumer drones in the years ahead.

Instead of high-end video cranes, photography enthusiasts are increasingly using consumer drones to capture photos and videos. Consequently, the manufacturers have focused on the automation of consumer drones using artificial intelligence, which permits the programming of navigation commands within the drone itself. The adoption of artificial intelligence (AI) allows drone users to capture and use optical and environmental data from sensors connected to the drone. Through this technology, drones can recognize objects in the air and analyze and capture data on the ground.

Therefore, the growing popularity of consumer drones and the integration of artificial intelligence has prompted the market players to tap this huge potential through regular investment and expansion of the product offering. For instance, in April 2024, India-based tech brand IZI launched the IZI MINI X drone, India's first 4K nano drone, priced at Rs 29,999. The drone features a 3-axis stabilized gimbal, 20MP image capability, and a CMOS sensor for seamless video recording with a flight time of 31 minutes and a maximum height of 120m.

- Rising popularity of drone blades in aerial videography is anticipated to fuel the Consumer Drones market expansion.

The most popular type of drone blades is used for videos from the angle of the bird's flight for personal and commercial purposes like real estate, sports events, and weddings. Furthermore, the continuous increase in the order of high-precision aerial photography and videography leads to the increasing demand for rotary blade drones.

Thereby, the variations in drone-related products that major companies offer can affect the overall product demand. Owing to this, the companies established their preposition by offering a wide range of rotary blade drone variants which have unique utilities and extra functions when compared to the competition. Such as drone providers, with the ability to fly for longer periods and have better camera resolutions or better obstacle avoidance systems, would have a higher market share due to these advantages.

Furthermore, manufacturers that produce rotary blade drone models complete with various custom features and features can equally stimulate innovation as they provide advanced abilities. For example, digital manufacturers are developing new and improved sensors or cameras that enhance the performance and function of drones while also creating a demand and expanding the market. Consequently, the different rotary blade drone product variants presented by leading companies, as well as the technological influence on the market, are anticipated to promote innovation and differentiation within the rotary blade drone market.

Advances in drone technology, such as improved sensors, longer battery life, and better cameras, are making rotary-blade drones more capable and versatile. This is driving the development of new and innovative drone applications, further fueling demand for rotary blade drones. The rotary blade drone market is also supported by the funding and investment secured by key market firms to rebrand and strengthen their positions.

What are the key geographical trends shaping the Consumer Drones Market?

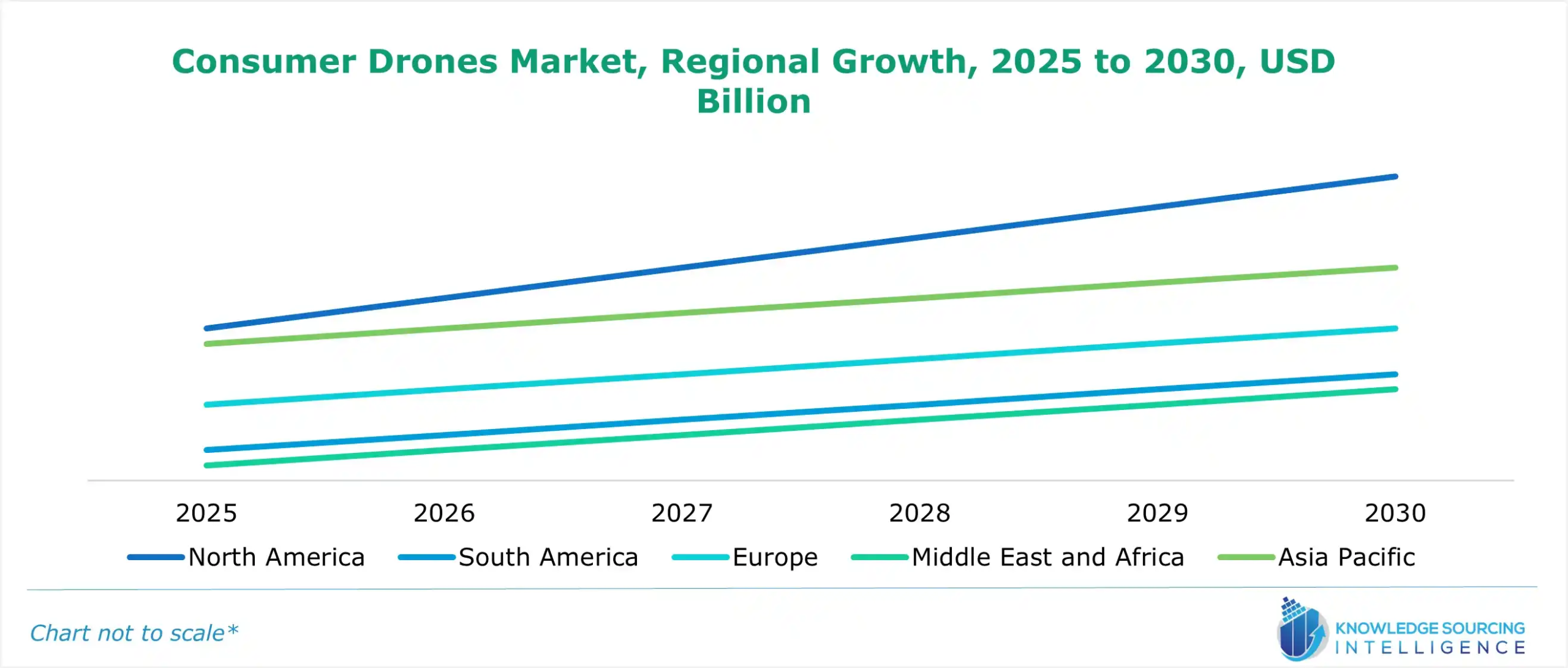

Based on geography, the Consumer Drones market is segmented into North America, South America, Europe, the Middle East and Africa, and the Asia Pacific. Asia Pacific is anticipated to hold a substantial market share. The growing popularity of social media like TikTok and Instagram has increasingly helped drone activities become more common among Chinese users. Over time, people started to use drones with great potential for taking and sharing bird’s eye view photos of their trips, adventures, and ordinary life; they share them online to show their creativity and talent. As amateurs and professionals alike are fond of them, they are mostly used to capture aerial videos of high quality.

China’s drone industry has shown an amazing growth rate over the last couple of years, with unmanned aerial vehicles (UAVs) now being used more widely in different industry sectors. According to the Civil Aviation Administration of China, 1.27 million licensed UAVs were registered at the end of 2023, which was a 32.2 percent increase from 2022. Drone operations constituted around one-fifth of all organizations, having employed more than 194,000 people with drone pilot certification.

Besides that, civilians use drones, which logged 23.11 million flying hours in the state in 2023, representing an 11.8 percent increase over the preceding year. UAVs are of great importance to the agricultural, forestry, animal husbandry, fishery industries, entertainment, and network photography in China.

On the other hand, the usage of drones has gone from uncommon to widespread in the entertainment and media industries, such as film and television, as well as photography and live events. Therefore, Chinese users are more involved in drones for recreation, such as capturing aerial footage and participating in drone races upsurging the overall market growth.

Further growth in the market will be propelled by the adoption of advanced technologies, such as AI and ML, into drone operations. These technologies help enhance flight safety and the capabilities for data analysis while permitting autonomous flight operations. Further advancements in regulatory frameworks, as these innovations are assimilated, will likely prompt more businesses to adopt Consumer Drones for a variety of applications, including logistics and delivery services. This trend not only depicts the move towards automation but also increases reliance on drones to enhance effectiveness and efficiency in different sectors.

Recent developments in the Consumer Drones Market:

- June 2024- SMTO has partnered with Essemtec, a leading company in complex electronics assembly solutions, for a strategic presence in the Mexican market. This alliance seeks to leverage the fast-expanding electronics manufacturing sector of Mexico, which has experienced a 30% increase between 2020 and 2023. Combining Essemtec's advanced manufacturing tools with SMTO's commitment to service excellence, the partnership will prove to be an opportunity to offer a holistic solution with support to local manufacturers. Both companies are enthusiastic regarding the growth potential, strengthening their market penetration through service provision, and ready for the shifting landscape of Mexico's electronics industry.

- January 2024- ASMTXTRA USA has joined up with Precision Tool Group as its representative from Virginia to Maine. This agreement is expected to improve the distribution of SMT products and solutions in the northeastern United States. SMTXTRA USA, an expert in surface mount technology, looks forward to leveraging Precision Tool Group's wide network and industry experience to better serve customers in the region. The agreement represents a common commitment to providing high-quality, cost-effective products that satisfy the changing needs of the electronics manufacturing industry. By combining thorganizationseir resources, both organisations hope to improve service delivery and extend their market presence. This strategic agreement is expected to improve manufacturers' access to modern SMT equipment and components, ultimately promoting enhanced efficiency.

Consumer Drones Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Consumer Drones Market Size in 2025 | US$10.727 billion |

| Consumer Drones Market Size in 2030 | US$19.083 billion |

| Growth Rate | CAGR of 12.21% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in Consumer Drones Market | |

| Customization Scope | Free report customization with purchase |

The Consumer Drones market is analyzed into the following segments:

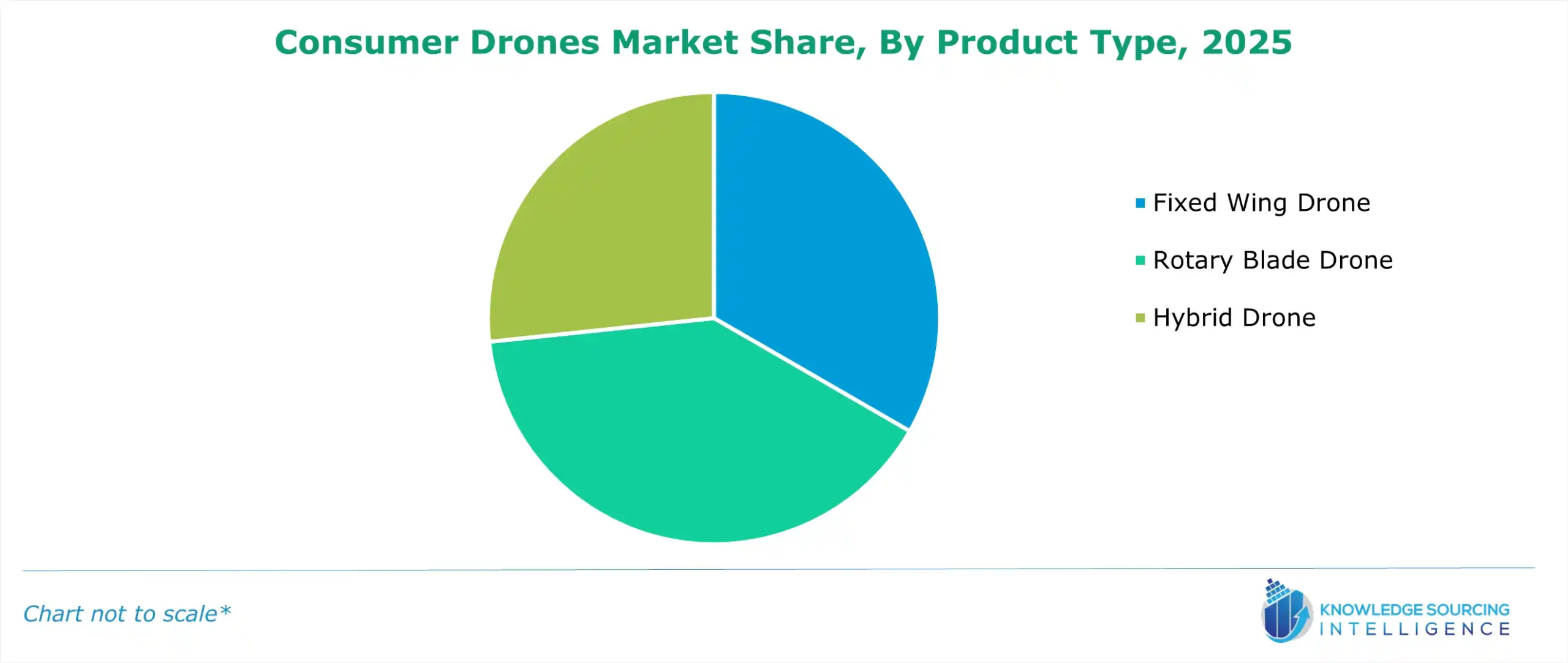

- By Product Type

- Fixed Wing Drone

- Rotary Blade Drone

- Hybrid Drone

- By Application

- Hobbyist & Gaming

- Aerial Photography

- By Geography

- North America

- United States

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- United Kingdom

- Germany

- France

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Israel

- Others

- Asia Pacific

- Japan

- China

- India

- South Korea

- Indonesia

- Thailand

- Others

- North America