Report Overview

Contract Food Services Market Highlights

Contract Food Services Market Size:

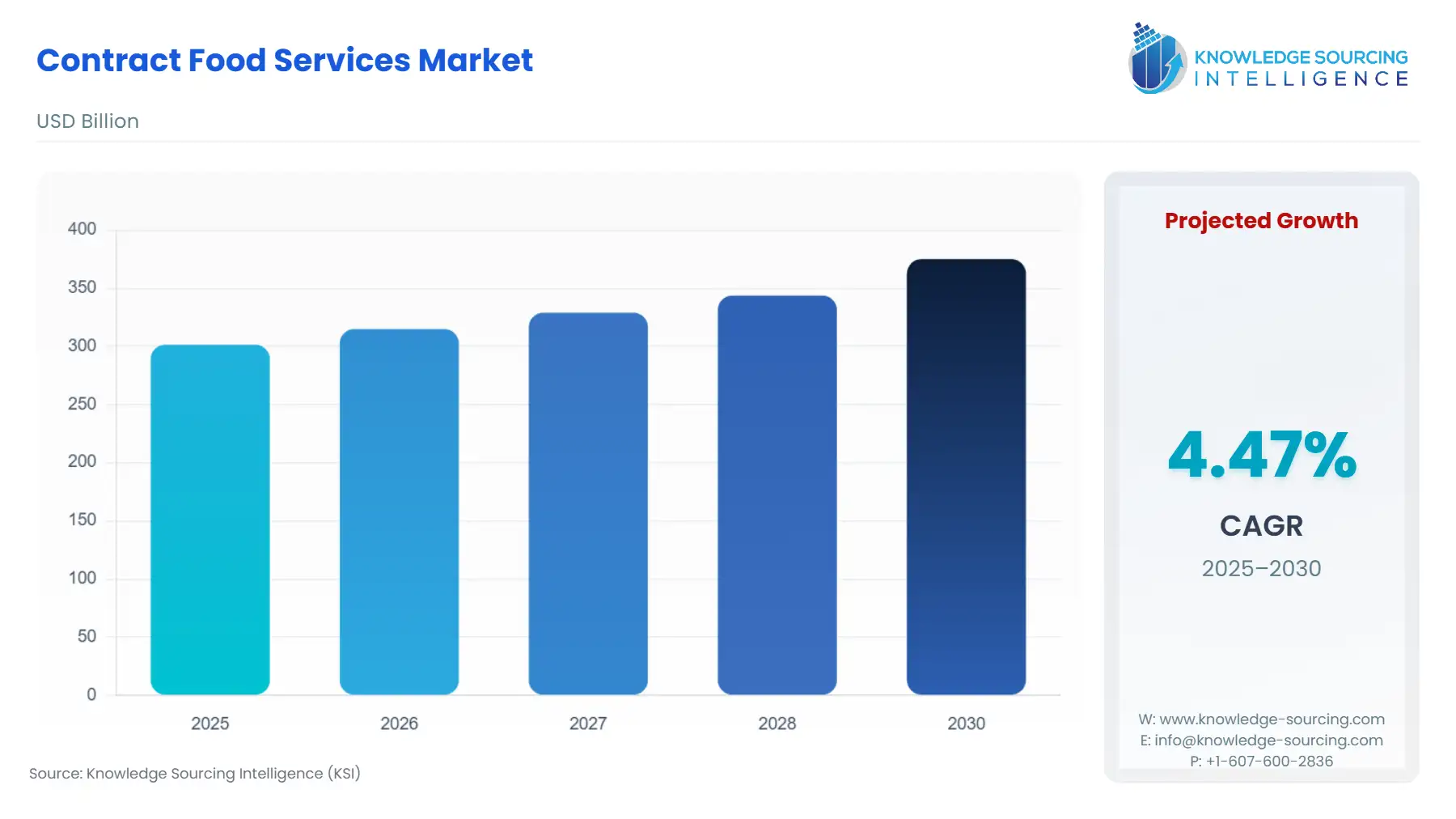

The Contract Food Services Market is expected to grow from US$301.455 billion in 2025 to US$375.147 billion in 2030, at a CAGR of 4.47%.

The global contract food services market is evolving significantly. This change is largely due to shifting consumer expectations, operational costs, and priorities of institutions, which makes foodservice outsourcing a strategic tool rather than a mere cost-containment tool. The market growth is driven by the needs of corporate workplaces, schools, healthcare systems, factories, hospitality venues, and off-site operations, which are all seeking service providers who can deliver quality, nutritional transparency, and operational efficiency on a large scale.

Various macro trends are impacting the market, including the widespread adoption of hybrid working, demographic changes in the populations of schools and universities, and the greater emphasis on clinical nutrition in hospitals. These changes are influencing the way menus are planned, volumes are forecasted, and service formats are diversified, providing additional support to the market. However, global labour shortages, increasing food inflation, tightening regulations on food safety, and the issuing of sustainability pledges are some of the factors encouraging institutions to seek the services of external experts to both reduce operational complexity and, simultaneously, improve their compliance and waste-reduction performance.

Contract Food Services Market Overview

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

The contract food services market continues to grow as companies in the corporate, institutional, hospitality, and industrial sectors are progressively outsourcing their foodservice operations to contracted service providers that can deliver higher efficiency, quality consistency, and cost savings. The need for such services is increasing sharply in corporate offices, hospitals, universities, manufacturing plants, and remote sites, which are seeking suppliers that can provide scalable culinary solutions, various menu formats, and nutrition-aligned meal programs without the expense of operating in-house kitchens.

The push for employee welfare, a better workplace experience, and increased productivity has led companies to upgrade their on-site dining to include healthier, more customizable, and internationally inspired menus. As a result, vendors have had to introduce innovations such as digital ordering platforms, AI-enabled menu planning, and data-driven demand forecasting tools. The EU business economy in 2024 comprised nearly 31 million enterprises that employed around 156 million people and generated €9.4 trillion of added value.

Different types of institutions, like schools and medical centres, are prioritizing the safety of food, dietary compliance, and setting sustainability standards that, in turn, reflect the role of contract caterers in creating transparent supply chains as well as facilitating eco-friendly procurement and waste-reduction practices. According to the German Federal Statistical Office[1], the number of higher education institutions in Germany was 428 in 2023/24, rising from 423 in 2022-2023. Out of these, 215 are universities of applied sciences (UAS), 109 are full universities, 52 are art and music colleges, 30 are administrative colleges, and 16 are theological colleges.

In general, the industry is moving away from the traditional outsourcing model mainly used for cost-saving purposes towards a network of strategic partnerships where customer experience through food innovation, operational resilience, and digital integration are the main factors for competitive differentiation and long-term value creation.

The major players in the Contract Food Services Market consist of a combination of global corporations and specialized regional operators. Some of these companies include ABM Catering Solutions, Aramark, Barlett Mitchell, Blue Apple Catering, Camst Group, Caterleisure Ltd., CH&CO Catering (Compass Group PLC), Elior Group, OCS Group Ltd., and Culinary Service Group. These firms extend the industry with their varied service offerings, from mass foodservice in institutions to personalized corporate dining, thus utilizing menu innovation, sustainability initiatives, and technologically enabled service models to satisfy customer expectations in different sectors.

Organizations are leveraging strategic partnerships, capabilities through mergers, and investments in supply chains to not only change the nature of competition but also to be able to give their customers highly differentiated value propositions that are customized to meet the needs of individual sectors.

Contract Food Services Market Drivers

- Increasing Need for Healthy, Transparent, and Diet-Compliant Meals

Healthy, transparent, and diet-compliant meals are becoming a major influential factor in the contract food services market as the mentioned institutions in healthcare, education, corporate workplaces, and senior living environments are confronted with rising expectations from consumers, regulators, and internal policy mandates. As a result, hospitals need clinical nutrition programs that can perfectly align with therapeutic diets, allergen restrictions, and physician-led meal plans, thus accuracy and traceability being the most important.

The increasing request for living healthy and eating transparent food and diet-compliant is a factor that goes hand in hand with the introduction of stricter rules in the market, which is managed by organisations such as the U.S. FDA, European Food Safety Authority (EFSA), and UK Food Standards Agency (FSA). They require clear nutritional labelling, allergen management, and compliance with dietary guidelines.

The demand for healthy, transparent, and diet-compliant meals is a major factor driving the Contract Food Services Market, and it is closely related to the global rise in obesity and lifestyle diseases that accompany it. As the rate of obesity increases in both developed and developing countries, schools, universities, hospitals, corporate offices, and senior living facilities are becoming the places most responsible for offering meals that not only meet the requirements of taste and convenience but also provide balanced nutrition and portion control. In 2024, the NCD Risk Factor Collaboration (NCD-RisC) published a study that estimates that the number of people living with obesity in the world has exceeded one billion, out of which almost 880 million are adults and 159 million are children and adolescents aged 5-19 years.

Contract Food Services Market Segmentation Analysis

- By End-user: Healthcare

By end-user, the contract food service market is segmented into healthcare, sports, defense, education, business & industry, and others. In the healthcare segment, a noticeable growth of this market has occurred mainly in acute care hospitals, rehabilitation centers, and nursing homes. One of the major factors driving this increase is the combined effect of changing demographics, people's expectations regarding treatments, and regulatory pressures on healthcare organizations, along with their efforts to achieve more efficient operations.

Additionally, healthcare end users are moving towards patient-centered healthcare settings, and the segment realizes that the quality of food served to patients is of utmost importance for satisfaction and thereby influencing recovery times and even reimbursements.

Furthermore, patients have become more demanding, leading to hospitals providing food of the same standard as restaurants. This means the food should be attractive, fresh, and include options, such as vegan, gluten-free, and other culturally diverse options. This is leading the hospital to create or extend a contract with the contract food services provider to align with the growing inpatient facilities requirement and green healthcare trends.

Contract Food Services Market Geographical Analysis

- North America: the US

Contract food services play a pivotal role in meeting the diverse consumer needs related to food & beverages, owing to which such services are highly required in commercial, educational, and other industrial settings.

Corporate culture in the United States is experiencing a boom, fueled by the establishment of new businesses, driving a rise in investment in commercial units. According to the US Census, in August 2025, commercial construction spending increased from US$10,484 million in July 2025 to US$10,534 million in August 2025. Moreover, the same sources further stated that construction spending in educational settings rose from US$11,823 million in May 2025 to US$13,349 million in August 2025. Meanwhile, the yearly spending in the commercial setting construction was US$120,610 million, while hospital construction spending was at US$69,625 million as of August 2025. Such investment in commercial and educational buildings is set to create demand for food contract services to fulfil the diverse needs of end-users.

Moreover, the United States also harbors major sports centers in Ohio, Michigan, New York, and Chicago, where sports participation is rising. Such significant growth will stimulate the demand for timely food consumption, thereby bolstering the necessity for food service contracts in sports centers.

Additionally, strategic collaboration and contract establishment between contract food service providers and major facilities have also augmented the market growth in the US. SSP America, in March 2024, secured a ten-year contract to manage 11 restaurants and 6 food retail programs at the Spokane International Airport. Moreover, other international players and food service providers are eyeing expansion of their presence in the US market through strategic acquisitions. For instance, in September 2023, Elior Group acquired Cater To You Food Services, which enabled the former to garner a major customer base in the education sector on the East Coast of the US.

Contract Food Services Market Key Developments

- In May 2025, Chesterfield Royal Hospital NHS Foundation Trust signed a new eight-year deal with Sodexo for the patient catering. The deal covers the production of patient meals in a central kitchen on-site and the delivery to the wards through the use of regeneration trolleys, a combination of Apetito meals and house-made menu items, an increase of the special diet range, and the launch of a new patient menu which includes High Energy options and mini meals for those with smaller appetites.

- In February 2025, Sodexo and Nuffield Health announced the extension of their long-lasting partnership which covers food services in 37 Nuffield Health hospitals with a focus on sustainable eating (vegan/vegetarian options), Soil Association bronze accreditation, Greener by Default pilot, Everyday in-room ordering app, planned carbon scoring for menus by the end of 2025, and ongoing WasteWatch food-waste reductions since 2020.

- In December 2024, ISS announced that its cleaning and catering services (including food services, dietetics, and aged care) to continue at four Northern Health locations (Northern Hospital Epping, Broadmeadows Hospital, Bundoora Centre, Craigieburn Centre). The main areas of focus are operational excellence, safety, waste-management optimization through real-time analytics, sustainability targets, and an inclusive jobs program.

Different segments covered under the contract food services market report are as below:

By Contract Type

- Cost Plus Contracts

- Royalty Contracts

- Profit & Loss (P&L) Contracts

- Management Fee Contracts

- Others

By Service Type

- On-Site Catering

- Delivered Catering

- Others

By End-User

- Healthcare

- Sports

- Defense

- Education

- Business & Industry

- Others

By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- France

- United Kingdom

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Israel

- Others

- Asia Pacific

- China

- India

- Japan

- South Korea

- Thailand

- Indonesia

- Others