Report Overview

Cyclamate Market Size, Share, Highlights

Cyclamate Market Size

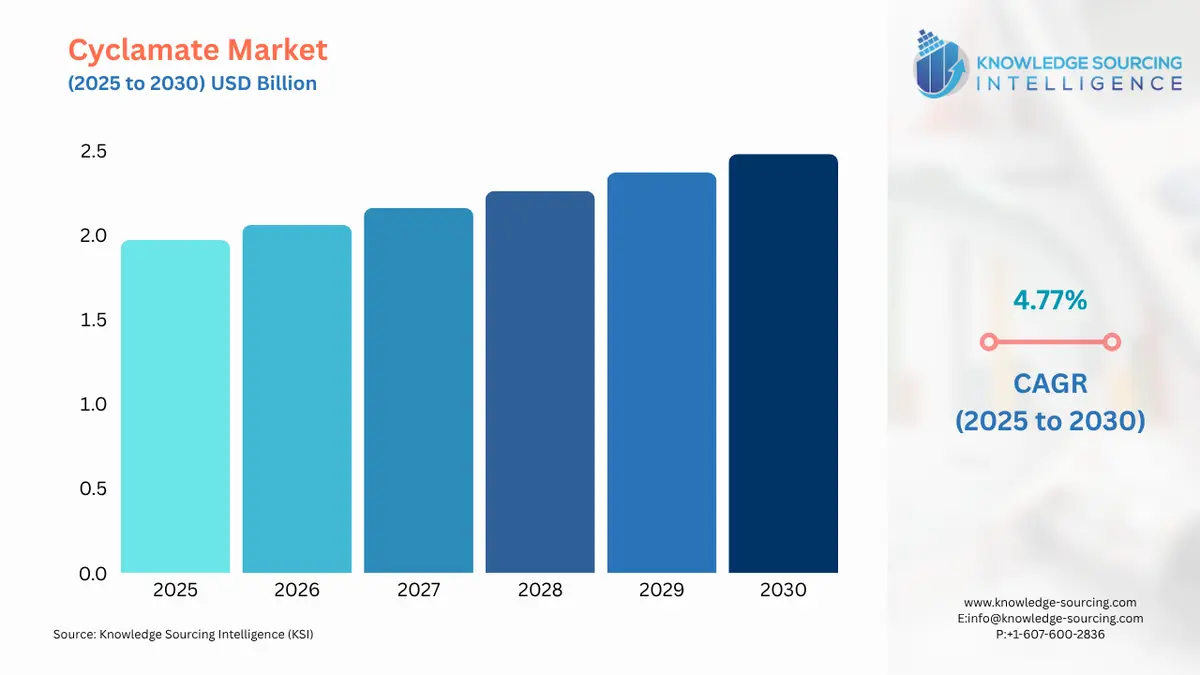

The cyclamate market is valued at US$1.965 billion in 2025 and is expected to grow at a compound annual growth rate of 4.77% to reach a market size of US$2.481 billion in 2030.

Cyclamate is an artificial sweetener, reported to be almost thirty to fifty times sweeter than sugar, making it the least potent among currently available commercial sweeteners. Michael Sveda discovered it at the University of Illinois as early as 1937. It is typically cheaper than sucralose and heat-stable. While this usually leaves an undesirable aftertaste, it is generally considered to be less than saccharin or acesulfame potassium. Cyclamate is mostly used synergistically with other sweeteners, especially with saccharin, to mask off-taste and is much less expensive than sucralose. It is the most affordable heat-stable sweetener. One of the most common uses is to combine it with saccharin to get a synergistic effect.

Additionally, cyclamate as a sweetener has been subject to heated debate regarding its adverse effects on humans. It has been said that high doses are linked to cases of bladder cancer and testicular atrophy among animals, thus banning cyclamate from food products by the U.S. Food and Drug Administration. However, many argue that cyclamate is safe to use under normal usage levels, with more than 55 countries approving its use. Cyclamate is considered safe by the European Union, allowing it to be used in foods, particularly in beverages. It is not permitted in the U.S. for food uses, but it is ordinarily used in nonfood materials like toothpaste and mouthwash.

The cyclamate market is consistently growing due to increasing consumer acceptance of low-calorie sweeteners in the food and beverage sectors. Some important growth factors include people's health consciousness, cyclamate's ability to provide sweetness without adding calories to the food, its cost-effectiveness, and high-temperature stability. However, the existing barriers in the market include regulatory restrictions in certain countries and safety concerns. Though cyclamate is said to be safe generally, few studies raise concerns about its health effects. Despite these issues, the cyclamate market is highly probable to expand because more people are inclined towards low-calorie sweeteners.

What are the drivers of the cyclamate market?

- The growing food and beverage industry is expected to fuel the cyclamate market growth.

The cyclamate market is anticipated to witness a considerable surge owing to its relation with the thriving food and beverage industry. The growing need for healthier alternatives and low-calorie and sugar-free products is largely driven by rising disposable income and changing lifestyle trends.

Emerging markets like Asia-Pacific are also stepping up their pace. They are growing rapidly in their food and beverage industry, offering new opportunities to form new business leads for cyclamate.

Based on the information derived from the Department of Science & Technology titled "Indian Food & Beverages SSI Survey" (IFBSSI), the Indian food processing industry is expected to reach $535 billion by FY 2025-26 while having huge investment opportunities in the food retail sector due to favorable policies and fiscal incentives. Further, the global industrial automation market is projected to grow to $297 billion by 2026, where food and beverage applications hold 11% of the market, promoting the demand for cyclamate in the market space.

Additionally, it is a non-caloric sweetening agent that reduces sugar content in many commodities. Its usage has been controversial in some countries but is widely accepted and used in many regions. Its cost-effectiveness is becoming an attractive alternative for manufacturers as well. With the continuously thriving food and beverage industries and the increasing demand for healthier options, cyclamate has a great opportunity for future establishment.

- An increase in the demand for low-calorie sweeteners is anticipated to foster the cyclamate market.

The cyclamate market is influenced by growing health and wellness awareness regarding low-calorie sweeteners, growing health concerns, and government regulatory support. Cyclamate, a non-caloric sweetener, can reduce calorific intake without compromising taste and is more economical than other artificial sweeteners available. Population growth directly influences increasing demand for low-calorie sweeteners such as cyclamate. According to the UN prediction, the world's population will increase to 11.2 billion from 7.6 billion in 2030 by 2100. Global population growth is expected to continue even as levels of fertility drop, rising to about 83 million annually.

Urbanization and lifestyle changes, both attributed to increased population flow, also bring the rising consumption of processed food, often containing sugars, hence the rise of low-caloric substitutes such as cyclamate, among other sweeteners. Positive changes in demand for low-calorie sweeteners alongside cyclamate benefits are expected to significantly increase cyclamate market growth. With the growing trend of health and fitness-oriented consumers, the market for reduced-calorie sweeteners, cyclamate included, is likely to widen further.

- The rising prevalence of obesity and diabetes is predicted to promote the cyclamate market.

Cyclamate markets heavily rely on incidences of diabetes and obesity, propelling awareness toward understanding the health risks associated with these conditions, including heart disease, stroke, and type-2 diabetes. Indeed, the sugar alternative industry is also driven by the diabetes crisis currently facing many nations worldwide. According to data released by the World Health Organization (WHO), as of 2022, 14 percent of adults aged 18 and above were diagnosed with diabetes, in comparison to 7 percent in 1990. Over half of the 30-and-above age category were not on any treatment, as the lowest treatment coverage of diabetes was in low- and middle-income countries.

Cyclamate helps with weight control by reducing calorie intake and maintaining blood sugar levels. Furthermore, it replaces sugar use without incurring health hazards from excessive sugar consumption. Several applications in food and beverage products reduce such concerns, and cyclamate suits the dietary requirements. Since modern consumers strive to consume healthier food alternatives, the demand for sweeteners such as cyclamate will increase, fuelling its market growth in the coming years.

Cyclamate market geographical outlook:

- Asia Pacific is expected to have a significant cyclamate market share.

Countries like China, India, and Indonesia are experiencing rapid economic growth, driving increased demand for food and beverage products. The combination of these factors is expected to fuel the demand for cyclamate in the Asia-Pacific region, making it a major market for this sweetener. As the region continues to develop and its population grows, the demand for low-calorie and sugar-free options will likely increase, solidifying the region's position as a key market for cyclamate.

Countries like China, India, and Indonesia have already shown fast growth acceleration, increasing demand for food and beverage products. Combining these factors makes this region one of the important markets for cyclamate sweeteners. As the population increases and develops, the demand for low-calorie and sugar-free products will increase in the region, making Asia Pacific a key market in cyclamate.

Cyclamate market scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Cyclamate Market Size in 2025 | US$1.965 billion |

| Cyclamate Market Size in 2030 | US$2.481 billion |

| Growth Rate | CAGR of 4.77% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in the Cyclamate Market | |

| Customization Scope | Free report customization with purchase |

The Cyclamate Market is analyzed into the following segments:

- By Type

- Cyclamic Acid

- Sodium Cyclamate

- Calcium Cyclamate

- By End-User

- Food and Beverages

- Pharmaceuticals

- Cosmetics and Personal Care

- Others

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- United Kingdom

- Germany

- France

- Italy

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Indonesia

- Others

- North America