Report Overview

E-Hailing Market - Strategic Highlights

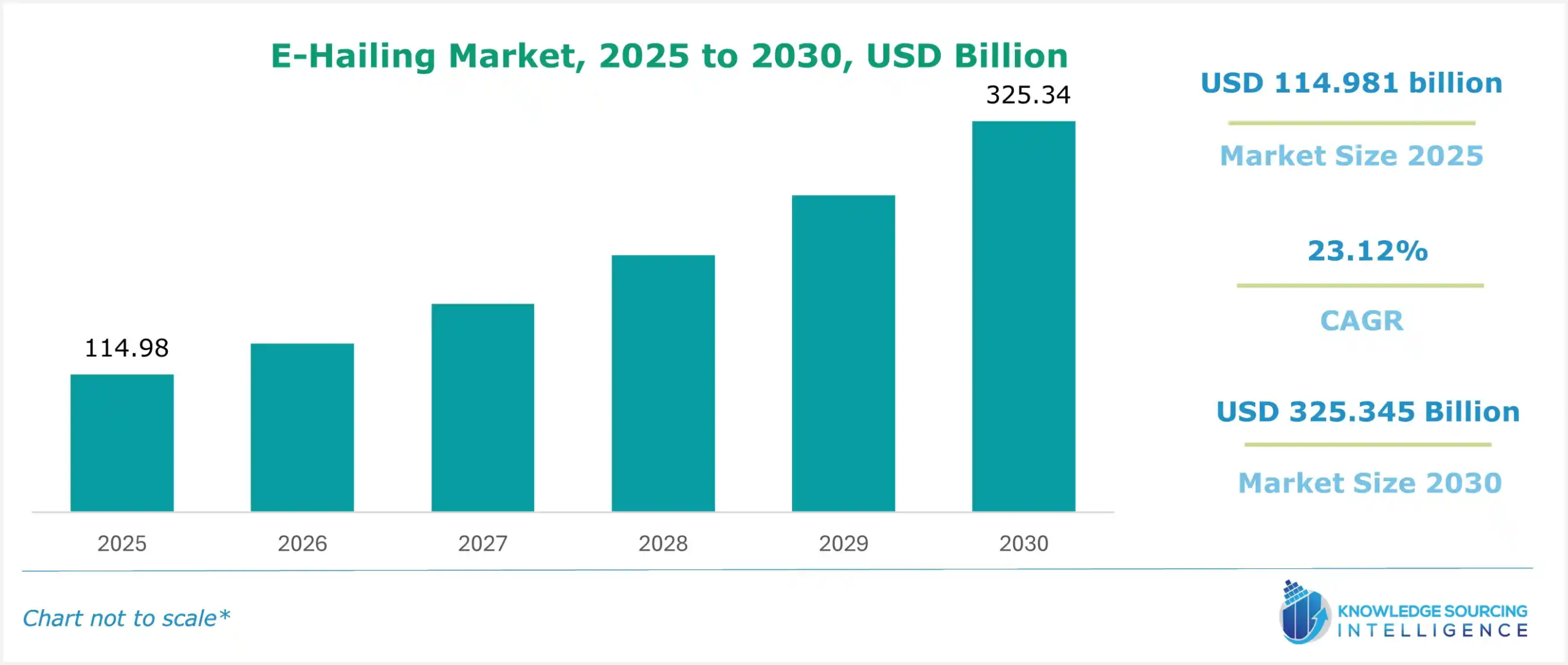

E-Hailing Market Size:

The global e-hailing market is projected to grow at a CAGR of 23.12% over the forecast period, from US$114.981 billion in 2025 to US$325.345 billion by 2030.

E-hailing services involve the service provider booking passenger vehicles by using any electronic applications, such as smartphones, tablets, or laptops. Such services have provided an easy-to-use transportation since users can get a ride anywhere within minutes. The growing traffic congestion in countries has negatively impacted the scale of owning private vehicles, which is accelerating the demand and usage of e-hailing services. Further, the upsurge in internet penetration in coordination with the growing technological advancements has potentially propelled the market expansion. According to the World Population Review, around 4.9 billion individuals worldwide were actively using the Internet in 2022, which accounts for 69% of the total population and a yearly rise of 4% in new Internet users.

Additionally, according to Our World Data's report on Urbanization, the urban population is rising at a higher rate and is estimated to rise from 4.38 billion in 2022 to 5.17 billion by 2030. Further, urban regions are predicted to become the home of over two-thirds of the world's population by 2050, with urban area shares estimated to rise largely across all nations. This increase will demand more convenient and affordable transportation options, contributing to a rise in the market.

Furthermore, the increased consumer convenience with easy mobility options provided through e-hailing has made mobility companies expand their services through investments and new launches in other regions.

E-Hailing Market Growth Drivers:

- Rising traffic congestion is expected to bolster the demand for the e-hailing market.

The growing number of vehicles on the road, improper public transport availability, and poor driving habits are some of the common causes of traffic congestion. A growing population coupled with rapid urbanization is expected to further increase the scale of traffic congestion, especially in major countries such as the USA, India, and China. According to the World Bank’s data, in 2022, India’s urban population stood at 508.37 million, while China also recorded a rise in its urban population to 897.58 million in 2022.

Moreover, according to the ACEA report on World new motor vehicle registrations of May 2023, India had a constant increase of 24.1%, with 4,741 new vehicle units registered in 2022, a rise from 3,820 units in 2021. In addition, about 82 million motor vehicles are sold worldwide every year. The European Union accounted for 13.3% of all motor vehicle registrations, with about 11 million new vehicles sold yearly.

In addition, e-hailing enables passengers to travel from their homes to workplaces and vice versa at a much lower rate and with greater convenience. Owing to this, the need to use personal transport for traveling is expected to witness slow growth, thereby reducing the overall number of personal vehicles on the road and reducing traffic congestion. Such benefits provided by e-hailing will positively impact the market demand in major economies such as India and China.

- Growing utilization of e-hailing for cars

The e-hailing services provide a preference for booking a ride through electronic applications, thereby providing the utmost comfort to users. Furthermore, with the increased adoption of smartphones and wearables, coupled with rising internet usage, and is anticipated to boost the market growth. The growing popularity of transportation models has made e-hailing services an alternative to traditional taxi services or other public transport vehicles. Cars have emerged as the most popular choice for customers among all vehicles. This is because it serves as a convenient transport mode with ease of getting a car availability on demand without worrying about the cost associated with its ownership. Moreover, users are free from car parking-related issues, which propels the demand for cars as the most suitable vehicle for e-hailing in the long term.

Additionally, numerous options from companies, such as competitive pricing and availability of ride-sharing and pooling services, enable more customers to reduce their total travel expenses. This aids their quick decision-making with transparent pricing related to car rides on apps and proper upfront fare estimates before the ride.

The waiting time for passengers will further reduce, boosting the growth of e-hailing platforms with the availability of more vehicles. This is because, as the supply of cars increases with more drivers joining these platforms, users will get a wide range of options to choose from per their unique needs. According to the OICA, the global sales of passenger cars increased by around 11% in 2023 compared to the previous year. This is expected to promote the efficient growth of the e-hailing platform with enhanced participation of four-wheeler vehicles. Furthermore, the expansion of e-hailing services provides car owners with more flexibility and income opportunities, thereby incentivizing them in large numbers to participate in ride-sharing platforms.

E-Hailing Market Geographical Outlook:

Geography-wise, the market of Global e-hailings is divided into North America, South America, Europe, the Middle East and Africa, and the Asia Pacific. The growth of e-hailing services in developed economies such as the United States will be impacted in a significant manner with increased adoption of the internet and higher proliferation of devices such as smartphones. Further, the rising demand for on-demand services serves as a perfect substitute for customers who look for alternatives to rental cars or other traditional modes. Therefore, this will result in lucrative prospects for ride-sharing across the country till the projected period.

Furthermore, efforts by major companies to develop sustainable modes of transportation, such as electric vehicles on their e-hailing platforms, are likely to emerge as a key trend in the upcoming years. For instance, in 2022, Uber tripled the number of electric vehicles on its ride platform in regard to its milestone of connecting 31 million unique riders with a ride in electric vehicles. This also aligns with the company’s commitment to emerge as a zero-emission mobility platform in North America and Europe by 2040.

Moreover, in 2024, Minneapolis, United States, announced a deal with Uber and Lyft related to an increase in driver wages and improved working conditions. Such interventions will attract more drivers to participate in e-hailing platforms, thereby expanding services for customers.

Additionally, according to the National Automobile Dealers Association’s estimate, the new vehicle share in total dealership sales in the country has increased and reached 53.6% in 2023 compared to 49.7% in 2022. With the rise in new vehicle ownership across the country, e-hailing services in the country will expand, contributing to market growth until the forecast period.

Nonetheless, with the growth of EV popularity, the e-hailing market will get a boost in the country with greater integration of EVs into ride-hailing fleets, thereby catering to the needs of environment-conscious customers. For instance, Tesla vehicles such as Model 3 and Model Y are known to be the most preferred choice among e-hailing companies mainly due to their inclusion of advanced technological features.

E-Hailing Market Key Developments:

- In October 2024, Dubai Taxi Company PJSC, a leading provider of comprehensive mobility solutions in Dubai, announced that it had signed a strategic partnership with Bolt, the global shared mobility platform, to launch its e-hailing platform in Dubai.

- In January 2024, Kia Corporation and Uber signed a Memorandum of Understanding (MoU) at the Consumer Electronics Show (CES) in Las Vegas, committing the two companies to collaborate on plans to develop and deploy a wide range of PBVs.

List of Top E-Hailing Companies:

- Uber Technologies Inc.

- Lyft Inc.

- Didi Chuxing Technology Co.

- Ola Cabs

- MyCar

E-Hailing Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| E-Hailing Market Size in 2025 | US$114.981 billion |

| E-Hailing Market Size in 2030 | US$325.345 billion |

| Growth Rate | CAGR of 23.12% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in E-Hailing Market |

|

| Customization Scope | Free report customization with purchase |

Global E-Hailing Market Segmentation:

- By Vehicle Type

- Cars

- Three Wheelers

- Two Wheelers

- By End-users

- Personal Use

- Business

- By Geography

- North America

- United States

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- France

- United Kingdom

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- India

- China

- Japan

- South Korea

- Others

- North America