Report Overview

Electronic Design Automation Software Highlights

Electronic Design Automation Software Market Size:

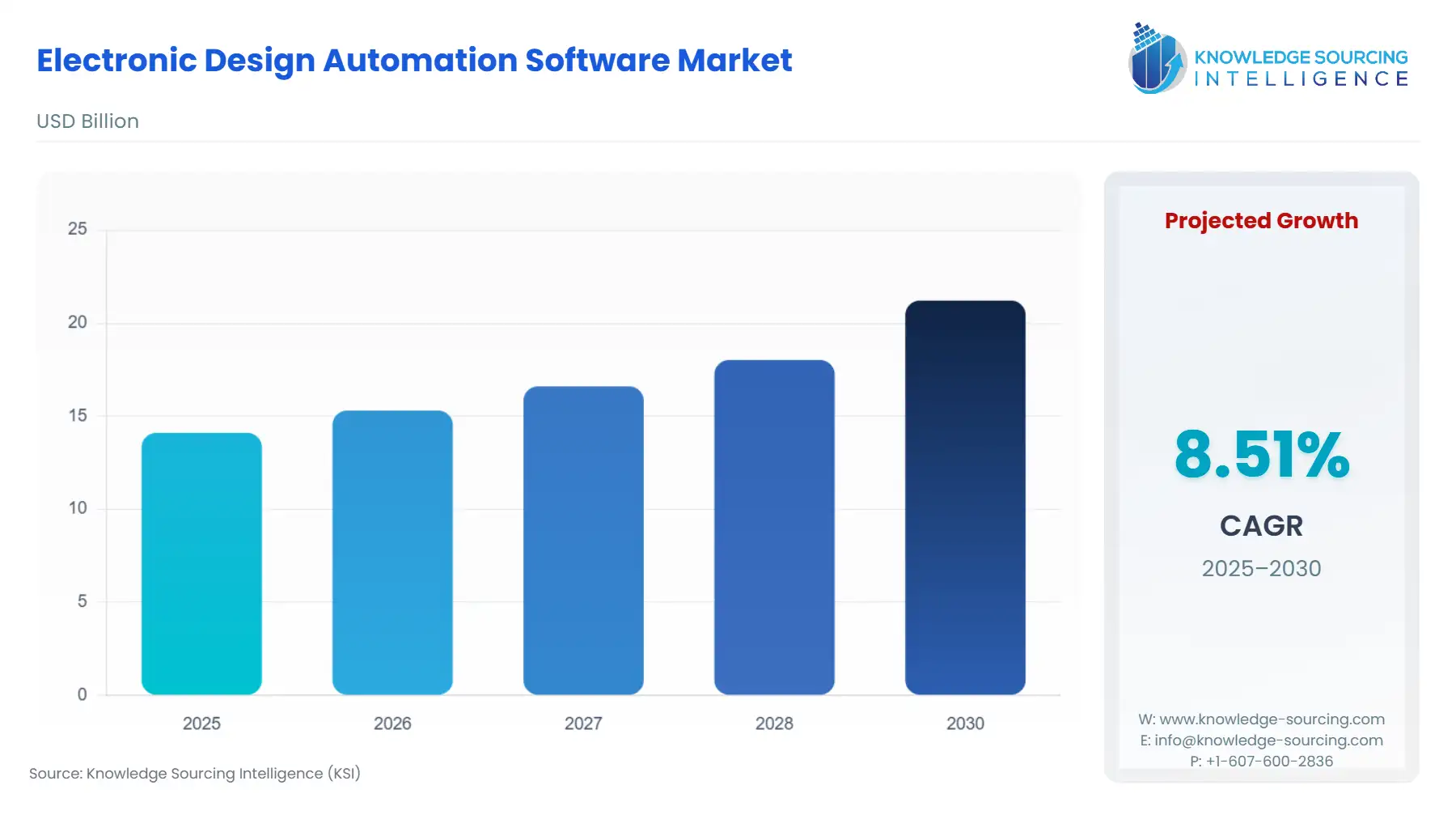

Electronic Design Automation Software Market, with a 8.25% CAGR, is anticipated to reach USD 22.695 billion in 2031 from USD 14.101 billion in 2025.

Electronic Design Automation Software Market Trends:

The electronic design automation (EDA) software market is expected to grow considerably during the forecast period. It refers to the software for defining, designing, implementing, verifying, and manufacturing semiconductor devices and electronics. This software finds multiple use cases, such as designing integrated circuits and printed circuit boards. The electronic design automation software market is heavily connected with the semiconductor business. The electronic design automation software market can be classified in the following ways: by product, deployment, application, end-user, and geographic region. The major drivers for the growth of this market include increased demand from several booming industries such as aerospace and electronics and technological advancements.

Electronic Design Automation Software Market Growth Drivers:

Advancements in technology

The rapid advancements in modern technologies greatly impact the electronic design automation software market size due to continuous research and development efforts by private manufacturers and public institutions. The increased adoption of FinFET architectural technology for processor designing has significantly impacted the electronic design automation software market. Other technological innovations, such as IoT, artificial intelligence, machine learning, virtual reality, etc., are also helping push the demand for electronic design automation software by opening up alternative avenues for their usage in technology and electronics-based industries.

Demand in the electronics industry

There is a noticeable growth in the electronics industry due to research and development efforts. For instance, India, considered a popular manufacturing hub, has grown its domestic electronics production from US$ 29 billion in FY15 to US$ 101 billion in FY23. The electronics sector of India contributes around 3.4% of the country's Gross Domestic Product (GDP). Many daily-use electronic products like smart televisions and smartphones are growing in demand globally, and their manufacturing involves using semiconductors to control and manage the flow of electric current. Therefore, as the demand for consumer electronics grows, the need for semiconductors will grow proportionately, increasing the electronic design automation software market size too.

Rising trend of miniaturization

There has been an increasing trend of miniaturization in electronic devices. This expands the scope for applications of electronic design automation in multiple industries, such as consumer electronics, healthcare, automotive, etc. Miniaturized semiconductor components are utilized in healthcare in several devices, such as blood pressure machines, pacemakers, glucose monitors, and various surgical devices. Similarly, the trend of smartphones and wearable electronics such as smartwatches and fitness trackers has also helped increase the electronic design automation software industry value by providing more scope for the usage of this software to continually improve on miniaturization to allow for the inclusion of other features in products.

Electronic Design Automation Software Market Restraints:

Technological changes and semiconductor shortages.

A significant challenge this industry faces is the constant technological changes characterizing the semiconductor industry. Changes in semiconductor technologies affect the overall design architectures, which can lead to integration challenges. Thus, there is a need to develop electronic design automation software solutions that can evolve with the changes in the market. Additionally, shortages of semiconductor chips in the global market can also restrain the growth of this industry, as the demand for electronic design automation is closely derived from the need for semiconductor chips.

Technical complexities.

Another additional barrier to the industry's growth is the increasing complexity of microcontrollers and microprocessors and the costs associated with the non-recurring engineering of large-scale integration designs. These complexities are expected to restrict the development of the electronic design automation software market.

Electronic Design Automation Software Market Solutions Offered:

Cadence Design Systems offers its Cadence Verification service, which includes the complete flow of verification designed to deliver a higher throughput to customers in terms of verification. The verification software is designed to provide maximized productivity and increased verification throughput, allowing for the detection and diagnostics of bugs.

Zuken’s CR-8000 suite of advanced PCB design software covers all stages of the PCB engineering lifecycle, from architectural planning to physical implementation and manufacturing. It is complemented by data management capabilities too. The core products in this range span from design force applications, such as those used for advanced packaging and simulation & analysis, to design gateways and data management applications.

Electronic Design Automation Software Market Geographical Outlook:

The geographic segmentation of the EDA software market.

The electronic design automation software market can be segmented into the following geographic regions: North America, South America, Europe, the Middle East and Africa, and Asia-Pacific. The growth of this market is expected to be driven by matured markets in developed regions.

North American region forecast.

The North American region is expected to constitute a significant share of the electronic design automation software industry, and similar trends are expected to be followed in the forecast period. This market share is owed to the increased adoption of electronic design automation tools such as processors, design circuit boards, etc., by major industries such as automotive and electronics in this region.

A major driver of market growth for electronic design automation software in this region is the presence of large semiconductor and circuit manufacturers, such as Cadence, Synopsys, Xilinx, etc., in the United States. These global leaders are responsible for most research and development that results in technological advancements in the field, thus, boosting the demand for electronic design automation software.

Forecast for the Rest of the World.

It is anticipated that the Asia-Pacific and European markets will experience moderate growth too. The electronic device automation software market is expected to grow steadily in the Asia-Pacific region due to large semiconductor manufacturers such as Samsung and a growing electronics industry in countries such as China, India, South Korea, etc.

Electronic Design Automation Software Market Key Developments:

In August 2025, Siemens Digital Industries Software announced that Addverb Technologies, a leading Indian company providing robotics and innovative warehouse automation solutions, is using software from the Siemens Xcelerator portfolio to deliver intelligent automation solutions faster and more efficiently while maintaining high product quality and scaling its automation offerings across diverse industries globally.

In June 2025, Siemens Digital Industries Software introduced two new solutions to its Electronic Design Automation (EDA) portfolio that help semiconductor design teams address and overcome the complexity challenges associated with the design and manufacture of 2.5D and 3D Integrated Circuit (IC) designs.

List of Top Electronic Design Automation Software Companies:

Cadence Design Systems, Inc.

Synopsys, Inc.

Siemens

ANSYS, Inc.

Altium LLC

Electronic Design Automation Software Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Companies |

|

Report Metric | Details |

Electronic Design Automation Software Market Size in 2025 | USD 14.101 billion |

Electronic Design Automation Software Market Size in 2030 | USD 21.214 billion |

Growth Rate | CAGR of 8.51% |

Study Period | 2020 to 2030 |

Historical Data | 2020 to 2023 |

Base Year | 2024 |

Forecast Period | 2025 – 2030 |

Forecast Unit (Value) | USD Billion |

Segmentation |

|

Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

List of Major Companies in Electronic Design Automation Software Market |

|

Customization Scope | Free report customization with purchase |

Electronic Design Automation Software Market Segmentation:

By Product

Computer-Aided Engineering

Semiconductor IP

IC Physical Design & Verification

Others

By Deployment

On-Premise

Cloud

By Application

Microprocessors & Microcontrollers

Memory Management Unit

Others

By End-User

Electronics & Semiconductors

Automotive

Aerospace

Medical & Healthcare

IT & Telecommunications

Others

By Geography

North America

United States

Canada

Mexico

South America

Brazil

Argentina

Others

Europe

Germany

France

United Kingdom

Spain

Others

Middle East and Africa

Saudi Arabia

UAE

Israel

Others

Asia Pacific

China

India

Japan

South Korea

Indonesia

Thailand

Taiwan

Others