Report Overview

Emotional AI Market - Highlights

Emotional AI Market Size:

The Global Emotional AI Market is forecast to grow at a CAGR of 13.0%, reaching USD 12.7 billion in 2031 from USD 6.9 billion in 2026.

An emotional AI is an AI solution that has the capability to understand human facial expressions and vocal tones and interact accordingly. This AI solution has the capability to detect human emotions through texts, audio, and video. It is set to play a crucial role in the global automation of various industries, like healthcare, automotive, gaming, and entertainment, among others.

In the healthcare industry, emotional AI solutions can act as an impartial tool to detect multiple disorders like anxiety, depression, and bipolar disorders. It also has the capability to detect autism spectrum disorder, a disease related to the development of the brain. According to the World Health Organization, there are about 1 case of autism in 100 children around the globe. The organization also stated that the characteristics of the disease can be detected in early childhood, but it is not generally diagnosed in later age of the children. Similarly, the cases of depression are also significantly increasing around the globe. The WHO also stated in its report that about 5% of the global adult population is suffering from or expressing depression. According to the data, about 4% of adult men and about 6% of adult women are suffering from depression. The cases of depression above the age of 60 years have increased to 5.7%.

Emotional AI Market Growth Drivers:

Growing demand for autonomous vehicles

Emotional AI is sure to play an important role in the automotive industry. In the industry, it can be embedded in completely autonomous vehicles to achieve the complete safety and security of the driver and passenger. In autonomous vehicles, emotional AI can detect the emotional stress and discomfort of the driver and passenger and can take over the operation on its own.

The increasing demand for autonomous vehicles in the global market is sure to propel the global demand for emotional AI. Tesla, the US-based automotive manufacturer, is one of the global leaders in offering autonomous vehicles to the global population. According to the company, the demand for their Model 3 and Model Y, one of the best-performing autonomous vehicles, has increased in the past few years. According to the annual report published by the company, the total delivery of its Model 3 and Y vehicles was about 1.247 million in 2022, which increased to about 1.739 million in 2023

Emotional AI Market Geographical Outlook:

The United States in North America is expected to hold a significant share of the Emotional AI market.

The United States market for emotional AI is expected to grow significantly in the projected period, owing to the strong adoption of artificial intelligence (AI) among various end-users such as healthcare, media, retail, and finance, among others. This technology can also be used for content personalization, employee well-being, and customer engagement.

Moreover, the rising trend for automation, coupled with the high penetration of companies in the country, is expected to have a positive impact on market growth. Additionally, rising product launches in the emotional AI market in the United States are one of the major reasons for market growth in the projected period

According to Goldman Sachs, the investment in artificial intelligence is expected to increase in the projected period, owing to the increasing attention on generative AI. Additionally, as per the company estimates, AI investment is expected to be at its peak and reach 2.5% to 4% of the GDP, and for the United States, it is expected to be at 1.5% to 2%, due to the presence of large players like Microsoft and Google, among others.

Moreover, Goldman Sachs, one of the leading investment banking, investment management, and securities firms, forecasted that the world’s AI investment will be US$132.12 billion in 2024, with the United States and China being the largest contributors. It is expected that the United States will invest US$68.14 billion in artificial intelligence in 2024, and China is expected to invest US$24.66 billion in the same year.

Emotional AI Market Company Profiles:

IBM Corporation is one of the leading providers of artificial intelligence (AI), hybrid cloud, and consulting expertise. The company has served clients in more than 175 countries, in streamlining data and business processes, and gaining a competitive edge in their respective industries. IBM Corporation aims to innovate, move faster, and invest strategically for future businesses. The company has three main business strategies: first, the corporate level strategy, which includes strategies and decisions made by an organization’s top-level management. Secondly, a functional-level strategy is run on a smaller scale, and these strategies focus on specific departments and areas of business. Lastly, business-level strategies include making plans about how a company can have a competitive advantage in a given market. The company has also started focusing on open hybrid cloud platforms and artificial intelligence (AI). This decision is driven by the company’s pursuit of the US$1 trillion hybrid cloud opportunity. The company has a team of more the 20,000 AI Experts, working with global clients and co-partners to co-create next in AI.

Amazon Inc. is guided by four principles: competitor focus, passion for invention, commitment to operational excellence, and long-term thinking. Amazon’s service portfolio consists of devices and services, Amazon Pay, delivery and logistics, Amazon Web Services (AWS), and entertainment, among others.

Entropic Tech is one of the Human Insight AI companies that specializes in consumer and user research. The company offers standalone technical solutions through API/SDK integrations. The technology stack includes Behavior AI, Emotion AI, and Generative AI.

Emotional AI Market Key Developments:

September 2023, Affectiva, headquartered in Boston, Massachusetts, announced the launch of new emotion AI attention metrics, with smart eye tracking technology, in its cloud-based offering. This metric is bolstered by Advanced Eye’s new automotive safety-grade eye-tracking technology.

In July 2023, Microsoft Inspire, headquartered in Washington, United States, announced the launch of general availability (GA) of the Microsoft Corporation has new multi-style, multi-lingual custom neural voice (CNV). With this technology, it will be easier to create a natural, branded voice that is capable of expressing different emotions and can speak different languages. Hence, in the coming years, with the increasing products launched, the market for emotional AI is expected to grow.

Emotional AI Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Companies |

|

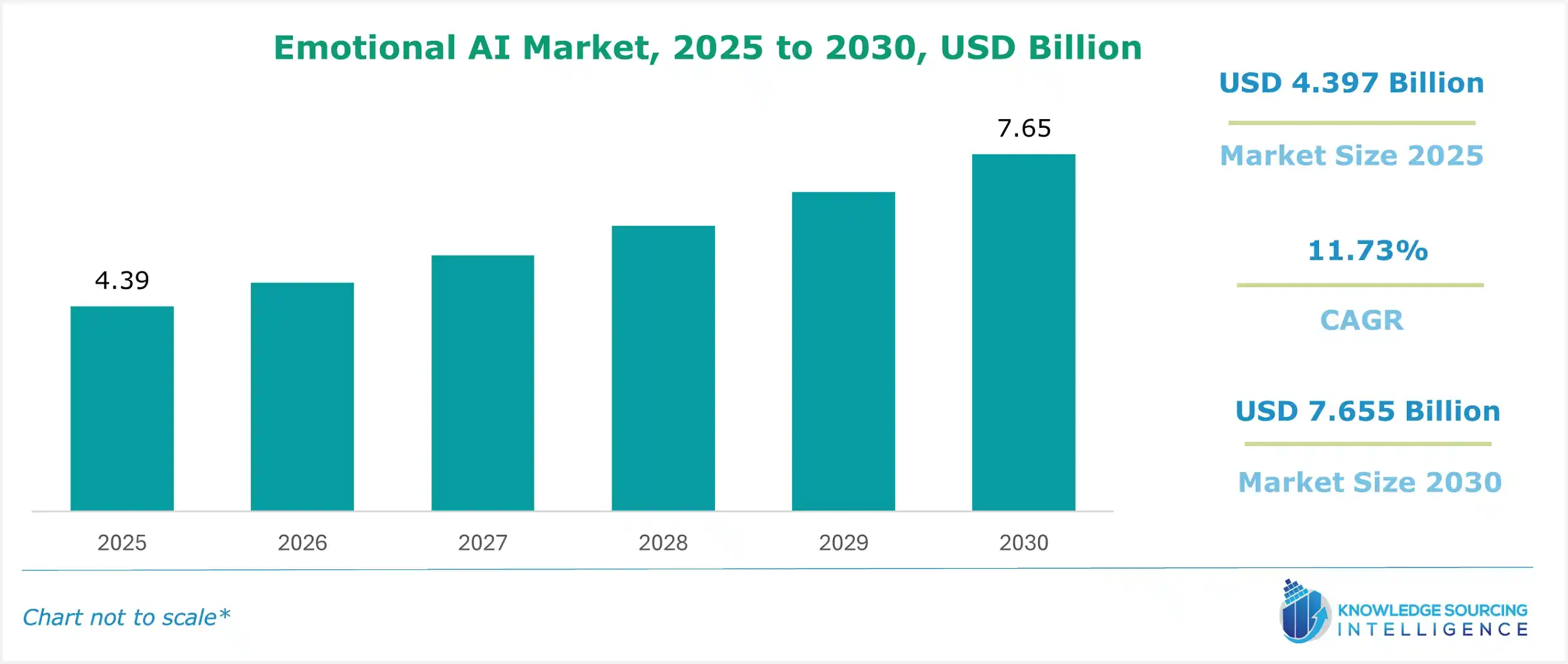

Report Metric | Details |

Emotional AI Market Size in 2025 | US$4.397 billion |

Emotional AI Market Size in 2030 | US$7.655 billion |

Growth Rate | CAGR of 11.73% |

Study Period | 2020 to 2030 |

Historical Data | 2020 to 2023 |

Base Year | 2024 |

Forecast Period | 2025 – 2030 |

Forecast Unit (Value) | USD Billion |

Segmentation |

|

Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

List of Major Companies in Emotional AI Market |

|

Customization Scope | Free report customization with purchase |

Emotional AI Market Segmentation:

By Deployment

Cloud

On-Premise

By Application

Automotive

Consumer Electronics

Customer Services

Gaming

Healthcare

Others

By Geography

North America

USA

Canada

Mexico

South America

Brazil

Argentina

Others

Europe

United Kingdom

Germany

France

Italy

Spain

Others

Middle East and Africa

Saudi Arabia

UAE

Others

Asia Pacific

China

Japan

India

South Korea

Australia

Indonesia

Others