Report Overview

Energy Management System Market Highlights

Energy Management System Market Size:

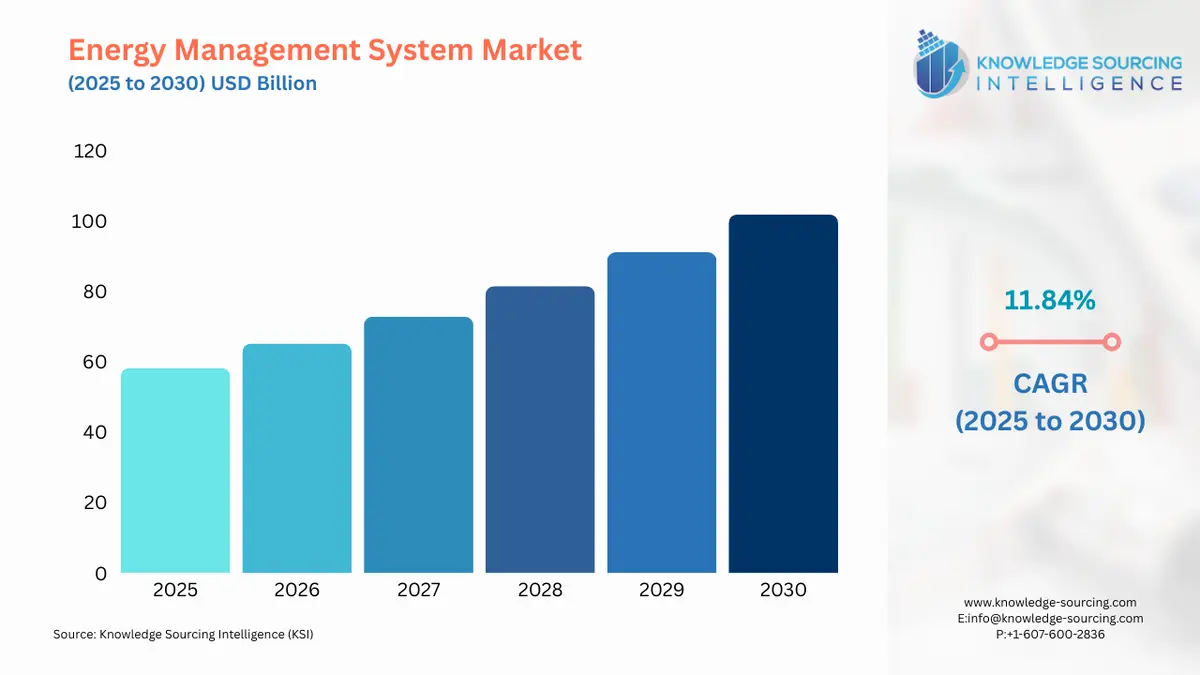

The Energy Management System Market is expected to grow at a CAGR of 11.84%, reaching USD 101.878 billion in 2030 from USD 58.222 billion in 2025.

The energy management system market, encompassing hardware, software, and services, provides a comprehensive framework for organizations to monitor, analyze, and optimize their energy consumption. This market's trajectory is intrinsically tied to global efforts to address both economic and environmental pressures. As businesses and governments prioritize operational efficiency and sustainability, EMS solutions have transitioned from a niche technology to a fundamental component of modern infrastructure. The convergence of digital transformation, smart grid initiatives, and stringent regulatory frameworks is reshaping the demand landscape, compelling a diverse range of end-users to adopt sophisticated energy management strategies to ensure competitiveness and compliance.

Energy Management System Market Analysis

Growth Drivers

- Escalating Energy Costs: The demand for energy management systems is propelled by several interlocking factors, each directly influencing the purchasing decisions of businesses and consumers. A fundamental driver is the escalating cost of electricity and fuel worldwide. As energy prices rise, the financial incentive to reduce consumption and eliminate waste becomes a direct imperative. EMS solutions provide the tools for real-time monitoring and data analysis, allowing enterprises to identify and rectify inefficiencies. This tangible benefit of cost savings creates a clear return on investment (ROI), which directly increases the demand for EMS hardware and software, particularly in energy-intensive sectors.

- Sustainability and Emission Reduction: A second major catalyst is the global push for sustainability and the reduction of greenhouse gas emissions. The International Energy Agency (IEA) has highlighted that energy consumption accounts for a significant portion of global emissions. In response, businesses and governments are setting ambitious carbon reduction goals. This creates a direct demand for EMS platforms that not only optimize energy use but also provide granular data on carbon emissions, helping organizations meet their sustainability targets. The integration of EMS with renewable energy sources, such as solar and wind, further enhances their value proposition by enabling seamless management of power flow, which is critical for companies seeking to transition to cleaner energy mixes.

- Smart Grid and Smart Meter Technologies: Additionally, the proliferation of smart grid and smart meter technologies acts as a foundational driver. These technologies, which enable two-way communication between utilities and consumers, generate a vast amount of energy consumption data. EMS leverages this data to perform advanced analytics, predictive maintenance, and demand response management. The increasing deployment of smart grids and meters, often driven by national-level infrastructure investments, directly creates a market for the software and services that can process this data and translate it into actionable energy-saving strategies. Without an EMS, the full value of a smart grid remains unrealized, making the adoption of one a logical next step for grid operators and end-users alike.

Challenges and Opportunities

- High Initial Investment: The market for energy management systems faces certain headwinds that can impede its growth. The most significant challenge is the high initial cost of implementation. The installation of comprehensive EMS platforms, particularly on-premise systems for large industrial or commercial facilities, requires substantial capital investment in hardware, software, and integration services. This can be a prohibitive barrier for small and medium-sized enterprises (SMEs) that may have limited capital expenditures for energy efficiency projects. Furthermore, the non-standardized nature of many energy management guidelines can lead to compatibility issues and higher post-installation maintenance costs. The need for specialized technical expertise to operate and maintain these systems also adds to the total cost of ownership, potentially slowing adoption.

- Cloud-Based Solutions and AI Integration: Conversely, these challenges present significant opportunities for market players. The high cost of on-premise solutions has fueled a major opportunity in the development and proliferation of cloud-based EMS platforms. These software-as-a-service (SaaS) models offer a lower initial investment, as they eliminate the need for significant on-site infrastructure and maintenance. Cloud-based solutions also provide enhanced scalability and remote accessibility, allowing businesses to monitor and control energy usage across multiple locations from a centralized dashboard. The increasing integration of Artificial Intelligence (AI) and Machine Learning (ML) into EMS software presents another key opportunity. AI-powered systems can analyze complex data patterns to forecast energy demand, detect anomalies in real-time, and automate energy optimization processes, providing a level of efficiency that was previously unattainable. This technological shift addresses the demand for more sophisticated, automated, and user-friendly energy management tools.

Supply Chain Analysis

The supply chain for energy management systems is complex and multi-layered, reflecting the product's combination of hardware, software, and services. At the foundation are the manufacturers of hardware components, including sensors, meters, controllers, and communication devices. These components often rely on a global network of semiconductor and electronics suppliers, with major production hubs in East Asia. The logistics of sourcing and shipping these physical components can be subject to geopolitical issues and global trade policies. Following hardware, the software development aspect is critical. This involves a highly skilled workforce of software engineers and data scientists, with major development centers located in tech hubs across North America, Europe, and Asia-Pacific. The supply chain for services, which includes implementation, integration, consulting, and maintenance, is often localized to the end-user's region to ensure proximity and timely support. A key logistical complexity is the integration of these disparate components, hardware from one vendor, software from another, and services from a third, to form a coherent, functional system. This requires robust coordination among different players, highlighting the importance of standardized protocols and open architecture.

Government Regulations

- European Union: European Green Deal / EU Energy Efficiency Directive: The European Green Deal mandates significant carbon neutrality and energy efficiency targets, compelling businesses to actively reduce their energy consumption. The directive provides a regulatory framework that directly drives corporate investment in EMS to ensure compliance and avoid penalties.

- United States: Department of Energy (DOE) regulations / State-level renewable portfolio standards: The U.S. Department of Energy sets energy efficiency standards for various equipment and buildings. Additionally, state-level renewable portfolio standards (RPS) incentivize the use of renewable energy. These policies increase demand for EMS to manage and integrate decentralized renewable energy sources into existing grids and to demonstrate compliance with efficiency standards.

- China: 14th Five-Year Plan for a Modern Energy System: China’s 14th Five-Year Plan emphasizes energy conservation and carbon reduction targets. This national policy provides a top-down mandate for industrial and commercial sectors to enhance energy efficiency, directly stimulating demand for EMS solutions to optimize consumption and report on progress.

- Japan: Energy Conservation Act: Japan's Energy Conservation Act sets benchmarks for energy efficiency across industries and commercial buildings. The act requires large-scale energy users to submit regular reports on their energy consumption. This regulatory pressure makes EMS an essential tool for companies to monitor consumption accurately and comply with reporting obligations.

- United Arab Emirates: UAE Energy Strategy 2050: The UAE Energy Strategy 2050 aims to increase clean energy contributions and improve energy efficiency. The strategy's ambitious targets for diversifying the energy mix and reducing carbon emissions create a direct demand for EMS to optimize energy use and manage the integration of new solar and other clean energy sources.

Energy Management System Market Segment Analysis

- Industrial Energy Management Systems (IEMS)

The Industrial Energy Management System (IEMS) segment holds the largest market share by application, driven by the unique and acute energy demands of the manufacturing and heavy industry sectors. Industrial operations, including manufacturing plants, refineries, and data centers, are characterized by their high energy intensity and complex operational environments. The primary demand driver in this segment is the imperative to reduce operational costs. Energy often represents a substantial portion of a manufacturer's overhead. IEMS provides a granular, real-time view of energy consumption at the machine, production line, and facility level, allowing managers to identify and correct inefficiencies, such as phantom load and equipment underperformance. This data-driven approach directly translates into significant cost savings, providing a powerful financial incentive for adoption.

Furthermore, the demand for IEMS is fortified by the need for regulatory compliance. Industrial sectors are frequently subject to stringent environmental regulations and carbon emission mandates. IEMS not only helps in meeting these targets by optimizing energy use but also provides the necessary data and reporting tools to demonstrate compliance with regulatory bodies. The ongoing global trend of industrial automation and the "Industry 4.0" revolution further fuels demand. As factories become more interconnected through the Internet of Things (IoT), IEMS integrates seamlessly with existing operational technology to provide holistic energy management, optimizing not just individual machines but entire production processes for energy efficiency.

- Building Energy Management Systems (BEMS)

The Building Energy Management System (BEMS) segment represents a significant portion of the market, driven by the demand from the commercial sector. This segment includes solutions for office buildings, retail spaces, and other commercial establishments. The demand for BEMS is primarily catalyzed by two core factors: the pursuit of energy efficiency to reduce utility bills and the need to create a more comfortable and productive indoor environment. For commercial property owners and managers, BEMS offers a centralized platform to control and automate building systems, including HVAC, lighting, and security. This automation allows for intelligent scheduling and optimization, such as adjusting temperatures or turning off lights in unoccupied spaces, leading to demonstrable reductions in energy consumption and associated costs.

A key demand driver for BEMS is the growing focus on green building certifications, such as LEED (Leadership in Energy and Environmental Design). These certifications require strict adherence to energy efficiency standards, making BEMS an essential tool for achieving and maintaining compliance. Moreover, a BEMS provides property owners with a competitive advantage by attracting tenants who prioritize sustainable and technologically advanced workspaces. The integration of sensors and smart devices within a building's infrastructure allows BEMS to collect vast amounts of data, which can then be analyzed to improve occupant comfort, enhance operational efficiency, and identify opportunities for further energy savings. This dual benefit of cost reduction and improved occupant experience drives sustained demand within the commercial end-user segment.

Energy Management System Market Geographical Analysis

- US Market Analysis: The US market for energy management systems is driven by a combination of federal initiatives and state-level policies, alongside a strong corporate push for sustainability. The nation's diverse energy landscape and a significant number of energy-intensive industries, particularly in manufacturing and data centers, create a substantial demand base. The Department of Energy's efficiency standards and various state-specific regulations, such as California's stringent building codes, directly influence the adoption of EMS. Additionally, the increasing cost of electricity in many regions and the corporate imperative for Environmental, Social, and Governance (ESG) reporting compel companies to invest in EMS to demonstrate sustainability and improve their financial performance. The US market is characterized by a high degree of technological sophistication, with a strong demand for advanced, AI-driven, and cloud-based solutions.

- Brazil Market Analysis: In Brazil, the demand for EMS is shaped by the country's rapid industrialization and urbanization, coupled with its reliance on a hydro-dominated and increasingly diversified energy mix. The primary driver is the need for operational efficiency in the burgeoning manufacturing and commercial sectors. Volatile energy prices and the periodic threat of energy rationing during dry seasons incentivize businesses to adopt EMS to optimize consumption and mitigate risk. Government initiatives aimed at modernizing the energy grid and promoting renewable energy sources, such as wind and solar, also stimulate demand. The market is still developing, and there is a growing opportunity for EMS providers to offer solutions that can manage both traditional and renewable energy sources, helping businesses and utilities to achieve greater energy security and efficiency.

- Germany Market Analysis: Germany is a European leader in the EMS market, with demand primarily fueled by its long-standing commitment to energy transition (Energiewende) and a robust regulatory environment. The German government's ambitious goals for renewable energy integration and carbon neutrality, as outlined in the European Green Deal, create a powerful, non-negotiable demand for EMS. German industries, particularly in the automotive and manufacturing sectors, are highly energy-intensive and are therefore early and enthusiastic adopters of advanced EMS to maintain their global competitiveness and comply with national and EU regulations. The market is mature and characterized by a strong emphasis on sophisticated, highly reliable, and integrated systems that can handle complex industrial processes and manage decentralized energy generation.

- UAE Market Analysis: The UAE market for EMS is experiencing rapid growth, largely due to the country's strategic vision for economic diversification and sustainability. The UAE Energy Strategy 2050 sets ambitious targets to increase the contribution of clean energy and improve energy efficiency. This policy-driven approach is the main catalyst for demand. The construction of futuristic, energy-efficient smart cities and commercial buildings, along with the development of large-scale solar power projects, creates a unique and high-growth market for Building Energy Management Systems (BEMS) and Industrial Energy Management Systems (IEMS). The high concentration of energy-intensive industries, such as petrochemicals and aluminum, also drives demand for EMS to optimize energy use and reduce operational costs in a region with traditionally high energy consumption.

- Japan Market Analysis: In Japan, the demand for EMS is a direct response to a strategic national imperative for energy efficiency and resource conservation, particularly in the wake of the Fukushima disaster. The government's Energy Conservation Act, which mandates energy reporting and efficiency targets for large companies and factories, is a key driver. This creates a regulatory demand for sophisticated EMS that can provide accurate data and analytics for compliance purposes. The Japanese market is also influenced by its highly developed industrial sector and a strong societal emphasis on precision and efficiency. As a result, there is a significant demand for technologically advanced and reliable EMS solutions that can seamlessly integrate with existing industrial automation and building management systems.

List of Top Energy Management System Companies:

The Energy Management System market is home to a mix of multinational conglomerates and specialized technology providers. The competitive landscape is defined by the ability to offer comprehensive, scalable, and technologically advanced solutions that address the specific needs of diverse end-users.

- Siemens AG: Siemens is a dominant force in the EMS market, leveraging its extensive expertise in industrial automation and digitalization. The company's strategic positioning is centered on providing a comprehensive, end-to-end portfolio that integrates hardware, software, and services. A core offering is the Siemens Desigo CC platform, a building management system that consolidates data from various systems—including HVAC, lighting, fire safety, and security—into a single, unified interface. This platform enables real-time monitoring and analysis of building energy performance, allowing for automated optimization and demand response. Siemens also offers solutions for industrial and utility sectors, providing a broad reach across the entire energy value chain. The company’s strength lies in its long-standing relationships with industrial clients and its ability to provide tailored, large-scale, and highly reliable on-premise solutions.

- Schneider Electric: Schneider Electric has established itself as a global leader in energy management and automation. The company’s strategy focuses on "EcoStruxure," a platform that connects devices, analytics, and software to deliver scalable solutions for various end-user segments, from residential to industrial. A key product is the EcoStruxure Power Advisor, an application that uses data analytics to identify energy-saving opportunities and improve power reliability. Schneider Electric's competitive advantage lies in its open architecture, which allows for seamless integration with third-party devices and systems. This flexibility is a significant demand driver, as it provides customers with a more customized and future-proof solution. The company also has a strong focus on sustainability, with its products and services helping customers meet their carbon reduction goals.

- Honeywell International Inc.: Honeywell is a major player in the Building Energy Management System (BEMS) segment, with a focus on delivering integrated building automation and security solutions. The company's strategy is to provide a holistic approach to building management that not only optimizes energy consumption but also enhances occupant comfort and safety. Honeywell's Experion PKS is a process knowledge system that helps to optimize production in process industries, including energy management. A key differentiator for Honeywell is its deep expertise in sensing and control technologies, which are fundamental to effective energy management. The company's solutions leverage a vast network of sensors and data to provide precise control over building systems, leading to verifiable energy savings and improved operational efficiency.

Energy Management System Market Recent Developments

- November 2025: Johnson Controls launched the Metasys 15.0 building automation system, setting a new industry standard for energy intelligence and scalability to optimize power consumption in large-scale commercial facilities.

- November 2025: Schneider Electric launched EcoStruxure Foresight Operation, an AI-driven platform that unifies energy, building, and power systems into a single interface to enhance operational efficiency in the built environment.

- September 2025: EndurEnergy Systems partnered with BMSer to develop advanced battery and energy management systems (BMS/EMS) tailored for U.S. regulatory, data-security, and scalability requirements.

- August 2025: Honda, Tokuyama, and Mitsubishi Corp launched a joint demonstration of a stationary fuel cell power station utilizing an Energy Management System (EMS) to optimize off-grid primary power.

- May 2025: EcoFlow expanded its Home Energy Management System (HEMS) into the European market at Intersolar Europe, featuring AI-enabled tariff and weather forecasting for optimized residential energy usage.

- March 2025: ABB launched ABB Ability™ InSite Energy Pro, a cloud-based energy management platform with real-time monitoring, automated load management, and customizable analytics for multi-site properties, powered by AWS infrastructure.

Energy Management System Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Energy Management System Market Size in 2025 | USD 58.222 billion |

| Energy Management System Market Size in 2030 | USD 101.878 billion |

| Growth Rate | CAGR of 11.84% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in the Energy Management System Market |

|

| Customization Scope | Free report customization with purchase |

Energy Management System Market Segmentation:

- By Offering

- System

- Services

- By Component

- Software

- Hardware

- Services

- By Type

- Industrial Energy Management System (IEMS)

- Building Energy Management System (BEMS)

- Home Energy Management System (HEMS)

- By Deployment

- On-premise

- Cloud-based

- By End-User

- Residential

- Commercial

- Industrial

- By Application

- Power & Energy

- Telecom & IT

- Manufacturing

- Enterprise

- Healthcare

- Others

- By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- South Africa

- Rest of Middle East & Africa

- North America