Report Overview

Food-Grade Gas Market - Highlights

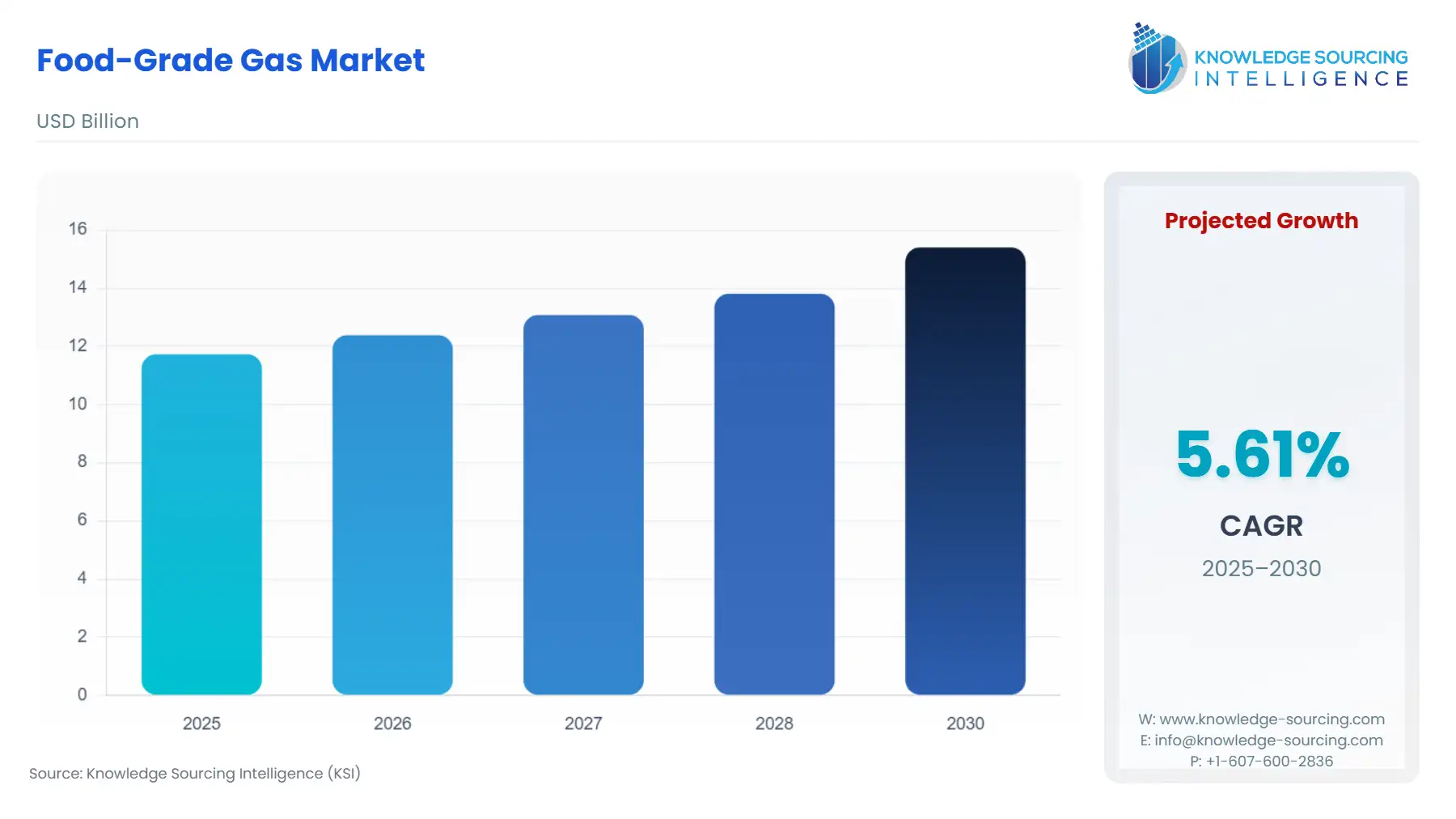

The food-grade gas market is estimated to grow at a CAGR of 5.61% to reach a market size of US$15.408 billion in 2030 from US$11.728 billion in 2025.

Key Highlights

The Food-Grade Gas Market supplies essential atmospheric and process gases—primarily Carbon Dioxide, Nitrogen, and Oxygen—that are critical components in the preservation, processing, and packaging of food and beverages. These gases serve vital functions, ranging from chilling and cryogenic freezing to inerting packaging atmospheres and carbonating beverages. Unlike industrial-grade gases, food-grade variants must adhere to stringent regulatory standards, such as those set by the FDA and the European Food Safety Authority (EFSA), requiring certified purity levels and strict adherence to Good Manufacturing Practices (GMP) throughout the entire supply chain. The market's expansion is intrinsically linked to macro trends in the food industry, including the rising consumer focus on extended shelf life, minimal chemical preservatives, and the operational growth of globalised supply chains.

________________________________________

Food-Grade Gas Market Analysis

Growth Drivers

The paramount factor driving market expansion is the proliferating global demand for long shelf-life food products and minimal preservative use, which necessitates advanced techniques like Modified Atmosphere Packaging (MAP). This trend directly increases the demand for Nitrogen and Carbon Dioxide for Packaging applications to displace oxygen and slow microbial growth in products like processed meats and pre-cut fruits. Simultaneously, the accelerated adoption of cryogenic freezing and chilling technologies in the Convenience food products sector creates substantial, high-volume demand for Nitrogen. Cryogenic freezing offers superior quality preservation by creating smaller ice crystals, a non-negotiable requirement for texture-sensitive items like ice cream and premium ready meals, thereby pulling through significant gas volumes.

Challenges and Opportunities

The key challenge facing the market is the intrinsic capital intensity and energy dependency of gas production. Operating Air Separation Units (ASUs) for Nitrogen and Oxygen requires immense, reliable energy inputs, making suppliers highly vulnerable to fluctuations in natural gas and electricity prices. This volatility presents a headwind to stable pricing for end-users. A significant opportunity lies in the burgeoning demand for on-site gas generation solutions. Smaller and medium-sized Meat, poultry, and seafood product processors are increasingly adopting modular nitrogen and oxygen generators. This decentralisation creates new, albeit smaller, demand for gas equipment sales and localised maintenance services, offering an alternative path to demand capture for gas suppliers who can provide efficient, turnkey systems.

Raw Material and Pricing Analysis

The Food-Grade Gas Market is a physical product market whose inputs are primarily ambient air, which is fractionated to produce Nitrogen and Oxygen, and naturally occurring wells or industrial by-products for Carbon Dioxide. The principal "raw material cost" is the energy expenditure required to compress, liquefy, and separate these gases. Pricing dynamics are thus directly correlated to regional energy prices; a sustained increase in European natural gas prices, for example, proportionally increases the production cost of merchant liquid Oxygen and Nitrogen supplied from ASUs, which in turn necessitate price adjustments for end-user segments like Dairy & frozen products. The purity imperative also imposes a cost burden, as additional purification and quality control steps are non-negotiable elements in the final pricing of food-grade gases.

Supply Chain Analysis

The global food-grade gas supply chain is characterised by a high degree of integration and regional distribution networks. Key production is consolidated in large-scale Air Separation Units (ASUs) located near major industrial and consumption centres in North America, Western Europe, and coastal Asia. The complexity resides in the final-mile logistics: the product, whether liquid (cryogenic) or compressed, must be stored and transported under strict temperature and pressure regimes using specialised cryogenic tankers and dedicated cylinder fleets. The high-purity mandate for food-grade gas creates a critical dependency on specialised, certified transport equipment and dedicated supply lines to prevent cross-contamination, particularly for Carbon Dioxide used in Beverages, which dictates a significant portion of the logistics capital expenditure.

Government Regulations

| Jurisdiction | Key Regulation / Agency | Market Impact Analysis |

|---|---|---|

| United States (US) | FDA Food Safety Modernization Act (FSMA) - Preventive Controls for Human Food | Mandates that food facilities must have a written food safety plan detailing hazard analysis and risk-based preventive controls. This law directly increases demand for certified, ultra-pure Nitrogen and CO2 in Packaging applications, as the gas quality must be validated as a preventive control to mitigate chemical contamination hazards. |

| European Union (EU) | Regulation (EC) No 1333/2008 on Food Additives (including E-numbers) | Defines the permitted uses and purity criteria for gases classified as food additives (e.g., E290 for Carbon Dioxide in Carbonation). This strictly constrains and controls the market, ensuring only gases meeting the highest specified purity benchmarks (e.g., 99.9% minimum) can be used, reinforcing the premium price and technical requirements for Beverages sector supply. |

| Global/Codex Alimentarius | Codex Stan 192-1995 (General Standard for Food Additives) | Provides international reference standards for the use and purity of gases in food. While non-binding, adherence is critical for global trade, which creates an interoperable demand across multinational food processors for suppliers who can guarantee product consistency across all geographies, driving demand toward globally recognized players. |

________________________________________

In-Depth Segment Analysis

By Application: Freezing & Chilling

The Freezing & chilling segment is a high-volume consumer of cryogenic gases, predominantly liquid Nitrogen (LN2) and to a lesser extent, solid Carbon Dioxide (dry ice). This application's demand is directly amplified by the macro-economic trend of global household structure shifts toward single-person and two-person households, which drives the proliferation of Convenience food products and Dairy & frozen products categories. Cryogenic chilling, particularly LN2 immersion or tunnel freezing, enables ultra-rapid temperature reduction. This speed is non-negotiable for preserving the cellular structure of high-value items like premium Meat, poultry, seafood products and ice cream, which avoids large ice crystal formation and freezer burn. Therefore, any increase in ready-meal or pre-portioned food production capacity generates a proportional and immediate demand surge for bulk cryogenic Nitrogen delivery, as the gas is a consumed processing utility.

By End-Use Products: Beverages

The Beverages segment is primarily dominated by the usage of high-purity Carbon Dioxide (CO2) for Carbonation, but also utilises Nitrogen for dispensing systems and inerting. The demand for Carbon Dioxide is directly tied to the consistent production volume of soft drinks, sparkling waters, and beer, where CO2 is an essential ingredient that defines the final product's quality and sensory profile. Regulatory stringency in this segment is exceptionally high; international bodies like the International Society of Beverage Technologists (ISBT) specify purity standards that exceed general food-grade requirements, necessitating rigorous testing for contaminants like benzene. This ultra-high purity requirement structurally increases the demand for CO2 suppliers who can provide certified, dedicated delivery and storage systems, establishing a strong barrier to entry for smaller players and channelling demand toward integrated global gas producers.

________________________________________

Geographical Analysis

US Market Analysis (North America)

The US market for food-grade gases is characterised by high technical maturity and stringent regulatory compliance, driven almost entirely by the FSMA's Preventive Controls rule. This non-negotiable requirement compels Beverages and Meat, poultry, and seafood products processors to use certified, high-purity Carbon Dioxide and Nitrogen, directly increasing the demand for verified quality control and dedicated supply logistics. The large-scale, centralised nature of the US food processing industry also favours high-volume, on-site supply models (pipelines or bulk tanks) for cryogenic Nitrogen to support vast Freezing & chilling operations, making the reliability of the supplier's bulk delivery network a key driver of contract awarding.

Brazil Market Analysis (South America)

Demand in Brazil is primarily fueled by the accelerating industrialisation of the Meat, poultry, and seafood products sector, positioning the country as a major global exporter. The key local factor is the requirement for rapid chilling and freezing to meet export quality standards and navigate long supply chains, which rapidly increases demand for bulk liquid Nitrogen for cryogenic applications. Furthermore, the burgeoning domestic beer and soft drink market creates sustained, high-volume demand for certified Carbon Dioxide for Carbonation. Supply chain reliability remains a critical differentiator due to complex internal logistics, favouring suppliers with strong regional distribution and production assets.

Germany Market Analysis (Europe)

The German market's demand profile is structured by the EU's stringent food additive regulations (E-numbers) and consumer-driven preference for fresh, minimally processed food. This combination highly increases demand for sophisticated Modified Atmosphere Packaging (MAP) solutions using precise Nitrogen and Carbon Dioxide mixtures in the Fruits & vegetables and Bakery & confectionery products segments to extend shelf life without chemical preservatives. German food processors prioritise technical application expertise and compliance documentation from their gas suppliers, reinforcing a high-purity, premium segment demand structure.

Saudi Arabia Market Analysis (Middle East & Africa)

Demand in Saudi Arabia is strongly influenced by extremely high temperatures, which makes effective food preservation a technical imperative. This climate condition fundamentally increases demand for cryogenic Freezing & chilling applications and high-barrier Packaging techniques utilising Nitrogen and Oxygen control. The reliance on significant food imports further amplifies demand for sophisticated gas solutions to maintain quality during long, hot transport and storage cycles. The market operates under a structure where supply reliability is prioritised over marginal cost savings, favouring global players with established regional supply chains, such as those that can leverage the significant industrial gas infrastructure in the GCC region.

India Market Analysis (Asia-Pacific)

The Indian market is experiencing rapid growth driven by the shift from unpackaged to organised, branded Convenience food products and beverages. The key driver is the massive expansion of the middle class and modern retail, which creates an explosive demand growth for packaged, chilled, and frozen goods, directly increasing the requirement for Nitrogen and Carbon Dioxide. The recent acquisition activity by major global players underscores a focus on strengthening the capacity and logistics backbone to meet this accelerating, high-volume demand across the country’s vast and geographically diverse processing centres.

________________________________________

Competitive Environment and Analysis

The Food-Grade Gas Market exhibits an oligopolistic structure dominated by a few global integrated industrial gas companies that possess the immense capital required for large-scale production and intricate, high-purity logistics networks. Competition revolves around securing long-term, high-volume contracts, technical application support, and supply reliability.

Air Liquide

Air Liquide holds a leading position globally, leveraging its scale and deep expertise in gas separation technologies to serve diverse end-markets. Their strategic positioning emphasises sustainable and high-purity supply, focusing on providing verified Carbon Dioxide and Nitrogen solutions for highly sensitive applications like Beverages and Packaging. The company's recent strategic acquisitions in the Asia-Pacific region, such as NovaAir in India, demonstrate an aggressive strategy to capture high-growth market share by expanding its geographic footprint and improving logistical density, directly enhancing its ability to meet growing local Packaging and Freezing & chilling demand.

Linde plc

Linde is a major competitor that emphasises technical service and application innovation, particularly in the Freezing & Chilling and MAP segments. Their strategic focus is on providing integrated solutions, including patented gas application technologies and precise gas mixtures for Packaging, alongside the core gas commodity (Nitrogen, CO2). Linde actively pursues complementary acquisitions to enhance regional supply chain density, such as increasing its shareholding in Airtec in the Middle East. This strategic move directly strengthens its ability to reliably supply industrial and food-grade gases across the GCC region, an area with high demand volatility driven by climate and import dependency.

________________________________________

Recent Market Developments

October 2025: Air Liquide Acquires NovaAir in India

- Air Liquide announced an agreement to acquire NovaAir, a prominent industrial gas producer and supplier operating in the East and South of India. This acquisition is strategically complementary to Air Liquide's existing operations in the North and West, significantly expanding its geographical reach and strengthening its footprint in the industrial merchant market. The move directly enhances Air Liquide's capacity to serve the burgeoning Indian food and beverage sector, where accelerating demand for Convenience food products and Beverages necessitates a reliable supply of Nitrogen for Freezing & chilling and Carbon Dioxide for Carbonation.

August 2025: Air Liquide Signs Agreement to Acquire DIG Airgas in South Korea

- Air Liquide signed an agreement to acquire DIG Airgas, a leading integrated gas player in South Korea. This strategic transaction is designed to reinforce Air Liquide's overall market presence in the Asia-Pacific region. The acquisition will enhance the company's ability to offer a comprehensive range of industrial and speciality gases, including high-purity food-grade Oxygen and Nitrogen, to advanced manufacturing and consumer-focused industries such as dairy and frozen products, thereby capturing sustained demand from a mature and high-value market.

Food-Grade Gas Market Segmentation

- By Gas Type

- Carbon Dioxide

- Nitrogen

- Oxygen

- Others

- By Application

- Carbonation

- Freezing & chilling

- Packaging

- Others

- By End-Use Products

- Bakery & confectionery products

- Beverages

- Convenience food products

- Dairy & frozen products

- Fruits & vegetables

- Meat, poultry, and seafood products

- Others

- By Geography

- North America

- United States

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- France

- United Kingdom

- Spain

- Others

- The Middle East and Africa

- Saudi Arabia

- UAE

- Israel

- Others

- Asia Pacific

- China

- India

- South Korea

- Taiwan

- Thailand

- Indonesia

- Japan

- Others

- North America