Report Overview

Forklift 360-Degree Camera Market Highlights

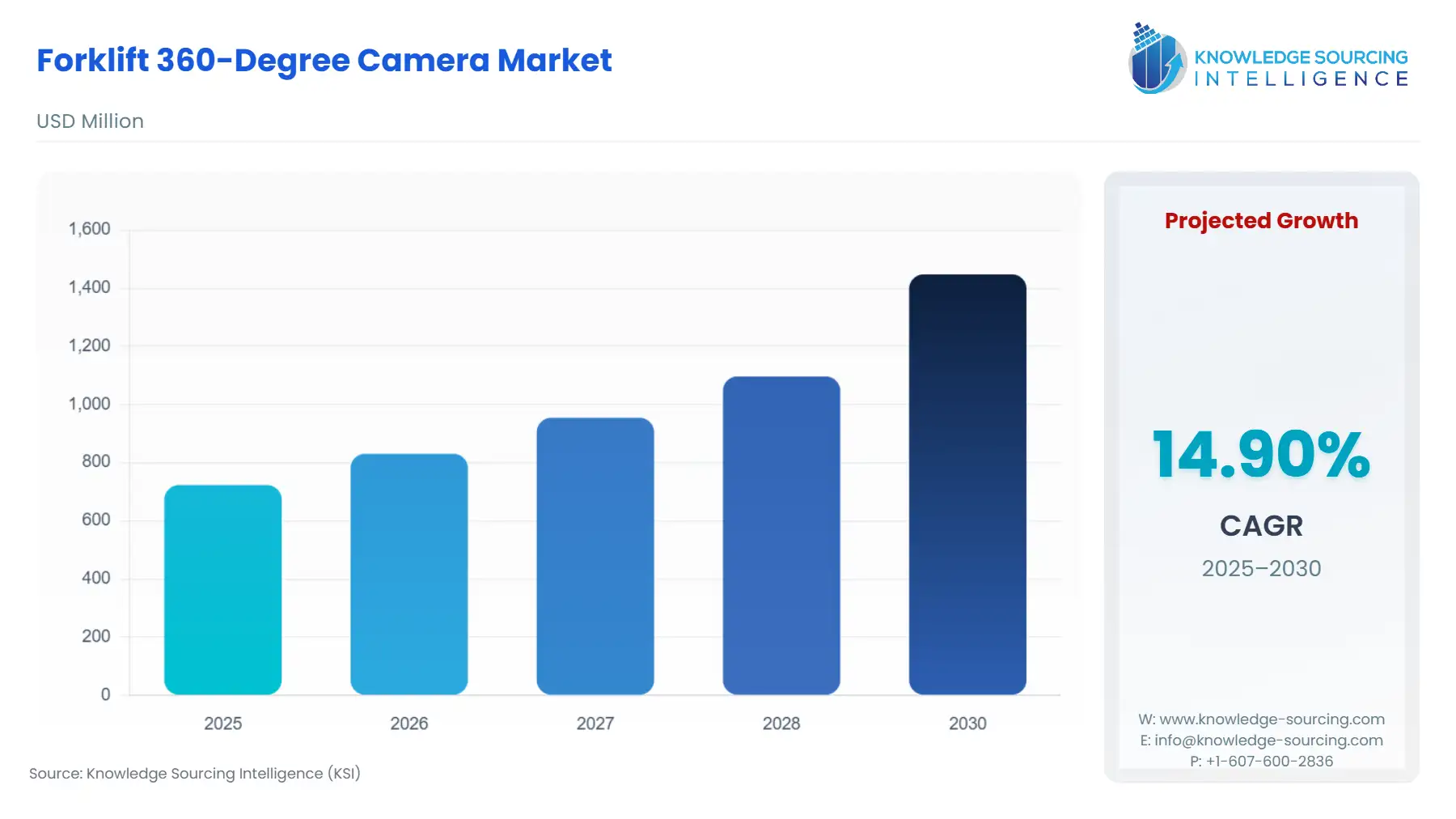

Forklift 360-degree Camera Market Size:

The Forklift 360-Degree Camera market will grow from US$0.723 billion in 2025 to US$1.448 billion in 2030 at a CAGR of 14.96%.

A 360-degree camera is a type of camera that is used to capture omnidirectional or complete 360-degree images or video of the location. These cameras are also known as omnidirectional cameras. A 360-degree camera offers massive safety solutions, especially in commercial vehicles like forklifts, excavators, and trucks. In such vehicles, the 360-degree camera provides the operators with an all-around view of their vehicles and warns against any incoming obstacles or pedestals. In forklifts, these cameras prevent the operator from obstruction and damage from any objects in the warehouse.

The demand for the forklift 360-degree camera system in the global market is sure to witness an increase in its market growth, as with the rise in the demand for the warehouse industry worldwide. around the globe. With the growing demand for the global logistics industry, the demand for commercial vehicles, like forklifts, increased in the global market. The global sales of commercial vehicles increased from 24.226 million in 2022 to about 27.452 million in 2023. This increase in the global sales of commercial vehicles reflects the increase in warehouse and logistics demand in the global market.

The forklift 360-degree camera market is estimated to grow significantly, fueled by the growing focus on safety, and many governments are implementing stricter safety regulations. This will increase the adoption of advanced safety technologies like forklift camera systems and technological advancements in forklift 360-degree cameras, fuelling the market growth. In addition, it increases productivity in diverse industries like warehousing, fueling future market expansion.

Forklift 360-Degree Camera Market Growth Drivers:

- An increase in the global warehousing industry is anticipated to propel market growth.

One of the major drivers for the global increase in the forklift 360-degree camera can be the increase in the global warehouse industry. In a warehouse, a forklift is among the most important components, helping in storing and maintaining the warehouse's operations. Here, the safety of the forklift and forklift-related accidents are common, which can be solved using a 360-degree camera installed in the vehicle.

The global warehouse and storage industry has significantly grown in recent years. The India Brand Equity Foundation suggested that the warehouse and logistic industry in the nation contributed about 31% of the total retail sales in 2022, which increased from 27% in 2021. Similarly, according to the Canadian Industry Statistics, in Canada, there are about 262,010 businesses offering warehouse and transportation services until 2023.

Forklift 360-Degree Camera Market Segment Analysis:

- The logistics segment is anticipated to propel market growth.

The logistics segment in the 360-degree forklift is expected to propel significantly in the projected period, as the logistics industry is growing rapidly owing to the rising e-commerce industry in the coming years. This camera is installed above the forklift picker and helps in having a 360-degree view of the surroundings as well as how the order is picked. This camera can move as high as the picker moves.

Moreover, the United States retail e-commerce industry is booming which can be one of the reasons for market growth in the projected period for 360-degree forklifts in logistics in the projected period. According to the Census Bureau of the Department of Commerce reported today that U.S. retail e-commerce sales for the first quarter of 2024, adjusted for seasonal variations but not for price changes, reached $289.2 billion. This figure represents a 2.1 percent (±0.7%) increase from the fourth quarter of 2023. Meanwhile, total retail sales for the first quarter of 2024 were estimated at $1,820.0 billion, marking a 0.1 percent (±0.4%) decline from the previous quarter.

Additionally, one of the major reasons influencing the market is the increasing demand for 360-degree forklift cameras. These cameras provide a bird' s-eye view, which helps the forklift operator navigate through narrow and congested areas with precision and minimize the risk of collisions and accidents. Moreover, they make it easy for the forklift operator to detect and pick out the correct package, which is important if there are a lot of packages.

The global growth in the business-to-business e-commerce market is expected to have a positive impact on the 360-degree forklift market in the projected period. For instance, according to the International Trade Administration (ITA), B2B e-commerce sales are expected to rise US$36,163 billion in 2026, above US$21,019 billion in 2023, which is a 14.5% growth year-on-year. Hence, such increasing growth in the e-commerce sector is expected to propel the market for 360-degree forklift cameras in the projected period.

Forklift 360-degree Camera Market Geographical Outlook:

- The market is projected to grow in the North American region.

The United States is expected to hold a considerable market share in the projected period, which is attributable to the rising demand for safe operations related to warehousing and logistics involving trucks. Additionally, the growing number of incidents in warehouse stores and the need to mitigate those risks is expected to propel the market for 360-degree forklift cameras in the projected period.

Moreover, the proliferation of advanced forklift camera systems is expected to witness an upward trend due to their several benefits, such as enhanced production, extended views, better monitoring, and maximum productivity with minimal damage. In addition to this, the improved vision of drivers across different warehouses in the United States with forklift cameras is anticipated to also ensure better pedestrian safety at the highest level.

Forklift 360-Degree Camera Key Market Developments:

- In 2024, SharpEagle Technology launched its innovative forklift camera, the forklift 360-degree camera, to capture a bird's-eye view. The company strives to come up with advanced safety solutions through continuous research. The bird's-eye technology included in the camera systems offered by the company provides accurate and precise detection of obstacles, hazards, and pedestrian traffic.

Forklift 360-Degree Camera Market Key Players:

- LEESENkam offers the Forklift Safety System for trucks. The product is equipped with HD night vision, which helps to avoid blind spots around the forklift. The company provides unique features such as parking monitoring and chip sensor cameras, among others.

- SharpEagle Technology Group Ltd is one of the leading companies that provides a bird-eye view camera system and other innovative products. These products include a combination of AI cameras and real-time technology to enable a complete view of the entire forklift.

- Linde Material Handling, a top forklift truck manufacturer, provides a surround-view camera system that provides a comprehensive 360-degree view of the forklifts for enhanced safety and operational efficiency.

Forklift 360-degree Camera Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Forklift 360-degree Camera Market Size in 2025 | US$0.723 billion |

| Forklift 360-degree Camera Market Size in 2030 | US$1.448 billion |

| Growth Rate | CAGR of 14.96% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in the Forklift 360-degree Camera Market |

|

| Customization Scope | Free report customization with purchase |

Forklift 360-Degree Camera Market Segmentation:

- By Industry Vertical

- Warehousing

- Logistics

- Manufacturing

- Automobile

- Others

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- UK

- Germany

- France

- Italy

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Indonesia

- Others

- North America