Report Overview

France AI in Finance Highlights

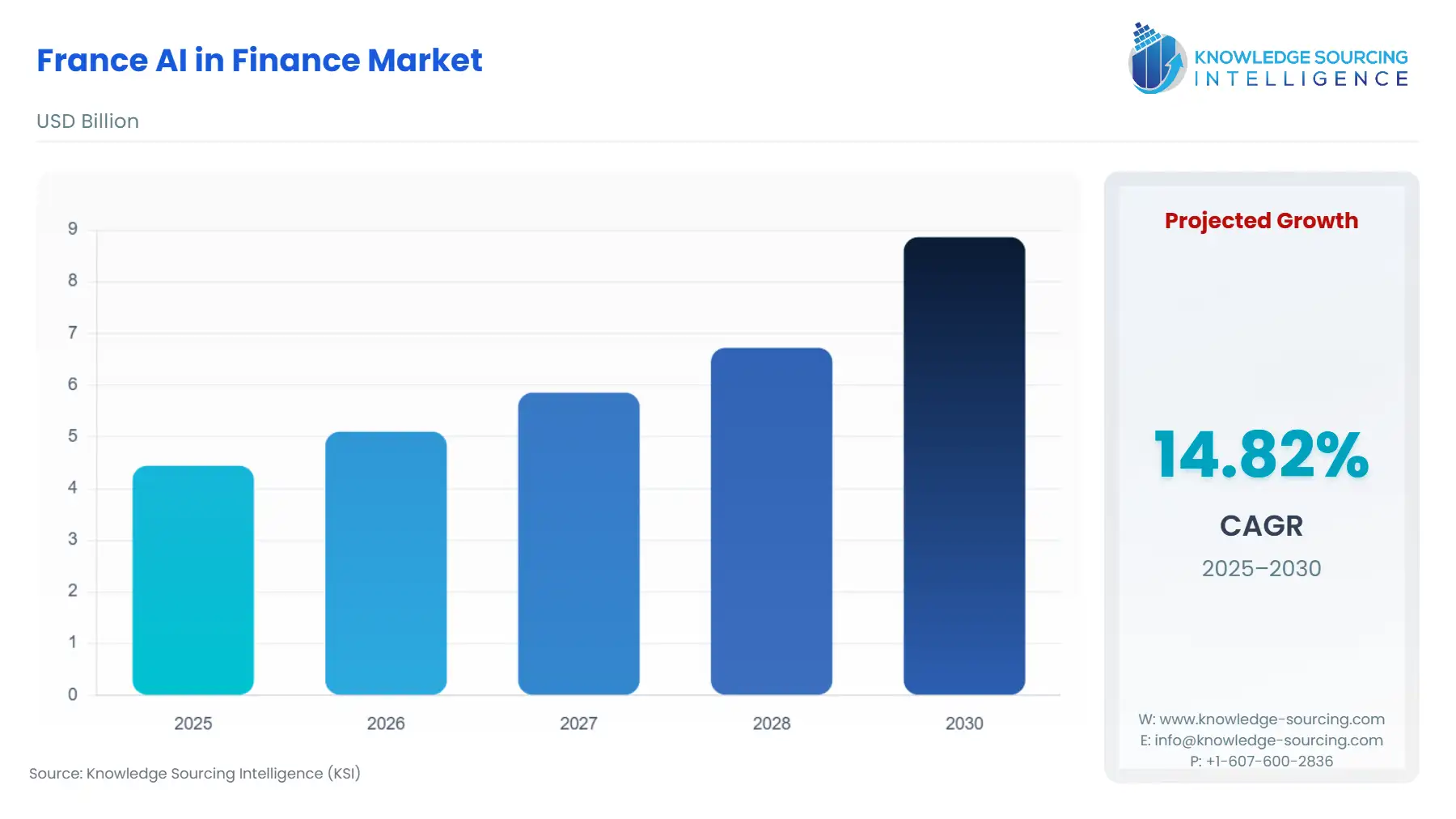

France AI in Finance Market Size:

The France AI in Finance Market is expected to grow at a CAGR of 14.83%, reaching USD 8.864 billion in 2030 from USD 4.441 billion in 2025.

The French AI in Finance market is undergoing a structural transformation, driven less by speculative venture capital and more by the confluence of rigorous European regulatory mandates and national digital sovereignty initiatives. This dynamic creates a distinct environment where compliance acts as a powerful catalyst for technological adoption. Financial institutions in France must balance the imperative for operational efficiency, which AI promises, with the non-negotiable requirement for data governance and algorithmic transparency, particularly as the European regulatory landscape solidifies. This context positions the market's focus firmly on highly auditable, secure, and sector-specific AI applications, primarily in risk management, regulatory technology (RegTech), and customer engagement platforms.

France AI in Finance Market Analysis:

Growth Drivers

The primary catalyst for AI adoption in French finance is the regulatory obligation to enhance compliance capabilities, which creates a quantifiable demand for RegTech solutions. The European Banking Authority’s (EBA) guidance on outsourcing and France’s national focus on AML-CFT compel institutions to deploy machine learning models for transaction monitoring and anomaly detection, directly increasing the demand for systems that can process and flag complex financial crime patterns with greater accuracy than traditional rule-based engines. Concurrently, the competitive pressure from domestic, AI-native fintechs drives incumbents to seek operational efficiencies. The need for AI is therefore propelled by the need to automate capital-intensive back-office processes, such as claims processing and document verification, transforming a cost-center problem into a strategic investment in efficiency. This regulatory and competitive duality ensures sustained investment in AI systems.

Challenges and Opportunities

The foremost challenge constraining market penetration is the severe talent deficit in AI and data science expertise within the financial sector, which hinders in-house development and increases the demand for third-party Software as a Service (SaaS) AI solutions. Furthermore, the inherent need for model explainability, amplified by the high-risk classification of certain financial AI systems under the EU AI Act, presents a significant technical obstacle, raising the deployment costs for complex Large Language Models (LLMs). The key opportunity lies in leveraging France's leadership in digital public services and the France 2030 investment plan to build sector-specific, sovereign data spaces. This directly increases the demand for AI-powered solutions that can securely and compliantly utilize aggregated data for advanced credit scoring, personalized wealth management, and systemic risk modeling.

Supply Chain Analysis

The French AI in Finance supply chain is anchored by a fundamental dependency on core digital infrastructure. The foundation is a tri-tiered structure: Data Provision (internal financial datasets, transaction histories), Compute/Platform (IaaS/PaaS layers), and Application Software (SaaS AI models). The Compute layer is highly concentrated, with a significant majority of growth captured by hyperscalers like Amazon Web Services, Google Cloud, and Microsoft Azure, which supply the scalable GPU resources and foundational ML platforms. However, the French government’s Cloud of Trust strategy dictates a logistical constraint, where sensitive financial workloads must migrate to SecNumCloud-certified providers, channeling demand toward either specific certified hyperscaler offerings or domestic European cloud platforms. This regulatory requirement imposes a significant compliance complexity, shifting the demand for the AI solution layer toward providers that can guarantee hosting and processing within this sovereign framework, thereby influencing the technical dependencies of the final AI software product.

Government Regulations

| Jurisdiction | Key Regulation / Agency | Market Impact Analysis |

|---|---|---|

| European Union (EU) / France | EU AI Act (Supervised in France by ACPR/CNIL) | Classifies AI in credit scoring and certain risk management as 'high-risk,' directly increasing demand for rigorous governance, extensive documentation, and external auditing software, making explainability (XAI) a non-negotiable feature for compliance-centric AI solutions. |

| France / EU | ACPR (Autorité de Contrôle Prudentiel et de Résolution) Guidelines on AI Governance | Compels financial institutions to focus on four criteria: data management, performance, stability, and explainability. This directly drives demand for continuous monitoring and model validation platforms to meet supervisory expectations for model risk management. |

| France / EU | GDPR (General Data Protection Regulation) / CNIL | Sets strict mandates for consent, data minimization, and the "right to explanation" for automated decisions, which constrains the types of data that can be used for training AI models and increases the demand for privacy-preserving AI techniques like federated learning. |

| France | SecNumCloud Certification (ANSSI) | The national security standard for cloud services hosting sensitive data. This requirement channels the demand for cloud-deployed AI solutions toward certified providers, structurally impacting the underlying IaaS/PaaS components of the AI supply chain. |

France AI in Finance Market Segment Analysis:

By Application: Back Office

The Back Office segment, encompassing functions such as regulatory reporting, compliance, reconciliation, and claims processing, represents a primary source of demand for AI solutions due to its high volume of repetitive, document-centric tasks. The critical growth driver is the imperative to compress operational costs and mitigate high error rates inherent in manual processing. The introduction of advanced Natural Language Processing (NLP) and Image Recognition technologies directly addresses this by automating the ingestion and classification of unstructured data (e.g., loan applications, insurance claims forms, KYC documents). This automation capability, particularly in areas like regulatory filing validation and internal audit documentation, increases the demand for AI platforms that offer guaranteed audit trails and explainable decision pathways, enabling a reduction in full-time equivalent (FTE) personnel dedicated to non-value-added compliance checks. The ultimate value proposition is not solely cost-saving but achieving non-linear scalability in operations without commensurate increases in human capital.

By User: Corporate Finance

The need for AI solutions within the Corporate Finance segment, primarily targeting Chief Financial Officers (CFOs) and treasury departments of French SMEs and large enterprises, is fundamentally driven by the need for real-time cash flow optimization and enhanced liquidity risk management. Unlike consumer-facing AI, the corporate demand is focused on predictive accuracy and integration with Enterprise Resource Planning (ERP) systems. The market requires AI-powered Sentiment Analysis and Large Language Models (LLMs) that can analyze complex data, including supplier invoice payment history, macroeconomic indicators, and trade press, to construct highly accurate working capital forecasts. This capability directly increases the demand for AI-driven platforms that can automate foreign exchange (FX) risk hedging, optimize invoice factoring, and provide dynamic credit assessments for commercial counterparties, moving the CFO function from reactive reporting to proactive, data-driven financial steering.

Competitive Environment and Analysis

The French AI in Finance competitive landscape is characterized by a strong ecosystem of domestic, specialized B2B technology providers and agile fintechs that operate adjacent to the traditional banking sector, which is dominated by institutions with significant legacy IT infrastructure. Competition is primarily focused on deep domain expertise (e.g., fraud, insurance, payments) and regulatory compliance, rather than sheer scale. The market is not yet consolidated, allowing specialized players to capture significant market share in niche RegTech and InsurTech verticals.

France AI in Finance Market Company Profiles:

Shift Technology

Shift Technology focuses on providing AI-native decisioning solutions, primarily for the global insurance industry. Its strategic positioning is centered on leveraging AI to drive fraud detection and optimize claims automation, utilizing machine learning algorithms to process high-volume, complex claim data. A core offering is its AI-powered claims automation platform, which automates the end-to-end processing of insurance claims, utilizing proprietary models to detect fraudulent or suspicious activity with high accuracy. This is a clear B2B play where their value proposition directly reduces insurer payouts and operating costs.

Qonto

Qonto is a prominent French-based neobank specifically targeting freelancers, startups, and SMEs, operating in the Corporate Finance user segment. Qonto's strategic positioning leverages its AI-native platform to offer streamlined financial services—including business accounts, expense management, and invoicing—that are significantly more efficient than those offered by traditional banks. Their key products/services are designed around automation, using AI to categorize transactions for easier accounting, manage expense reports via mobile application, and offer API integration for simplified financial data flow, addressing the modern corporate demand for seamless, digital-first financial management.

Lydia

Lydia Solutions, known initially for its P2P payment application, has strategically repositioned itself to capture a broader consumer finance market. The company’s strategy involves building an AI-enabled, digital-first banking ecosystem to compete directly with traditional retail banks. Their key recent launch, the new digital bank application Sumeria, provides a remunerated current account and other consumer banking capabilities. This product is a prime example of their AI adoption, as the platform relies on sophisticated back-end machine learning for real-time risk scoring and personalized financial nudges to drive customer engagement and loyalty.

France AI in Finance Market Recent Developments:

- September 2025: Shift Technology officially launched its Generative AI solution, integrated into its Claims Automation product. This platform allows insurers to accelerate routine claims-handling tasks by using LLMs to synthesize information from various unstructured documents and generate first-draft communications and claim summaries, directly increasing the automation capacity of their core service offering.

- May 2024: Lydia Solutions officially launched its new digital banking application, Sumeria. This product launch represents a significant capacity addition to the company's offering, expanding beyond peer-to-peer payments to provide full digital bank accounts, a remunerated current account, and physical/virtual cards, leveraging their underlying AI platform for advanced risk management and a simplified user experience.

France AI in Finance Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 4.441 billion |

| Total Market Size in 2031 | USD 8.864 billion |

| Growth Rate | 14.83% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Type, Deployment Model, User, Application |

| Companies |

|

France AI in Finance Market Segmentation:

- BY TYPE

- Natural Language Processing

- Large Language Models

- Sentiment analysis

- Image recognition

- Others

- BY DEPLOYMENT MODEL

- On-Premise

- Cloud

- BY USER

- Personal Finance

- Consumer Finance

- Corporate Finance

- BY APPLICATION

- Back Office

- Middle office

- Front Office