Report Overview

Canada AI in Finance Highlights

Canada AI in Finance Market Size:

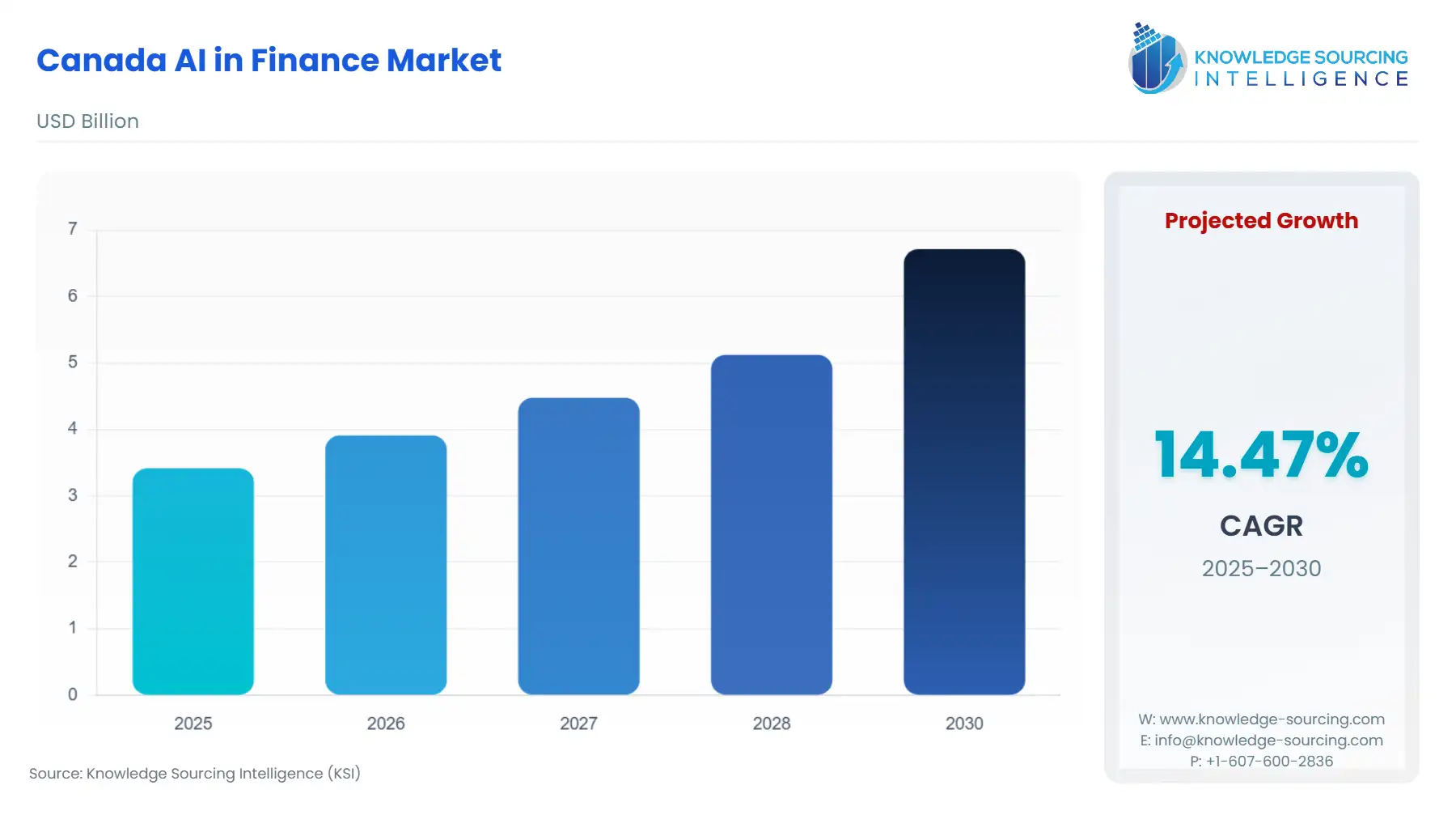

The Canada AI in Finance Market is expected to grow at a CAGR of 14.48%, reaching USD 6.715 billion in 2030 from USD 3.416 billion in 2025.

The Canadian AI in Finance Market is undergoing a rapid maturation phase, distinguished by a confluence of strong governmental support for foundational research and a practical imperative from the financial services industry to enhance operational resilience and customer value.

This market’s evolution is characterized not by an exploration of AI's potential, but by the determined, strategic integration of machine learning and natural language processing solutions into core banking, lending, and wealth management functions. The nation’s highly consolidated banking structure, coupled with its globally recognized AI talent hubs in Toronto, Montreal, and Edmonton, provides a fertile ground for the swift deployment of sophisticated financial technology. The central focus remains on leveraging AI as a powerful tool to manage complex financial risks, including fraud and model bias, while simultaneously using it to meet the rising consumer expectation for hyper-personalized digital financial services.

Canada AI in Finance Market Analysis:

Growth Drivers

The escalating volume and complexity of financial data necessitate advanced computational tools, directly increasing the demand for AI-driven data analysis platforms. Further propelling its requirement is the stringent regulatory environment around anti-money laundering (AML) and know-your-customer (KYC) compliance; AI models offer superior real-time transaction monitoring and anomaly detection, creating a critical business requirement for automated compliance solutions that supersede rules-based systems. Moreover, Canadian FIs are pursuing operational efficiency and cost reduction through automation of back-office processes like loan origination and claims processing, which directly drives demand for AI and machine learning platforms that optimize workflows and reduce human error.

Challenges and Opportunities

A primary challenge facing the market is the constraint of data governance and quality. Biased or insufficient training data directly undermines the reliability and explainability of AI models, which increases regulatory and reputational risk and subsequently depresses the demand for new AI deployment until robust data pipelines are established. Conversely, a significant opportunity lies in the burgeoning demand for Agentic AI, specialized bots capable of autonomous action. Deploying these agents for tasks like compliance reporting and real-time dialogue assistance in wealth management reduces the administrative burden on human advisors, directly increasing the demand for tailored, high-value AI solutions that augment human expertise.

Supply Chain Analysis

The Canadian AI in Finance supply chain is predominantly digital and global, with key dependencies on US-based hyperscale cloud providers (e.g., Google, Microsoft, Amazon) for computing infrastructure and deployment platforms. Key production hubs are concentrated within Canada’s AI centers in Toronto (Vector Institute) and Montreal (Mila), which generate the core algorithms and intellectual property. Logistical complexities revolve not around physical transport, but data sovereignty and cross-border data transfer regulations, given that many Canadian FIs use US-based cloud infrastructure to store and process customer data. The reliance on third-party AI vendors for specialized models introduces third-party risk management and contractual standardization as key dependencies in the supply chain.

Government Regulations

| Jurisdiction | Key Regulation / Agency | Market Impact Analysis |

|---|---|---|

| Federal, Canada | Office of the Superintendent of Financial Institutions (OSFI) / Guideline E-23 | OSFI advocates for the adoption of the EDGE principles (Explainability, Data, Governance, Ethics) for AI use by federally regulated financial institutions (FRFIs). This acts as a governance imperative, increasing demand for AI model risk management platforms, explainability tools, and robust data governance solutions. |

| Federal, Canada | Artificial Intelligence and Data Act (AIDA) / Bill C-27 | This proposed legislation aims to establish rules for the development and deployment of high-impact AI systems. Its focus on mitigating risks of harm and bias, including "economic loss to an individual," will drive demand for AI auditing tools and responsible AI frameworks within the financial sector to ensure compliance and avoid penalties. |

| Quebec | Law 25 (Amendments to the Act respecting the protection of personal information in the private sector) | Requires organizations to conduct privacy impact assessments (PIA) for any project involving personal information and implement a "privacy by design" approach. This mandates FIs to integrate privacy controls into the design of AI systems from the outset, directly increasing the cost and complexity but also the demand for privacy-enhancing technologies and secure data-sharing solutions. |

Canada AI in Finance Market Analysis:

By Application: Back Office

The Back Office segment, encompassing critical functions such as compliance, internal audit, and trade settlement, is experiencing an increase in demand for AI solutions driven by the imperative for cost reduction and enhanced control. AI-powered financial risk intelligence platforms are directly replacing traditional sampling-based audit processes with continuous, full-population anomaly detection. The increasing regulatory pressure from OSFI and evolving cyber threats makes the automation of risk scoring, fraud detection, and regulatory reporting a strategic necessity, not merely an efficiency gain. This transition from manual, retrospective checks to proactive, predictive AI monitoring in the back office has created a high-demand sub-segment for solutions that provide unbiased, enterprise-wide financial risk discovery across billions of transactions.

By User: Personal Finance

The Personal Finance segment is characterized by a strong demand for AI-driven personalization and automation, fundamentally transforming how Canadian consumers interact with their banks. The growth is catalyzed by the desire of FIs to increase client retention and cross-sell services. AI-powered robo-advisors are meeting the needs of mass-market investors for low-cost, automated portfolio management, democratizing wealth management services. Furthermore, tools that use machine learning to analyze individual spending patterns and generate CIBC Insights, offering personalized savings opportunities or transaction alerts, are directly responding to consumer expectations for actionable, data-driven recommendations, thus driving demand for conversational AI and recommendation engines.

Canada AI in Finance Market Competitive Environment and Analysis:

The Canadian AI in Finance market features a dynamic competitive landscape, primarily segmented between well-funded, domestic pure-play AI vendors and the entrenched in-house innovation labs of major Canadian banks (e.g., Royal Bank of Canada's Borealis AI). Competition is focused on providing highly specialized, domain-specific AI models that deliver measurable ROI in risk management and customer experience.

Overbond

Overbond is strategically positioned as a fixed income trading automation platform that leverages AI for bond pricing, liquidity scoring, and predictive trade execution. The company's core offering directly addresses the need for efficiency and precision in illiquid bond markets. Its key product, the COBI (Corporate Bond Intelligence) pricing model, uses machine learning to provide real-time, unbiased best-execution recommendations, effectively increasing demand for AI-driven trade optimization within the capital markets segment.

MindBridge AI

MindBridge AI is a significant domestic player focused on the financial risk intelligence and auditing space. Their platform utilizes an Ensemble AI approach to detect anomalies and risk across financial data. The company's strategic positioning targets audit and finance professionals, providing them with a platform that scores every financial entry for risk. This directly aligns with OSFI’s focus on governance and data integrity, positioning MindBridge’s AI-powered financial decision intelligence platform as an imperative for FRFIs seeking comprehensive, traceable risk oversight.

Canada AI in Finance Market Recent Developments:

- February 2025: MindBridge, the AI-powered financial decision intelligence platform, announced an official partnership with Databricks, the data and AI company. This collaboration enables joint customers to leverage the MindBridge platform on the Databricks Lakehouse Platform, allowing them to unlock the full potential of their financial data for smarter risk management. The partnership signifies an investment in seamless data integration, directly addressing the demand for robust, scalable AI platforms that can operate across large, unified data environments.

- December 2024: MindBridge was named to the annual ranking of Canada's Top Growing Companies for the second consecutive year. This recognition confirms the significant top-line growth and market adoption of its AI-powered financial risk intelligence platform within the Canadian and global audit and finance sectors, demonstrating strong, verifiable market traction based on historical performance.

Canada AI in Finance Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 3.416 billion |

| Total Market Size in 2031 | USD 6.715 billion |

| Growth Rate | 14.48% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Type, Deployment Model, User, Application |

| Companies |

|

Canada AI in Finance Market Segmentation:

- BY TYPE

- Natural Language Processing

- Large Language Models

- Sentiment analysis

- Image recognition

- Others

- BY DEPLOYMENT MODEL

- On-Premise

- Cloud

- BY USER

- Personal Finance

- Consumer Finance

- Corporate Finance

- BY APPLICATION

- Back Office

- Middle office

- Front Office