Report Overview

Germany AI in Finance Highlights

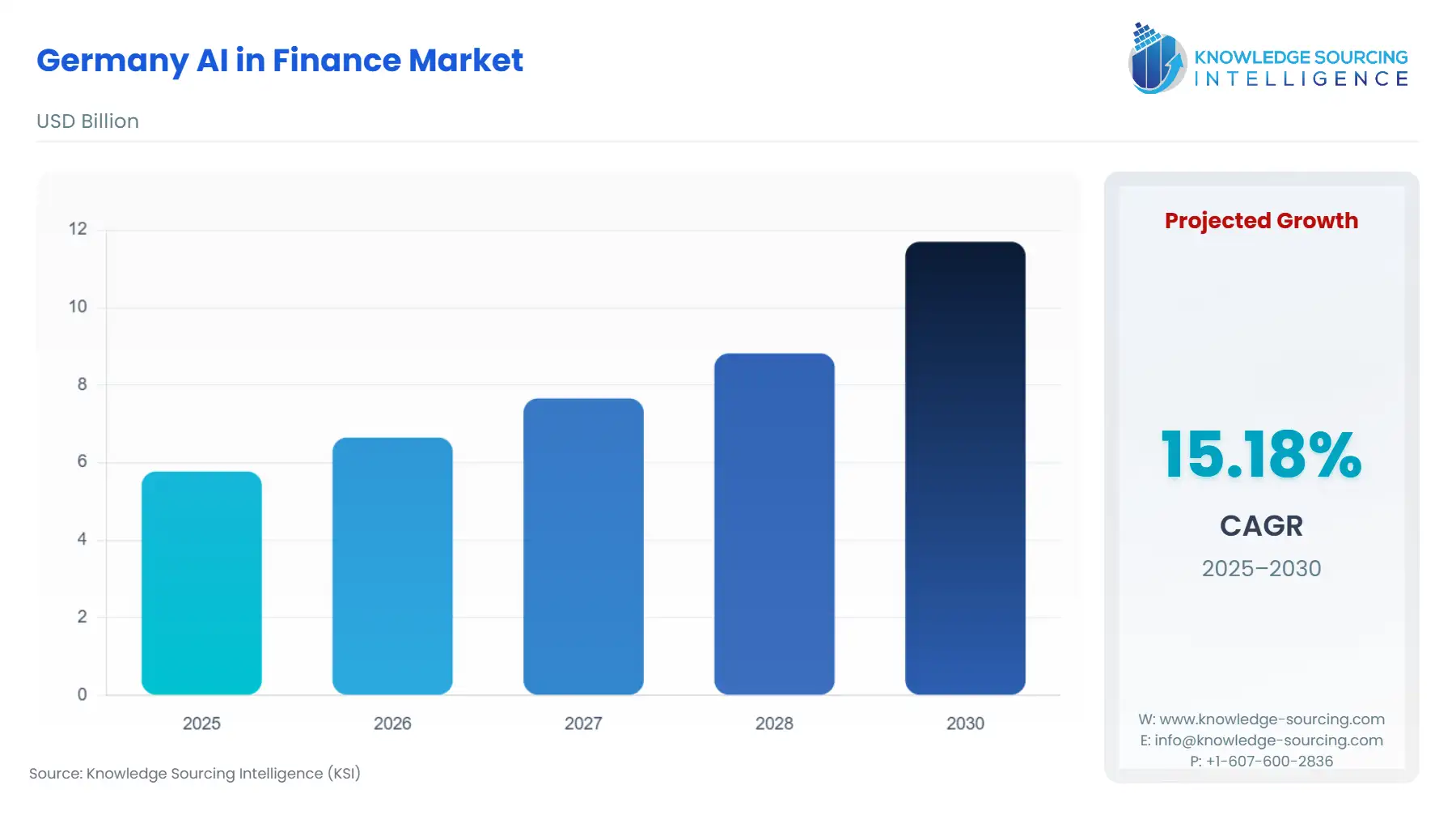

Germany AI in Finance Market Size:

The Germany AI in Finance Market is expected to grow at a CAGR of 15.18%, reaching USD 11.701 billion in 2030 from USD 5.773 billion in 2025.

The German Artificial Intelligence (AI) in Finance market is undergoing a structural transformation, catalyzed by an acceleration of enterprise-wide digital initiatives and a uniquely stringent regulatory framework that is simultaneously restrictive and catalytic. The established financial ecosystem, concentrated in hubs like Frankfurt, is being aggressively challenged by Berlin-based FinTechs that leverage cloud-native infrastructure and machine learning for superior customer experience and risk management. This dynamic interplay between traditional institutions focused on regulatory adherence and agile digital banks pursuing disruptive product strategies forms the core tension driving AI deployment. Germany's financial sector is increasingly compelled to adopt AI not merely for competitive advantage, but as an operational necessity to manage vast data volumes, comply with evolving Anti-Money Laundering (AML) and IT supervision mandates, and offset skilled labor constraints.

Germany AI in Finance Market Analysis:

Growth Drivers

The primary factor propelling market expansion is the regulatory compliance imperative. The Federal Financial Supervisory Authority (BaFin) mandates robust, auditable IT systems through its Supervisory Requirements for IT in Financial Institutions (BAIT), which now incorporates principles for Big Data and AI (BDAI). This directly increases the demand for AI solutions that provide verifiable, reproducible, and documented decision-making processes (Explainable AI - XAI), specifically to automate compliance checks, risk aggregation, and reporting under frameworks like MaRisk. Secondarily, the national focus on operational efficiency and cost reduction compels institutions to invest in AI. The demand for automation in processes like credit scoring, fraud detection, and Know-Your-Customer (KYC) onboarding rises directly, as AI can process data volumes and identify anomalies at scales unachievable by conventional statistical methods, improving efficiency and reducing regulatory penalty risk associated with financial crime.

Challenges and Opportunities

The primary challenge is the stringent, multi-layered regulatory environment. The General Data Protection Regulation (GDPR) imposes strict constraints on personal data processing, particularly restricting fully automated decision-making and requiring transparency on the logic involved. This constrains the complexity of AI models deployed in high-risk areas like lending, thereby reducing the addressable market for purely black-box AI systems but increasing demand for privacy-preserving AI techniques and legal compliance tools. The resultant opportunity lies in the country's strategic pursuit of "Trusted AI". The EU AI Act, in force since August 2024, creates high compliance costs for high-risk applications prevalent in finance, yet it simultaneously creates a strategic market positioning: German firms that meet these rigorous transparency and safety standards can market their AI as a premium, certifiable, and trustworthy solution globally, driving demand for specialized, compliant AI-as-a-Service platforms.

Supply Chain Analysis

The AI in Finance market is a software and services supply chain, globally dependent on foundational models, specialized data sets, and a highly skilled labor pool. The initial production hubs are decentralized, with primary development centered in Germany's FinTech ecosystem (Berlin, Frankfurt, Munich) for application development and cloud service provider centers (e.g., in Frankfurt, a major data/cloud hub) for infrastructure. The logistical complexity is governed not by physical transport, but by cross-border data flow regulations, where GDPR mandates and BaFin's insistence on data localization for high-risk financial processes constrain the use of non-EU cloud and AI training services, driving localized demand for compliant European cloud infrastructure. Key dependencies are on open-source machine learning frameworks and globally sourced specialized AI talent, which represents a persistent supply constraint in the domestic market, further raising the cost and demand for highly efficient, pre-trained AI models.

Government Regulations

| Jurisdiction | Key Regulation / Agency | Market Impact Analysis |

|---|---|---|

| Germany/EU | BaFin (Bundesanstalt für Finanzdienstleistungsaufsicht) / BDAI Guidance | The principles on Big Data and AI (BDAI) demand clear documentation, model selection explainability, and contingency measures for algorithmic decision-making. This directly increases the need for specialized Governance, Risk, and Compliance (GRC) AI software and Explainable AI (XAI) tools. |

| EU | General Data Protection Regulation (GDPR) / Art. 22 | Restrictions on "solely automated individual decision-making" constrain the full deployment of black-box AI in critical areas (e.g., credit scoring) but elevate demand for "human-in-the-loop" AI systems and tools for pseudonymization and data minimization. |

| EU | EU Anti-Money Laundering Directive (6AMLD) | The directive's emphasis on accountability for money laundering offenses intensifies the need for sophisticated, AI-driven transaction monitoring, anomaly detection, and fraud pattern analysis systems, driving demand for specific AI security applications. |

Germany AI in Finance Market Segment Analysis:

By Application: Back Office

The Back Office segment is characterized by the highest, most immediate demand for AI solutions due to its clear-cut potential for automation and cost optimization in non-customer-facing processes. Key growth drivers center on regulatory documentation, fraud detection, and transaction reporting. Specifically, AI-driven Anti-Money Laundering (AML) and Know-Your-Business (KYB) solutions are essential, as the escalating volume and complexity of cross-border financial activity—coupled with the strict liability under the 6th AMLD—render manual compliance unfeasible. The application of machine learning in transaction monitoring and sanctions screening significantly reduces false positives while improving the efficacy of financial crime prevention, which directly drives demand. Furthermore, the mandatory digitization of document processing, especially for archival and audit purposes under BaFin's supervision, accelerates the deployment of Natural Language Processing (NLP) and Intelligent Document Processing (IDP) to ingest, categorize, and verify legal and accounting documentation, which is a key driver for process efficiency.

By User: Personal Finance

The Personal Finance segment, primarily served by digitally native banks and specialized FinTechs, exhibits a pronounced demand for AI that drives product stickiness, personalization, and user engagement. The core necessity is for robo-advisory and AI-driven budgeting/savings tools. The verifiable success of players like N26 in scaling products such as Instant Savings (offering competitive interest rates) and investment products (Stocks, ETFs) highlights a strong consumer appetite for tools that optimize individual wealth management. AI is indispensable here for risk profiling, portfolio rebalancing, and providing hyper-personalized financial guidance that goes beyond generic advice. The deployment of Large Language Models (LLMs) and Sentiment Analysis in customer-facing chat services also serves to triage inquiries, offer customized credit/overdraft offers based on behavioral data, and enhance the overall digital user experience, ultimately driving increased transaction volume per customer and higher revenue per user for digital platforms.

Germany AI in Finance Market Competitive Environment and Analysis:

The German AI in Finance competitive landscape is a dual-structured environment: established multinational banks slowly integrating AI, and a core group of agile, licensed FinTechs that have AI and platform-based strategies embedded in their fundamental architecture. The competitive friction point is centered on data-driven customer experience and compliance-as-a-service offerings.

N26 (Mobile Bank)

N26 is strategically positioned as a pan-European mobile bank that leverages AI to drive profitability through product diversification and customer engagement. Its core AI deployment is focused on personal finance, risk management, and product personalization. Verifiable strategic positioning centers on its ability to rapidly launch and scale investment products, such as N26 Stocks and ETFs and N26 Crypto, alongside core services like its Instant Savings account. The company's achievement of its first quarterly profit in Q3 2024 validates the operational efficiency gained from its digital-first, heavily automated back-end and its high customer transaction volume, a key metric driven by an AI-optimized user flow that promotes cross-selling. The strategy emphasizes organic, high-engagement customer growth with a suite of digital banking services managed within a single application.

Solarisbank (Banking-as-a-Service Platform)

Solarisbank occupies a pivotal infrastructure position, operating as a fully licensed Banking-as-a-Service (BaaS) platform. Its strategic positioning is to function as an invisible technological layer, enabling non-financial companies (e.g., FinTechs, corporates) to embed financial services into their customer journeys. Solaris's AI solutions are critical to its core service offerings, particularly its KYC Platform and Consumer Lending solutions, which require machine learning for instant risk assessment and identity verification. Recent verifiable product developments include the launch of Safeguarding Accounts (2025) and updates to its BankIdent Plus product (2025), which demonstrate a commitment to utilizing technology to meet heightened regulatory requirements for security and payment infrastructure, directly fueling the embedded finance market's need for compliant, API-accessible financial functionality.

Germany AI in Finance Market Recent Developments:

- September 2025: Solaris, the technology platform, announced it selected ACI Connetic to modernize and future-proof its payments infrastructure. This strategic investment is a capacity addition, focusing on enhancing the platform's core processing capability to handle increased transaction volumes and improve fraud detection across its embedded finance ecosystem, which directly serves a multitude of German FinTechs and corporate clients.

- May 2025: N26 announced its entry into the European telecommunications market with the launch of N26 SIM, a digital mobile plan offer. This product launch is an important strategic move to increase customer stickiness and revenue per user by integrating a non-financial essential service, leveraging the bank's existing user base and digital infrastructure to expand its service ecosystem beyond traditional finance.

- February 2025: N26 announced that new Metal customers would benefit from an ECB-linked interest rate, currently 2.75% per annum, on their Instant Savings accounts. This represents a product enhancement aimed at stimulating customer deposits and increasing interest revenue, a key profitability lever that relies on automated, AI-driven treasury management and a rapid response to shifting European Central Bank monetary policy.

Germany AI in Finance Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 5.773 billion |

| Total Market Size in 2031 | USD 11.701 billion |

| Growth Rate | 15.18% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Type, Deployment Model, User, Application |

| Companies |

|

Germany AI in Finance Market Segmentation:

- BY TYPE

- Natural Language Processing

- Large Language Models

- Sentiment analysis

- Image recognition

- Others

- BY DEPLOYMENT MODEL

- On-Premise

- Cloud

- BY USER

- Personal Finance

- Consumer Finance

- Corporate Finance

- BY APPLICATION

- Back Office

- Middle office

- Front Office