Report Overview

Australia AI in Finance Highlights

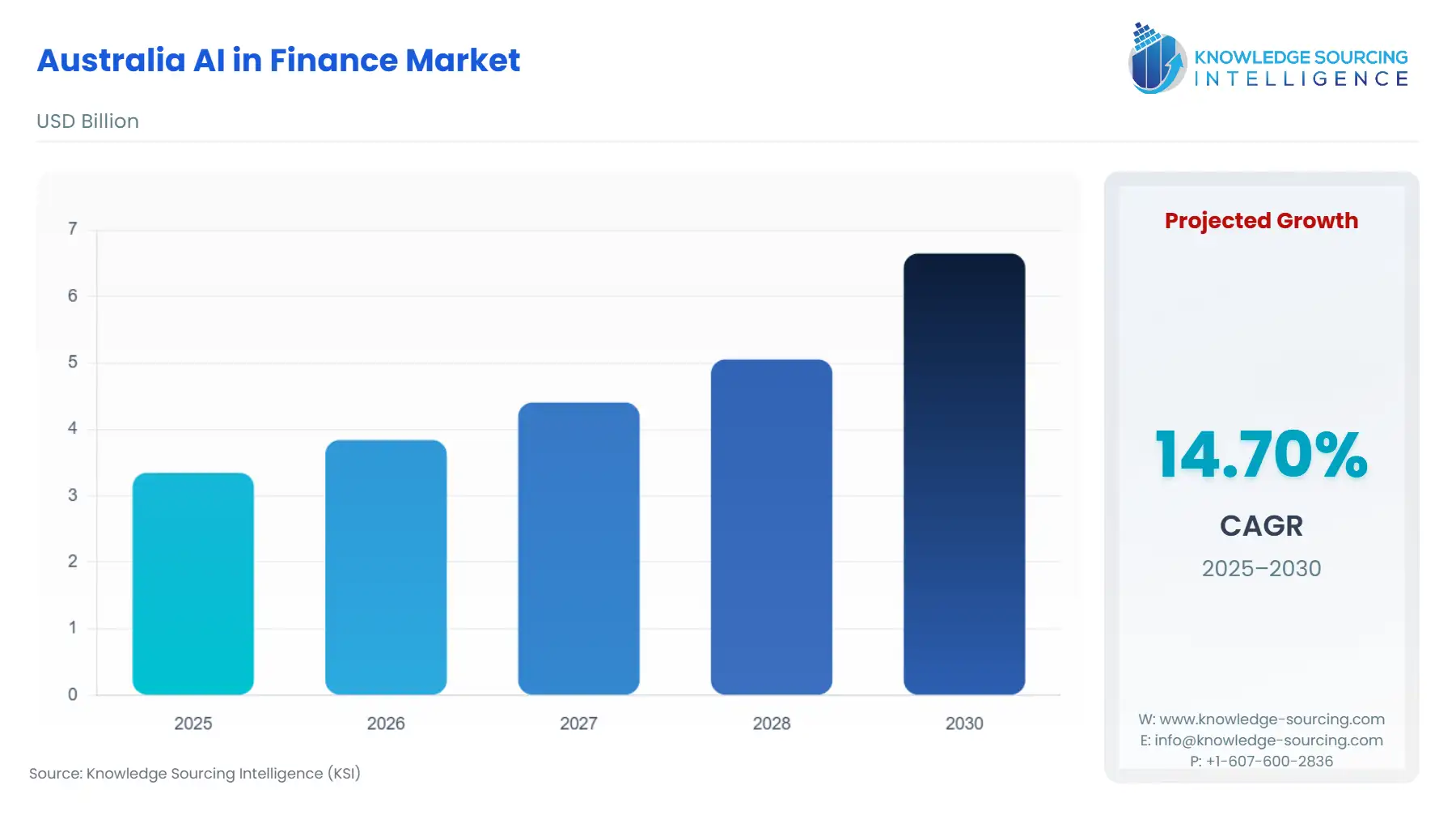

Australia AI in Finance Market Size:

The Australia AI in Finance Market is expected to grow at a CAGR of 14.70%, reaching USD 6.649 billion in 2030 from USD 3.349 billion in 2025.

The Australian financial services sector is undergoing a profound structural evolution, propelled by technology adoption and sustained competitive pressure. The increasing integration of Artificial Intelligence (AI) solutions has moved from a speculative opportunity to a core strategic mandate across major banks, superannuation funds, and agile FinTech challengers. This transformation is being met with a regulatory environment—defined by the Australian Prudential Regulation Authority (APRA) and ASIC—that simultaneously encourages innovation while placing rigorous expectations on risk management, data quality, and model explainability. This confluence of technological push and regulatory pull directly intensifies the demand for sophisticated, compliant AI tools designed not merely for process automation but for critical decision augmentation across the financial value chain.

Australia AI in Finance Market Analysis:

Growth Drivers

The primary catalyst for market expansion is the relentless pursuit of operational leverage, which directly increases demand for Robotic Process Automation (RPA) and Machine Learning (ML) solutions capable of streamlining back-office functions. This data indicates a significant majority of Australian financial institutions (76%) are actively using or testing AI for financial reporting and compliance, translating the regulatory burden into an immediate demand for efficiency-enhancing technologies. Furthermore, the rising volume and sophistication of financial crime have made AI-driven fraud detection the market's leading application, forcing institutions to procure ML models that deliver real-time, predictive risk scoring to safeguard customer assets and reduce loss rates. This dual pressure of operational cost reduction and enhanced security unequivocally propels the consumption of AI platforms.

Challenges and Opportunities

The dominant challenge is the "governance gap," identified by ASIC, which creates a significant headwind against the widespread deployment of consumer-facing AI. The regulator's focus on consumer fairness, bias, and disclosure demands that financial institutions invest in specialized RegTech AI solutions that enforce transparency and model explainability, thereby increasing the cost and complexity of deployment. However, this same environment creates opportunities: the rapid expansion of the digital banking sector, coupled with a thriving FinTech startup landscape, intensifies the demand for AI-driven, hyper-personalized customer experience (CX) tools. These firms require agile, scalable AI solutions to differentiate their offerings and capture market share by providing services like personalized investment advice or dynamic credit scoring. The regulatory focus on risk management inherently drives demand for compliant and ethical AI frameworks.

Supply Chain Analysis

The supply chain for the Australia AI in Finance market is an ecosystem primarily dependent on three intangible elements: global cloud infrastructure, quality data sources, and a specialized talent pool. Cloud service providers (CSPs) like Amazon Web Services (AWS) and Microsoft Azure form the foundational backbone, facilitating the deployment of Machine Learning (ML) models through their serverless architectures and managed services. This dependency introduces logistical complexities related to data sovereignty and latency, driving demand for sovereign cloud solutions and local data-processing hubs. A secondary, but critical, dependency is the scarcity of domestic AI/ML engineers and data scientists, which forces Australian institutions to rely on international talent and third-party vendor solutions. This talent constraint shifts institutional demand towards accessible, pre-built, and high-performance AI-as-a-Service platforms.

Government Regulations

The Australian AI in Finance market operates under strict oversight, where key regulatory actions directly shape and, in some cases, constrain the demand profile.

| Jurisdiction | Key Regulation / Agency | Market Impact Analysis |

|---|---|---|

| Australia | ASIC (Australian Securities and Investments Commission) | ASIC's focus on consumer protection and market integrity, especially concerning advice and sales, directly drives demand for explainable AI and AI governance platforms to manage risks of unintended bias, misrepresentation, and consumer harm. The pursuit of compliance is a non-negotiable demand driver. |

| Australia | APRA (Australian Prudential Regulation Authority) | APRA's prudential mandate, specifically the Financial Accountability Regime (FAR) and its focus on operational resilience (CPS 230), increases the demand for AI systems with robust risk management controls and clear human accountability. This mandates due diligence on third-party AI vendors, shaping vendor selection. |

| Australia | ACCC (Australian Competition and Consumer Commission) | The ACCC's oversight of competition and consumer law, including digital platforms, impacts the demand for AI models related to pricing and personalized offerings. Regulatory scrutiny ensures that algorithms do not engage in discriminatory practices, thereby creating demand for ethical AI auditing tools. |

Australia AI in Finance Market Segment Analysis:

By Application: Front Office

The Front Office segment encompasses all customer-facing applications of AI, including automated customer service, personalized product recommendation engines, and digital wealth management (robo-advice). This segment's growth is accelerating, driven by the customer experience imperative and the push for sales efficiency. For instance, the use of Natural Language Processing (NLP) and Large Language Models (LLMs) powers sophisticated chatbots and virtual assistants, enabling financial institutions to offer 24/7 service while simultaneously reducing contact centre operational expenditure. This direct shift in customer service architecture—from human-centric to AI-augmented—creates a persistent demand for conversational AI platforms. Furthermore, the competitive market compels institutions to use AI for personalized customer segmentation and tailored marketing offers, increasing the demand for prescriptive analytics to maximize the efficacy of sales channels and improve customer lifetime value metrics.

By User: Corporate Finance

The Corporate Finance user segment, which includes large enterprises and major banks utilizing AI for their internal financial operations and treasury management, represents a high-value vertical. The primary growth driver is the optimization of cash flow and risk exposure on a global scale. This is evidenced by Australian-founded global platforms, such as Airwallex, which strategically acquired technologies to unify procurement, billing, and global treasury workflows. The complexity of cross-border financial operations—including foreign exchange risk management, multi-currency account management, and sanctions screening—drives a direct demand for advanced ML algorithms capable of real-time market prediction and automated compliance checks. The size and complexity of transactions in this segment necessitate high-accuracy AI tools, particularly in the fraud detection application area, where even minor errors can lead to substantial financial and reputational losses.

Australia AI in Finance Market Competitive Environment and Analysis:

The Australian AI in Finance competitive landscape is characterized by a mix of established Big Four banks integrating AI into legacy systems, agile domestic challenger banks, and internationally expanding FinTech platforms that are AI-native. Competition centers on achieving speed-to-market with compliant, high-performing AI solutions that deliver demonstrable cost efficiencies and superior customer or corporate user experiences.

Airwallex

Airwallex, a global financial platform proudly founded in Melbourne, positions itself as an AI-first enabler for modern, borderless businesses. Its strategic focus is on providing robust solutions for payments, treasury, and spend management through proprietary infrastructure, empowering its clients to manage global financial operations. A core element of its strategy is expansion through acquisition and product rollout. In September 2025, Airwallex significantly enhanced its offering by acquiring OpenPay, a billing platform, to introduce billing capabilities that automate revenue growth and subscription management. Furthermore, the company successfully rolled out its multi-currency Yield product in multiple jurisdictions during 2025, allowing businesses to generate competitive returns on idle funds held in their multi-currency accounts, directly addressing the corporate finance demand for efficient treasury management. This aggressive product and M&A strategy is aimed at capturing market share from legacy financial institutions by offering highly efficient, AI-augmented infrastructure.

Zip Co

Zip Co (ASX: ZIP) operates as a prominent digital financial services company focused on point-of-sale credit (Buy Now, Pay Later) and digital payment services across Australia/New Zealand and the United States. The company's strategic positioning emphasizes a balance of risk management through disciplined credit decisioning with a customer-centric growth model. Zip Co's use of AI is geared towards enhancing customer experience and loyalty. In September 2025, the company announced a key partnership with Nift in the US, leveraging Nift's AI-powered platform to deliver personalized gift offers to customers after checkout. This integration moves beyond core financial processing by utilizing AI for post-transaction personalization, aiming to increase brand sentiment, drive customer retention, and potentially create new ad revenue streams within the platform ecosystem.

Australia AI in Finance Market Recent Developments:

- September 2025: Airwallex announced the acquisition of OpenPay, a San Francisco-based billing platform, to introduce robust billing and subscription management capabilities to its global financial platform. This M&A activity is a strategic capacity addition, integrating advanced revenue automation directly into Airwallex's core offerings.

- September 2025: Zip Co's US operations formalized a partnership with Nift, an AI-powered gifting platform. This collaboration is a product enhancement, integrating AI to provide customers with personally tailored, post-checkout gift offers, aligning the company's services with the demand for highly personalized digital experiences.

- July 2025: Airwallex launched its Purchase Orders feature to unify procurement and bill pay workflows, alongside the introduction of Airwallex Pay for instant B2B transfers. This product launch directly addresses the corporate finance user segment's need for end-to-end, integrated financial process automation.

Australia AI in Finance Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 3.349 billion |

| Total Market Size in 2031 | USD 6.649 billion |

| Growth Rate | 14.70% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Type, Deployment Model, User, Application |

| Companies |

|

Australia AI in Finance Market Segmentation:

- BY TYPE

- Natural Language Processing

- Large Language Models

- Sentiment analysis

- Image recognition

- Others

- BY DEPLOYMENT MODEL

- On-Premise

- Cloud

- BY USER

- Personal Finance

- Consumer Finance

- Corporate Finance

- BY APPLICATION

- Back Office

- Middle office

- Front Office