Report Overview

France AI in Transportation Highlights

France AI in Transportation Market Size:

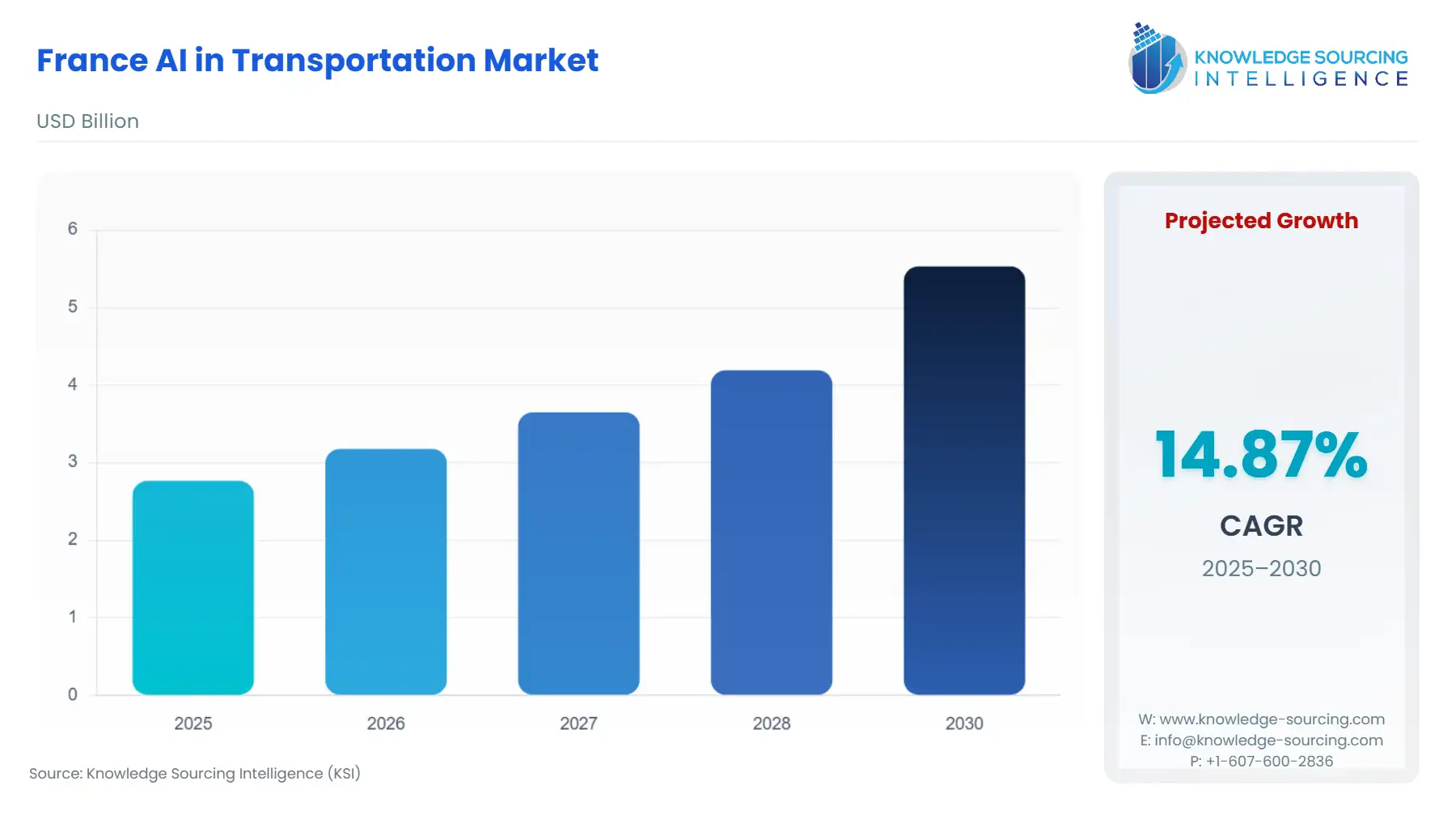

The France AI in Transportation Market is expected to grow at a CAGR of 14.87%, rising from USD 2.766 billion in 2025 to USD 5.532 billion by 2030.

________________________________________

The French Artificial Intelligence (AI) in Transportation market is entering a pivotal phase, transitioning from early-stage research and pilot projects to concrete commercial deployments, particularly within logistics and guided transport systems. This evolution is fundamentally anchored in the government's proactive policy posture, which regards AI not merely as a technological trend but as a core pillar of national industrial sovereignty and ecological transition.

The confluence of ambitious national investment programs, such as France 2030, and binding European regulatory acts, including the forthcoming operationalization of the EU AI Act, is ensuring a strategic reorientation among key domestic players. This macro-environmental pressure directly accelerates the procurement cycles for AI-enabled software solutions, primarily focusing on safety-critical functions, operational efficiency, and the management of increasingly complex, multi-modal transport networks. The resulting market dynamics mandate a high degree of collaboration between French OEMs, public transport operators, and deep technology specialists.

France AI in Transportation Market Analysis:

Growth Drivers

The government's Phase 2 (2022–2025) of the National AI Strategy, which allocated a significant budget toward the diffusion of AI in priority areas like transportation, creates direct demand by subsidizing and de-risking initial adoption for small and medium enterprises (SMEs) and large-scale public-private initiatives. Furthermore, the burgeoning requirement for advanced driver-assistance systems (ADAS) and autonomous functionality in road and rail rolling stock, particularly in response to safety and efficiency mandates, compels OEMs like Renault Group and Stellantis to integrate certified deep learning and computer vision technology, thereby solidifying demand for these specific AI modules. The sheer volume of data generated by connected vehicles and infrastructure, which exceeds human analytical capacity, necessitates the immediate deployment of machine learning algorithms for real-time monitoring and actionable insight generation, fundamentally fueling the software and services segments.

Challenges and Opportunities

A primary challenge remains the high initial implementation cost associated with integrating sophisticated AI platforms, encompassing specialized hardware (e.g., neural processing units) and the acquisition of scarce, high-level AI engineering talent. This cost structure acts as a financial barrier to entry for smaller fleet operators, constraining widespread demand. However, this restraint simultaneously presents a clear opportunity for local software-as-a-service (SaaS) providers to deliver cloud-based, subscription-model AI solutions, such as predictive maintenance and real-time routing, lowering the capital expenditure threshold and democratizing access to the technology. Additionally, concerns over data privacy, especially following precedents like the CNIL's sanction of Clearview AI, create an imperative demand for AI solutions that are intrinsically compliant with the General Data Protection Regulation (GDPR), favoring French and European firms specializing in secure, 'trusted AI' frameworks.

Supply Chain Analysis

The French AI in Transportation supply chain is characterized by a strong vertical integration in rail and aerospace, with major European integrators like Alstom and Thales acting as anchor tenants who drive specifications for AI and digital components. Production hubs for the underlying hardware components, specifically high-performance computing (HPC) and graphic processing units (GPUs) essential for deep learning models, are globally concentrated, leading to a crucial dependency on international semiconductor manufacturers. Logistical complexities arise from the need to secure a steady supply of these advanced chips, which are subject to global geopolitical and industrial constraints. The supply chain for the software component, however, is increasingly localized, relying on French academic institutes and a vibrant startup ecosystem to supply the intellectual property (IP) and specialized engineering required for bespoke AI algorithms tailored to French-specific road, rail, and urban mobility requirements.

Government Regulations

The regulatory environment exerts a powerful, demand-shaping influence on the market, moving it toward compliance-driven procurement.

| Jurisdiction | Key Regulation / Agency | Market Impact Analysis |

|---|---|---|

| France / EU | Decree No. 2024-1063 on automated road transport of goods (2024) | Directly mandates safety compliance for autonomous logistics. This compels road freight operators to purchase and validate AI safety drivers and supervision systems to meet the defined regulatory process for demonstrating operational safety. |

| EU | EU Artificial Intelligence Act (AI Act) (In Force August 2024) | Classifies AI systems by risk level. High-risk systems, including those used for the operation of critical transport infrastructure and safety components of vehicles, must comply by February 2025. This creates non-negotiable demand for certified, auditable, and transparent AI governance and testing platforms. |

| France | France 2030 Investment Program | Provides multi-billion euro public funding for innovation in strategic sectors, including AI-driven transport pilots. This acts as a direct financial catalyst, stimulating early demand and scaling for proof-of-concept AI solutions in public transport and logistics. |

France AI in Transportation Market Segment Analysis:

By Technology: Deep Learning

Deep learning (DL) holds the highest relevance for accelerating the sophistication of autonomous mobility solutions, directly creating specific demand within the computer vision and decision-making modules of transport systems. The French market is increasingly prioritizing DL for processing high-volume, unstructured sensor data from vehicle fleets—be it lidar, radar, or camera feeds—which is paramount for achieving Level 3 and Level 4 autonomy. The requirement is not merely for generic DL tools but for pre-trained models optimized for European-specific road signage, weather conditions, and densely packed urban environments, as demonstrated by French autonomous shuttle developers. This technological push is a direct response to the legislative framework established by the 2021 law on connected road mobility, which necessitates robust, verifiable object recognition and path planning capabilities. Deep learning's capacity for complex pattern recognition, such as in predicting component fatigue from acoustic or vibration data, further drives its demand in predictive maintenance systems for high-speed rail networks, where preemptive intervention is an economic and safety imperative.

By Application: Predictive Fleet Maintenance

Predictive Fleet Maintenance (PFM) solutions, which utilize machine learning to forecast asset failures, are experiencing a sharp ascent, driven by the operational necessity to reduce non-revenue-generating downtime and optimize multi-billion euro asset portfolios. End-users, including rail operators like Alstom's clientele and commercial road freight companies, are explicitly demanding PFM to move away from costly, time-based, or reactive maintenance protocols. The shift is mandated by the competitive pressure of time-sensitive logistics and high-frequency public transport schedules. PFM systems directly increase demand for AI analytics platforms that ingest massive volumes of IoT sensor data (e.g., temperature, pressure, current draw) from engine components, bogies, and braking systems, translating raw telemetry into a calculated 'Remaining Useful Life' metric. This capability allows operators to consolidate repairs, minimize depot time, and extend asset lifespan, offering a compelling return on investment that bypasses typical adoption hurdles.

France AI in Transportation Market Competitive Environment and Analysis:

The competitive landscape in France is bifurcated: established multinational conglomerates dominate the high-value rail and defense sectors, while a specialized group of start-ups and mid-sized technology firms drive innovation in autonomous road mobility and logistics software. The competition centers not just on product features but on the ability to integrate AI solutions into legacy infrastructure and comply with stringent public procurement safety standards.

Alstom

Alstom's strategic positioning leverages its legacy dominance in rail rolling stock and signaling. The company's key AI focus is within its Digital Rail offering, aimed at realizing autonomous train operations and enhancing asset performance management. Alstom is increasingly embedding AI into its Urbalis and Atlas signaling systems to enable Communication-Based Train Control (CBTC) functions, using machine learning to optimize headway and energy consumption. This vertical integration makes Alstom a crucial driver of AI demand within the mainline and metro segments, as its solutions are engineered to manage complex, mixed-traffic rail environments, providing a single-source solution for operators.

Thales Group

Thales Group's approach is rooted in its extensive expertise in critical air and ground transportation systems, defense, and cybersecurity. The company is strategically focused on using AI for Air Traffic Management (ATM) and predictive security within urban networks. Thales leverages advanced algorithms for tasks such as optimising aircraft arrival spacing at congested hubs, demonstrated by the deployment of its Approach Spacing Tool (AST) internationally. In ground transport, its AI capabilities support supervisory control systems to enhance the safety and resilience of complex networks, positioning Thales as a key supplier for national public infrastructure contracts where system integrity is paramount.

Navya

Navya, a prominent French specialist, focuses its entire business model on Level 4 autonomous driving systems for shared passenger and last-mile logistics services. Their core AI products center on their patented Navya Drive and Navya Operate systems, which handle perception, sensor fusion, and safe trajectory planning for their autonomous shuttles. The company's strategic positioning is predicated on providing certified, low-speed, autonomous transport solutions for pre-defined, complex environments such as industrial sites, airports, and private campuses. Their public-facing deployments directly create demand for their full-stack autonomous software suite among mobility service operators and municipalities seeking defined-route automated services.

France AI in Transportation Market Recent Developments:

- October 2025: Schaeffler, an automotive and industrial supplier, received the Red Dot Design Award for its driverless transport system, GraviKart. This product integrates AI-based social behavior, showcasing a technology-driven step in using AI for intelligent internal logistics and factory automation, a direct development in the commercial end-user application of AI outside of on-road transport.

- August 2025: Alstom secured a major contract to supply trains, signaling solutions, and maintenance for Mumbai Metro Line 4. While an international contract, it highlights the continuous expansion and deployment of Alstom's integrated digital rail portfolio, which centrally features AI for predictive maintenance and signaling optimization, reinforcing the company's strategic, data-centric business model.

- July 2025: Thales announced the successful deployment of its Approach Spacing Tool (AST) at Hong Kong International Airport. This product uses algorithms to optimize aircraft arrival spacing, demonstrating a verifiable, commercial product launch in the Air Traffic Management segment that uses AI to improve operational efficiency and sustainability in a high-density, real-world critical environment.

France AI in Transportation Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 2.766 billion |

| Total Market Size in 2031 | USD 5.532 billion |

| Growth Rate | 14.87% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Technology, Deployment, Application |

| Companies |

|

France AI in Transportation Market Segmentation:

- BY TECHNOLOGY

- Deep Learning

- Natural learning process

- Machine Learning

- Others

- BY DEPLOYMENT

- On-Premise

- Cloud

- BY APPLICATION

- Route optimization

- Shipping volume prediction

- Predictive Fleet Maintenance

- Real-time Vehicle tracking

- Others