Report Overview

Germany AI in Transportation Highlights

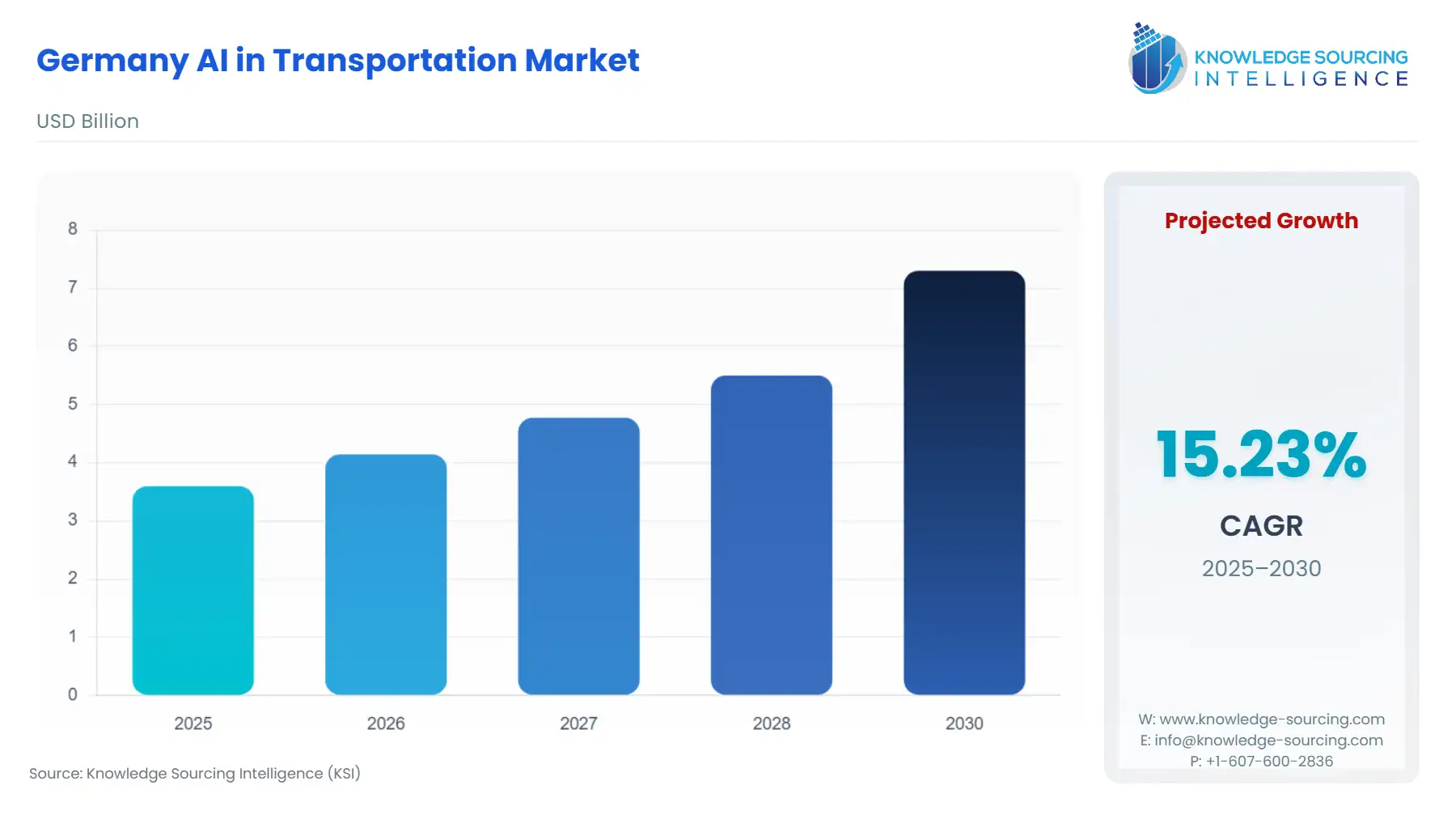

Germany AI in Transportation Market Size:

The Germany AI in Transportation Market is expected to grow at a CAGR of 15.22%, rising from USD 3.595 billion in 2025 to USD 7.302 billion by 2030.

The German Artificial Intelligence (AI) in Transportation market represents a strategic confluence of advanced automotive engineering, stringent regulatory oversight, and a nationwide push for digitalization across critical infrastructure. As the birthplace of the modern automobile and a European logistics hub, Germany views AI integration as essential for retaining global competitiveness, particularly in the twin pillars of autonomous mobility and logistics optimization. The market trajectory is defined not by incremental technology adoption, but by a foundational transformation toward software-defined vehicles (SDV) and intelligent transport systems (ITS).

Germany AI in Transportation Market Analysis:

Growth Drivers

The German Federal Government's Strategy for Autonomous Driving acts as a central growth accelerator by establishing a legal framework for Level 4 autonomous functions, particularly in commercial freight and local public transport. This legislative clarity creates direct demand for highly-complex AI stack components, including perception and decision-making systems based on Deep Learning. Concurrently, the increasing complexity of vehicle platforms, especially in electric and connected vehicles, compels OEMs to adopt AI-powered engineering tools. For instance, the strategic commitment by major automotive groups to an AI-powered engineering environment mandates the purchase of advanced simulation and virtual testing software, designed to shorten the product development lifecycle from forty-eight to thirty-six months. This industrial mandate sustains and propels the demand for AI software solutions over traditional hardware-centric development.

Challenges and Opportunities

A significant constraint is the stringent European regulatory landscape, specifically the EU AI Act, which classifies vehicle AI systems as "high-risk." This necessitates mandatory, pre-market conformity assessments, increasing development cost and time-to-market, which marginally suppresses demand by increasing the barrier to entry for smaller firms. However, this same regulation creates a massive opportunity for certified compliance solutions. Companies capable of offering validated, transparent, and auditable AI systems gain a critical competitive advantage, leading to a substantial demand increase for trustworthy AI (Trustworthy AI) software providers. Furthermore, the persistent shortage of specialized AI and software engineers in Germany limits the speed of internal development, driving up demand for outsourcing partnerships and packaged AI software-as-a-service (SaaS) solutions from external technology firms.

Supply Chain Analysis

The supply chain for AI in transportation is inherently a global semiconductor and talent-centric value chain, not a material-based one. The core logistical complexity lies in the global procurement of high-performance System-on-Chips (SoCs) and electronic control units (ECUs) required for AI inference and processing, largely sourced from Asia and North America. German Tier-1 suppliers, such as Bosch and Continental, function as the critical integration layer, translating hardware capacity into vehicle-ready, functional software stacks. The key dependency is the availability and pricing of advanced computing hardware, which is subject to global geopolitical and industrial capacity constraints. A further complexity is the 'data supply chain,' where the vast quantities of real-world driving data necessary to train Deep Learning models must be collected, curated, and legally transferred across international boundaries, necessitating robust compliance and data handling logistics solutions.

Government Regulations

| Jurisdiction | Key Regulation / Agency | Market Impact Analysis |

|---|---|---|

| European Union (Applicable in Germany) | EU Artificial Intelligence Act (AI Act) | AI systems in vehicles are classified as "High-Risk," creating an imperative for mandated conformity assessments before market entry. This elevates demand for transparency, audibility, and certified safety-critical AI software, while imposing increased compliance costs. |

| Germany | Federal Government's Strategy for Autonomous Driving in Road Traffic (BMDV/BMV) | Establishes a legal foundation for Level 4 autonomous operations, initially focusing on defined public road areas for shuttles and logistics. This directly accelerates demand for Level 4-capable perception, localization, and control AI solutions in freight and municipal transport segments. |

| Germany | Federal Office for Information Security (BSI) & UNECE R155 (Cybersecurity) | Mandates strict cybersecurity management systems for software updates and vehicle data. This drives demand for AI systems that incorporate real-time threat detection, secure over-the-air (OTA) update protocols, and robust data integrity verification to protect the AI model itself. |

Germany AI in Transportation Market Segment Analysis:

By Technology: Deep Learning

Deep Learning is the predominant technological catalyst driving new demand within the German AI transportation market. Its capacity to handle non-linear, high-dimensional data—specifically real-time inputs from camera, LiDAR, and radar sensors—makes it indispensable for achieving advanced perception in autonomous and semi-autonomous systems. The necessity for Deep Learning is directly propelled by the industry's strategic pivot to Software-Defined Vehicles (SDV), where manufacturers integrate AI to enhance complex features like environmental scene understanding and path planning. Deep Learning models, particularly Convolutional Neural Networks (CNNs) and Recurrent Neural Networks (RNNs), are the fundamental building blocks for crucial functions like pedestrian detection and traffic sign recognition, which are non-negotiable for L2+ and higher automation levels. The competitive edge of German automotive firms is increasingly defined by the proprietary data sets they can train their Deep Learning models on, leading to increased demand for robust data collection and processing infrastructure. This requirement for the Deep Learning segment is not generic, but a precise function of safety and functional requirements placed upon advanced driver assistance systems (ADAS) and autonomous platforms.

By Application: Predictive Fleet Maintenance

The application of AI in Predictive Fleet Maintenance (PFM) represents a tangible, high-ROI demand segment in Germany's logistics and commercial transport sector. This requirement is intrinsically tied to the financial imperative of maximizing asset utilization and mitigating the immense operational losses associated with unplanned vehicle downtime. PFM systems use Machine Learning algorithms to analyze historical maintenance logs, real-time telemetry data (engine temperature, vibration, sensor output), and contextual variables to forecast component failure with a high degree of precision. This capability creates direct, quantifiable demand because it enables a logistical shift from reactive or time-based preventative maintenance to truly proactive, condition-based maintenance. The direct economic benefit—reduced maintenance costs, prolonged asset life, and elimination of costly roadside failures—drives logistics operators, including rail and heavy-truck fleets, to procure AI platforms that offer integration with existing telematics and IoT infrastructure. The demand here is strictly business-to-business (B2B), centered on enhancing operational throughput across the extensive German road and rail network.

Germany AI in Transportation Market Competitive Environment and Analysis:

The German AI in Transportation competitive landscape is concentrated among global automotive OEMs and powerful Tier-1 technology suppliers, who are transitioning from component manufacturers to integrated software developers. Competition centers on the ownership of the AI software stack, specialized computing hardware, and proprietary data.

BMW Group

The BMW Group focuses on a scalable, proprietary software stack for highly automated driving and connected services. The company's strategy involves the vertical integration of AI, utilizing a global network of specialized development centers to secure core software competency. Their key product strategy centers on the implementation of advanced ADAS features and personalized user experience through machine learning, aiming for a unified, scalable AI platform across their vehicle portfolio. This includes continuous development of their iDrive system, which leverages AI for contextual decision-making and real-time navigation optimization, a core demand point for premium consumer vehicles.

Bosch

Bosch, a global leader in automotive technology, strategically positions itself as the provider of the fundamental AI building blocks for the industry, emphasizing its transition to a software-defined mobility supplier. A key product is their Vehicle Motion Management (VMM) software, which uses AI to integrate and control all vehicle actuators (braking, steering, powertrain). This enables advanced driver assistance and personalized driving experiences based on cross-domain data analysis. Furthermore, Bosch's introduction of the AI-supported cubiX Tuner tool demonstrates a direct strategic move to sell development-enabling software to OEMs, facilitating the complex calibration of chassis dynamics functions and thus directly participating in the AI development value chain.

Volkswagen Group

The Volkswagen Group's competitive strategy is characterized by a massive investment and internalization of AI competency to reduce dependency on external software providers. In September 2025, the group committed to investing up to €1 billion in AI by 2030 to create a proprietary, AI-powered engineering environment with partners like Dassault Systèmes. This initiative aims to accelerate the product development cycle to under 36 months, a direct response to software-centric competitors. Their primary product focus is leveraging AI across the entire value chain, from virtual testing in R&D to optimizing logistics and production processes via their Digital Production Platform (DPP).

Germany AI in Transportation Market Recent Developments:

- September 2025: ZF Friedrichshafen presented the AI-powered cubiX Tuner tool at IAA Mobility 2025. This specialized software is designed to simplify the complex calibration of chassis dynamics functions across multiple actuators (steering, braking, suspension). This product launch directly addresses the engineering complexity introduced by software-defined vehicle architectures, creating an immediate demand for manufacturers seeking to streamline their development processes for advanced vehicle motion control.

- September 2025: The Volkswagen Group officially announced a plan to invest up to €1 billion in Artificial Intelligence by 2030. This long-term financial commitment is specifically targeted at building a proprietary, AI-powered engineering environment in partnership with Dassault Systèmes. The objective is to shorten the product development cycle by approximately 12 months, indicating a strategic, internal push to dominate the digital vehicle development process and secure its long-term competitive positioning.

- September 2024: At IAA Transportation 2024, Continental showcased its latest ContiConnect digital solutions, which include in-tire sensor technology for real-time tire monitoring. These AI-powered connected solutions directly serve the Predictive Fleet Maintenance segment by providing fleet operators with actionable data to optimize tire usage, reduce vehicle downtime, and ensure safer operations, thereby enhancing operational efficiency for heavy commercial vehicles.

Germany AI in Transportation Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 3.595 billion |

| Total Market Size in 2031 | USD 7.302 billion |

| Growth Rate | 15.22% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Technology, Deployment, Application |

| Companies |

|

Germany AI in Transportation Market Segmentation:

- BY TECHNOLOGY

- Deep Learning

- Natural learning process

- Machine Learning

- Others

- BY DEPLOYMENT

- On-Premise

- Cloud

- BY APPLICATION

- Route optimization

- Shipping volume prediction

- Predictive Fleet Maintenance

- Real-time Vehicle tracking

- Others