Report Overview

India AI in Transportation Highlights

India AI in Transportation Market Size:

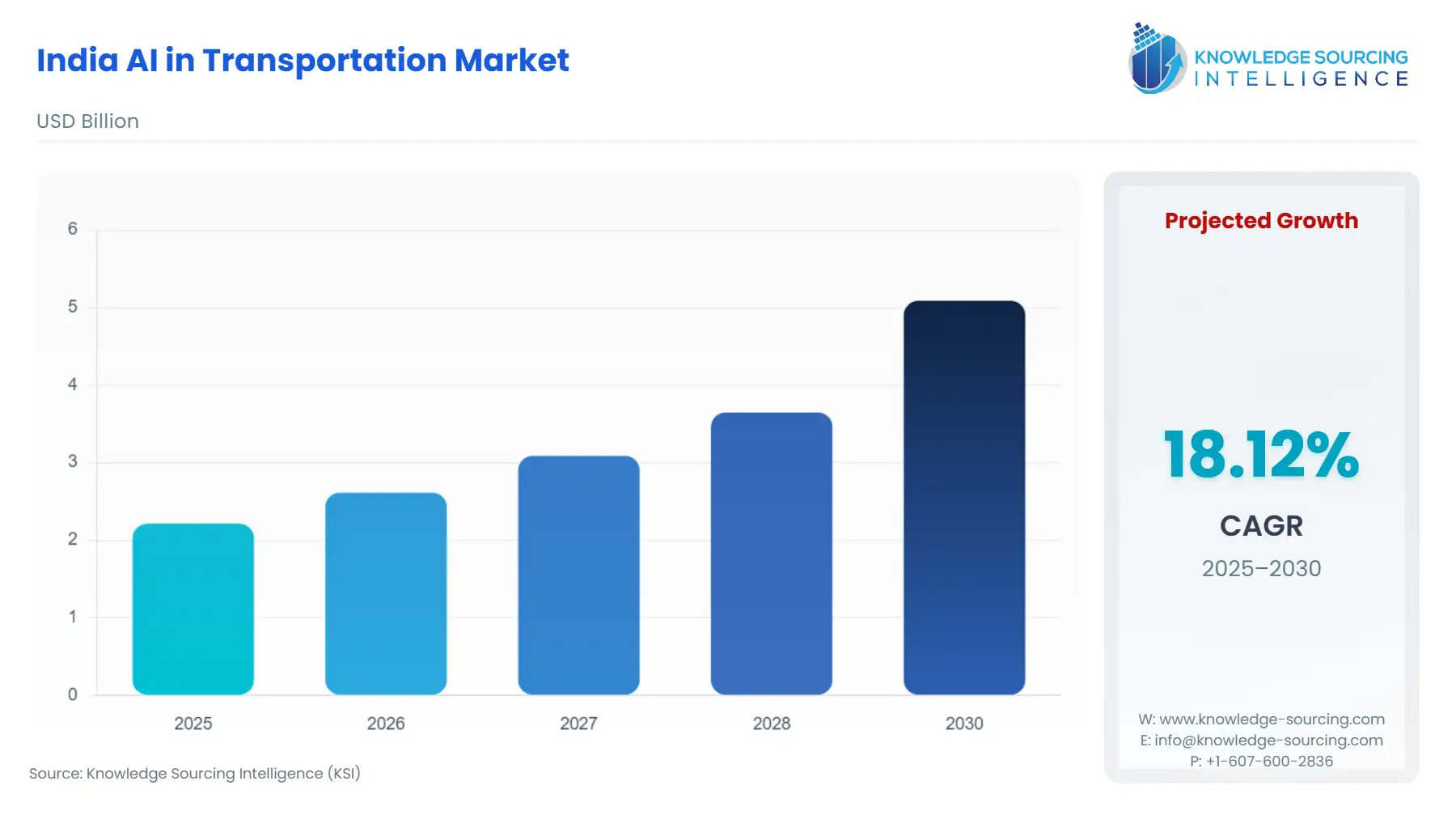

The India AI in Transportation Market is expected to grow at a CAGR of 18.13%, rising from USD 2.213 billion in 2025 to USD 5.089 billion by 2030.

The integration of Artificial Intelligence (AI) into India's transportation ecosystem marks a fundamental shift from traditional infrastructure management to data-driven, cognitive systems. This transformation is not merely technological but is being institutionalized by a multi-tiered policy framework aimed at modernizing urban mobility and national logistics.

The core value proposition of AI in this sector—enhancing safety, reducing congestion, and optimizing costs—is now moving from pilot projects to large-scale deployment, supported by both government procurement for public assets and sustained private sector investment in commercial fleet intelligence.

India AI in Transportation Market Analysis:

Growth Drivers

Urban congestion and the consequential demand for optimized traffic flow act as a primary catalyst for AI adoption. Metropolitan cities are increasingly implementing AI-based Adaptive Traffic Signal Control (ATSC) systems, which directly increase the demand for Deep Learning algorithms capable of real-time analysis of traffic density and pattern prediction. Furthermore, the nation's ambitious push for Electric Vehicles (EVs) creates an embedded demand for battery management systems and charging infrastructure optimization, both fundamentally reliant on AI/ML to manage dynamic energy loads and predict range limitations accurately. These dual drivers—efficiency in traffic and intelligence in vehicles—compel a shift in procurement toward advanced software stacks.

Challenges and Opportunities

A significant constraint is the fragmentation and non-standardization of transportation data across different state and local bodies, which complicates the training and deployment of nationwide AI models, thereby inhibiting scaled demand. This data silo issue creates a technical barrier for comprehensive solution providers. However, this challenge simultaneously presents an opportunity for middleware platforms and data aggregation services that can ingest, normalize, and harmonize disparate data streams from various sources (e.g., public transit, toll plazas, vehicular telematics). Successful aggregation platforms will unlock new demand for cross-modal optimization and predictive analytics tools that currently operate in isolated environments.

Supply Chain Analysis

The Indian AI in Transportation market, being primarily a software and services-based sector, relies critically on the global semiconductor and advanced computing supply chain for hardware components such as LiDAR, radar, high-resolution cameras, and on-board compute units (ECUs/TCUs). Key production hubs for these complex electronics are predominantly located in East Asia and the US. This dependence exposes the Indian market to geopolitical and logistical complexities that can inflate the cost and extend the lead time for deployment of physical, edge-AI solutions like Advanced Driver-Assistance Systems (ADAS). Conversely, the software development aspect is largely centered within India's robust domestic IT and Engineering Research & Development (ER&D) sector, creating a localized, highly competitive supply of AI expertise and custom model development.

Government Regulations

| Jurisdiction | Key Regulation / Agency | Market Impact Analysis |

|---|---|---|

| India (Central) | Motor Vehicles (Amendment) Act, 2019 / MoRTH | Authorizes the use of AI-generated digital evidence, significantly bolstering the legal framework for AI-based surveillance, monitoring, and automated enforcement systems, directly increasing demand for validated computer vision applications. |

| India (Central) | Advanced Traffic Management Systems (ATMS) Standards / MoRTH | Formally requires AI-based real-time traffic monitoring systems for national highways, creating mandatory, large-scale procurement demand from NHAI and state governments for AI-enabled infrastructure sensors and analytical software. |

| India (Central) | Smart Cities Mission / Ministry of Housing and Urban Affairs | Drives localized, city-level tender demand for AI-enabled surveillance, predictive maintenance, and integrated transport analytics platforms, specifically catering to public transport and urban traffic management use cases. |

India AI in Transportation Market Segment Analysis:

By Technology: Deep Learning

The Deep Learning (DL) segment is experiencing rapid growth, fueled by the rising necessity for high-fidelity perception and prediction capabilities in transport systems. Unlike traditional Machine Learning, DL's multi-layered neural networks excel at processing complex, unstructured data, such as real-time video feeds from road cameras and sensor fusion data from Advanced Driver-Assistance Systems (ADAS). This technological superiority directly propels demand in two critical areas: sophisticated object detection and classification for accident prevention in vehicles, and Adaptive Traffic Signal Control (ATSC) for urban infrastructure. For OEMs like Tata Motors, DL is the core enabler for advanced ADAS features like Lane Departure Warning and Driver Monitoring Systems. Furthermore, for the NHAI, DL-based systems facilitate automated road defect detection and pavement condition analysis through Network Survey Vehicles, a task previously reliant on less efficient manual inspection. The ability of DL to self-learn from vast, noisy Indian road data sets makes it the indispensable technology for enhancing safety and operational reliability, securing its position as a high-growth segment.

By Application: Predictive Fleet Maintenance

The Predictive Fleet Maintenance (PFM) solutions segment is driven by the commercial transportation sector's intense focus on total cost of ownership (TCO) and asset uptime. In a highly competitive logistics environment, unscheduled vehicle breakdown translates directly into massive financial loss. PFM utilizes ML algorithms to analyze real-time telematics data, sensor readings, and historical performance logs to forecast component failure (e.g., engine, transmission, battery health) with high precision. This capability creates direct, measurable demand for Cloud-based AI platforms among large fleet operators and State Transport Undertakings (STUs). The actionable insights provided by PFM—such as recommending optimal service schedules before failure occurs—allow companies to transition from reactive or calendar-based maintenance to a data-driven, condition-based strategy. This optimization directly reduces inventory costs for spare parts, eliminates catastrophic failures, and significantly improves vehicle utilization, compelling operators to invest in embedded and cloud-hosted AI analytics.

India AI in Transportation Market Competitive Environment and Analysis:

The Indian AI in Transportation market features a blend of domestic automotive giants, global technology providers, and specialized Indian Engineering Research & Development (ER&D) firms. The competitive landscape is characterized by deep vertical integration from OEMs and specialized software development expertise from technology services firms.

Tata Motors

Tata Motors, as a major domestic OEM, occupies a strategic position by embedding AI directly into its commercial and passenger vehicle lines. Its strategy focuses on integrating AI for enhanced vehicle safety and performance. For instance, the company is deploying machine learning for rapid, precise responses within its integrated safety systems, leveraging a combination of radars and cameras for object detection and classification tailored to unique Indian road scenarios. Their product strategy centers on making ADAS and connected vehicle features, such as E-Call and B-Call, accessible across multiple vehicle segments, ensuring the company captures the demand for factory-fitted intelligence.

L&T Technology Services (LTTS)

LTTS specializes in Engineering and R&D (ER&D) services, positioning itself as a core technology enabler for global and domestic OEMs and Tier 1 suppliers. The company focuses on the development and integration of AI-powered digital twins, predictive analytics, and next-gen software-defined vehicle architectures. LTTS has established a Digital Twin Center of Excellence, which targets customers in the mobility and hi-tech segments, directly addressing the demand for sophisticated simulation and validation of AI systems before physical deployment. Their offerings include AI/ML-powered log analysis and a suite of test automation platforms for accelerating the quality assurance lifecycle of automotive software.

KPIT Technologies

KPIT Technologies focuses exclusively on the automotive and mobility sector, providing core software integration and development for the Software-Defined Vehicle (SDV) future. The company is actively engaged in developing AI solutions for autonomous driving and ADAS. KPIT's strategic positioning is predicated on providing outsourced engineering intelligence to global OEMs and Tier 1s. Their technology development leverages AI for complex tasks such as validation and verification of automotive software, which is critical for the safety certification of AI-driven systems. KPIT’s value proposition is its ability to accelerate the realization of the SDV by providing the foundational software stack.

India AI in Transportation Market Recent Developments:

- October 2025: The National Highways Authority of India (NHAI) announced the deployment of Network Survey Vehicles (NSV) across a network exceeding 20,000 km of National Highways. The NSV system utilizes a 3D laser-based platform and high-resolution cameras to capture and automatically report road defects and pavement conditions without human intervention. The data collected will be uploaded to NHAI's 'AI' based portal, Data Lake, for specialized analysis. This initiative is a capacity addition that creates mandatory demand for AI-driven data processing and analytical services from private partners to transform raw road data into actionable maintenance insights.

- October 2025: Tata Motors Commercial Vehicles commenced deliveries of the advanced Tata Prima E.55S battery electric prime-mover to Enviiiro Wheels Mobility. These heavy-duty trucks feature a 3-speed Auto Shift transmission with an e-axle and are equipped with advanced features such as a Driver Monitoring System (DMS), Lane Departure Warning, and Tyre Pressure Monitoring System (TPMS). The DMS is a capacity addition that integrates AI/ML to enhance safety, demonstrating the OEM's strategic shift to embed intelligence directly into commercial fleet vehicles to meet demand for cleaner, safer, and more efficient logistics operations.

India AI in Transportation Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 2.213 billion |

| Total Market Size in 2031 | USD 5.089 billion |

| Growth Rate | 18.13% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Technology, Deployment, Application |

| Companies |

|

India AI in Transportation Market Segmentation:

- BY TECHNOLOGY

- Deep Learning

- Natural learning process

- Machine Learning

- Others

- BY DEPLOYMENT

- On-Premise

- Cloud

- BY APPLICATION

- Route optimization

- Shipping volume prediction

- Predictive Fleet Maintenance

- Real-time Vehicle tracking

- Others