Report Overview

France Application-Specific Integrated Circuits Highlights

France Application-Specific Integrated Circuits (ASIC) Market Size:

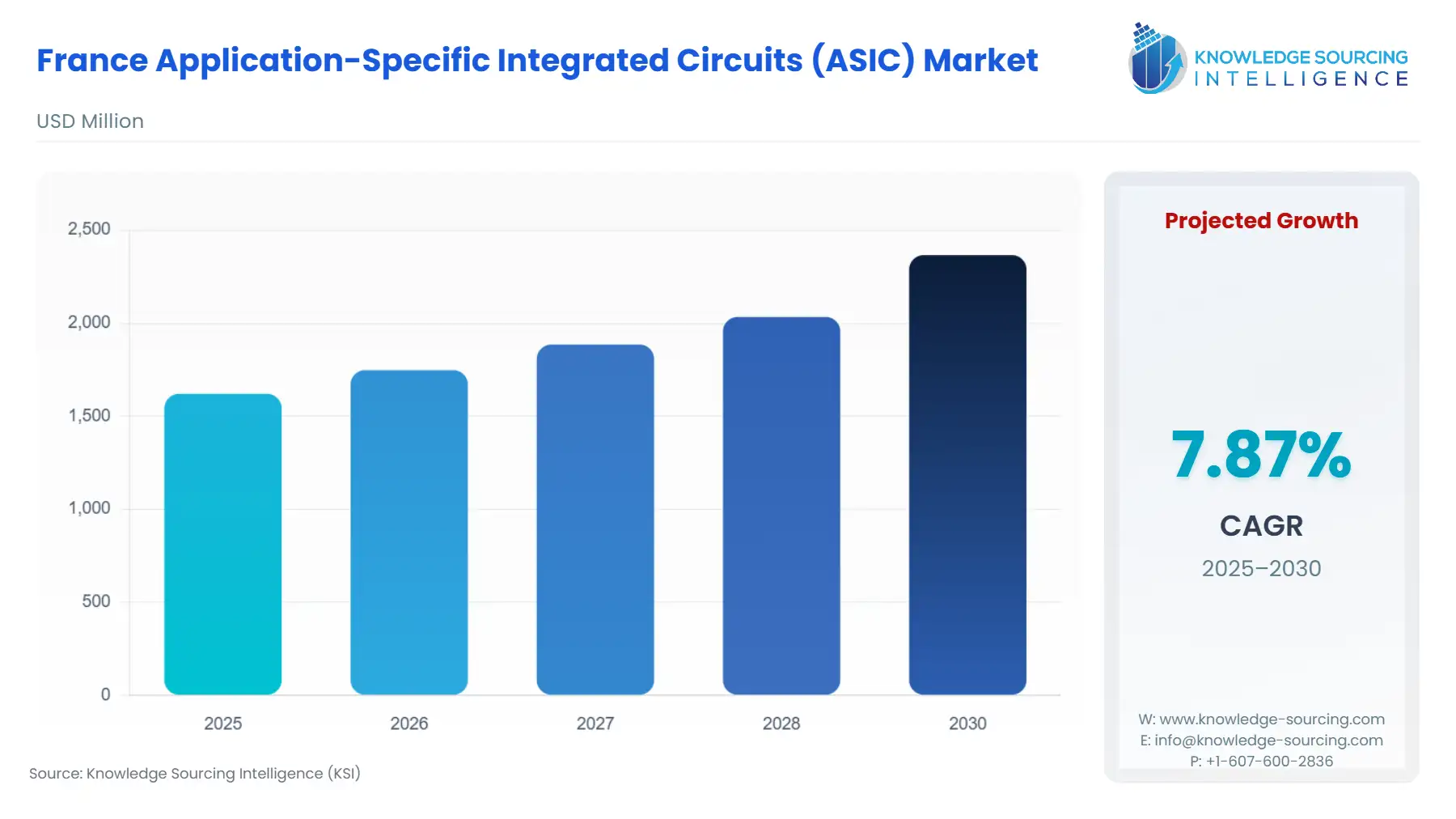

The France Application-Specific Integrated Circuits (ASIC) Market is forecast to grow at a CAGR of 7.87%, reaching USD 2.366 billion in 2030 from USD 1.62 billion in 2025.

The French Application-Specific Integrated Circuits (ASIC) market is undergoing a period of significant strategic re-orientation, shifting from a primarily research and design-focused hub to an area with rapidly expanding manufacturing ambitions. This transformation is anchored by decisive governmental intervention at both the national and European levels, aimed at mitigating geopolitical supply chain vulnerabilities and seizing technological leadership in key domains like electric vehicles, artificial intelligence, and advanced connectivity. The market operates at the confluence of deep industrial expertise and a targeted policy mandate, positioning ASICs—custom-designed, high-efficiency silicon—as critical enablers for next-generation domestic technological platforms, a trend driving demand away from general-purpose integrated circuits toward highly optimized solutions.

France Application-Specific Integrated Circuits (ASIC) Market Analysis:

- Growth Drivers

The electrification imperative within the French automotive industry serves as a powerful, non-cyclical growth driver. The push toward zero-tailpipe emission vehicles by 2035 necessitates the integration of high-performance, resilient power ASICs, specifically SiC and GaN devices, for traction inverters and on-board chargers, directly increasing the semiconductor content per vehicle. Furthermore, the substantial capital allocation under the European Chips Act and the France 2030 plan, which incentivizes advanced manufacturing, acts as a pivotal catalyst. This funding directly lowers the capital expenditure barrier for establishing or expanding fabrication facilities (Fabs) and pilot lines for sophisticated ASICs, ensuring a domestic supply for critical sectors and stimulating local ASIC design activity.

- Challenges and Opportunities

A significant market challenge is the severe global shortage of specialized talent, especially in advanced node ASIC design and fabrication process engineering, which constrains the speed of capacity ramp-up despite financial incentives. Simultaneously, the rising sophistication of advanced nodes, such as 5 nm and 3 nm, dramatically increases the Non-Recurring Engineering (NRE) costs associated with full-custom ASIC development, posing an adoption barrier for smaller enterprises.

A key opportunity lies in the expanding FD-SOI (Fully Depleted Silicon-on-Insulator) ecosystem, where Soitec holds a global leadership position. FD-SOI substrates are optimized for low-power, high-frequency ASICs—ideal for 5G, IoT, and edge-AI applications—offering a unique, lower-cost, and more energy-efficient alternative to bulk CMOS for specialized ASIC designs, thus directly creating new demand.

- Raw Material and Pricing Analysis:

The ASIC market, being a physical product, is fundamentally dependent on the supply of ultra-high-purity silicon wafers, particularly the engineered substrates produced by French companies like Soitec (FD-SOI). Pricing dynamics are heavily influenced by the global supply-demand balance of these specialized substrates. During periods of high demand, tight supply of the underlying silicon, as well as exotic materials (e.g., Gallium Nitride (GaN) and Silicon Carbide (SiC) required for power ASICs, causes price volatility and lead-time extensions. This directly impacts the final ASIC cost for end-users, potentially slowing product development cycles in high-volume sectors like automotive and industrial IoT.

- Supply Chain Analysis:

The global ASIC supply chain is characterized by extreme specialization and geographical concentration, creating inherent logistical complexities and dependencies. Key production hubs for the most advanced nodes (7 nm and below) remain predominantly in Asia-Pacific, particularly Taiwan and South Korea, which are essential for the manufacturing phase of French-designed ASICs. France's role is concentrated at the highly valuable front-end of the chain: materials (Soitec’s engineered substrates), advanced design (CEA-LETI), and manufacturing of mid-range and legacy nodes (STMicroelectronics). The logistical complexity involves secure, highly specialized transportation of photomasks and finished wafers across continents. This dependency on Asia-Pacific for fabrication introduces significant vulnerability to geopolitical and logistical disruptions, which the European Chips Act explicitly aims to mitigate through localized capacity addition in Crolles.

France Application-Specific Integrated Circuits (ASIC) Market Government Regulations:

| Jurisdiction | Key Regulation / Agency | Market Impact Analysis |

|---|---|---|

| France (Federal) | France’s National Digital Strategy (France Num) | Encourages digital transformation, boosting demand for ASICs in sectors like AI, IoT, and telecommunications, and promoting innovation in custom chip solutions. |

| France (Environmental) | Waste Electrical and Electronic Equipment (WEEE) Directive | Requires proper recycling and disposal of electronic waste, pushing ASIC manufacturers toward eco-friendly designs and sustainable production practices. |

| France (Telecommunications) | ARCEP – Authority for Regulation of Electronic Communications and Post | Regulates telecom infrastructure, spurring demand for ASICs optimized for 5G networks, requiring high-performance chips for advanced telecommunications systems. |

| France (Energy Efficiency) | Energy Transition Law (Loi de Transition Énergétique) | Promotes energy-efficient technologies, leading to higher demand for power-efficient ASICs, particularly in applications like automotive, IoT, and smart cities. |

| France (Customs & Trade) | Customs and Duty Laws | Imposes tariffs on foreign ASIC imports, creating a market opportunity for local semiconductor production and incentivizing domestic manufacturing for cost competitiveness. |

France Application-Specific Integrated Circuits (ASIC) Market Segment Analysis:

- By Application – Automotive: The automotive segment is the most critical vertical for the French ASIC market, distinguished by a direct governmental mandate for electrification. The need for ASICs is surging due to the architectural shift from distributed Electronic Control Units (ECUs) to zonal architectures and the rapid proliferation of ADAS features. Full-Custom ASICs are indispensable here, specifically for power management ICs (PMICs), high-speed networking (e.g., for LIDAR and sensor fusion), and high-reliability microcontrollers. The rigorous safety standards (ISO 26262) and the long design-in cycles of the industry necessitate highly specialized, fault-tolerant chips. This environment favors Integrated Device Manufacturers (IDMs) with local design and long-term supply commitment, driving direct, multi-year demand pipelines for custom-developed, high-performance silicon.

- By Process Technology – 5 nm: The 5 nm process node represents the current leading edge for high-performance, high-density ASICs designed for the most compute-intensive French applications: Data Centers, Cloud Computing, and AI/Machine Learning. Demand is exclusively driven by hyperscale cloud providers and AI research institutions requiring maximum performance per watt. ASIC at this node offers a power-efficiency advantage over general-purpose processors, making it the technology of choice for specialized AI accelerators (AI ASICs) and custom network processors. The investment in domestic pilot lines, supported by the European Chips Act, intends to establish capability in 5 nm and below, thereby cultivating a local design community that directly drives demand for domestic prototyping and testing services for these sophisticated, high-value chips.

France Application-Specific Integrated Circuits (ASIC) Market Competitive Environment and Analysis:

The French ASIC market is characterized by a dual competitive structure: a robust domestic ecosystem for materials and power/mixed-signal ASICs, and intense global competition in advanced digital ASICs. Key players include large Integrated Device Manufacturers (IDMs) with a deep historical footprint in Grenoble and global fabless leaders. The domestic competitive dynamic is heavily influenced by strategic partnerships and government incentives that favor local R&D and manufacturing capacity.

- STMicroelectronics: STMicroelectronics, a French-Italian multinational, holds a dominant position in the French ASIC landscape, particularly in the automotive and industrial segments. The company operates significant manufacturing and R&D facilities, notably the Crolles 12-inch wafer fab in France, which focuses on digital technologies. Their strategic positioning centers on being an IDM with vertical integration, specializing in smart power, automotive, and microcontrollers. Key product offerings that drive ASIC demand include high-performance MCUs for ADAS and powertrain applications, alongside advanced power semiconductors (SiC and GaN). Their joint venture for a new large-scale semiconductor manufacturing facility in Crolles underscores their commitment to localized European capacity for advanced nodes.

- Soitec: Soitec, headquartered in France, is a world leader in developing and manufacturing innovative semiconductor materials, specifically engineered substrates like Fully Depleted Silicon-on-Insulator (FD-SOI). Soitec is not an ASIC manufacturer but is critically positioned as a key enabler and a single point of failure for FD-SOI-based ASIC designs. Its strategic positioning leverages the inherent advantages of FD-SOI—low power consumption and excellent integration capabilities—to cater to the massive, growing demand for energy-efficient ASICs in mobile, IoT, and edge-AI applications. Their collaboration with research bodies like CEA-Leti ensures their substrates are foundational to next-generation European ASIC design roadmaps.

France Application-Specific Integrated Circuits (ASIC) Market Developments:

- September 2025: STMicroelectronics announced a new investment exceeding $60 million for the development of a next-generation Panel-Level Packaging (PLP) technology pilot line in its Tours, France, facility. This capacity addition is part of a strategic initiative focused on heterogeneous integration, contributing to the packaging and testing of RF, analog, power, and digital products. The investment is intended to boost manufacturing efficiency and flexibility for advanced chip packaging techniques critical for high-performance ASICs.

- April 2025: STMicroelectronics disclosed plans to further expand the manufacturing scale of its 12-inch wafer fab in Crolles, France, aiming to increase weekly production capacity to 14,000 pieces by 2027, with a modular expansion plan up to 20,000 pieces per week, depending on market conditions. This substantial capacity addition reinforces the Crolles site's core mission in ST's digital product ecosystem, directly addressing the need for higher-volume domestic ASIC fabrication capability.

France Application-Specific Integrated Circuits (ASIC) Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 1.62 billion |

| Total Market Size in 2031 | USD 2.366 billion |

| Growth Rate | 7.87% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Process Technology, Product Type, Application |

| Companies |

|

France Application-Specific Integrated Circuits (ASIC) Market Segmentation:

- BY PROCESS TECHNOLOGY

- Advanced Nodes

- 3 nm and below

- Leading-Edge Nodes

- 5 nm

- 7 nm

- Mid-Range Nodes

- 10 nm

- 12 nm

- 14 nm

- 16 nm

- Mature Nodes

- 22 nm and above

- Advanced Nodes

- BY PRODUCT TYPE

- Full-Custom ASIC

- Semi-Custom ASIC

- Standard Cell-Based ASIC

- Gate-Array Based ASIC

- Programmable ASIC

- Others

- BY APPLICATION

- Consumer Electronics

- Automotive

- Networking & Telecommunications

- Data Centers & Cloud Computing

- Healthcare

- Industrial & IoT

- Defense & Aerospace

- Others