Report Overview

Frozen Edamame Market - Highlights

Frozen Edamame Market Size:

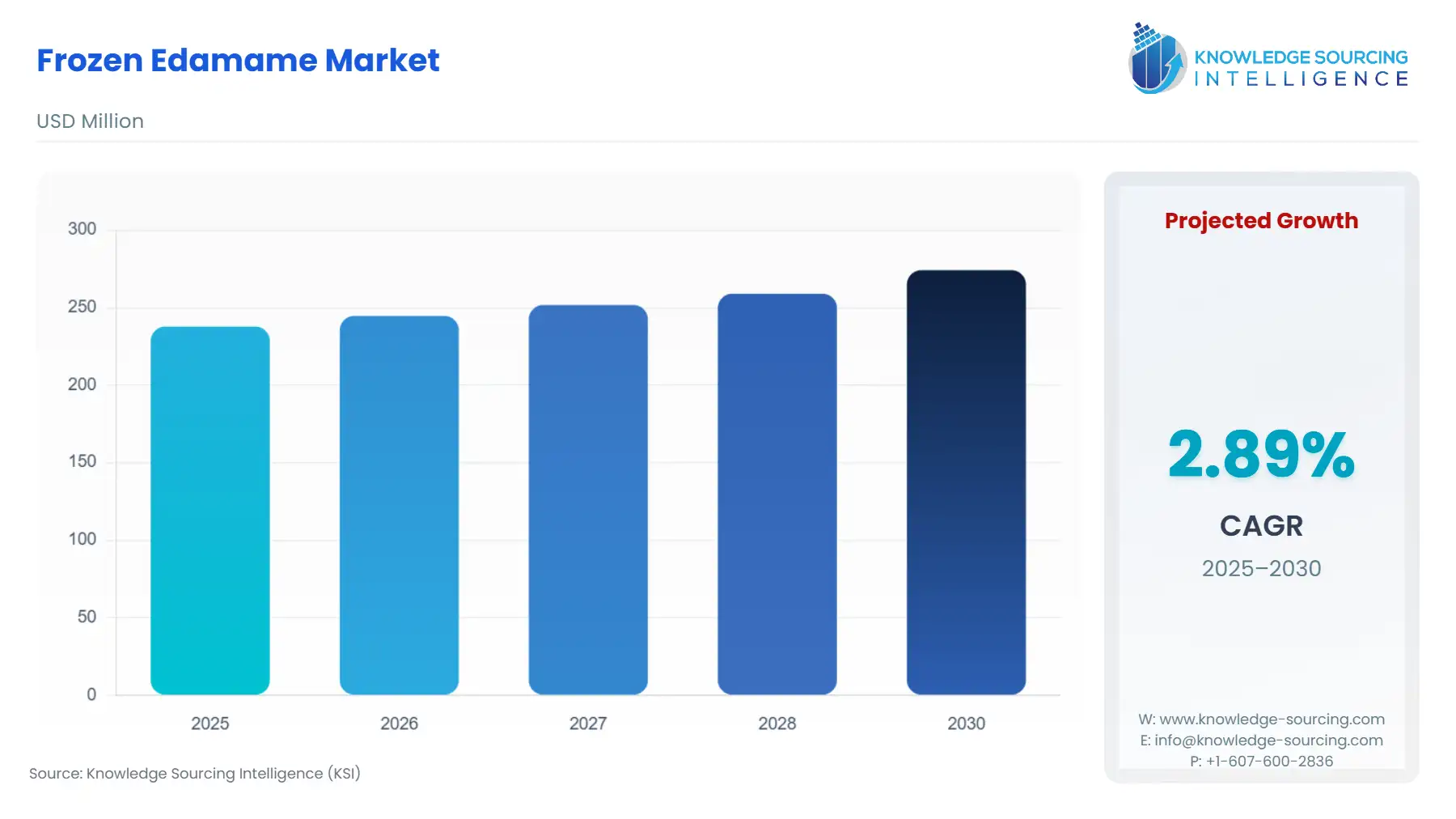

The Frozen Edamame Market, valued at US$274.204 million in 2030 from US$237.799 million in 2025, is projected to grow at a CAGR of 2.89% through 2030.

Edamame is a special type of soybean harvested when the seeds expand to 80 to 90 percent of the pod width. It is rich in protein and high nutrients and is popular in East Asia. The edamame can be eaten within three days. The fresh pods packaged can be kept under refrigeration. The global trade has provided the platform for the international edamame trade. Edamame is becoming more popular worldwide, particularly in Europe and North America, because of its unique taste and multiple health benefits.

Frozen Edamame Market Overview & Scope:

The Frozen Edamame Market is segmented by:

- Product Type: The different varieties of edamame products have been fuelling the overall growth of edamame utilization in different applications. The frozen edamame market is segmented into whole edamame, shelled edamame, edamame snaps, edamame paste, and edamame flour.

- Application: The food service segment is growing due to increasing food outlets and restaurants. The rising demand for specialized food and processed foods follows this.

- Distribution Channel: The online segment is expected to hold a significant share and grow notably. This growth is expected to increase internet users and increase online shopping trends.

- Region: By geography, the frozen edamame market is segmented into North America, South America, Europe, the Middle East and Africa, and Asia Pacific.

Top Trends Shaping the Frozen Edamame Market:

1. Growing demand for organic edamame

- The organic edamame is higher than the other market prices. Organic cultivation produces lower crop yields and thus has a higher cost of sale. The cultivation and processing are small, considering the economies of scale. Although the demand for organic edamame has been increasing at a significant pace.

2. Sustainability in sourcing and distribution

- There is an urgent need for sustainability to reduce CO? emissions. In many parts of the world, the cultivation of edamame beans is associated with deforestation and high pesticide use. CO? emissions can be reduced by shorter transport distances and using better refrigerators.

Frozen Edamame Market: Growth Drivers vs. Challenges:

Drivers:

- Rising health awareness: Edamame is a nutritious legume. It is gaining popularity and is typically eaten as a snack owing to its low-calorie content. It is rich in vitamins and minerals and offers health benefits such as lowering cholesterol and regulating blood sugar. It can be eaten by adding to soups, stews, salads, and noodle dishes. The growing popularity of edamame for its health benefits and taste is surging the market expansion.

- Growing popularity of plant-based diets: There has been a growing trend of veganism worldwide. According to a United States Department of Agriculture report in 2023, 1.58 million Germans identified as vegan. Edamame is a major source of protein in many countries worldwide. It can be served in many recipes and used in infant formulas, milk alternatives, soy sauce, etc.

Challenges:

- Price volatility: The price volatility due to the supply-chain constraint is a serious challenge in the industry.

Frozen Edamame Market Regional Analysis:

- Asia-Pacific: The major economies like China, Japan, India, and South Korea dominate the Asia-Pacific region. Some of the fastest-growing emerging economies are from this region, such as ASEAN countries. The edamame originated from Southeast Asia, and for centuries, it has been popular among people who make soy sauce, miso, and tofu. Additionally, as Japanese cuisine continues to grow in popularity globally, so does edamame.

- Europe: The European frozen edamame market is very promising. This is due to the growing consumer awareness of stress-related health issues. Germany, France, the UK, and Spain are a few of the largest markets. The consumers are keen on high-protein food. Vienna-based EDAMAX is an Austrian startup that is growing and marketing European edamame. By growing edamame in southeastern Romania, EDAMAX will ensure a shorter distance to the market and lower the environmental impact. They also ensure the adherence to European quality standards.

Frozen Edamame Market: Competitive Landscape:

The market is fragmented, with many notable players, including Brecon Foods, Xiamen Sinocharm, Xiamen Sharp Dragon, SINOFROST, Bariball Agriculture, Yuyao Gumancang Food, ANJ Group, Young Sun, Cixi Yongjin Frozen Food, Shaoxing Lurong Food, Chiangmai Frozen Foods Public Company, Jooever, and LACO, among others:

A few strategic developments related to the market:

- Expansion: In September 2024, Dutch edamame beans will be available in Jumbo supermarkets starting in 2025. This was the collaboration between the supermarket chain and Dutch farmers. Plant Protein Forward, an initiative of Foodvalley NL, Rabobank, and Interprovincial Eiwitoverleg, supports the partnership. The Dutch edamame is more sustainable than its Asian alternative.

Frozen Edamame Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Frozen Edamame Market Size in 2025 | US$237.799 million |

| Frozen Edamame Market Size in 2030 | US$274.204 million |

| Growth Rate | CAGR of 2.89% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Million |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in Frozen Edamame Market |

|

| Customization Scope | Free report customization with purchase |

Frozen Edamame Market Segmentation:

By Product Type

- Whole Edamame

- Shelled Edamame

- Edamame Snaps

- Edamame Paste

- Edamame Flour

By Application

- Food Processing

- Food Service Industry

- Retail

By Distribution Channel

- Online

- Offline

By Region

- North America

- Europe

- Asia Pacific

- South America

- Middle East & Africa