Report Overview

Frozen Fruit Market Size, Highlights

Frozen Fruit Market Size:

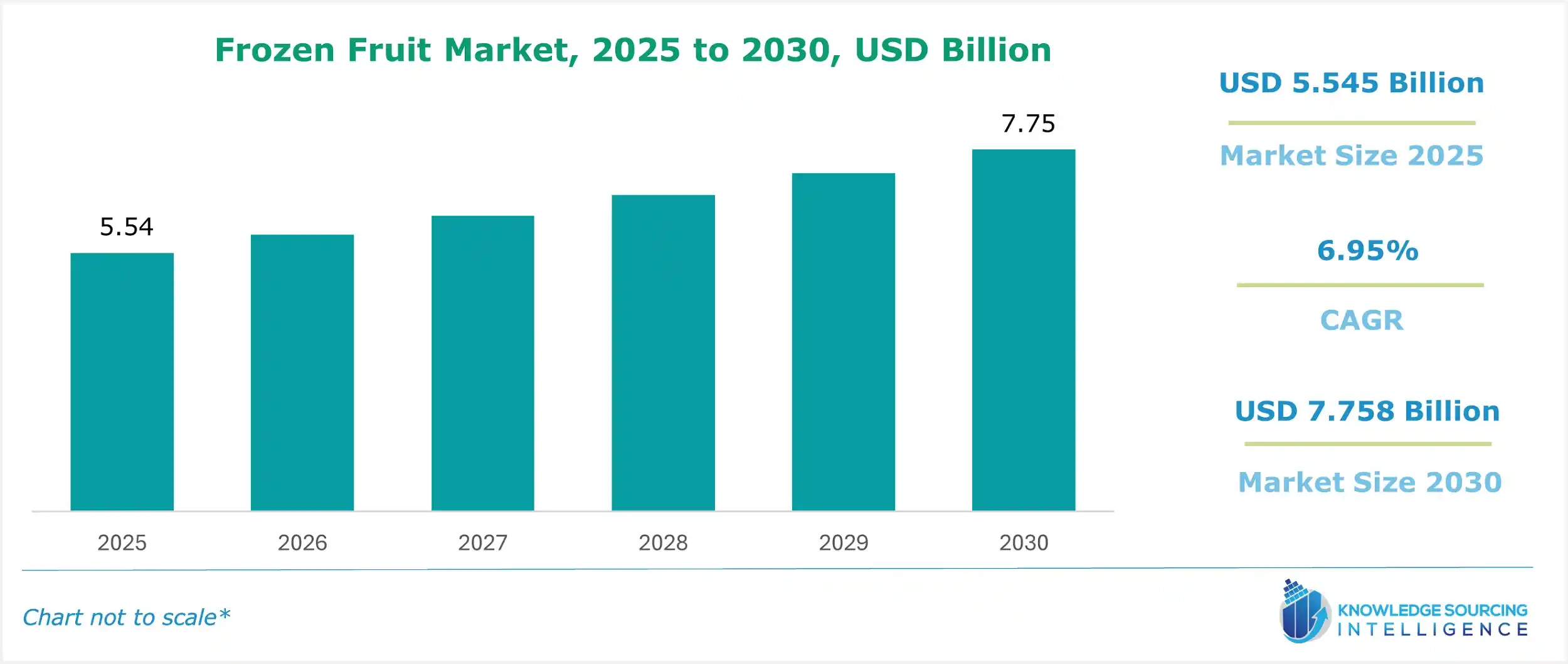

The Frozen Fruit Market is projected to grow at a CAGR of 6.95% over the forecast period, increasing from USD 5.545 billion in 2025 to USD 7.758 billion by 2030.

Frozen Fruit Market Highlights:

- Increasing health-conscious diets are driving demand for nutrient-rich frozen fruit products.

- Expanding bakery applications are boosting frozen fruit use in confectionery items.

- Asia-Pacific is leading the frozen fruit market with rising disposable incomes.

- Innovating sustainable packaging is enhancing appeal and shelf life of frozen fruits.

This global market’s growth is mainly attributed to the rising popularity of non-seasonal fruits due to their freshness and exceptional nutritional benefits. Moreover, the increasing usage of frozen fruits in bakery products cakes, rolls, jams, muffins, tarts, and jellies, is driving the overall market growth during the forecast period. Manufacturers worldwide are making efforts to produce innovative products and increase the quality and shelf life of their bakery products by using frozen fruits.

Frozen Fruit Market Overview & Scope:

The Frozen Fruit Market is segmented by:

- Product: The Frozen Fruit Market is segmented into berries, citrus fruits, tropical fruits, and others.

- Form: The Frozen Fruit Market is segmented into whole, cubed, sliced, and others.

- Source: The Frozen Fruit Market is segmented into organic and inorganic.

- Distribution Channel: The Frozen Fruit Market is segmented into online and offline.

- Application: The Frozen Fruit Market is segmented into confectionery and bakery, dairy products, fruit-based beverages, and Jams & preserves.

- Region: The Frozen Fruit Market is segmented into North America, Europe, Asia Pacific, South America, and the Middle East & Africa.

Top Trends Shaping the Frozen Fruit Market:

1. Demand from emerging markets

- There is significant growth in emerging markets due to various reasons, such as rising urbanization and changing lifestyles.

- Emerging markets, particularly Asia-Pacific, South America, and the Middle East, are experiencing rising demand for frozen fruits due to rising urbanization and changing consumer preferences towards ready-to-eat frozen foods.

- ingredient in hypoallergenic formulas.

2. Growing demand for non-regional fruits:

- The increasing demand for non-regional fruits is contributing to the overall market growth. The rising penetration of the internet has made people familiar with the cultural foods and lifestyles of different regions and countries.

- For instance, in April 2024, Torani announced the newest addition to its Torani Dragon Fruit Syrup. It will be served to cafe partners and coffee shops. Torani food scientists and the team at Café Cà Phê (Vietnamese coffee shop) collaborated on the development process. They tested several dragon fruit varieties and products for the syrup.

3. The berry market will be growing significantly

- Berries are rich in antioxidants, vitamins, and fibre, and are considered superfoods in diets. To have these nutrients in a healthy diet, frozen berries solve the problem of availability year-round and thus will grow significantly during the forecast period.

- To illustrate the growing demand for berries, according to the World Integrated Trade Solution (WITS) data, the frozen strawberries imported from the world in diverse countries were reported, in the United States at 161,145,000 kg and in the European Union at 1,99,101,000 kg. Meanwhile, Germany was valued at 81,982,700 kg, and 62,961,000 kg was recorded in France. Further, Canada and Japan recorded imports from the world at 37,193,200 kg and 28,265,300 kg, respectively, in 2023

Frozen Fruit Market Growth Drivers vs. Challenges:

Opportunities:

- Growing popularity of frozen fruit products: One of the prime reasons supporting the market growth is the rising inclination towards healthy lifestyle choices and the increasing popularity of frozen fruit products. Consumers worldwide are improving their lifestyle choices and switching toward healthy dietary habits, augmenting the demand for frozen fruits during the forecast period. Moreover, the rising popularity of frozen fruit products is driven by the fast-paced modern lifestyle, which has forced consumers to look for easy and hygienic fruit products that eliminate the conventional hassles and time constraints of traditional cooking. For example, the imports of apple juice (unfermented) in the United States were US$699.398 million in 2023, which expanded from US$568.580 million in 2021; in Germany, the imports were US$272.273 million, which was US$252.884 million in 2021.

Challenges:

- High storage and transportation costs: There is a need for significant investment in refrigeration, transport, and storage for frozen fruits. This cost is particularly high in developing countries, leading to a major restraining factor for the frozen fruit market.

Frozen Fruit Market Regional Analysis:

- North America: North America is projected to hold a significant market share in the Frozen Fruit Market. The consumption scale of food & beverage items in the United States is on a positive track, and with the constant growth in the younger generation, the demand is further set to pick up pace. Non-seasonal fruits are mainly used in confectionery, preserves & juices applications, and with the positive expansion in purchasing power, followed by a transition towards healthier sources, demand for frozen fruit will witness growth in the United States. According to the cold storage data provided by the United States Department of Agriculture, in November 2024, the frozen fruits stock stood at 1,359,020 thousand pounds, signifying a 35.8% growth over the stock volume recorded in March 2024. Moreover, the same source also specified that the volume of frozen fruit juice concentrate stock was recorded at 549,024 thousand pounds in November 2024.

- Asia-Pacific: The increase in disposable income in the region of Asia Pacific, growing health awareness, expansion of retail channels, longer shelf life, consumer demand for convenience, and innovation in product offerings are expected to propel the frozen fruit market growth.

Frozen Fruit Market Competitive Landscape:

The Frozen Fruit Market is fragmented due to the presence of various players operating in different regions, with some notable key players such as Dawtona Frozen, Greenyard, and Euroberry Pty Ltd. Key market players are introducing innovative products that will enhance the frozen fruit market. Some recent key developments are:

- Product Launch: In January 2025, Unilever Ice Cream launched a line of new flavours and products within 2025 under this ice cream portfolio. The new S'mores Campfire, Carb Smart Strawberry Bars, and Strawberry Shortcake Tub were launched by the Breyers brand, while the Popsicle brand introduced dairy products like the Buzz Lightyear Rocket Pop with ingredients including berry, lime, and lemon flavors.

Frozen Fruit Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Frozen Fruit Market Size in 2025 | USD 5.545 billion |

| Frozen Fruit Market Size in 2030 | USD 7.758 billion |

| Growth Rate | CAGR of 6.95% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in Frozen Fruit Market | |

| Customization Scope | Free report customization with purchase |

The Frozen Fruit Market is analyzed into the following segments:

By Product

- Berries

- Citrus Fruits

- Tropical Fruits

- Others

By Form

By Source

- Organic

- Inorganic

By Distribution Channel

- Online

- Offline

By Application

- Confectionery And Bakery

- Dairy Products

- Fruit Based Beverages

- Jams & Preserves

By Region

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- UK

- France

- Spain

- Others

- Middle East and Africa

- UAE

- Israel

- Others

- Asia-Pacific