Report Overview

Functional Beverages Market - Highlights

Functional Beverages Market Size:

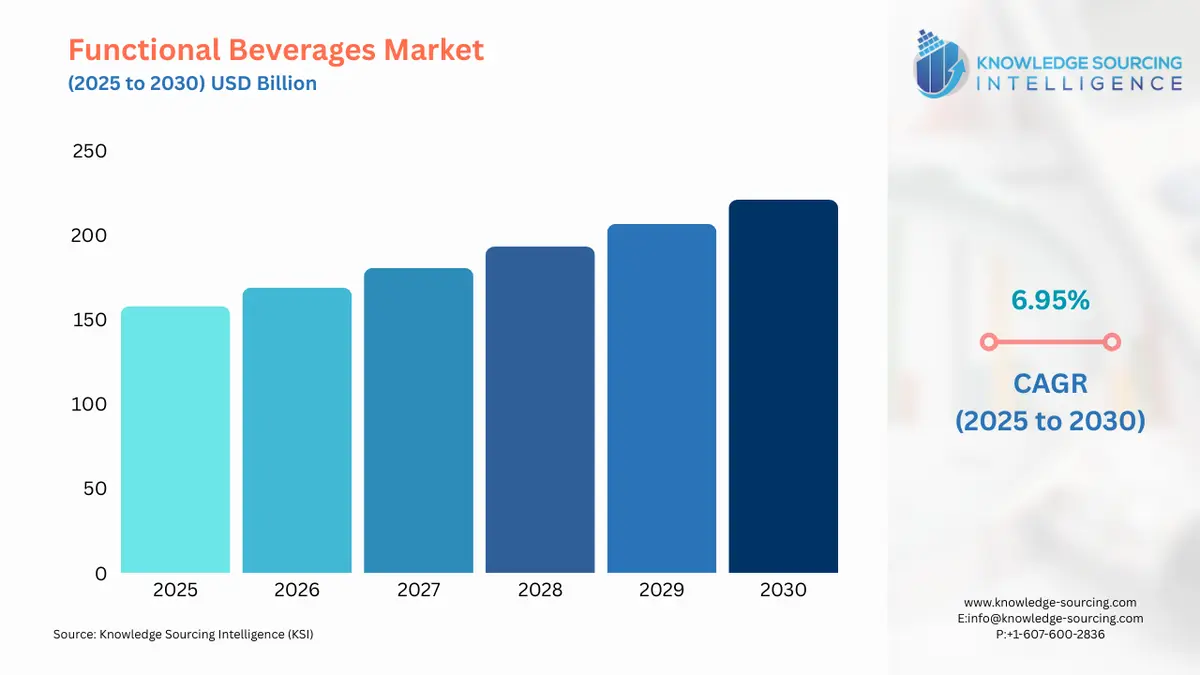

The Functional Beverages Market is expected to grow at a CAGR of 6.95%, reaching USD 220.922 billion in 2030 from USD 157.887 billion in 2025.

The global functional beverages market is undergoing a significant transformation, driven by an evolving consumer perspective on health and wellness. Consumers are increasingly seeking out proactive, convenient solutions to manage their well-being, shifting their purchasing behavior from traditional soft drinks to beverages that provide a specific, targeted health benefit. This demand-side evolution has become a primary catalyst for innovation across the industry, compelling manufacturers to develop new formulations and product lines that address a wide spectrum of health concerns, from cognitive performance to gut health. The market's growth trajectory is therefore not simply a function of rising consumption, but a reflection of a fundamental change in how consumers view their daily diet as a tool for preventative health management.

Functional Beverages Market Analysis

- Growth Drivers

The primary force propelling the functional beverages market is the global surge in consumer awareness regarding preventative health. This is not a generalized trend but a direct demand driver. Consumers, particularly in developed markets, are actively seeking to manage their health proactively rather than reactively. This mindset translates into a direct demand for products that can offer specific, verifiable health benefits. For instance, the growing interest in the "gut-brain axis" has directly stimulated the demand for beverages enriched with probiotics and prebiotics. Consumers are not just buying a drink; they are purchasing a product designed to improve their digestive health and, by extension, their mental well-being. Similarly, the increasing geriatric population is a distinct driver. As this demographic prioritizes vitality and independence, they create a specific demand for functional beverages that enhance bone density, support cardiovascular health, and improve cognitive function. Manufacturers are responding to this by launching products with ingredients like calcium, omega-3 fatty acids, and antioxidants, specifically tailored to the needs of older adults.

Another critical driver is the rising demand for "clean-label" and naturally sourced ingredients. This trend directly impacts consumer choice, as shoppers increasingly scrutinize ingredient lists for artificial colors, preservatives, and sweeteners. A beverage that contains a high level of sugar or a synthetic additive will see reduced demand from this segment, regardless of its purported functional benefit. This consumer preference compels manufacturers to reformulate products using natural ingredients like stevia, monk fruit, and other botanical extracts, which in turn fuels the supply chain for these specific raw materials. The shift towards plant-based diets and sustainability is also a significant catalyst. The growing number of consumers adopting meat-free or vegan diets has directly increased the demand for plant-based dairy alternatives and protein-fortified beverages made from sources like pea or hemp protein, creating an entirely new sub-segment within the functional beverage market.

- Challenges and Opportunities

The functional beverages market faces several challenges, with the most significant being the high cost of production and ingredients. The incorporation of specialized, bioactive components such as adaptogens, probiotics, and nootropics often comes at a premium. This elevated production cost can result in higher retail prices, which can act as a barrier to entry for cost-sensitive consumers. This dynamic places a direct constraint on demand, particularly in price-sensitive markets.

Despite these challenges, the market is rich with opportunities. The increasing emphasis on mental well-being and stress management presents a major opportunity for product innovation. As research deepens into the gut-brain axis, there is a clear pathway for manufacturers to develop and market beverages that support cognitive function and stress relief, thereby creating a new demand segment. Furthermore, the growth of e-commerce and direct-to-consumer models provides an avenue for companies to bypass traditional retail challenges and offer highly specialized, personalized products directly to their target audience. This distribution channel allows for more effective brand storytelling and can better educate consumers on the specific benefits of a product, ultimately strengthening demand.

- Raw Material and Pricing Analysis

The functional beverage market is a physical product category, and its pricing dynamics are heavily influenced by the raw material supply chain. Key functional ingredients, such as adaptogens (e.g., ashwagandha, maca root), nootropics (e.g., L-theanine, ginseng), and probiotics, are often derived from specialized agricultural or fermentation processes. The supply of these materials can be volatile, subject to climate-related events, harvest yields, and processing complexities. This inherent volatility creates price fluctuations that can directly impact the final product cost. For instance, a poor harvest of a specific herb used as an adaptogen can lead to a supply shortage, driving up its cost and forcing beverage companies to either absorb the cost, pass it on to consumers, or seek alternative, potentially less effective ingredients. The cost of specialty packaging, such as slim cans or glass bottles that maintain the viability of live cultures, also contributes to the final product's pricing.

- Supply Chain Analysis

The functional beverage supply chain is a complex network that begins with the sourcing of raw materials, many of which are geographically dispersed. For example, ingredients like açai berries may come from South America, while specific botanicals are sourced from Asia. The supply chain moves from the collection of these raw materials to processing and extraction facilities, where the functional ingredients are prepared for integration into beverage formulations. These ingredients are then transported to manufacturing plants for mixing, pasteurization, and packaging. The logistical complexity is heightened by the need for refrigerated transport and storage for products containing live cultures, such as kombucha and kefir. Key production hubs are located in regions with strong agricultural infrastructure and advanced food processing capabilities. The supply chain's efficiency is directly tied to the ability to maintain the potency and stability of the functional ingredients throughout the entire journey, from raw material to a retail shelf.

- Government Regulations

| Jurisdiction | Key Regulation / Agency | Market Impact Analysis |

|---|---|---|

| United States | Food and Drug Administration (FDA) | The FDA regulates functional beverages under the Federal Food, Drug, and Cosmetic Act. The use of "structure/function claims" (e.g., "helps support immune health") is common but must be truthful and not misleading. This places a high burden of proof on manufacturers to have scientific evidence, which can slow product development and market entry. The FDA's Generally Recognized as Safe (GRAS) status for ingredients like Fructo-oligosaccharides (FOS) provides a clear pathway for their use, thereby enabling innovation. |

| European Union | European Food Safety Authority (EFSA) / EU Health Claims Regulation | The EU has a stringent and centralized approval process for health claims. Manufacturers must submit a dossier of scientific evidence to the EFSA for authorization. This rigorous process significantly impacts the market by limiting the types of claims companies can make, which directly affects marketing strategies and consumer demand. The high barrier to approval can discourage smaller companies from entering the market with novel claims. |

| Japan | Ministry of Health, Labour and Welfare (MHLW) / Foods with Function Claims (FFC) system | Japan's FFC system allows companies to register products with health claims based on scientific evidence, without a full government-led review, provided the claims are non-disease-related. This streamlined process encourages innovation and has a positive impact on market growth by allowing for a wider variety of explicitly functional products to reach consumers more quickly than in regions with more rigid pre-market approval. |

| Brazil | National Health Surveillance Agency (ANVISA) | ANVISA regulates food products, including functional beverages, focusing on safety and labeling. The agency requires registration and approval for new ingredients or products, which can be a lengthy process. This regulatory framework can act as a brake on rapid product launches but also builds consumer trust, which can foster long-term demand. ANVISA’s guidelines on caffeine content and other stimulants are particularly impactful on the energy drink segment. |

| South Africa | Department of Health / Foodstuffs, Cosmetics and Disinfectants Act | South Africa's regulations are focused on ensuring product safety and preventing misleading labeling. While the framework is still evolving, there is a push towards stricter guidelines on health claims, similar to international trends. The lack of a specific, dedicated functional food category can create ambiguity for manufacturers, which can slow down product development and limit consumer choice. |

Functional Beverages Market Segment Analysis:

- By Application: Energy Drinks

The energy drinks segment of the functional beverage market is not merely driven by the need for a caffeine boost but by a demand for enhanced physical and cognitive performance. Consumers in this segment, primarily young adults and professionals, are seeking products that offer a rapid increase in alertness and concentration without the negative side effects of high sugar content. This demand has catalyzed a shift from traditional sugar-laden energy drinks to new formulations that incorporate nootropics, B-vitamins, and natural caffeine sources like green tea extract. The demand for these new products is directly linked to the rise of professional gaming, high-performance athletics, and demanding work environments where sustained focus is an imperative. For example, a student pulling an all-nighter or a professional preparing for a major presentation will directly seek a beverage that promises not just energy, but cognitive clarity and reduced mental fatigue. The consumer is willing to pay a premium for a product that can demonstrably improve their performance, making this segment highly responsive to innovation and strategic marketing.

- By End-User: Athletes and Sports Enthusiasts

Athletes and sports enthusiasts represent a distinct and highly demanding end-user segment. Their consumption of functional beverages is driven by a very specific set of needs: hydration, electrolyte replenishment, and muscle recovery. Traditional sports drinks, which often contained high levels of sugar and artificial dyes, are being replaced by products with cleaner ingredient profiles. The demand drivers here are multifaceted. First, the growing prominence of professional sports and the associated sponsorship deals directly influences brand visibility and consumer trust. Second, the rise of recreational athletics and fitness culture has created a vast consumer base that requires products to support their training regimens. This audience seeks beverages fortified with essential electrolytes like sodium, potassium, and magnesium, as well as protein and branched-chain amino acids (BCAAs) to aid in post-workout recovery. The requirement is not for a general "energy" boost but for a scientifically formulated product that can tangibly improve performance and accelerate recovery time, thereby enabling them to train more effectively. The growth is therefore highly specific and performance-oriented.

Functional Beverages Market Geographical Analysis

- US Market Analysis

The US functional beverage market is characterized by a mature and highly health-conscious consumer base. The market is driven by a robust fitness and wellness culture, where individuals are actively seeking convenient, on-the-go solutions that integrate seamlessly into their active lifestyles. A key demand driver in the US is the preference for "free-from" products—those that are gluten-free, dairy-free, or contain no artificial sweeteners. This has compelled manufacturers to innovate with plant-based milks and natural sweeteners. The presence of major food and drug retail chains and a well-established e-commerce infrastructure facilitates widespread availability, which in turn fuels consumer demand. The US market is also highly receptive to new trends, with a rapid adoption rate for products incorporating novel ingredients like adaptogens and CBD, driven by extensive marketing and consumer education campaigns. - Brazil Market Analysis

In Brazil, the functional beverages market is emerging, with demand primarily concentrated in major urban centers. The key demand driver is a rising middle class with increasing disposable income and a growing awareness of health and wellness. Consumers are increasingly turning to functional beverages to address lifestyle-related health concerns. The market sees a strong demand for products that promise immunity-boosting properties, often with ingredients derived from native fruits and botanicals. However, the market faces challenges related to distribution and consumer education in rural areas. While there is a strong demand for innovative products, the high cost of imported raw materials and complex regulatory processes can act as a constraint on market growth. - UK Market Analysis

The UK functional beverages market is dynamic and innovative. The market is largely shaped by a strong public health focus on reducing sugar intake. The government's sugar tax has been a direct catalyst for demand for low-sugar and zero-sugar functional beverages. Consumers are increasingly seeking out alternatives to sugary sodas, which has created a significant opportunity for products such as vitamin-enhanced waters and kombucha. The market is also driven by a strong ethical consumerism trend, with demand for products that are sustainably sourced, organically certified, and align with ethical production practices. This demand places a direct burden on manufacturers to provide transparent supply chains and clean-label products. - Japan Market Analysis

Japan's functional beverage market is one of the most developed globally, largely due to a long-standing cultural appreciation for health-centric food and drink. The key driver is the country's aging population, which has created a significant market for products that support joint health, digestive function, and cognitive performance. Japan's unique regulatory framework for "Foods with Function Claims" has also been a powerful catalyst, allowing companies to explicitly market the health benefits of their products with scientific backing. This regulatory clarity fosters consumer trust and directly stimulates demand. The market also sees a strong demand for small-format, highly concentrated shots and ready-to-drink teas fortified with functional ingredients. - South Africa Market Analysis

The South African functional beverages market is still in a nascent stage, but is poised for growth. The expansion is primarily concentrated among a small but growing segment of health-conscious, affluent consumers in urban areas. Key market drivers include a rising interest in sports and fitness, which fuels the demand for sports and energy drinks. However, the market faces significant challenges. The high cost of these products makes them inaccessible to the majority of the population. Furthermore, a lack of widespread consumer education on the benefits of functional ingredients limits the broader market potential. The supply chain can also be a challenge, with logistical hurdles and a dependency on imported raw materials contributing to high prices.

List of Top Functional Beverages Companies:

The functional beverages market is highly competitive, with a mix of established beverage giants and agile, innovative startups. The competitive environment is defined by strategic acquisitions, continuous product innovation, and aggressive marketing campaigns. Major players leverage their extensive distribution networks and brand recognition, while smaller companies compete on the basis of unique product formulations, clean-label ingredients, and targeted marketing to niche consumer segments.

- PepsiCo, Inc.

PepsiCo is a global powerhouse in the beverage and snack industry, strategically positioning itself in the functional beverage market through both its established brands and targeted acquisitions. The company's strategic imperative is to diversify beyond its traditional soft drink portfolio. A prime example of this strategy is the acquisition of Rockstar Energy Drink. This move allowed PepsiCo to immediately gain a stronger foothold in the energy drink segment. PepsiCo also strategically partners with and distributes innovative brands to expand its portfolio. For instance, in August 2025, PepsiCo and Celsius Holdings strengthened their partnership, with Celsius's Alani Nu brand moving into the PepsiCo distribution system in the U.S. and Canada. This strategic collaboration directly addresses consumer demand for wellness-oriented energy and hydration solutions and leverages PepsiCo's established distribution power to reach a wider consumer base. - The Coca-Cola Company

The Coca-Cola Company has a long history of responding to consumer trends by expanding its portfolio beyond its core carbonated soft drinks. The company has a diverse range of functional beverage brands, including Honest Tea and Fairlife. Coca-Cola's strategic approach is centered on acquiring and nurturing brands that resonate with the evolving consumer demand for healthier options. The company's acquisition of Fairlife, a dairy-based beverage company, in January 2020, positioned it to capitalize on the growing demand for protein-fortified and lactose-free dairy alternatives. This move demonstrates a clear intent to move into the value-added beverage space, addressing the demand from health-conscious consumers for products with nutritional benefits. - Danone S.A.

Danone's strategic positioning in the functional beverage market is rooted in its historical expertise in dairy and plant-based products. The company has a strong presence in the market for probiotic and fortified dairy beverages, with brands like Activia. Danone's focus is on digestive health and overall wellness, directly addressing a significant and growing consumer concern. The company has also made strategic moves to capture the demand for plant-based alternatives. In February 2021, Danone completed the acquisition of Follow Your Heart, a plant-based food company. This acquisition enhances Danone's portfolio of dairy-free products, directly responding to the increasing consumer shift towards plant-based and sustainable dietary choices, thereby fortifying its competitive position in the functional beverage space.

Functional Beverages Market Developments

- August 2025: Keurig Dr Pepper to Acquire JDE Peet's

Keurig Dr Pepper (KDP) announced a definitive agreement to acquire JDE Peet's in an all-cash transaction. KDP stated that it plans to separate into two independent companies following the acquisition. This strategic move is designed to consolidate KDP's position in the coffee and beverage market and streamline its portfolio. The acquisition of JDE Peet's, a major coffee and tea company, is aimed at broadening KDP's hot and cold beverage offerings, thereby addressing diverse consumer preferences. - August 2025: Celsius Holdings and PepsiCo Strengthen Partnership

Celsius Holdings Inc. and PepsiCo Inc. announced a strengthened long-term strategic partnership. As part of this agreement, Celsius Holdings' Alani Nu brand will move into the PepsiCo distribution system in the U.S. and Canada. This development is a significant step for both companies, as it leverages PepsiCo's extensive distribution network to amplify the reach of the Alani Nu brand, which is popular with consumers seeking fitness-oriented energy and hydration products. The partnership reflects a trend where major players are leveraging partnerships to capture new market segments rather than relying solely on organic growth or outright acquisition. - May 2025: PepsiCo Completes Acquisition of poppi

PepsiCo completed its acquisition of poppi, an Austin, Texas-based functional beverage brand, for $1.95 billion. The transaction was officially closed and announced by PepsiCo in a news release. This acquisition strengthens PepsiCo's functional food and beverage portfolio by integrating a brand known for its prebiotic soda, a product that directly targets the consumer demand for gut health and digestive wellness. The deal allows PepsiCo to expand its footprint in the high-growth, health-oriented beverage segment.

Functional Beverages Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Functional Beverages Market Size in 2025 | USD 157.887 billion |

| Functional Beverages Market Size in 2030 | USD 220.922 billion |

| Growth Rate | CAGR of 6.95% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in the Functional Beverages Market |

|

| Customization Scope | Free report customization with purchase |

Functional Beverages Market Segmentation:

- By Product Type

- Energy Drinks

- Sports Drinks

- Nutraceutical Drinks (Vitamins, Proteins, etc.)

- Probiotic Drinks

- Herbal & Fruit Teas

- Functional Water

- Functional Juices & Shots

- By Application

- Health & Wellness

- Weight Management

- Sports Nutrition

- Clinical Nutrition

- Cardiovascular Health

- Digestive Health

- Immune Health

- By End-User

- Adults

- Athletes and Sports Enthusiasts

- Geriatric Population

- Children

- By Distribution Channel

- Supermarkets & Hypermarkets

- Convenience Stores

- Online Retail

- Pharmacies & Health Stores

- Specialty Stores

- By Region

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- Australia

- South Korea

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- South Africa

- Rest of Middle East & Africa

- North America

Our Best-Performing Industry Reports:

Navigation:

- Functional Beverages Market Size:

- Functional Beverages Market Key Highlights

- Functional Beverages Market Analysis

- Functional Beverages Market Segment Analysis:

- Functional Beverages Market Geographical Analysis

- List of Top Functional Beverages Companies:

- Functional Beverages Market Developments

- Functional Beverages Market Scope:

- Our Best-Performing Industry Reports:

Page last updated on: September 18, 2025