Report Overview

Global Antimony Reserve Market Highlights

Global Antimony Reserve Market Size:

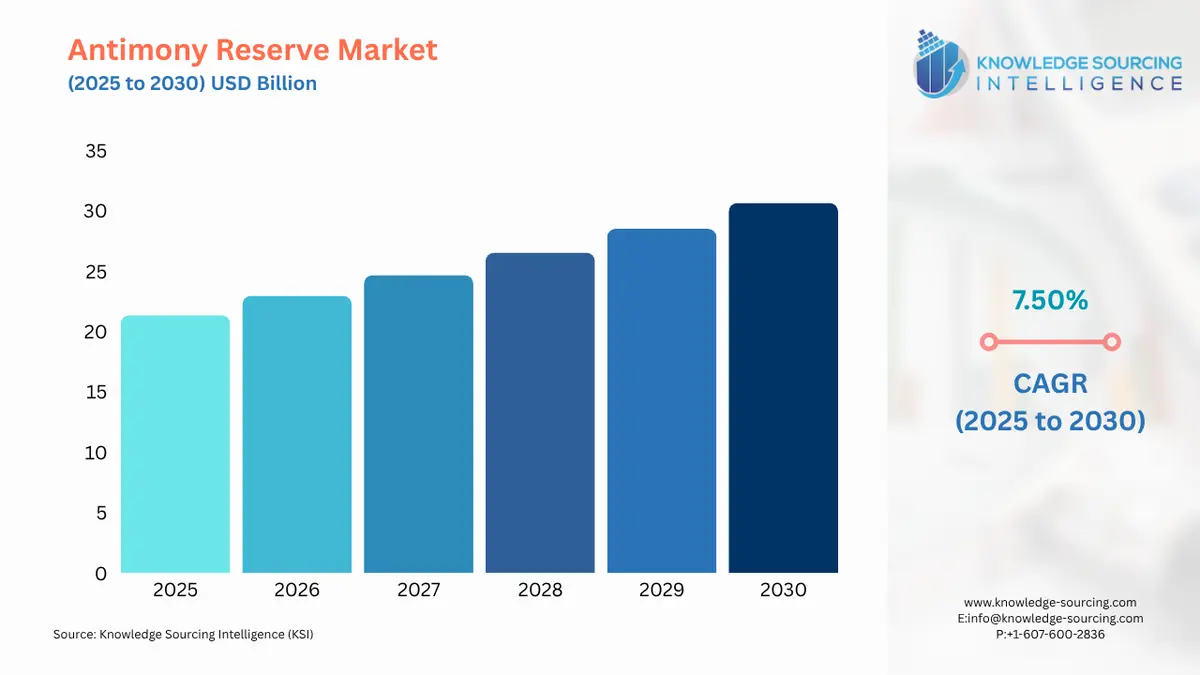

The Global Antimony Reserve Market is expected to grow at a CAGR of 7.50%, reaching USD 30.664 billion in 2030 from USD 21.359 billion in 2025.

Global Antimony Reserve Market Key Highlights:

- China is rapidly growing its share of global antimony reserves, giving it significant influence over supply and pricing.

- Growing interest in alternative reserves outside China is reshaping exploration and investment strategies to diversify supply sources.

Antimony is one of a number of critical mineral resources with varied supply and a number of industrial uses, from flame retardants and lead-acid batteries to alloys and semiconductors. Global reserves are geographically concentrated, and China is the largest, enjoying most of the mining and reserve amounts, which raises raising risk of over-exploitation or supply chain issues. Increasing geopolitical risk and the rising demand due to energy storage/ electronics in general, as well as more stringent environmental constraints, are changing the landscape for antimony reserves. To reduce reliance on a limited source of supply, countries are also exploring reserve alternatives and recycling. Understanding the distribution, grade and access of antimony reserves is important to forecasting price direction, ensuring, as much as possible, supply security, allowing both established legacy industrial markets and new emerging markets to expand their industries.

Global Antimony Reserve Market Overview & Scope

The Global Antimony Reserve Market is segmented by:

- Reserve Type: The market is segmented by reserve type - proven reserves, probable reserves, and possible reserves. Proven reserves define what is the most certain reserves that can be exploited commercially or economically away from, beyond limits in reserve estimation. Proven reserves provide the basis for production planning and global supply forecasts, which are the most important category for any market.

- Form: The market is also segmented by form as antimony trioxide, antimony metal, antimony alloys, and others. Antimony trioxide is the largest form, and the reason is related to its great use in flame retardants. Furthermore, since antimony trioxide is the best commercially available form, its demand is ranked and influences how reserves are sourced and developed, as producers will prefer to supply this form to meet required industrial demand by using it as a flame retardant.

- Application: The market is further segmented by application: flame-retardants, lead-acid batteries, alloys, semiconductors, catalysts, and others. Again, flame-retardants lead in total use as antimony trioxide is necessary because it is the required synergist. Therefore, the flame-retardant application leads to demand, which guarantees long-term demand. This demand is directly linked and related to the overall process of exploiting reserves with reference to fire safety regulations and global consumer product manufacturing.

- Region: Geographically, the market is expanding at varying rates depending on the location.

Top Trends Shaping the Global Antimony Reserve Market

- Geopolitical Influence on Reserve Access

China controls almost all the world's antimony reserves, allowing it to wield creamy control over supply and pricing. Export constraints and inappropriate policy decisions from China resulted in divergence from other nations to consider alternative reserves and diversify supply to reduce risks when accessing this vital mineral. - Mining Shift Toward Supply Diversification

Countries such as Australia, Russia and Tajikistan are spending money on antimony exploration and reserve development to reduce the overdependence on a monopolised Chinese supply. This trend promotes resilience in global supply and opens up collaboration opportunities for multi-national partnerships to promote the potential for securing additional reserves and long-term stability of antimony supply.

Global Antimony Reserve Market Growth Drivers vs. Challenges

Drivers:

- Rising Demand from Energy Storage and Batteries: Lead-acid and an increasingly wide variety of battery technologies generate substantial demand for antimony. Favourable mining and extraction conditions will be prioritized to extract proven and probable reserves as demand continues to go up, and more importantly, given energy storage demand as a growth driver for exploration, reserve development, and long-term investments of antimony markets globally.

- Government Support for Critical Minerals: Antimony is a rare mineral and is recognised by governments as a critical mineral needed for energy, defence and other manufacturing needs. Driving policy support, funding for exploration and reserve mapping are all steps governments are taking to encourage private sector investments to promote utilisation of reserves, reducing supply risks to ensure a sustainable supply of a strategically important resource.

Challenges:

- Environmental and Regulatory Constraints: Strict mining and environmental laws will always be a hurdle to reserve exploitation, especially within limited ecologically sensitive areas. High compliance costs, along with permitting processes and length, can delay and prolong reserve development. For the time being, this limits economies to quickly moving to increase supply to meet rising global demand and potential market disruption.

Global Antimony Reserve Market Regional Analysis

- Asia-Pacific: Asia-Pacific holds the upper hand in the global antimony reserves space with China having a big share of proven and probable reserves. This alluded concentration brings considerable supply, price, and export power to the region. China, Russia and Tajikistan have substantial reserve concentrations while Australia is increasing exploration in hopes to cause some supply diversification. The region’s overwhelming significance in antimony availability makes for the geopolitical considerations, environmental discussions and the international security efforts to gain reliable, long-term access to resources.

Key Development: The US Administration has approved Perpetua Resources’ Stibnite antimony–gold mine in Idaho. The project is expected to supply greater than 35% of the U.S. annual antimony requirement and produce 450,000 ounces of gold annually to develop the reserves by 2028. This is a major increase for domestic critical mineral capacity.

Antimony Reserve Market Scope:

| Report Metric | Details |

|---|---|

| Growth Rate | CAGR during the forecast period |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Reserve Type, Form, Application, Geography |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

| Report Metric | Details |

| Antimony Reserve Market Size in 2025 | USD 21.359 billion |

| Antimony Reserve Market Size in 2030 | USD 30.664 billion |

| Growth Rate | CAGR of 7.50% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in the Antimony Reserve Market | |

| Customization Scope | Free report customization with purchase |

Global Antimony Reserve Market Segmentation:

- By Reserve Type

- Proven Reserves

- Probable Reserves

- Possible Reserves

- By Form

- Antimony Trioxide

- Antimony Metal

- Antimony Alloys

- Others

- By Application

- Flame Retardants

- Lead-Acid Batteries

- Alloys

- Semiconductors

- Catalysts

- Others

- By Geography

- North America

- United States

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- United Kingdom

- Germany

- France

- Italy

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- Japan

- China

- India

- South Korea

- Taiwan

- Others

- North America