Report Overview

Global Antimony Trade Market Highlights

Global Antimony Trade Market Size:

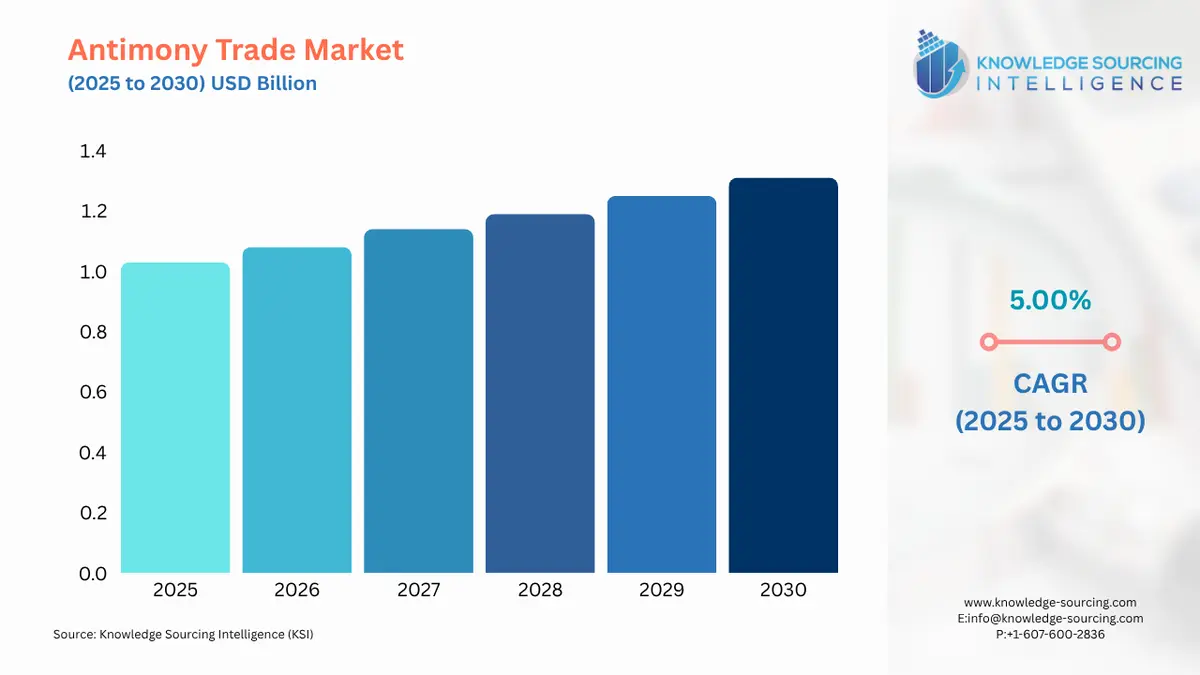

The Global Antimony Trade Market is expected to grow at a CAGR of 5.00%, reaching USD 1.314 billion in 2030 from USD 1.030 billion in 2025.

The global antimony trade market is an important part of the international metals and minerals market. The broad uses of antimony in flame-retardant products, alloys, semiconductors, and energy storage technologies are prompting an unprecedented international focus within the antimony production and trading market. Antimony is classified as a semi-metal, primarily derived from the ore stibnite. Antimony has become a strategically important material across multiple industries that require fire resistance for plastics, textiles, and electronics. Antimony contributes toward the energy storage functionality of lead-acid batteries and is used in advanced grid-scale storage systems. The supply side of the antimony market is particularly heavily weighted, considering one country's monopolization of production and export. The majority of both mined antimony and refined products comes from China, and only relatively small amounts of antimony are mined by Russia, Tajikistan, Bolivia, and Turkey.

Global Antimony Trade Market Overview & Scope:

The global antimony trade market is segmented by:

- Product Type: The increasing global demand for flame retardants, the more stringent fire safety standards in construction and electronic applications, and growth in high-growth regions (e.g., Asia-Pacific) support antimony trioxide growth.

- Application: Flame retardants are the largest application segment, and the fastest growing, as the segment accounts for a large share of traded antimony, blending antimony with halogenated and non-halogenated retardant chemicals to provide safety for plastics, textiles, and electronic devices. The global enforcement of fire safety legislation intended to enhance safety in construction, passenger vehicles, and consumer electronics is essentially growing the key segment of traded antimony in flame retardants.

- End-User: Electrical & Electronics is a major source of antimony-based flame retardants and semiconductors, particularly in the Asia-Pacific manufacturing hub. The electrical & Electronics Industry supports the fastest-growing share of antimony trade, driven by rising global electronics production, 5G expansion, and a growing demand for safer consumer devices.

- Region: The market is segmented into five major geographic regions, namely North America, South America, Europe, the Middle East, Africa, and Asia-Pacific. Asia-Pacific is anticipated to hold the largest share of the market, and it will be growing at the fastest CAGR.

Top Trends Shaping the Global Antimony Trade Market:

- Antimony's Growing Strategic Significance as a Vital Raw Material

Several governments have categorized antimony as a "critical raw material" due to its concentration of supply and its necessity for industrial purposes. This will influence trade policies by countries that will now need to get long-term supply contracts, find supply options outside of China, and look to develop their recycling process. The changing world is creating a more robust global trade market, which is now seen not just through industrial demand but rather through a lens of national security and supply chain resilience. - Trade Trends Driven by Geopolitics and Defense

Antimony is an essential material in defense applications such as ammunition, protective alloys, and military-grade materials. With escalating geopolitical conflict, defense industries are incrementally locking the material under dedicated trade means, rather than through open market methods. The characterization of antimony as a strategic mineral has increased the quantity of defense-led stockpiling in the U.S. and EU, thereby affecting global trade movements, availability, and alternatives for civilian industries.

Global Antimony Trade Market Growth Drivers vs. Challenges:

Drivers:

- Infrastructure Development and Urbanization in Developing Economies: In developing economies such as India, Southeast Asia, and Africa, rapid industrialization and urbanization will continue to increase the demand for flame-retardant construction materials, automotive batteries, and electronics. As these economies have limited domestic production capacity, they have become very dependent on imports of refined antimony products from China and other exporters. The development of megacities, expansion of power infrastructure, and increased use of consumer electronics are further establishing these economies as new demand centres and increasing global trade flows.

- Encouragement of Recycling and Secondary Sources of Supply: The growing focus on recycling and circular economy initiatives is another chief driver, especially in Europe and North America. Recycling antimony from lead-acid batteries, plastics, and industrial residues will reduce reliance on mined supplies and create trade opportunities for recycled materials. This movement is improving sustainability and demonstrating the benefits to trade through recycling antimony into the global supply chains.

Challenges:

- Limited Mining Investments and Exploration: Global antimony reserves are predominantly located within a small number of countries. Although there have been insufficient new deposits explored globally, the number of new producers is shrinking due to high costs and environmental issues, along with a lack of investor interest. If there are no adequate new supply sources developed outside of China, the global trade is facing supply blockages that cannot be resolved, and which will limit long-term growth in the industry. Many of the smaller producers (like Bolivia and South Africa), in addition, do not have the technological requirements or sufficient funding to successfully move to a stable, large-volume export basis.

- Transportation and Logistics Difficulties: Refined goods are basically shipped over a very long distance to different places that produce the antimony, which are located even in the middle of the land like Tajikistan, and the biggest areas that consume the metal are Asia-Pacific, Europe, and North America. Poor transportation facilities, increasing freight rates, and supply interruptions are some of the most serious limitations. The obstacles of the logistics not only increase the costs but also slow down the shipments, making the trade flows less efficient as they further impede the flows.

Global Antimony Trade Market Regional Analysis:

- Asia-Pacific: Asia-Pacific is the most important region influencing present and future trade patterns since it not only controls the supply side of the global antimony trade but also drives consumption growth.

- China: China is still the main point of the global antimony market from where most of the mined supply, as well as the smelted exports, originate. Besides that, it is the largest consumer of antimony because of its huge electronics, construction, and chemical industries.

- Japan: Japan is a significant purchaser from China and depends largely on supplies from that country to satisfy its need for flame retardants, semiconductors, and specialty alloys. The primary areas of application are the high-tech industry and products meeting very stringent quality standards.

Global Antimony Trade Market Competitive Landscape:

The market is fragmented, with many notable players, including China Minmetals Corporation, Tri-Star Resources Plc, Matsuda Sangyo Co., Ltd, United States Antimony Corporation, Campine NV, Yiyang Huachang Antimony Industry Co., Ltd, Shenyang Antimony Chemical Co., Ltd, Youngsun Antimony, Geodex Minerals Ltd, and Kazzinc.

- Regulations: In August 2024, Exports of antimony, gallium, germanium, and superhard materials to the United States will stop, according to China's Commerce Ministry, which announced an export ban and restrictions on several minerals and metals to the US a day after the United States increased its technology restrictions on China.

- New Product Launch: In August 2024, the third generation of antimony recycling is being developed by Campine, which should enable them to meet 50% of needs in time. At current prices, the returns are more promising.

Antimony Trade Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 1.030 billion |

| Total Market Size in 2031 | USD 1.314 billion |

| Growth Rate | 5.00% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Product Type, Application, End-User, Geography |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

Antimony Trade Market Segmentation:

- By Product Type

- Antimony Trioxide (ATO)

- Antimony Alloys

- Antimony Pentoxide & Compounds

- Others

- By Application

- Flame Retardants

- Batteries & Energy Storage

- Chemicals & Catalysts

- Defense & Military Applications

- Electronics & Semiconductors

- By End-User

- Construction & Infrastructure

- Electrical & Electronics

- Automotive & Transportation

- Defense & Aerospace

- Chemical & Plastics Industry

- By Geography

- North America

- United States

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- United Kingdom

- Germany

- France

- Italy

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- Japan

- China

- India

- South Korea

- Taiwan

- Others

- North America