Report Overview

Global Artificial Organ Market Highlights

Artificial Organ Market Size:

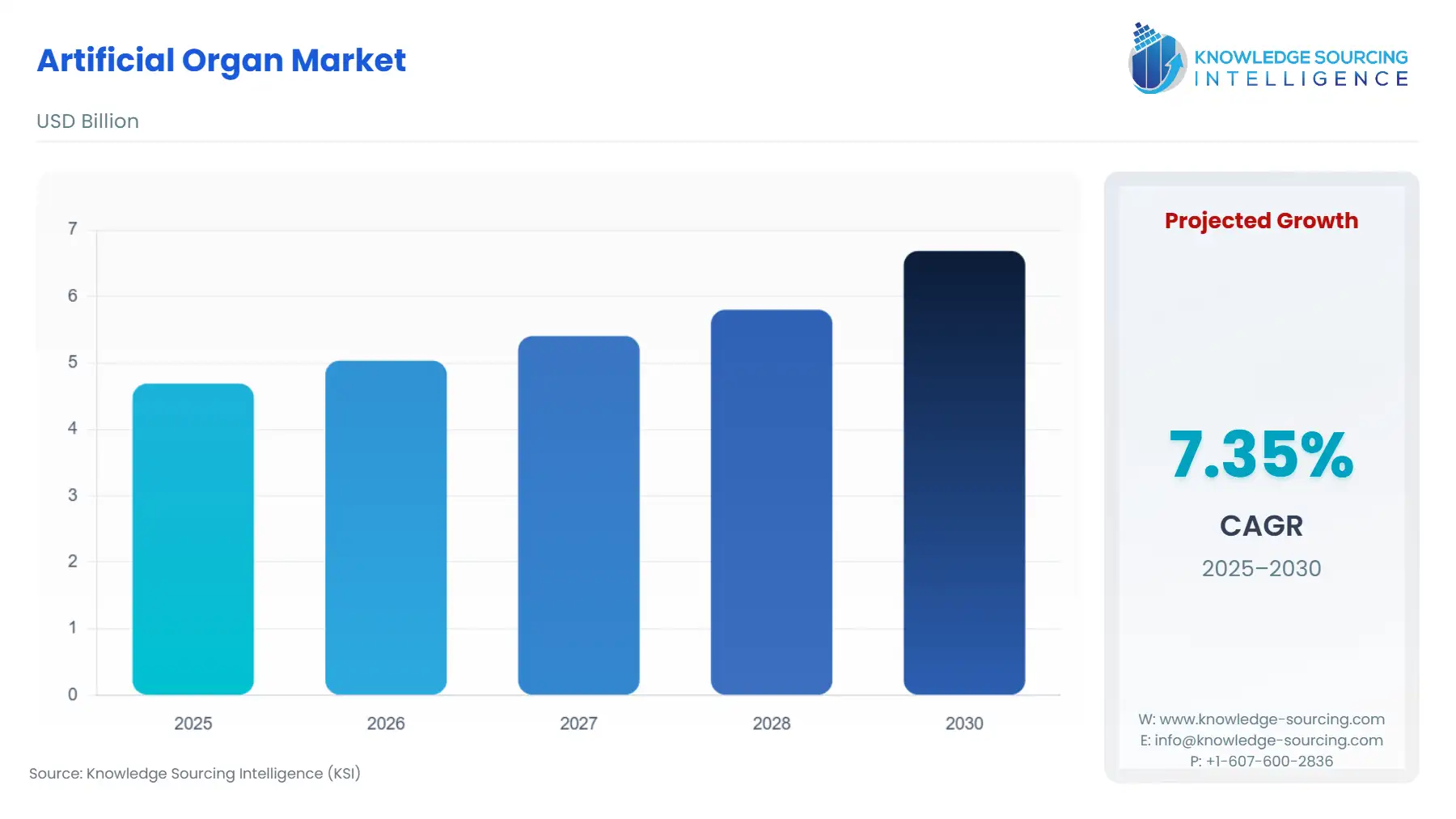

The global artificial organ market is set to witness robust growth at a CAGR of 7.35% during the forecast period, to reach S$6.687 billion in 2030 from US$4.691 billion in 2025.

Artificial Organ Market Introduction:

The global artificial organ market refers to the industry associated with the development, production, and distribution of artificial organs and related medical devices that provide replacement and support for the damaged or failed human organs. The market is anticipated to grow at a significant rate during the forecast period, driven by the increasing prevalence of chronic diseases like cardiovascular disease, diabetes, and kidney failure.

The rising prevalence of diseases is illustrated by data from the World Health Organization. Cardiovascular diseases (CVDs) are the leading cause of death globally, taking an estimated 17.9 million lives each year. The NCD portal highlights that NCDs account for 74% of all deaths.

As per the data by the National Institute of Diabetes and Digestive and Kidney Diseases, chronic kidney disease affects more than 1 in 7 U.S. adults, with is estimated 35.5 million people. As per the United States Renal Data System 2023 Annual Data Report, 8,08,000 people in the United States are living with end-stage renal disease (ESRD), with 68% on dialysis and 32% with a kidney transplant.

Another significant driver for the market is the global shortage of donor organs. The severe and persistent shortage of donor organs worldwide is a key critical factor that is fueling the growth of the global artificial organ market. There is a wide gap between the organ supply and the demand, leaving millions of patients on transplant waiting lists, many of whom die before receiving a suitable donor organ.

The advancement in technology, such as biocompatible materials, 3D bioprinting and bioartificial organs, is driving the market. These trends are driving innovations in products, leading to further expansion of the market. Partnerships and collaborations are a key strategy driving innovation and growth in the global artificial organ market.

Artificial Organ Market Trends:

Several trends are driving the global artificial organs market growth, including 3D printers, nanotechnology, and advanced AI. These technologies make organs with patient-specific structures with a high level of complexity and biocompatibility. Nanomaterials are constantly integrated to improve the performance and durability of the product. AI is applied in organ design, and its functionality is integrated with patient needs for better treatment application and a higher success rate. The lack of organ donors is encouraging patients waiting for a transplant to use artificial organs, increasing its popularity in the future.

Artificial Organ Market Growth Drivers:

- Increasing prevalence of chronic diseases: Chronic disease, including diabetes, hypertension, kidney failure, and autoimmune disorders, causes metabolic imbalances, which result in tissue damage, scarring, and nerve vessels damage which can impact the overall functioning of the organ. Such diseases have become one of the leading causes of death in various major economies, and with the constant growth in sedentary lifestyle and improper nutrition intake, the health factor has started to deteriorate, which is further expected to increase the overall prevalence. The market for artificial organs worldwide is rising because the population requires more treatment solutions due to the rising incidence of chronic illnesses. These devices present a possible approach to patients with organ dysfunction, serving as temporary support to organ transplantation or lifelong replacement. Heart disease, cancer, stroke, chronic lower respiratory diseases, and diabetes are the leading causes of death in America, with statistics showing 702,880 deaths, 608,371 deaths, 165,393 deaths, 147,382 deaths, and 101,209 deaths, respectively, in 2023.

According to the International Diabetes Federation, in 2024, the number of people having diabetes in Europe stood at 65.6 million, and by 2050, the number is expected to grow to 72.4 million, thereby showing a 9.39% growth in the diabetic cases. Likewise, the same source also specified that the region has the highest frequency of people suffering from Type-1 diabetes in 2024, nearly 193 USD billion in Europe for treating such disease. Diabetic patients hold a high risk for organ failure, and with such high prevalence, the organ demand is expected to show considerable growth, thereby creating a huge imbalance between demand and supply. Hence, artificial organs have provided a new prospect to fulfil this imbalance, which positively impacts the overall market growth.

Likewise, as per the American Kidney Fund, in 2024, there were nearly 90,000 Americans on the kidney transplant list, and from them, only 28,492 received a kidney transplant. Hence, with such a shortage of donor kidneys coupled with constant growth in newly diagnosed cases, the demand for other alternatives such as artificial organs, which are engineered to meet the specific patient requirements, is anticipated to pick up pace, thereby driving the overall market growth in the coming years.

- Rising Aging Population: The current aging global population boosts the development of the artificial organ market, caused by diseases such as cardiovascular, kidney, respiratory, and neurodegenerative diseases, and declining organ functions during the aging process, resulting in organ failure arising from the natural aging process. The number of US Americans aged 50 and older will increase by 61.11% from 137.25 million in 2020 to 221.13 million by 2050, and chronic illness will increase by 99.5%, from 71.522 million in 2020 to 142.66 million in 2050.

Artificial Organ Market Segmentation Analysis:

Product Type:

- Artificial Heart: An upsurge in heart failures, particularly due to lifestyle-induced changes and an aging population, has increased the demand for artificial hearts. This is coming with the rise in technological advances and less invasive surgical techniques that are giving rise to the adoption of smaller, more durable, and enhanced artificial heart implants.

- Artificial Kidney: The artificial kidney segment leads the global artificial organ market due to the high prevalence of kidney diseases and the critical shortage of donor kidneys. Artificial kidneys, including wearable and implantable dialysis devices, aim to replicate natural kidney functions, offering patients greater mobility and quality of life compared to traditional dialysis. Technological advancements and the urgent need for alternatives to transplantation drive this segment’s expansion.

Globally, CKD affects over 850 million people, with end-stage renal disease (ESRD) requiring dialysis or transplantation as per the WHO. The growing CKD burden fuels demand for artificial kidneys as a viable solution. According to the United Network for Organ Sharing, in 2024, over 150,000 patients globally awaited kidney transplants, with only 90,000 transplants performed annually. Artificial kidneys address this gap by offering a scalable alternative.

Advances in bioengineering, such as the Kidney Project’s bioartificial kidney (University of California, San Francisco), integrate living cells with synthetic materials. In 2024, the project received FDA Breakthrough Device designation, accelerating development. Wearable artificial kidneys, like those tested by AWAK Technologies in 2024, reduce dependency on dialysis clinics, improving patient autonomy and reducing healthcare costs.

- Artificial Lungs: The product type has been driven mainly due to increasing respiratory diseases like COPD and lung cancer. Advancements in extracorporeal membrane oxygenation (ECMO) technology work to improve patient outcomes and expand use across critical care settings.

Organ Type:

- Permanent Artificial Organs: Permanent artificial organs are designed to cover organ failures permanently, hence an enduring solution for the escalating demand in end-stage organ failure. Permanent artificial organs dominate the market over temporary solutions due to their long-term functionality and ability to address chronic organ failure. These include devices like cochlear implants, artificial hearts, and implantable kidneys, designed for sustained use without replacement. Their adoption is driven by durability, technological advancements, and the need for lifelong solutions.

According to the UN, the global population aged 65+ is projected to reach 1.5 billion by 2050, increasing demand for permanent organ replacements to treat age-related organ failure. Innovations in biomaterials and 3D bioprinting enhance the durability and biocompatibility of permanent organs. In 2024, 3D Systems introduced a bioprinted scaffold for artificial livers, improving long-term functionality. Streamlined regulatory pathways, such as the FDA’s Breakthrough Device program, accelerate market entry for permanent organs. Carmat’s Aeson artificial heart received FDA approval for U.S. trials in 2023. Permanent organs reduce the need for repeated surgeries or temporary interventions, lowering long-term healthcare costs. For example, cochlear implants have a lifespan of 20+ years, making them cost-effective.

- Temporary Artificial Organs: These organ types will witness a rise with the advancements in mobility and ease of use. Compact and easy-to-use temporary artificial organs are slowly gaining traction in intensive care settings.

Artificial Organ Market Geographical Outlook:

The global artificial organ market report analyzes growth factors across the following five regions:

- North America: High healthcare infrastructure, increased adoption of advanced technologies, and a vast patient pool make North America the dominant market player. For example, healthcare expenses increased by 7.5% to $4.9 trillion in 2023, reaching 14,570 per person. Ongoing technological advancements in the United States have provided a new approach to the country’s healthcare sector, with various ongoing developments in medical equipment and other necessary infrastructure taking place. Hence, technologies such as 3D bioprinting, organoids & tissue engineering, and developments of biomaterials for medical applications are witnessing progression in the country.

Likewise, the high demand for organ transplants, followed by improved prevalence of surgical procedures in the country, has provided a framework that has led to the development of alternatives that are specifically engineered to replicate the function of a human organ. According to the Organ Procurement and Transplantation Network, in 2024, the total organ transplant procedures conducted in the United States stood at 48,149, which marked a 3.3% growth over the number of procedures conducted in 2023 and a 23.3% growth over the past five years.

Additionally, the growing chronic disease prevalence, including diabetes, kidney failure, and heart disease, in the country is also expected to accelerate the demand for artificial organs that can provide the required support for sustenance. As per the American Diabetes Association, nearly 1.2 million Americans are diagnosed with diabetes every year.

Moreover, the ongoing innovations in the medical field have motivated the market players to improve their product development. For instance, in December 2024, United Therapeutics Corporation announced that the company successfully conducted the world’s first “UKidney” transplant in an Alabama-based patient suffering from kidney failure. The procedure was approved by the U.S. Food and Drug Administration, which established new ways of treating kidney failures.

- South America: The South American region is on the rise in sales of artificial organ products. With the rapid incidence of chronic diseases, reduced awareness, and improved infrastructure in the health sector, the region is slowly creating brand equity in the artificial organ sector.

- Europe: Europe is well known for using artificial organs due to the aging population and a robust healthcare system backed by government initiatives emphasizing investigation, innovative technologies, and developments. The region will see a drastic rise from the 90.5 million older population in 2019 to reach 129.8 million in about 30 years, i.e., by 2050.

- Middle East and Africa: The emergence of a strong artificial organ market in the MEA regions will largely be driven by health infrastructural investments, increasing government funding, and the government's efforts at enhancing healthcare access.

- Asia-Pacific: The Asia-Pacific region is anticipated to experience significant growth in the artificial organ market due to economic transformations. This growth is driven by the increasing prevalence of chronic diseases among the aging population, rising government expenditures on healthcare facilities, and improvements in public awareness.

Artificial Organ Market– Competitive Landscape:

- Abiomed

- Asahi Kasei Medical Co. Ltd.

- Baxter

- Boston Scientific Corporation

- Medtronic

Positive changes are observed in the market as major companies develop new technologies and introduce innovative products. This is leading to higher competition among already established players and new companies being attracted to the field. However, based on the present scenario, established leaders are still predicted to be the major contributors to market growth.

Artificial Organ Market Latest Developments:

- In May 2025, a Chinese research team successfully developed five bioartificial organs (liver, heart, kidneys, lungs, skin) using 3D printing and cell culture technologies. These organs, applied in preclinical research, advance regenerative medicine and address organ shortage challenges.

- In December 2024, BiVACOR reported the insertion of its BiVACOR Total Artificial Heart (TAH) into five patients in the presence of an FDA Early Feasibility Study. The results are proven to be safe and effective in bridging the gap till a standard donor heart transplant. This appears to promote expanding its EFS to twenty patients.

- In December 2024, United Therapeutics inaugurated the transplantation of the world's first Ukidney in the company of a living transplant after successfully conducting UHeart™ and UThymoKidney™ within three living recipients.

Artificial Organ Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Artificial Organ Market Size in 2025 | US$4.691 billion |

| Artificial Organ Market Size in 2030 | US$6.687 billion |

| Growth Rate | CAGR of 7.35% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in the Artificial Organ Market |

|

| Customization Scope | Free report customization with purchase |

Artificial Organ Market Segmentation:

- By Product Type

- Artificial Heart

- Artificial Kidney

- Artificial Lungs

- Artificial Liver

- Artificial Pancreas

- Cochlear Implants

- Other Types

- By Material

- Metal

- Polymer

- Others

- By Application

- Permanent Organ Replacement

- Temporary Organ Replacement

- By End-User

- Hospitals

- Research Institutes

- Others

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- United Kingdom

- Germany

- France

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Taiwan

- Australia

- Others

- North America