Report Overview

Global Glycerin Market Size, Highlights

Glycerin Market Size:

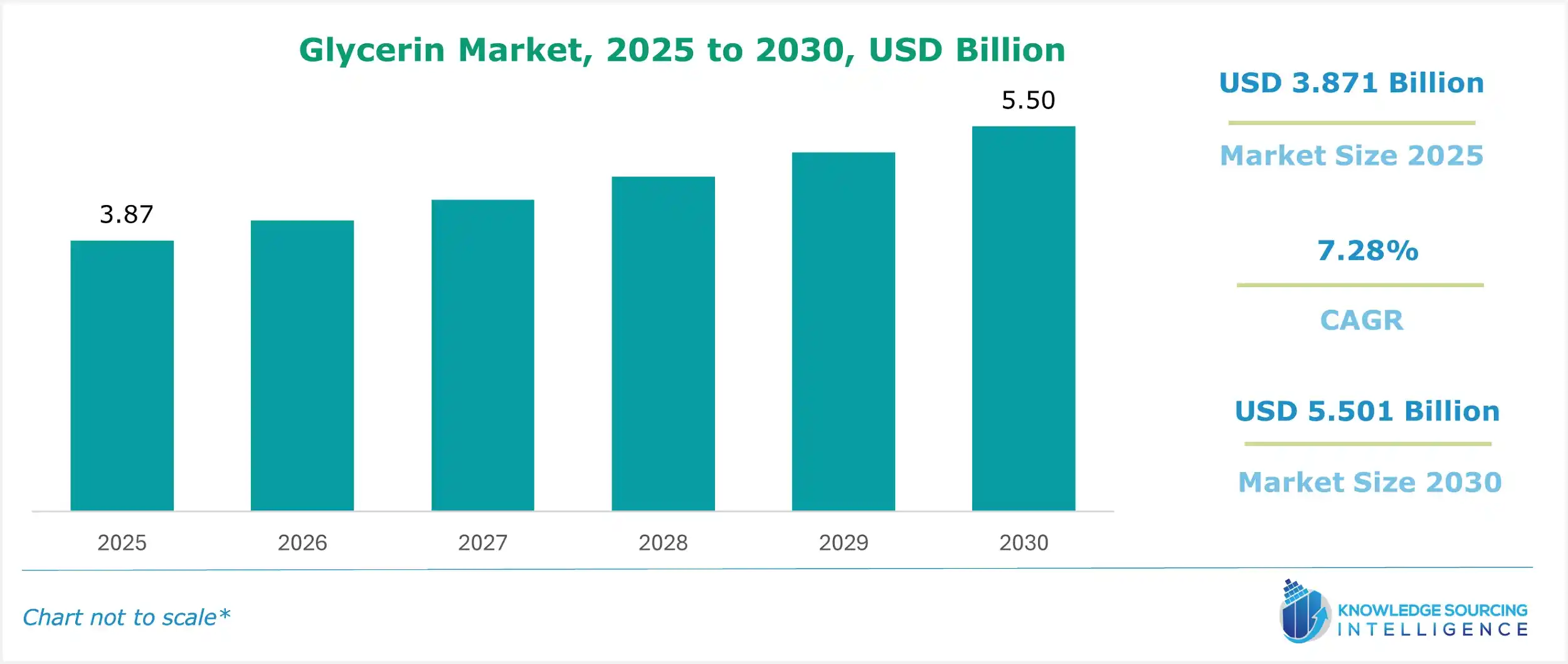

The global glycerin market is expected to attain US$5.501 billion in 2030 from US$3.871 billion in 2025, growing at a CAGR of 7.28%.

The usage of glycerin is rising in different end-user industries, such as pharmaceuticals, food, and beverages, among others, because it has several distinct properties that make it suitable for use in the end-user industries. In the food and beverage industry, glycerin is gaining popularity owing to its use as a thickening agent or to control the moisture level in the food and stabilize it if it contains both water and oil. Glycerin is also regarded as a safe additive by the U.S. Food and Drug Administration (FDA). Moreover, its use in the pharmaceutical industry as an excipient and a humectant in cosmetics is pushing the market growth. However, the availability of substitutes threatens the market’s expansion during the forecast period. Some end-users are still using chemicals such as propylene and ethylene glycol for applications that include antifreeze and de-icing, thus impacting the market growth.

Global Glycerin Market Overview & Scope:

The global glycerin market is segmented by:

- Grade: By grade, the global glycerin market is categorized into crude glycerin and refined glycerin. The refined glycerin category is estimated to grow substantially. The refined glycerin offers its application across multiple sectors, including pharmaceutical, cosmetics, and food & beverage, among others.

- Source: By source, the market is divided into biodiesels, fatty acids, fatty alcohols, and other sources. The biodiesels category is growing significantly.

- Application: By application, the market is divided into pharmaceuticals, food & beverage, personal care & cosmetics, industrial chemicals, and others. The pharmaceutical industry is estimated to hold a significant share over the forecast period due to its rising usage in different applications, such as a sweetener in syrups and lozenges and as an excipient compound in various eyewash solutions.

- Region: The Asia Pacific region is estimated to hold a considerable share during the forecast period owing to the increasing cosmetics industry and personal care products manufacturing due to the rising demand from the population. In addition, the low manufacturing cost is boosting demand for the chemical glycerin and bolstering regional market growth.

Top Trends Shaping the Global Glycerin Market:

1. Increasing demand for biodiesel

- The increasing global biodiesel production is also among the key factors pushing the demand for glycerin forward. The production of biodiesel also produces glycerin as a by-product. The increasing governmental initiatives for the utilization of biodiesel across multiple sectors, especially in countries like India and the USA, are estimated to propel the market forward.

Global Glycerin Market Growth Drivers vs. Challenges:

Opportunities:

- Growing demand for the cosmetics sector: The increasing global demand for cosmetics and personal care products is propelling the market expansion. In this sector, glycerin is commonly used to formulate various creams and serums. It helps in providing a smooth texture to the skincare products.

- Increasing application in the pharmaceutical sector: In the pharmaceutical sector, glycerin offers key applications across multiple products. Glycerin improves the taste and smoothness of various drugs, like tablets and capsules. It is also used in the formulation of cough syrups, as glycerin helps in preventing throat irritation and reducing coughing. The increasing global demand for the pharmaceutical sector is also among the key factors pushing this market forward worldwide.

Challenges:

- Rising demand for synthetic alternatives: The increasing demand for synthetic substitutes, like propylene glycol, is among the key factors restricting the global glycerin market growth during the forecasted timeline. The demand for synthetic alternatives witnessed major growth, especially in industrial applications, along with utilization in the cosmetics and pharmaceutical sectors.

Global Glycerin Market Regional Analysis:

- North America: The North American region is expected to grow considerably during the forecast period. This is attributable to the chemical, petrochemical, and food and beverage industries, which are also contributing to the regional market position.

Global Glycerin Market Competitive Landscape:

The market is fragmented, with many notable players including Cargill, Incorporated, Kao Corporation, BIODEX TRADING GmbH, Wilmar International Ltd., Louis Dreyfus Company, Godrej Industries Limited, Vance Group Ltd., ADM, BASF SE, Dow, Croda International Plc, Procter & Gamble, Emery Oleochemicals, Pilot Chemical Company, and SEPPIC S.A., among others.

Product Launch: In October 2024, Argent Energy, a global leader in bio-based fuels, launched technical grade, bio-based glycerin, which is specifically designed for the chemical market. The company also opened its glycerin refinery at the port of Amsterdam, producing about 50,000 tons of bio-based glycerin.

Glycerin Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Glycerin Market Size in 2025 | US$3.871 billion |

| Glycerin Market Size in 2030 | US$5.501 billion |

| Growth Rate | CAGR of 7.28% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in Glycerin Market | |

| Customization Scope | Free report customization with purchase |

The Global Glycerin Market is analyzed into the following segments:

By Grade

- Crude Glycerin

- Refined Glycerin

By Source

- Biodiesels

- Fatty Acids

- Fatty Alcohols

- Other Sources

By Application

- Pharmaceuticals

- Food and Beverage

- Personal Care and Cosmetics

- Industrial Chemicals

- Others

By Region

- North America

- Europe

- Asia Pacific

- South America

- Middle East & Africa