Report Overview

Global Craft Spirits Market Highlights

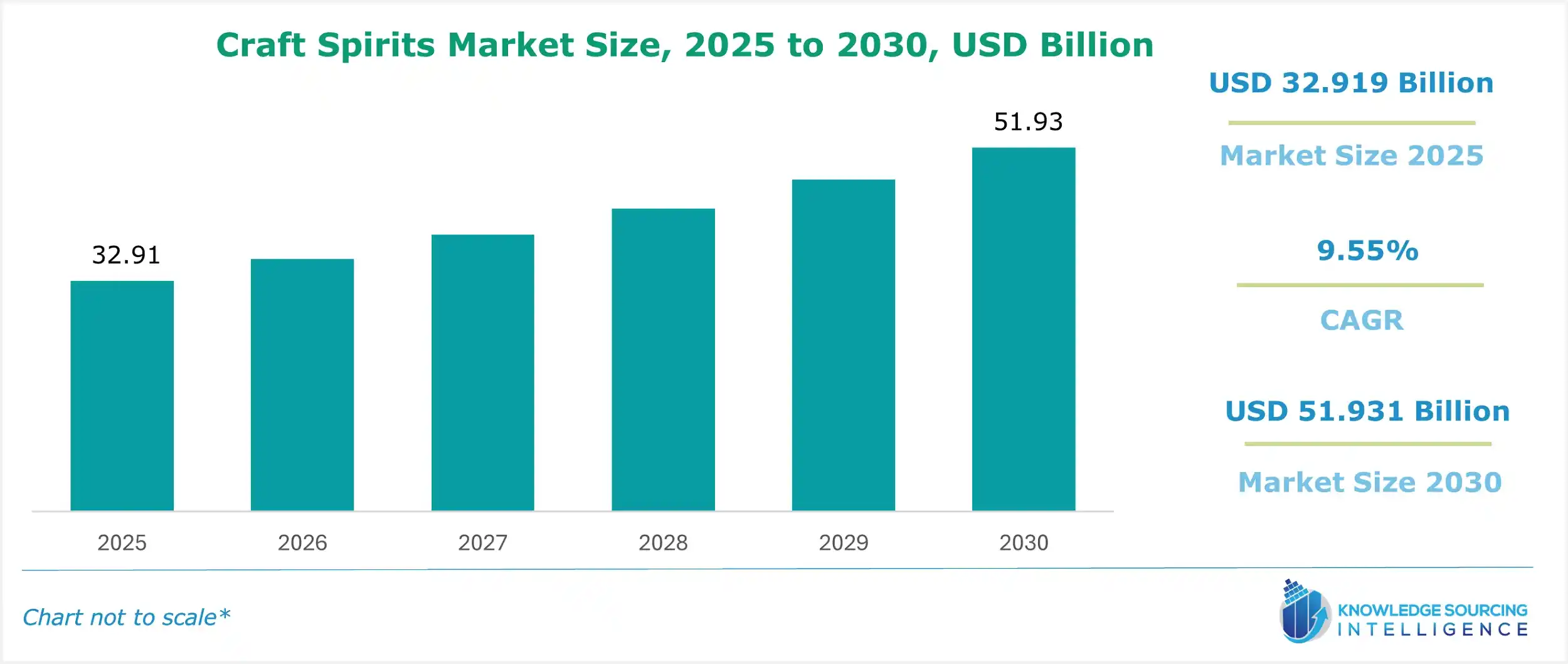

Craft Spirits Market Size:

The Global Craft Spirits Market is expected to grow from USD 32.919 billion in 2025 to USD 51.931 billion in 2030, at a CAGR of 9.55%.

The craft spirits market represents a vibrant and rapidly growing segment of the global alcoholic beverage industry, defined by small-batch, artisanal production that prioritizes quality, authenticity, and innovation. Craft spirits are typically produced by independent distilleries that emphasize locally sourced ingredients, unique flavor profiles, and traditional or experimental distillation techniques. This market caters to consumers seeking premium, experiential, and story-driven drinking experiences, reflecting a broader cultural shift toward craftsmanship, sustainability, and individuality in the beverage sector.

The market encompasses a diverse range of products, including whiskey, gin, rum, brandy, flavored liqueurs, and other specialty spirits, distributed through on-trade channels (bars, restaurants, and pubs) and off-trade channels (retail stores, supermarkets, and e-commerce platforms). Geographically, the market spans North America, Europe, Asia Pacific, South America, and the Middle East and Africa, each region contributing distinct cultural and economic dynamics to its growth.

The craft spirits market is experiencing significant expansion, driven by evolving consumer preferences, rising disposable incomes, and a growing appreciation for artisanal products. The market is particularly strong in North America, fueled by a robust cocktail culture, and in Asia Pacific, where Westernization and rising affluence are boosting demand. However, challenges such as regulatory complexities, high production costs, and competition from larger brands pose restraints, particularly for smaller distilleries. This introduction provides a comprehensive overview of the market’s key drivers, restraints, and major segments, offering insights for industry experts navigating this dynamic sector.

Craft Spirits Market Growth Drivers:

The craft spirits market is propelled by several key drivers that reflect consumer trends and industry innovations, creating opportunities for craft distillers to thrive.

- Growing Consumer Demand for Premium and Artisanal Spirits: Consumers, particularly millennials and Generation Z, are increasingly drawn to high-quality, small-batch spirits that offer unique flavors and authentic brand narratives. This trend is evident in the rising popularity of craft whiskey and gin, which emphasize local ingredients and traditional methods.

- Expansion of Cocktail Culture and Mixology: The global rise of cocktail culture has significantly boosted demand for craft spirits, as bartenders and consumers seek innovative and high-quality ingredients for cocktails. High-end bars and restaurants are leveraging craft spirits to create bespoke drinks, enhancing the on-trade channel’s prominence. In 2023, Hong Kong was the ninth-largest importer of spirits in the world. The city's international imports were 30 percent above pre-pandemic levels and hit a record value of $779 million. Domestic consumption increased sharply last year as on-trade and off-trade sales posted impressive growth. Sales of spirits are likely to rise, following the recently reduced duties, increased interest in cocktails among consumers, and tourists coming back into the city.

- Rising Disposable Incomes and Urbanization: Increasing disposable incomes in emerging markets such as China, India, and Brazil have enabled consumers to spend more on premium craft spirits. Urbanization further amplifies this trend, with affluent urban consumers seeking luxury and experiential drinking experiences. In the financial year ending (FYE) 2023 median household disposable income in the UK was £34,500, a decrease of 2.5% from FYE 2022, based on estimates from the Office for National Statistics (ONS) Household Finances Survey (HFS).

- Focus on Sustainability and Local Sourcing: Consumers are prioritizing brands that emphasize eco-friendly practices and locally sourced ingredients. Craft distilleries are responding by adopting sustainable production methods, such as organic certifications and recyclable packaging.

These drivers highlight the market’s shift toward premiumization, authenticity, and sustainability, positioning craft spirits as a high-growth segment within the global spirits industry.

Craft Spirits Market Restraints:

Despite its growth potential, the craft spirits market faces several challenges that impact distilleries, particularly smaller operations.

- Complex Regulatory and Licensing Requirements: Craft distilleries must navigate stringent regulations related to production, distribution, and labeling, which vary across regions. Current regulations under the Federal Alcohol Administration Act (FAA Act) do not require the disclosure of major food allergens on alcohol beverage labels. However, TTB has issued a notice of proposed rulemaking, Notice No. 62, 71 FR 42329, which proposes to make the labeling of major food allergens mandatory. In addition, we have published an interim rule, T.D. TTB-53, 71 FR 42260, which sets forth standards for optional allergen labeling statements.

- High Production Costs and Limited Scalability: Craft spirits production is labor-intensive and relies on premium, often locally sourced ingredients, resulting in higher costs compared to mass-produced spirits. Small and medium-sized distilleries lack the economies of scale of larger producers, limiting their ability to compete on price or expand production. This challenge is particularly acute for new entrants with limited capital.

- Intense Competition from Large Brands: The craft spirits market faces competition from multinational companies launching or acquiring craft-style brands to capture market share. These larger players leverage extensive distribution networks and marketing budgets, challenging smaller brands’ visibility.

These restraints underscore the need for craft distilleries to adopt innovative strategies, such as direct-to-consumer sales or partnerships, to mitigate operational and competitive challenges.

Craft Spirits Market Segments:

By Product Type: Whiskey

- Market Dominance: Whiskey is the leading product type in the craft spirits market, driven by its versatility, rich flavor profiles, and widespread consumer appeal. In 2024, whiskey accounted for a significant portion of craft spirits sales, particularly in North America and Europe, due to its popularity in both cocktails and standalone consumption.

- Consumer Appeal: Craft whiskey’s unique taste, often enhanced by innovative aging techniques and local ingredients, resonates with consumers seeking premium experiences. For example, in December 2024, DIAGEO India announced the launch of India Rare Spirits, an exclusive cask program that redefines luxury whisky ownership through personalized craftsmanship. This initiative offers connoisseurs the unique opportunity to own a bespoke expression of rare, aged malts meticulously crafted to reflect individual tastes and stories.

- Growth Factors: Innovations such as flavored whiskeys and health-focused variants infused with herbs and spices are driving demand. Whiskey’s perceived health benefits, such as high polyphenol content that may support heart health, further enhance its appeal, particularly in markets like the U.S., where health-conscious drinking is on the rise.

Whiskey’s dominance reflects its ability to cater to diverse consumer preferences, making it a cornerstone of the craft spirits market.

By Craft Spirit Distilleries Size: Small

- Market Significance: Small distilleries, typically producing less than 750,000 gallons annually, are the heart of the craft spirits market, driving innovation and authenticity. U.S. craft spirits market volume reached 14m 9-liter cases in retail sales, growing at an annual rate of 6.1%. In value terms, the market reached $7.9 billion in sales, growing at an annual rate of 5.3%. While there was still growth in 2022, it has slowed considerably from 2021, where craft spirits volume grew by 10.4% and value by 12.2%. U.S. craft spirits market share of total U.S. spirits maintained a 4.9% share in volume and increased value share to 7.7% in 2022, up from 7.5% in 2021.

- Innovation and Flexibility: Small distilleries are agile, enabling them to experiment with unique flavor profiles and limited-edition releases.

Small distilleries are pivotal in shaping the craft spirits market, offering niche products that resonate with consumers seeking authenticity.

By Sales Channel: On-Trade Channel

- Market Leadership: The on-trade channel, including bars, restaurants, and pubs, dominates craft spirits sales, driven by the rise of cocktail culture and experiential drinking. In 2024, on-trade venues accounted for a significant share of craft spirits consumption, particularly in urban areas.

- Consumer Engagement: High-end bars and craft cocktail venues educate consumers about artisanal spirits through expert recommendations and bespoke cocktails.

- Urban Influence: The on-trade channel thrives in urban markets, where themed establishments like mezcalerías and gin bars attract consumers seeking premium experiences. This trend is strong in Europe and North America, where social drinking culture drives sales.

The on-trade channel’s dominance reflects its role in fostering consumer engagement and driving demand for craft spirits.

By Geography: North America

- Market Leadership: North America, particularly the U.S., leads the craft spirits market, driven by a robust network of craft distilleries and high consumer spending on alcoholic beverages. For instance, in December 2024, Suntory Holdings, a global beverage leader, announced the expansion of its US Ready-to-Drink (RTD) portfolio with the launch of MARU-HI, a new Japanese-inspired sparkling cocktail. MARU-HI launched in California in January 2025, with plans to expand to other states in the following year, and is a key part of Suntory’s ambition to become the leading global RTD company by 2030.

- Consumer Trends: North American consumers, particularly millennials and Generation Z, prioritize premium, locally sourced spirits, driving demand for innovative cocktails and sustainable brands. The region’s vibrant distillery scene and high purchasing power solidify its market leadership.

North America’s dominance is fueled by its cultural affinity for craft spirits, supportive regulatory environment, and strong consumer demand.

List of Top Craft Spirits Companies:

- St. George Spirits

- FEW Spirits

- High West Distillery

- Kings County Distillery

- Sipsmith

Craft Spirits Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Craft Spirits Market Size in 2025 | US$32.919 billion |

| Craft Spirits Market Size in 2030 | US$51.931 billion |

| Growth Rate | CAGR of 9.55% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in the Craft Spirits Market |

|

| Customization Scope | Free report customization with purchase |

Craft Spirits Market Segmentation:

- By Product Type

- Brandy

- Gin

- Whiskey

- Rum

- Flavored Liqueurs

- Others

- By Craft Spirit Distilleries Size

- Small

- Medium

- Large

- By Sales Channel

- On-Trade Channel

- Off-Trade Channel

- By Geography