Report Overview

Digital Asset Management Market Highlights

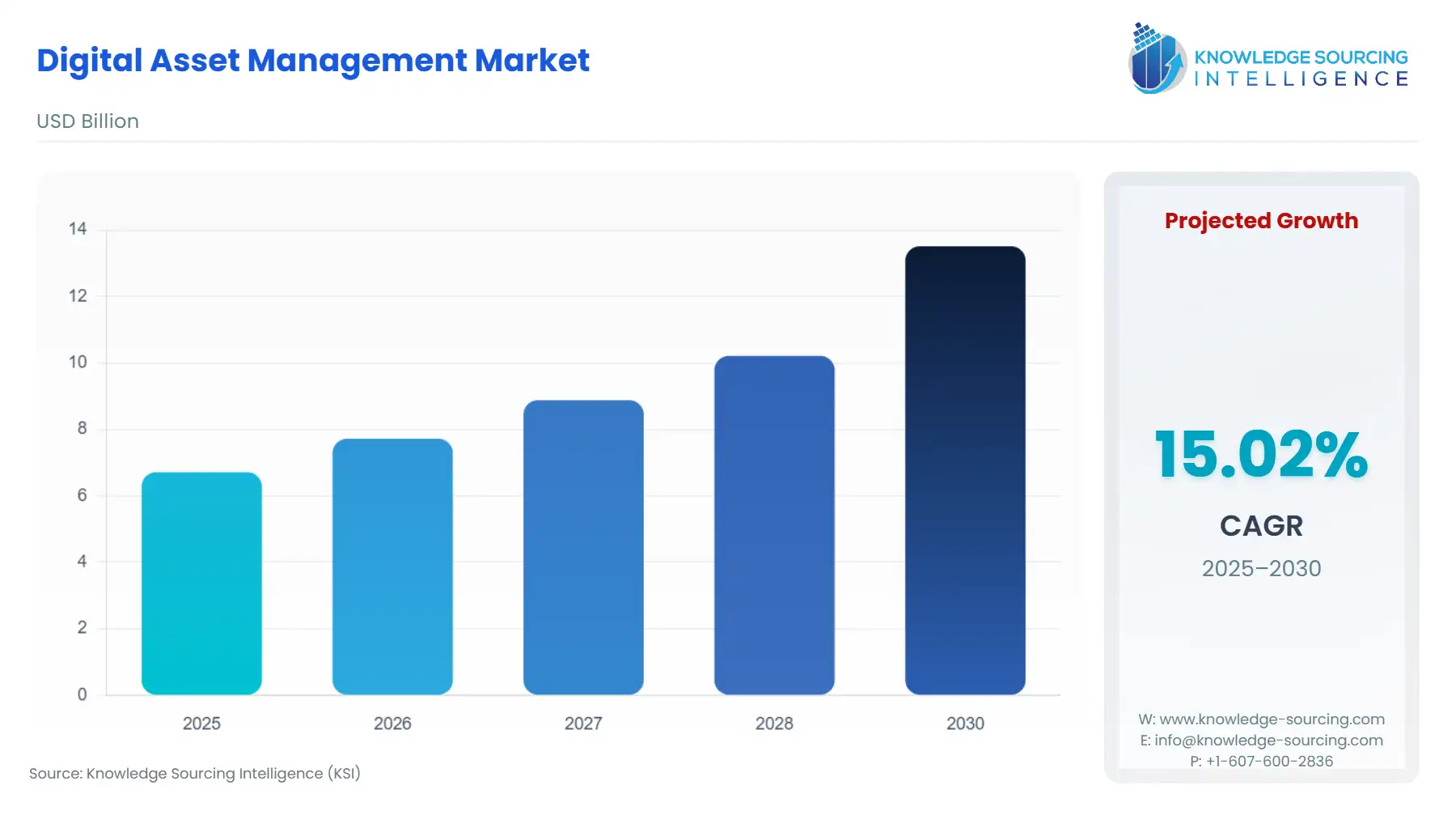

Digital Asset Management Market Size:

The Digital Asset Management Market is expected to grow from USD 6.714 billion in 2025 to USD 13.516 billion in 2030, at a CAGR of 15.02%.

Digital Asset Management (DAM) refers to the software systems that facilitate the centralized organization, storage, retrieval, and distribution of an organization's rich media content, including images, videos, documents, and creative files. This market is driven by the sheer volume and accelerating velocity of digital content creation necessitated by omnichannel marketing strategies and decentralized content production teams. DAM platforms are critical infrastructure for preserving brand consistency, enforcing intellectual property rights, and streamlining the content lifecycle from creation (Production Asset Management) to final distribution and archiving (Library Asset Management). The core value proposition for end-users is the ability to leverage their existing content library more effectively, thereby maximizing return on creative investment and minimizing time-to-market for new campaigns and products.

Digital Asset Management Market Analysis:

- Growth Drivers

The key factor propelling market demand is the proliferation of digital content across every industry, driven by the shift to digital-first customer engagement models and the imperative for personalized marketing. The increasing requirement for businesses to deliver content across numerous channels, social media, e-commerce, and mobile apps, simultaneously compels demand for central systems like DAM that can efficiently store, find, and repurpose assets at scale. Furthermore, the verifiable introduction of Generative AI tools within platforms enhances productivity by automating metadata tagging, search refinement, and derivative asset generation, directly creating new value-based demand by promising faster content output and reducing manual effort for creative teams. The absence of specific US tariffs on core DAM software as an intangible service minimizes direct cost inflation, but tariffs on underlying cloud computing hardware (servers, networking gear) subtly increase the operational cost for Cloud providers, which is subsequently factored into subscription pricing.

- Challenges and Opportunities

A primary challenge facing the DAM market is the significant initial investment and complexity involved in migrating legacy assets and integrating the DAM system with an organization's existing MarTech and IT stack (e.g., CMS, PIM, ERP). This integration difficulty acts as a constraint, particularly for mid-sized enterprises. The greatest opportunity lies in the evolution of DAM into a Content Hub or Content Supply Chain Orchestrator. By moving beyond simple file storage, platforms can leverage AI to dynamically tailor and syndicate content variations automatically for personalized campaigns. This shift to active content orchestration directly creates premium demand for highly integrated, API-driven Cloud solutions that automate the entire content lifecycle from asset creation to multi-channel deployment, transforming DAM from a repository into a crucial revenue enablement tool.

- Supply Chain Analysis

Digital Asset Management systems, being software-as-a-service (SaaS) or licensed software, do not have a traditional physical raw material supply chain. However, their operational supply chain is critical and resides entirely in the software and cloud infrastructure pipeline. The primary production hubs are the global centres for software development and data centre operations (e.g., North America, Western Europe, and specialized outsourcing centres in Asia). Key dependencies include a concentrated supply of skilled AI/ML data science talent necessary for developing and refining features like auto-tagging and generative asset creation, and the global availability and pricing stability of hyperscale cloud infrastructure (AWS, Azure, Google Cloud). Logistical complexity is centred on ensuring continuous global accessibility, low latency, and adherence to regional data residency laws, which drives specialized demand for multi-region Cloud deployment capabilities and localized data storage.

Government Regulations

Regulations are increasingly imposing strict data governance and intellectual property (IP) requirements that directly influence DAM system design and adoption, moving it from an optional marketing tool to a regulatory compliance mechanism.

|

Jurisdiction |

Key Regulation / Agency |

Market Impact Analysis |

|

European Union |

General Data Protection Regulation (GDPR) |

GDPR mandates strict control over personal data, which often includes images and videos of identifiable persons stored in a DAM. This regulation compels demand for robust DAM features that can track consent expiration, restrict access, and automate the "right to erasure." This elevates the importance of metadata and access controls for all European end-users, especially in Retail and BFSI. |

|

United States |

Copyright Law and Intellectual Property Enforcement |

The rigorous enforcement of US Copyright Law, particularly regarding the commercial use of licensed stock images, videos, and fonts, drives demand for DAM systems with advanced rights management features. Companies require systems that can accurately track license expiration dates, usage restrictions, and geographic limits directly linked to the asset, mitigating the legal and financial risks of non-compliance. |

|

European Union |

Digital Operational Resilience Act (DORA) |

Effective in the EU financial sector, DORA imposes stringent requirements on financial entities and their third-party ICT service providers (including Cloud DAM vendors) regarding digital operational resilience, data backup, and recovery. This regulation intensifies demand from the BFSI segment for DAM solutions that can demonstrate verifiable, high-availability, secure, and geographically resilient infrastructure, prioritizing established vendors with proven compliance records. |

Digital Asset Management Market Segment Analysis:

- By Type: Production Asset Management

Production Asset Management (PAM) systems are specifically designed to manage digital assets during the active creation and post-production phases, often characterized by work-in-progress files, large file sizes, and rapid versioning. The core demand driver is the increasing volume and complexity of high-resolution video and rich media creation, particularly within the Media & Entertainment and large Retail sectors. Modern creative workflows involve multiple collaborators across different locations needing real-time access to raw footage, layered design files, and dynamic previews. PAM solutions capture demand by offering features like deep integration with professional creative tools (e.g., Adobe Creative Cloud), high-speed file transfer acceleration, and immediate check-in/check-out capabilities. This minimizes production bottlenecks and reduces the time required for post-production approval cycles, directly addressing the creative imperative for high content velocity and rapid iteration required by marketing teams.

- By End-User Industry: Retail

The Retail industry represents a powerful and growing source of demand for DAM, driven by the omnichannel marketing imperative and the explosion of product-specific imagery. The central demand driver is the necessity to manage, customize, and rapidly deploy product visuals across thousands of simultaneous touchpoints, including e-commerce platforms, third-party marketplaces, social media feeds, and printed catalogues. Each product often requires tens of localized, size-specific, and context-specific images and videos. A DAM solution directly generates demand by solving this massive logistical and brand consistency challenge, serving as the "single source of truth" for all product imagery. The integration of DAM with Product Information Management (PIM) and e-commerce platforms is crucial, ensuring that every front-end system always pulls the latest, brand-compliant, and accurately rights-managed asset for every SKU, thereby mitigating errors that lead to customer friction and returns.

Digital Asset Management Market Geographical Analysis:

- US Market Analysis (North America)

The US market exhibits mature demand characterized by early and high-scale enterprise adoption across Media & Entertainment and Retail. Local factors significantly driving demand include a highly competitive and advertising-intensive corporate environment that necessitates rapid content creation cycles and a strong culture of intellectual property enforcement. This competitive intensity compels large US corporations to invest in sophisticated, API-first Cloud DAM solutions to gain a content velocity advantage. Furthermore, the presence of major tech hubs and a large volume of SaaS companies ensures a robust ecosystem for innovation and vendor choice, though the high cost of skilled labour often makes automation features a core demand requirement for cost-conscious IT departments.

- Brazil Market Analysis (South America)

The Brazilian market is defined by rapid digital transformation and the need for global brands to localize content for the Portuguese-speaking consumer base. The key local factor impacting demand is the concentration of marketing expenditure on rapidly expanding social media and mobile platforms. This necessitates DAM systems capable of efficient Brand Asset Management and quick localization features, directly driving demand from large multinational CPG (Consumer Packaged Goods) and Retail firms operating in Brazil. Adoption is heavily skewed towards Cloud solutions due to lower up-front capital requirements compared to on-premises infrastructure, making DAM accessible to a greater number of rapidly scaling regional businesses.

- Germany Market Analysis (Europe)

The German market is characterized by strong manufacturing and highly regulated financial sectors, leading to a focus on security and data integrity. The local factor driving demand is the strict enforcement of European data residency and compliance regulations (e.g., GDPR, DORA for BFSI). German companies, known for their rigorous IT standards, often generate high demand for DAM solutions that offer guaranteed regional data hosting options (either private Cloud or compliant On-Premises installations) and robust audit trails for asset usage and version control, prioritizing vendors that demonstrate certified compliance and enterprise-grade security.

- United Arab Emirates Market Analysis (Middle East & Africa)

The UAE market is fueled by massive government investment in smart city initiatives and the rapid establishment of major international commercial hubs. The local factor driving demand is the high concentration of international marketing and media production agencies and the creation of large, new public sector digital repositories. This generates unique demand from the Government and large corporate entities for high-capacity, multi-language DAM solutions that can handle both public-facing marketing assets and secure, sensitive documents, often requiring systems with high uptime guarantees and local service support.

- India Market Analysis (Asia-Pacific)

The Indian market is experiencing one of the fastest rates of digital adoption globally, particularly in e-commerce and media consumption. The key local factor driving demand is the sheer volume of first-time internet users and the proliferation of regional language content. This necessitates DAM systems that can manage content in multiple Indian languages, offering efficient search and categorization across diverse script formats. The strong preference for mobile-first marketing across Retail and Media & Entertainment directly compels demand for Cloud-based DAM solutions that can efficiently deliver lightweight, optimized asset versions to low-bandwidth mobile networks nationwide.

Digital Asset Management Market Competitive Environment and Analysis:

The DAM competitive environment is highly fragmented, featuring major enterprise content management (ECM) conglomerates and specialized, pure-play DAM vendors. Competition is centred on system extensibility, integration depth with adjacent platforms, and the speed of AI feature deployment.

- OpenText Corporation

OpenText is positioned as an enterprise information management giant, leveraging acquisitions to assemble a comprehensive suite that includes DAM as a component of its wider Experience Cloud offerings. OpenText strategically addresses demand from large-scale, highly regulated enterprises, such as Government and BFSI, that require DAM integrated seamlessly with enterprise content management (ECM), security, and compliance platforms. Their product, OpenText Digital Asset Management (formerly Media Management), is known for its ability to handle massive file volumes and complex workflows, offering flexibility for both Cloud and private On-Premises deployments, thereby capturing the compliance-driven market segment.

- Widen

Widen, a pure-play DAM vendor, focuses on delivering a user-friendly, cloud-native DAM platform, the Widen Collective. Widen's strategic positioning targets marketing and creative teams in the Retail, consumer goods, and education sectors, prioritizing ease of use, swift deployment, and robust integration capabilities. The Widen Collective captures demand by offering a centralized hub that manages brand guidelines (Brand Asset Management) and automates content distribution to various marketing channels. Their commitment to the SaaS model and continuous, rapid feature deployment, including advanced metadata and AI capabilities, makes them highly competitive in the agility-focused marketing technology segment.

- H.P Development Company L.P (Brandfolder Inc.)

Brandfolder, now a part of H.P. Development Company L.P., positions itself as a modern, aesthetically driven DAM solution, primarily focused on Brand Asset Management and simple, elegant distribution. Brandfolder's platform is designed to be highly intuitive for non-technical users, making it particularly appealing to marketing, sales, and external partners. The system drives demand by solving the critical problem of brand consistency through features that automate content approval, manage usage rights, and provide clear access to approved brand assets globally. Its cloud-native architecture and API-first design enable rapid integration with sales enablement and web content management systems, servicing the need for quick, on-brand content deployment.

Digital Asset Management Market Developments:

- January 2026: Adobe announced its feature release (2026.1.0) for Adobe Experience Manager (AEM) as a Cloud Service, integrating AI-assisted Java development and snapshot capabilities for Rapid Development Environments.

- December 2025: Bynder expanded its agentic AI capabilities with the launch of the Compliance Agent, designed to autonomously audit DAM libraries against legal guidelines and brand standards at scale.

- October 2025: Canto launched Canto XI, the 11th generation of its platform, introducing four new AI-powered products, Brand Studio, Approval Hub, AI Library Assistant, and Media Publisher, to unify content lifecycles.

- September 2025: Bynder debuted its Agentic AI platform for enterprise DAM, enabling autonomous AI-driven content operations that automate discovery, enrichment, governance, and orchestration workflows at scale.

- September 2025: Aprimo introduced Future-Ready Content Operations, enhancing DAM with AI-driven predictive metadata dashboards, smart asset discovery, and intelligent automation to improve content management and personalization.

Digital Asset Management Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 6.714 billion |

| Total Market Size in 2031 | USD 13.516 billion |

| Growth Rate | 15.02% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Type, Deployment, End-User Industry, Geography |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

Digital Asset Management Market Segmentation:

- By Type

- Brand Asset Management

- Library Asset Management

- Production Asset Management

- By Deployment

- Cloud

- On-Premises

- By End-User Industry

- Media & Entertainment

- Government

- Healthcare

- BFSI

- Retail

- Education

- Others

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- France

- United Kingdom

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- China

- India

- Japan

- South Korea

- Indonesia

- Thailand

- Others

- North America