Report Overview

Global Digital Video Advertising Highlights

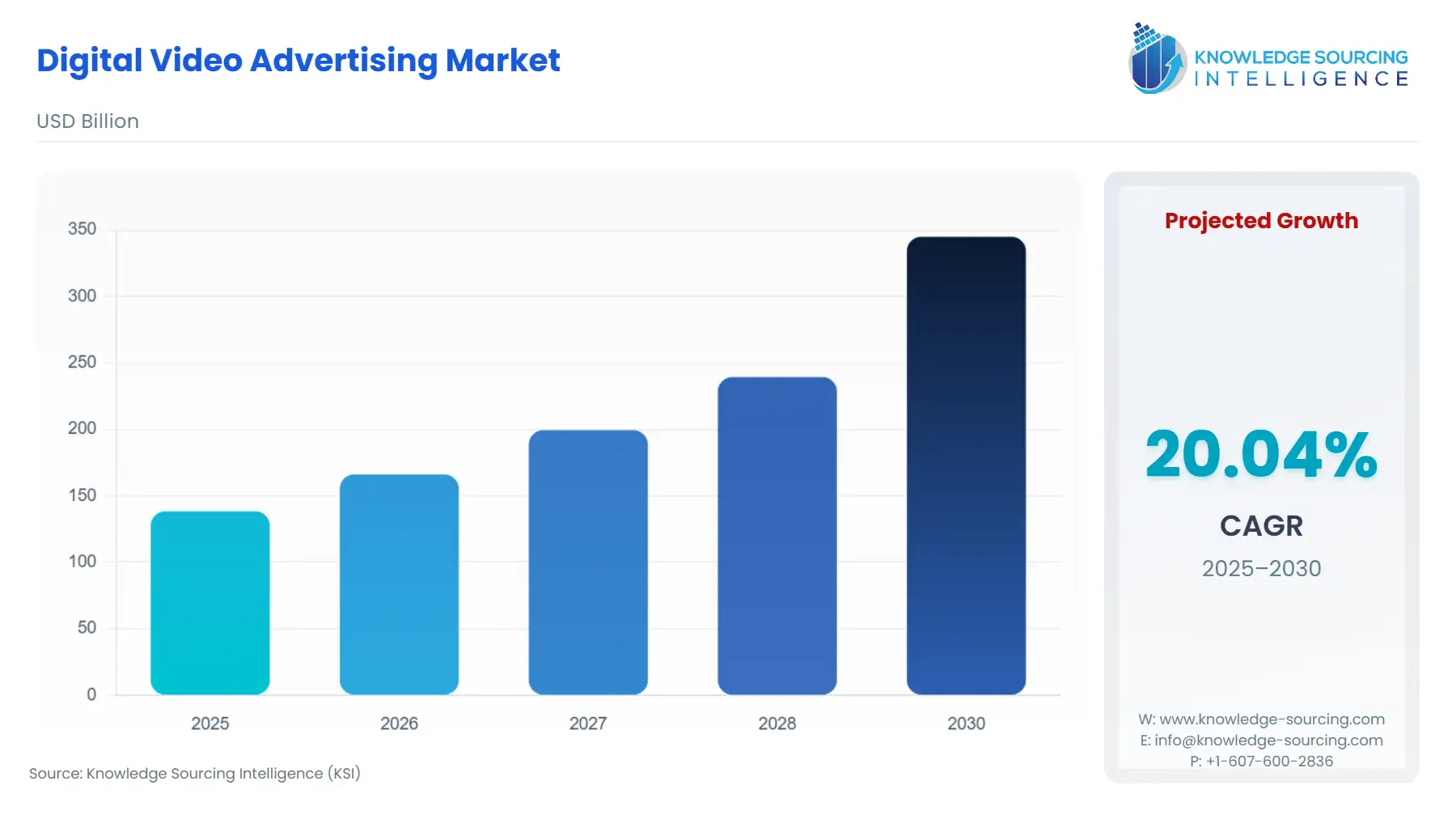

Digital Video Advertising Market Size:

The Digital Video Advertising Market will soar from USD 138.426 billion in 2025 to USD 345.023 billion by 2030, with a 20.04% compound annual growth rate (CAGR).

The digital video advertising market is defined by a continuous, rapid migration of audiences and budgets from linear television to streaming and social video platforms. This transformation is driven by ubiquitous high-speed internet access and the proliferation of connected devices, which fundamentally expands the addressable inventory pool for brands. The market's structural evolution necessitates a focus on technological agility, with programmatic efficiency and cross-platform measurement becoming core competencies. Industry growth is currently steered by the imperative to reconcile personalized, data-driven advertising effectiveness with increasingly stringent global privacy legislation, forcing a strategic realignment from audience tracking to contextual and first-party data strategies to sustain demand.

Global Digital Video Advertising Market Analysis

- Growth Drivers

The primary factor propelling market growth is the verified surge in Connected TV (CTV) and Mobile Video Consumption. This shift directly increases the available, high-value inventory, compelling advertisers to transfer budgets from traditional media to digital channels. The high-speed internet penetration, especially across Asia-Pacific economies, creates a fertile ground for seamless, high-definition video delivery, escalating demand for pre-roll and mid-roll placements. Furthermore, the increasing sophistication of Programmatic Advertising technology acts as a catalyst; the automation of ad placement, bidding, and optimization increases the efficiency and reach of video campaigns, lowering the barrier to entry and thereby intensifying demand for digital video advertising solutions across all end-user segments.

- Challenges and Opportunities

The primary constraint facing the market is the ongoing deprecation of third-party tracking mechanisms, driven by regulatory bodies and browser policy changes. Privacy mandates like GDPR mandate explicit user consent, increasing the operational cost and reducing the scale and effectiveness of classic audience-based targeting. This challenge, however, precipitates a significant opportunity: the resurgence and evolution of Contextual Targeting. Placing video advertisements based on the content of the viewing page, rather than on user data, offers a privacy-safe pathway to engage highly relevant audiences. The shift from surveillance-based metrics to performance models like Consented Engagement Rate (CER) and first-party data conversion value creates a new demand stream for advanced, privacy-compliant ad-tech solutions and new measurement frameworks.

- Supply Chain Analysis

The digital video advertising supply chain operates as a highly complex, interconnected digital ecosystem. It is primarily composed of Advertisers/Brands (the demand side), Publishers/Content Owners (the supply side, e.g., YouTube, Meta, CTV apps), Demand-Side Platforms (DSPs), and Supply-Side Platforms (SSPs). The core logistical complexity does not reside in physical shipment but in the real-time data flow and synchronization required for programmatic transactions. Key production hubs are centered around the tech headquarters in North America (US) and, increasingly, Asia-Pacific (China, India) where content platforms and ad-tech firms innovate. Market dependency is heavily concentrated on large "walled gardens" (Google, Meta), which control both content distribution and data access, creating transparency and interoperability challenges for the broader ecosystem.

Digital Video Advertising Market Segment Analysis

- In-Stream Advertisement (By Advertisement Type)

In-Stream advertising, which includes pre-roll, mid-roll, and post-roll video advertisements played before, during, or after video content, is the market's foundational segment. The core demand driver is the guarantee of high viewability and low ad avoidance inherent in its placement. For mandatory, full-length formats, advertisers are assured that their message is consumed, leading to greater brand safety and higher completion rates compared to out-stream formats. This segment's demand is further fueled by the growth of premium Advertising-Based Video On Demand (AVOD) and hybrid Subscription Video On Demand (SVOD) platforms (like YouTube and Disney+’s ad-supported tier). As media companies invest in original, high-quality content, they create a captive, engaged audience that advertisers are willing to pay a premium to reach. The ability for platforms to offer highly detailed segmentation of audiences, even with privacy-safe methods, maintains a robust demand for In-Stream inventory, as it facilitates sequential storytelling and maximises the effective reach of a video creative.

- Media & Entertainment (By End-Users)

The Media & Entertainment sector is a crucial end-user for digital video advertising, utilizing the medium for both self-promotion and monetization. Its demand is specifically driven by the fierce competition among Over-the-Top (OTT) streaming platforms to acquire and retain subscribers in a saturated market. Companies in this segment, spanning film studios, music labels, and content aggregators, leverage video ads to promote new releases, original series, and service tiers. The shift from one-time transactional models to sticky subscription services (SVOD/AVOD) necessitates continuous digital marketing to maintain subscriber numbers, directly fueling demand for targeted video ads on social, search, and competitive platforms. Moreover, as AVOD gains traction in cost-sensitive markets, Media & Entertainment companies become the primary suppliers of the most valuable, high-quality video ad inventory. The growth of esports and live-streamed gaming content also creates a high-demand sub-segment, as advertisers seek to engage the coveted, younger demographic that consumes entertainment almost exclusively through in-stream digital formats.

Digital Video Advertising Market Geographical Analysis

- US Market Analysis (North America)

The US market commands the highest spending due to its robust, advanced broadband infrastructure and the high consumer adoption of Connected TV (CTV) devices. The demand for digital video advertising here is propelled by the saturation of traditional advertising channels (print/radio) and the complete shift of major media holding companies' budgets toward programmatic CTV. Local factors, such as the implementation of state-level privacy legislation like the CCPA, also force a market response, accelerating the adoption of first-party data solutions among advertisers to maintain targeting efficiency.

- Brazil Market Analysis (South America)

In Brazil, market demand is intrinsically linked to high mobile device penetration and social video platform usage. With a significant portion of the population accessing the internet primarily via smartphones, mobile video advertisements, particularly short-form and vertical formats, dominate spending. The country's dynamic e-commerce sector fuels demand for direct-response video advertising, where brands leverage engaging, locally relevant video creatives on platforms like Instagram and TikTok to bridge discovery with immediate conversion.

- UK Market Analysis (Europe)

The UK market is largely defined by its position under the stringent GDPR and European Data Protection Board (EDPB) compliance regimes. This regulatory environment is the core demand-shaping factor, compelling advertisers to invest in sophisticated Ad-Tech solutions that facilitate privacy-compliant consent management and attribution. Demand is therefore focused on high-quality, auditable programmatic platforms, favoring technology that can offer transparency and first-party data integration over generalized behavioral targeting.

- Saudi Arabia Market Analysis (Middle East & Africa)

Demand in Saudi Arabia is strongly driven by its young, digitally native population and extremely high social media platform engagement rates. The market sees a high demand for video advertisements tailored for platforms like Snapchat, TikTok, and YouTube, where creators and influencers command significant consumer attention. The rapidly growing domestic e-commerce landscape further fuels demand for localized, entertaining, and Arabic-language video creatives to drive direct sales.

- China Market Analysis (Asia-Pacific)

China's digital video advertising demand is unique, dominated by domestic platforms like Douyin (TikTok’s mainland version) and Kuaishou, and intrinsically linked to its live-streamed e-commerce model. The integration of shoppable links and real-time purchasing within short-form and live video content is a key demand driver, creating a massive, dedicated market for performance-based, video-centric ad spend that focuses on immediate conversion rather than just brand awareness.

Digital Video Advertising Market Competitive Environment and Analysis

The global competitive environment is characterized by a high degree of market power concentrated in a few integrated platforms—the "walled gardens"—which offer end-to-end solutions combining audience, technology, and inventory. Competition centers on AI-driven optimization, cross-platform audience measurement, and the effective leveraging of first-party data.

- Google Inc. (YouTube, Google Ads)

Google’s strategic positioning is anchored by the unrivaled scale of YouTube, the world's largest video platform, and its unified Google Ads programmatic ecosystem. The company focuses on simplifying complex multi-channel buys through products like Performance Max, which utilizes Google AI to automatically serve video, search, and display assets across all Google properties, including YouTube, to drive conversion goals. This strategy directly appeals to the growing advertiser imperative for automated efficiency and cross-channel optimization, ensuring continuous demand for its full-funnel video advertising solutions.

- Meta Platforms Inc. (Facebook, Instagram, Reels)

Meta's competitive leverage resides in its dominant position in the social video and short-form content space via Instagram Reels and Facebook Video. The company’s strategic focus is on the creator economy and full-stack AI integration. By continuously launching new AI-powered tools for video creation and discovery, such as the introduction of Vibes, Meta ensures a constant, high-velocity flow of new video content. This organic supply of video content feeds its advertising inventory, maintaining high demand for its video ad products which benefit from its extensive first-party user data for precision targeting across its applications.

Digital Video Advertising Market Developments

The following verified developments demonstrate a continuing industry focus on AI-driven creative optimization, channel expansion, and brand safety. These events are verifiable and sourced directly from official company publications.

- November 2025: Google Launches New Brand Suitability Controls for YouTube Feed & Discover

Google expanded its Brand Suitability controls to include the YouTube Home Feed, Watch Next Feed, and Discover. This product enhancement, announced in the Google Ads Help center, establishes a consistent brand suitability experience across key placement environments. This development directly addresses advertiser concerns over brand safety in user-generated content environments, increasing confidence and, therefore, stimulating demand for these specific YouTube ad placements.

- November 2025: Google Integrates Waze Ads Inventory into Performance Max for Store Goals

Google announced the inclusion of Waze ads inventory within Performance Max campaigns targeting store goals for U.S. advertisers. This update allows businesses to appear as 'Promoted Places in Navigation' pins on Waze maps. The integration is a strategic capacity addition that leverages AI to drive real-world, in-store sales, creating new, measurable demand pathways for advertisers focused on localized conversion.

- September 2025: Meta Introduces Vibes for AI Video Creation and Discovery

Meta announced the early preview rollout of Vibes, a new feed of AI-generated short-form videos within the Meta AI app, alongside new AI visual creation and remix tools. This development is a core product launch focused on boosting the supply of video content on Meta’s platforms by making creation easier through AI. The increased supply of original, engaging video content serves to strengthen the overall video ecosystem, ultimately solidifying the platform’s inventory for advertisers.

Digital Video Advertising Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 138.426 billion |

| Total Market Size in 2031 | USD 345.023 billion |

| Growth Rate | 20.04% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Advertisement Type, Devices, End-User, Geography |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

Digital Video Advertising Market Segmentation:

- By Advertisement Type

- In-Stream Advertisement

- Out-Stream Advertisement

- Social Media Advertisement

- Others

- By Devices

- Smartphones & Tablets

- Desktops & Laptops

- Others

- By End-User

- Retail & E-Commerce

- Media & Entertainment

- BFSI

- Healthcare

- Automotive

- Others

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Israel

- Others

- Asia Pacific

- China

- India

- Japan

- South Korea

- Indonesia

- Thailand

- Taiwan

- Others