Report Overview

Dysprosium Market Size, Share, Highlights

Dysprosium Market Size:

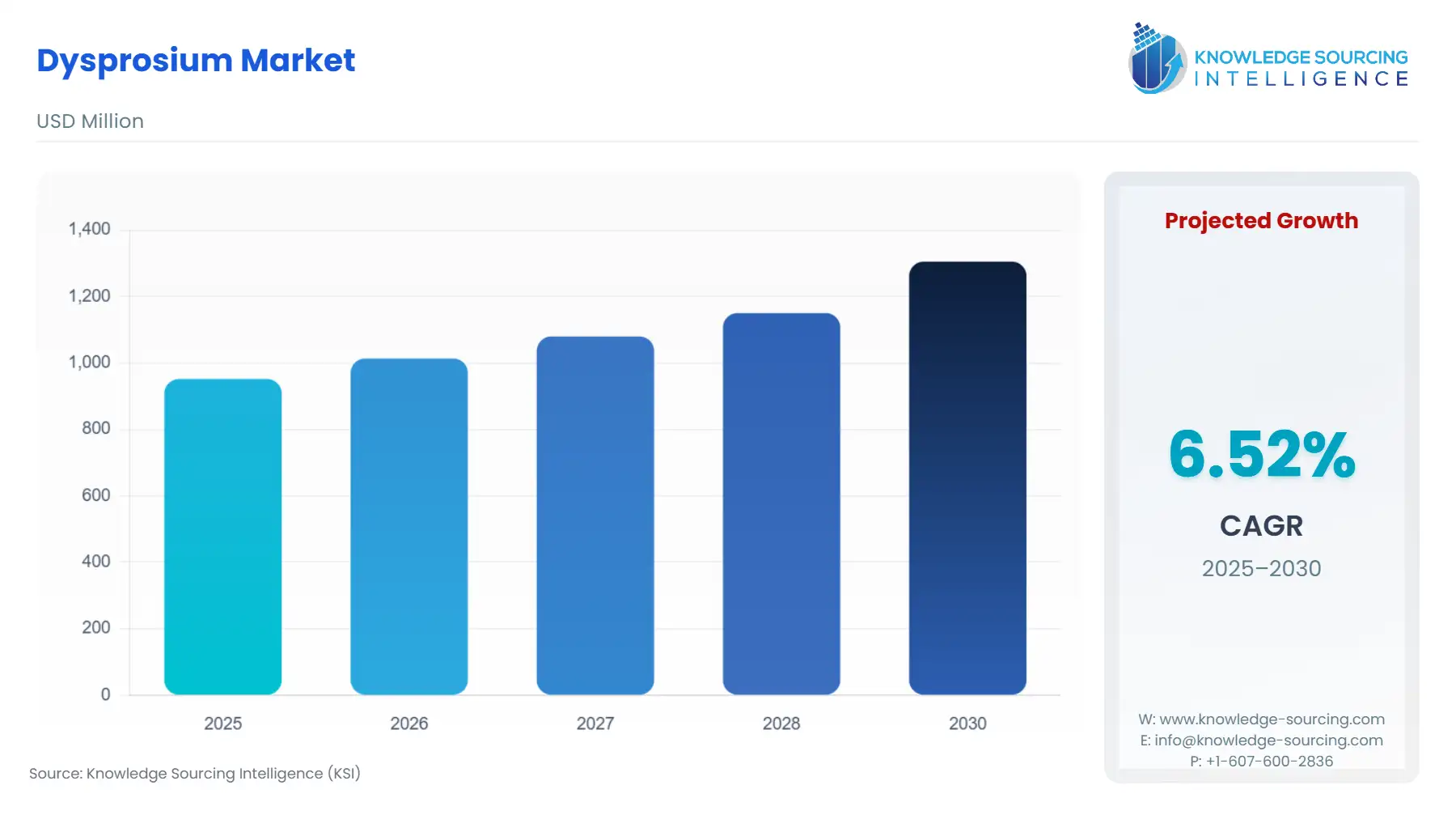

The dysprosium market is expected to grow at a CAGR of 6.51%, reaching a market size of US$1,305.285 million in 2030 from US$951.849 million in 2025.

Dysprosium is a soft silver metal with one of the strongest magnetic properties of any rare-earth metal, comparable only to holmium. It is frequently added to permanent rare earth magnets to improve their performance at higher temperatures. Dysprosium is used in lasers, commercial lighting, hard disks, and other devices requiring specific magnetic qualities. It can also be utilized in nuclear reactors and energy-efficient cars. Rising demand for electric vehicles is important in the dysprosium market’s growth.

Dysprosium Market Growth Drivers:

- The growing demand for electric vehicles will boost the dysprosium market growth.

As fossil-fueled vehicles are quickly being replaced with energy-efficient electric vehicles, the demand for dysprosium is increasing. Due to escalating environmental and climate change concerns, the demand for electric vehicles and eco-friendly vehicles has surged dramatically.

As more eco-friendly cars and electric vehicles (EVs) are used, the need for dysprosium in the automotive industry will likely rise. Many countries, particularly in Europe and North America, are progressively banning the use of fossil-fueled vehicles. For example, the United Kingdom aims to reach net-zero emissions by 2050.

Furthermore, the European Union has mandated a prohibition on new petrol and diesel vehicles beginning in 2035. The state of California in the United States of America has proposed a ban on new gasoline-powered passenger automobiles and trucks beginning in 2035. Eco-friendly vehicles will likely drive the global dysprosium market as nations tighten their stance on global warming and climate change.

- Multiple uses of dysprosium

Multiple uses of dysprosium are driving the overall demand for the metal. It is used in the manufacture of control rods for nuclear reactors, as it can absorb many neutrons without undergoing fission. This property of dysprosium is its high neutron capture cross-section. Further, dysprosium is used in deposition processes, including semiconductor deposition, chemical vapor deposition (CVD), and physical vapor deposition (PVD).

Data storage devices such as hard disks, floppy disks, compact disks, and flash drives can be produced with dysprosium alloys. As the demand for electronic devices like smartphones, laptops, tablets, computers, etc., increases, the demand for dysprosium would also increase in the market.

Due to their magnetic properties, dysprosium alloys are used in ships' sound navigation and range systems. They can also be employed to make laser devices. Vanadium dysprosium alloys are used in laser cutting, law enforcement, medicine, printers, and even communication. Dysprosium is used to manufacture nanofibers, which are strong and can, in turn, be used to reinforce other products.

Dysprosium Market Geographical Outlook:

- The Asia Pacific region will dominate the dysprosium market during the forecast period.

Based on geography, the global dysprosium market is segmented into the Americas, Europe, the Middle East and Africa, and the Asia Pacific regions. Major G20 economies like China, Japan, India, Australia, Indonesia, and South Korea dominate the Asia-Pacific region. Thailand, Malaysia, Singapore, Vietnam, Taiwan, etc., are the other emerging economies in this region.

The study found that China contributes the majority of mining and other commercial necessities for dysprosium, such as dysprosium concentrate, primary products, intermediate products, and final products. The main supplier of dysprosium in the world is China. China is also the most important trading country and consumer in the global dysprosium cycle. Japan is the world leader in importing dysprosium-containing products, especially in internal combustion engine vehicles, automation products, and household appliances.

Dysprosium Market Restraints:

- Environmental concerns regarding extraction are a major concern. Supply and production monopolies of a few nations could create price volatility and supply chain disruption.

Dysprosium Market Segment Analysis:

The dysprosium market is segmented by product into dysprosium metal, dysprosium oxide, dysprosium alloy, and others. By application, it is segmented into permanent magnets, phosphors, commercial lighting, halide lamps, and others.

Countries mainly rely on imports of dysprosium-containing final products to meet domestic demand. The rapid development of traditional and emerging industries has driven the demand for dysprosium, especially in high-tech industries such as electric vehicles, internal combustion engine vehicles, industrial robots, and wind turbines.

Dysprosium Market Key Developments:

- In June 2024, Australia-listed mining company Lynas Rare Earths announced it would start producing two separated heavy rare earth (HRE) products at its Malaysian facility by 2025. Lynas would start production of separated dysprosium and terbium. The facility would be designed to separate up to 1,500 t/yr of a mixed heavy rare earth compound containing mixed samarium, europium, gadolinium, holmium, dysprosium, and terbium (SEGH).

- February 2024, PNNL (Pacific Northwest National Laboratory) researchers achieved sustainable recovery of minerals from e-waste. It was first reported by the University of Washington. The experiment involved the successful separation of two essential rare earth elements, neodymium and dysprosium, from a mixed liquid. The two separate and purified solids formed in the reaction chamber in 4 hours, versus the 30 hours needed for conventional separation methods. These two critical minerals are used to manufacture permanent magnets found in computer hard drives and wind turbines, among other uses.

Dysprosium Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Dysprosium Market Size in 2025 | US$951.849 million |

| Dysprosium Market Size in 2030 | US$1,305.285 million |

| Growth Rate | CAGR of 6.51% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Million |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in Dysprosium Market |

|

| Customization Scope | Free report customization with purchase |

The dysprosium market is segmented and analyzed as follows:

- By Product

- Dysprosium metal

- Dysprosium oxide

- Dysprosium alloy

- Others

- By Application

- Permanent Magnets

- Phosphors

- Commercial Lightings

- Halide Lamps

- Others

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Rest of South America

- Europe

- United Kingdom

- Germany

- France

- Italy

- Spain

- Rest of Europe

- Middle East and Africa

- Saudi Arabia

- UAE

- Rest of the Middle East and Africa

- Asia Pacific

- China

- India

- Japan

- South Korea

- Taiwan

- Thailand

- Indonesia

- Rest of Asia-Pacific

- North America