Report Overview

Global Eye Health Supplements Highlights

Eye Health Supplements Market Size:

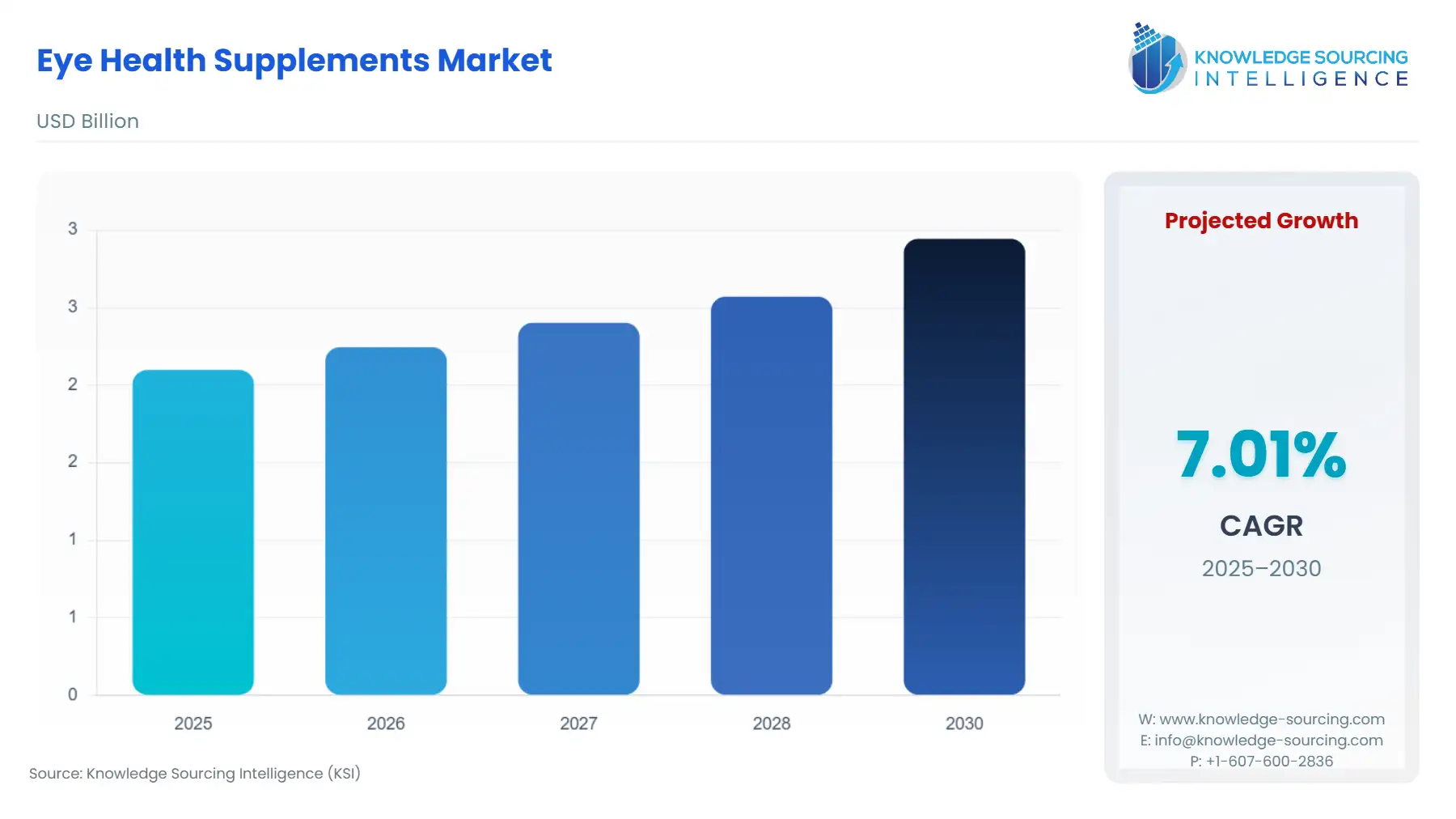

The Eye Health Supplements Market is projected to surge from USD 2.098 billion in 2025 to USD 2.944 billion by 2030, at a CAGR of 7.01%.

Eye Health Supplements Market Trends:

Eye health supplements refer to all those nutritional products that help to maintain eye health and reduce the effects of several eye disorders. These supplements come in the form of liquid drops, soft gels, capsules, and others. The global eye supplements market is projected to amplify at a significant rate during the forecast period. The key factors supporting the market growth include the globally growing awareness regarding the intake of eye health supplements and the growing prevalence of eye disorders.

In addition, the market is also projected to witness growth on account of the increasing myopic population in many parts of the world. Similarly, a growing geriatric population is also propelling the business growth opportunities for the market players over the forecast period since old people are more susceptible to eye disorders such as age-related macular degeneration (AMD) and diabetic retinopathy. Thus, growth in the number of diabetic people globally also plays a significant role in shaping the market growth during the given time frame. On the other hand, the increasing participation by the market players also supports the market growth significantly since active participation by major players operating in the market is actively participating in the form of increased investments in the R&D for the launch of new and enhanced products, which in turn, represents the growth potential of the market. Also, the expansion of distribution channels and the movement of market players to online channels to capture a greater market share further provides an impetus for market growth in the near future.

Eye Health Supplements Market Segment Analysis:

The segmentation of the global eye health supplements market has been done into type, form, indication, distribution channel, and geography. On the basis of type, the market has been classified as vitamins, minerals, fatty acids, and others. By form, the segmentation has been done as gels, capsules, liquids, and others. By indication, the classification of the market has been done as cataract, age-related macular degeneration, dry eye syndrome, and others. By the distribution channel, the market has been segmented into online and offline. Geographically, the global eye health supplements market has been segmented into North America, South America, Europe, the Middle East and Africa, and the Asia Pacific.

Eye Health Supplements Market Growth Drivers:

- Rising prevalence of eye disorders

The key factor that is propelling the demand for these supplements is the globally growing prevalence of common eye diseases and disorders. The increasing prevalence of eye diseases like cataracts and glaucoma is expected to drive the market for eye health supplements during the forecast period. For instance, according to the American Academy of Ophthalmology report in 2011, 2.71 million in the United States were having primary open-angle glaucoma which is expected to increase to 7.32 million by 2050 and the highest number among the population aged 70 and above.

Similarly, in the United States, approximately 12 million adults of ages 40 and above suffer from vision impairment out of which 1 million are blind, 3 million have vision impairment after correction, and 8 million have vision impairment due to uncorrected refractive error (Source: U.S Department of Health and Human Services). The department also predicts that people with uncorrectable vision impairment are projected to reach 8.96 million by the year 2050 which has been also supported by the fact that the increasing prevalence of diabetes and other chronic diseases will support this number.

- Growing ageing population

The rapid growth in the geriatric population who are more susceptible to eye disease or eye disorders also fuels the growth of the global eye health supplements market during the forecast period. Also, aged people suffer from numerous age-associated diseases. This, combined with a significant increase in the health-savvy people particularly in developed countries is supporting the demand for various supplements, thus playing a major role in shaping the growth for the next five years. For instance, as per the data from the World Bank Group, the geriatric population (65 years of age or older) in the United Kingdom has grown from a population size of 11.706 million in 2015 to a population size of 12.370 million in 2019.

Eye Health Supplements Market Geographical Outlook:

- APAC to witness healthy growth

Geographically, the North American region dominates the global market which is attributed to the availability of well-established healthcare infrastructure across the region coupled with the presence of a larger health-savvy population base in countries such as the United States and Canada. On the other hand, the Asia Pacific region is projected to show healthy growth due to emerging local market players and growing eye health awareness across several countries of the region.

Eye Health Supplements Market Key Developments:

There is a high volume of companies working in the global eye health supplements market, however, some have solidified their position as the leading providers in this industry. These players are involved in a plethora of investments, product launches, and R&D as a part of their growth strategies to further strengthen their position and provide better products and services to their customers worldwide, which is further expected to propel the growth of the market in the coming years. Some of the following are:

- In October 2020, Nature's Way, an emerging dietary supplements provider announced the launch of a range of kid's products that cater to the multiple health needs of children which also includes Nature's Way Healthy Eyes, a supplement for healthy eye function.

- In June 2020, Netsurf, a Pune-based company announced the launch of three new products under its healthcare range to deal with lifestyle disorders which include Naturamore Eye Care for the health of the eye.

- December 2019, Bausch & Lomb Incorporated announced the launch of PreserVision AREDS 2 Formula mini gel eye vitamins in the U.S.

Eye Health Supplements Market Competitive Insights

The players in the global eye health supplements market are implementing various growth strategies to gain a competitive advantage over their competitors in this market. Major market players in the market have been covered along with their relative competitive strategies and the report also mentions recent deals and investments of different market players over the last few years. The company profiles section details the business overview, financial performance (public companies) for the past few years, key products and services being offered along with the recent deals and investments of these important players in the global eye health supplements market.

Eye Health Supplements Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 2.098 billion |

| Total Market Size in 2031 | USD 2.944 billion |

| Growth Rate | 7.01% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Type, Form, Indication, Geography |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

Eye Health Supplements Market Segmentation:

- By Type

- Minerals

- Vitamins

- Fatty Acids

- Others

- By Form

- Minerals

- Vitamins

- Fatty Acids

- Others

- By Indication

- Minerals

- Vitamins

- Fatty Acids

- Others

- By Distribution

- Minerals

- Vitamins

- Fatty Acids

- Others

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- France

- United Kingdom

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- China

- India

- Japan

- South Korea

- Indonesia

- Thailand

- Others

- North America