Report Overview

Global Pollination Market Report Highlights

Pollination Market Size:

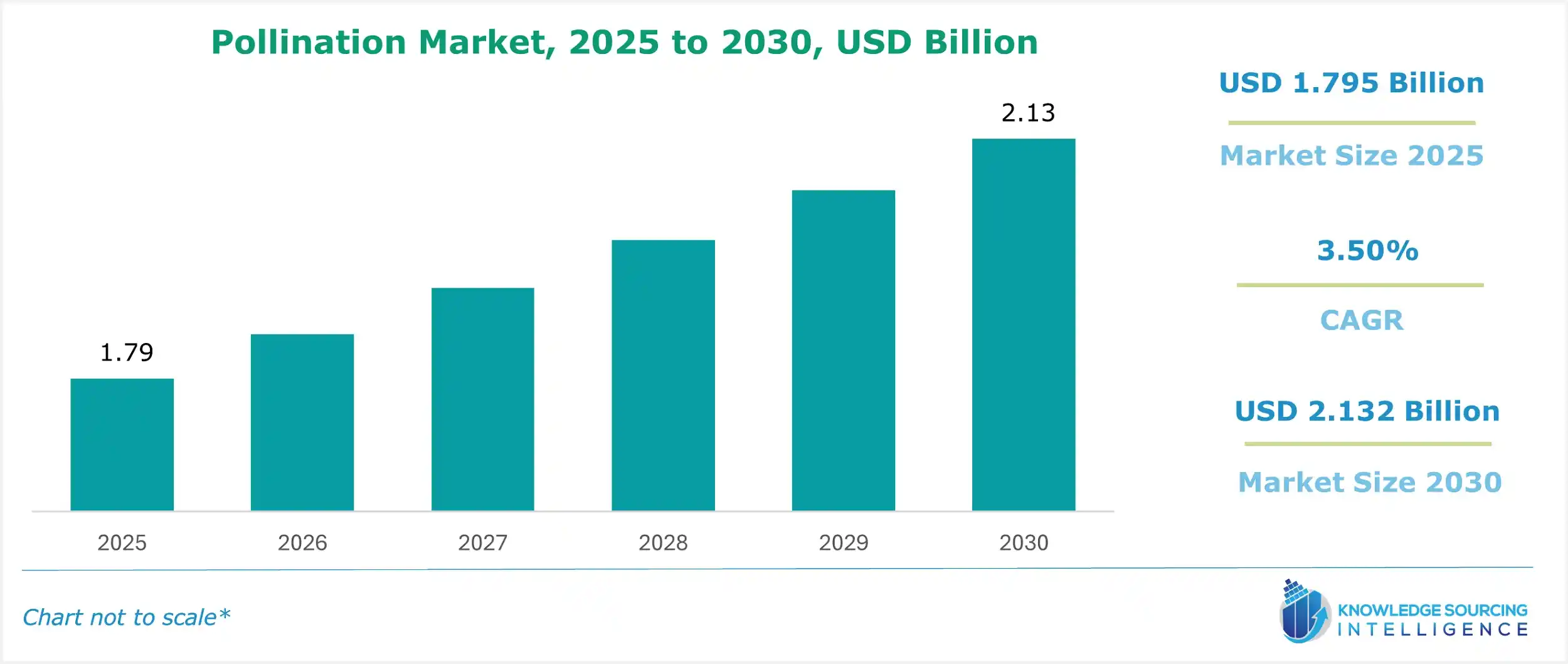

The global pollination market is projected to grow at a CAGR of 3.50% over the forecast period, increasing from US$1.795 billion in 2025 to US$2.132 billion by 2030.

Pollination Market Highlights:

- Growing demand for pollination services boosts crop yield and quality.

- Technological advancements enhance precision in managed pollination solutions.

- Declining wild pollinator populations increase reliance on commercial pollination.

- Sustainable agriculture trends drive the adoption of eco-friendly pollination practices.

Pollination Market Introduction:

The demand for pollination services is estimated to grow in the coming years due to an increasing need to accelerate the development of the agriculture sector, thereby providing a boost to the economy. Moreover, there are rising concerns among the market players to boost pollination activities.

Furthermore, the adoption of AI-integrated models in analyzing different pollinator activities and improving pollination techniques is going to provide an opportunity for the end-user industries to increase their market share and bolster market growth further. However, the seasonal production of California Almonds, which is a highly popular product in the North American region and globally, is hindering the market growth. In addition, the use of pesticides is also depleting the pollinator colonies, which is adding to the restraints being imposed on market growth.

Geographically, North America is estimated to hold a considerable share over the forecast period, owing to the fact that there is a surging demand and increased production of California almonds by pollinators. The Asia Pacific region is expected to witness significant growth over the forecast period, owing to the fact that there are increasing initiatives being taken by the government in order to boost the agriculture sector in countries such as India.

_______________________

Global Pollination Market Overview & Scope:

Pollination is the process through which pollens are transferred from a male species of a plant to a female species. It helps in increasing the efficiency and yield of crops and boosts the quality of the seed. Pollination services also help in developing a genetically diverse population of plants.

The rising demand for floriculture globally is propelling the pollination market’s growth. Pollination plays a critical role in the production of flowers. The total production of floriculture in the global market witnessed massive growth. The US Department of Agriculture stated that in 2023, the total number of floriculture producers in the USA was recorded at 10,216, a drastic increase from 8,949 flower producers in 2022. The agency further stated that the total value of floriculture sales increased to US$6.69 billion in 2023.

In the USA, Florida accounted for about US$1,208 million in floriculture sales, followed by California and Michigan with US$983 million and US$695 million, respectively.

Pollination Market Key Players:

Some of the major companies include Biobest Group NV, Bee Farms Products, and Koppert.

- Bee Farms Products is among the leading pollination service providers based in India. The Company offers a wide range of products and solutions, including natural honey, flora honey, hydroponics, herbal cosmetics, and infused natural honey, among many others.

- Biobest Group NV is a global subsidiary of Floridienne, which offers a wide range of products and services, including biopesticides, biostimulants, pollinations, feeding supplements, and monitoring & scouting, among others.

- Koppert is a global leader in sustainable solutions provider. The company offers a wide range of products and solutions, including crop protection, pollination, crops, and additives, among others.

Pollination Market Segmentation Analysis:

The global pollination market is segmented by:

- Type: The benefits of cross-pollination over self-pollination, such as the ability to maintain genetic diversity and create new adaptations through genetic recombination, are driving the market for this kind of pollination. Additionally, many plants have characteristics that encourage cross-pollination over self-pollination.

- Crop Type: The global pollination market, by crop type, is divided into almond, sunflower, canola, and others. The sunflower category is forecasted to attain a greater market share due to growing demand by consumers driven by increased pollinator dependency, and provides a better seed quality, together with better yield.

- End-users: The global pollination market, by end-users, is divided into agricultural companies, farmers, and gardeners. The agricultural company category is forecasted to attain a greater market share.

- Region: APAC is expected to witness a substantial CAGR during the forecast period. The growth of this regional market is attributed to the increasing demand for honey as a natural sweetener and rising agricultural activity for which pollination is required. Furthermore, the rising consumption of honey across the globe is also driving the demand for pollination services in the APAC region.

________________________________________

Top Trends Shaping the Global Pollination Market:

1. Growing Demand for Floriculture

- The rising demand for floriculture globally is witnessed due to increased consumer demand, along with gardening hobbyists. Pollination plays a critical role in the production of flowers. The total production of floriculture in the global market witnessed massive growth. The US Department of Agriculture stated that in 2023, the total number of floriculture producers in the USA was recorded at 10,216, a drastic increase from 8,949 flower producers in 2022. The agency further stated that the total value of floriculture sales increased to US$6.69 billion in 2023. In the USA, Florida accounted for about US$1,208 million in floriculture sales, followed by California and Michigan with US$983 million and US$695 million, respectively.

________________________________________

Global Pollination Market Growth Drivers vs. Challenges:

Drivers:

- Increasing Global Agricultural Output: A major factor propelling the global demand for pollination is the increasing output of the agricultural sector in the global market. In crop production, the pollination service plays a critical role in enhancing crop productivity. It also helps in the transfer of pollen, the successful development of seeds, the fertilization process, and crop production.

The global production of different types of crops witnessed significant growth over the past few years. The US Department of Agriculture, in its report, stated that the production of crops across multiple countries, like India, China, Malaysia, and the USA, witnessed growth over the past few years. The agency stated that in the USA, the production of soybeans was 113,273 thousand tons in 2023/24, which increased to 121,417 thousand tons in 2024/25. Similarly, the production of rice and sorghum increased to 6,931 thousand tons and 8,071 thousand tons in 2023/24, respectively, which increased to 6,979 and 8,147 thousand tons, respectively, in 2024/25.

- Rise in Adoption of Cross-Pollination: Increased use of cross-pollination worldwide is due to its critical contribution to agriculture, ensuring better quality and quantity of crop yield. More than 87 of the 115 major food crops globally are cross-pollinated, promoting nutrition and food security. Pollination is done ancillary to the activities of pollinators such as bees, birds, and bats, and it is vital for producing fruits, vegetables, nuts, and seeds. This has further increased the production of fruits and vegetables. For instance, according to the National Horticulture Board's National Horticulture Database, India produced 204.96 million metric tonnes of vegetables and 112.62 million metric tonnes of fruits in 2023–2024.

Additionally, the "First International Forum for Action on Sustainable Beekeeping and Pollination" was convened by FAO and Slovenia for the whole world. It focused on youth engagement and sustainable practice. The intent is for this forum to collaborate internationally to share knowledge on matters of pollinator protection.

Further, research shows that low pollination can lead to large declines in agricultural revenues from pollination loss, especially in poor countries whose development depends on livelihood and food. Thus, raising pollinator populations and biodiversity is now increasingly important for environmental and financial sustainability.

- Growing Initiatives to Accelerate the Development of the Agricultural and Bee Sector: the development of the agriculture sector is one of the central points of augmenting the overall economy of a country and pollination is an activity that contributes significantly to the agricultural sector, in different applications such as facilitating the production of a wide range of crops. There is a good amount of revenue that is generated every year owing to pollination activities. According to the Food and Agriculture Organization (FAO) data of 2023, about $235 to $537 billion of revenue is generated from food production, and it is directly connected to pollinators. However, as there are threats to the pollinators due to climate change and other agents, such as poor conditions, the FAO is taking measures and has put forward options to ensure pollinator safety.

Some of these include decreasing the exposure of the pollinators to the pesticides that are used by using other forms and methods to control the pests, and improving the bee husbandry industry for more effective pathogen control, among others. Thus, these factors are bolstering the market growth. In addition, California almonds, which are amongst the finest varieties of almonds, are also produced by pollination among some of the other products, such as honey, beeswax, watermelons, and blueberries, among some other fruits and vegetables, which are boosting agriculture production thereby leading to the development of the agriculture sector.

Furthermore, the Food and Agriculture Organization (FAO) has taken an action plan called “The International Pollinator Initiative”. The stipulated time period for this plan is from 2019-2030. The objective of this action plan is to safeguard the different pollinators and promote the use of sustainable practices, and ensure that continuous monitoring is being conducted and pollinator-friendly practices are being implemented, among others. The growth in the bee and honey industry is significant to the overall pollination market growth.

Challenges:

- Increasing applications of fertilizers and pesticides: The rise in utilization of pesticides and fertilizers, especially in conventional agriculture, is leading to a decline in pollinator populations. As these components lead to harming the healthy neurological functioning of pollinators, which reduces their life span, which could lead to limiting or reducing the yield obtained, ultimately hindering the overall market growth.

________________________________________

Global Pollination Market Segmentation Analysis:

- Cross-pollination is expected to grow substantially

The global pollination market is segmented by type into self-pollination and cross-pollination. Increased use of cross-pollination worldwide is due to its critical contribution to agriculture, ensuring better quality and quantity of crop yield. More than 87 of the 115 major food crops globally are cross-pollinated, promoting nutrition and food security. Pollination is done ancillary to the activities of pollinators such as bees, birds, and bats, and it is vital for producing fruits, vegetables, nuts, and seeds. This has further increased the production of fruits and vegetables. For instance, according to the National Horticulture Board's National Horticulture Database, India produced 204.96 million metric tonnes of vegetables and 112.62 million metric tonnes of fruits in 2023–2024.

Additionally, the "First International Forum for Action on Sustainable Beekeeping and Pollination" was convened by FAO and Slovenia for the whole world. It focused on youth engagement and sustainable practice. The intent is for this forum to collaborate internationally to share knowledge on matters of pollinator protection.

Further, research shows that low pollination can lead to large declines in agricultural revenues from pollination loss, especially in poor countries whose development depends on livelihood and food. Thus, raising pollinator populations and biodiversity is now increasingly important for environmental and financial sustainability.

Global Pollination Market Regional Analysis:

North America: The region is expected to hold a significant market share due to regional farmers increasing their production of pollinator-dependent crops due to rising consumer demand for fruits, nuts, and vegetables. Beekeepers relocate their bees nationwide to service the growing number of pollination contracts and find high-quality forage to produce honey.

There is a shortage of nationwide information regarding the number of honey bee colonies that travel through each state over the year, as well as the routes and distances that these colonies cover. This has also increased the production of honey. For instance, in 2023, the United States produced 139 million pounds of honey, an 11% increase over 2022. In 2023, there were 2.51 million honey-producing colonies.

U.S. farmers are increasing their production of pollinator-dependent crops due to rising consumer demand for fruits, nuts, and vegetables. Beekeepers relocate their bees nationwide to service the growing number of pollination contracts and find high-quality forage to produce honey.

There is a shortage of nationwide information regarding the number of honey bee colonies that travel through each state over the year, as well as the routes and distances that these colonies cover. This has also increased the production of honey. For instance, in 2023, the United States produced 139 million pounds of honey, an 11% increase over 2022. In 2023, there were 2.51 million honey-producing colonies.

Further, the United States Department of Agriculture, with different agencies, namely the National Agricultural Statistics Service, National Institute of Food and Agriculture, and Economic Research Service, supports several conservation and research projects that leverage the importance of maintaining pollinator populations. The programs address diseases, habitat degradation, and losses in honey bee colonies.

Moreover, greater efforts have been directed towards preserving healthy pollinator ecosystems because of dwindling native pollinator numbers and growing commercial beekeeping challenges. Even though the USDA continues this support through grants for research on pollinator health and habitat conservation, unique programs like CRP strive to create land management practices that favour pollinators.

________________________________________

Global Pollination Market Competitive Landscape:

The market is fragmented, with many notable players, including Koppert, Biobest Group, Overberg Honey Company, Ubees, Ontario Honey Company, Bee Farms Products, Pollinator Partnership, Applewood Seed Company, Ubusi Beekeeping, Sullivan Bees (API Holdings), BioBee, Stagg Honey Company, QueenDee (Tech-19), and Biobest Group (Floridienne Group), among others.

- Biobest (Floridienne Group): The company offers varieties of pollination products such as Masculino-System (B.t.), Medium Hive (B.t.), Mini Hive, Mini Hive Seed Production, Multi-Hive, Multi-Hive Turbo, Premium Hive, Standard Hive, and Turbo Hive. This gives the company a strategic advantage over its competitors. Although the company mainly operates in the UK and the US, it is expanding its footprint outside. For example, it signed an agreement with Aqua Capital and GIC to acquire Biotrop in Brazil.

Pollination Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Pollination Market Size in 2025 | US$1.795 billion |

| Pollination Market Size in 2030 | US$2.132 billion |

| Growth Rate | CAGR of 3.50% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in the Pollination Market |

|

| Customization Scope | Free report customization with purchase |

Segmentation

By Crop Type

- Almond

- Sunflower

- Canola

- Others

By Type

- Self-Pollination

- Cross-Pollination

- By End-User

- Agricultural Companies

- Farmers

- Gardeners

By Region

- North America

- United States

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- United Kingdom

- Germany

- France

- Spain

- Others

- Middle East & Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- China

- Japan

- South Korea

- India

- Thailand

- Taiwan

- Indonesia

- Others

Our Best-Performing Industry Reports:

Navigation:

Page last updated on: