Report Overview

Global Poultry Vaccine Market Highlights

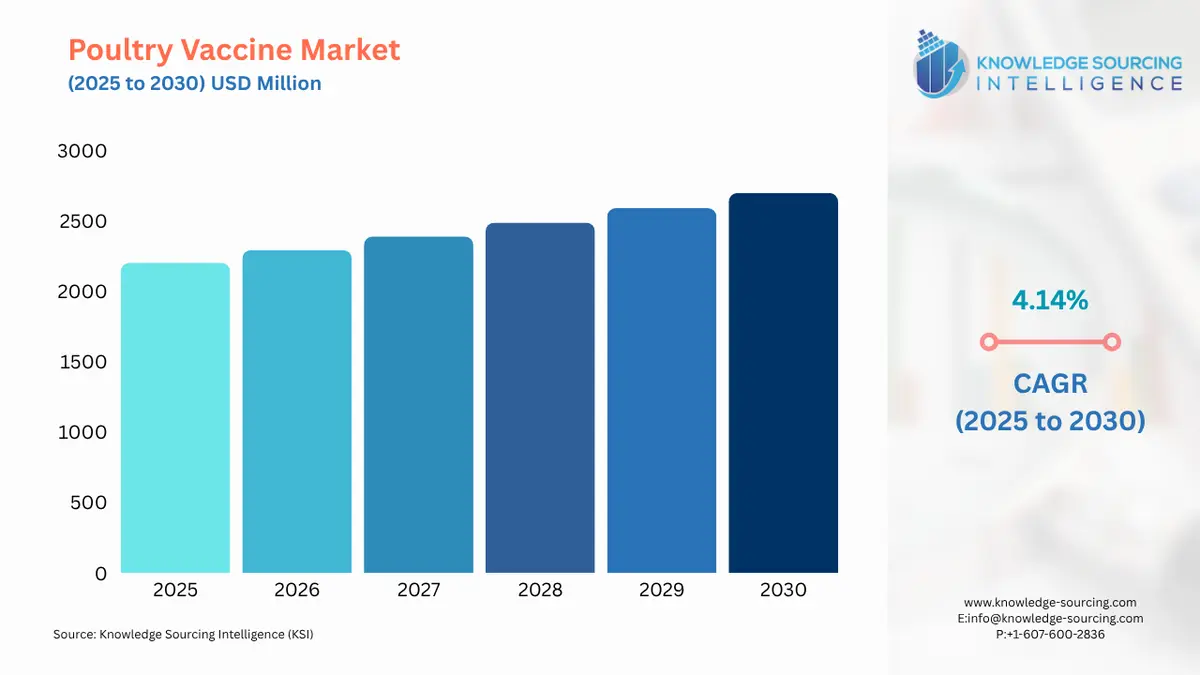

Poultry Vaccine Market Size

The Global Poultry Vaccine Market is expected to grow at a CAGR of 4.14%, reaching a market size of US$2,698.1 million in 2030 from US$2,202.673 million in 2025

The rapidly growing poultry production worldwide and the growing incidence of several poultry diseases are driving this global market. As the demand for poultry products increases, so does the awareness of the health risks associated with consuming diseased poultry. This heightened awareness is prompting poultry manufacturers to regularly vaccinate their flocks, positively influencing the global poultry vaccine market growth.

National governments and international organizations are increasingly taking steps to reduce the risk of disease transmission due to poultry animals by regulating poultry farming and ensuring biosecurity. Governments are implementing strict biosecurity regulations, taking up disease control programs like vaccination programs, and framing rules and policies to regulate poultry farming. The rules and regulations regarding vaccination are increasing the market for global poultry vaccines.

The global poultry vaccine market has been segmented by disease type, product, and geography. By disease type, it is classified as avian influenza, Marek’s Disease, bronchitis, and others. It is segmented based on products such as inactivated vaccines, attenuated live vaccines, recombinant vaccines, and others. This segmentation allows for a better understanding of diverse needs within the global poultry vaccine market.

Poultry Vaccine Market Growth Drivers:

- Growing poultry population is increasing the demand for poultry vaccines

The growing poultry population is anticipated to lead the market growth of poultry vaccines. The demand for poultry is growing globally as consumers prefer more of it in their diet than earlier. Due to its high nutritional value in terms of protein, the demand for poultry food is growing. As the global population grows, the demand for poultry due to their diet preference also increases. As per the Food and Agriculture Organization of the United States, meat production has soared from 9 million tonnes in 1961 to 133 million tonnes in 2020. Thus, the growing demand for poultry, in turn, would lead to an increase in the market for poultry vaccines.

- The need to prevent disease in poultry is growing the demand for poultry vaccines

The demand for poultry vaccines is increasing due to many factors. One such reason is the increased prevalence of diseases affecting poultry, like Marek’s disease and Newcastle disease. These diseases are zoonotic, i.e., they are transferable to humans as well. Past decades have seen disease outbreaks from poultry affecting millions of human lives. For instance, a recent outbreak of Avian Influenza Virus was reported in five geographic regions, including North & South America, Europe, Asia, and Africa, impacting millions of birds and raising health concerns in humans. Thus, the need for vaccination in poultry is on the rise, and governments and organizations worldwide are implementing new rules and regulations and vaccination awareness to prevent disease outbreaks. Hence, the poultry vaccination market will be rising in the forecast period.

Poultry Vaccine Market Segment Analysis:

- Recombinant Vaccines are anticipated to lead the market during the forecast period

Based on types of vaccines for poultry, they are segmented into Inactivated Vaccines, Attenuated Live Vaccines, and Recombinant Vaccines. The basis of this segmentation is how they are designed to work on the immune system to fight off certain kinds of germs. Recombinant vaccines use specific antigens like proteins, providing a strong immunization response, and are effective against diseases like Newcastle disease, infectious bronchitis, and Avian influenza.

These vaccines can target specific antigens, making them a safer option and reducing the risk of side effects. These vaccines are compatible with mass immunization methods, making them a more suitable option for poultry farmers. Thus, Recombinant Vaccines are anticipated to dominate the poultry vaccine market in the forecast period as the demand for safer immunization methods and enhanced immunity is growing.

- North America holds a significant market share in global poultry vaccine and will continue to dominate in the forecast period

Region-wise, the global market is segmented into Asia-Pacific, North America, South America, Europe, Middle East and Africa. North America accounted for a significant share of the global poultry vaccine market. Increasing consumption of poultry-related food products has boosted poultry production in the region. This has led to concerns about the safety of poultry food products due to the rising incidence of avian diseases, augmenting the demand for poultry vaccines in the region. Moreover, the presence of major market players in the region is contributing to the poultry vaccine’s growth.

According to the United Nations Food and Agriculture Organization (FAO), the United States is the largest producer of poultry meat, holding 17% of the global output. As per USDA, the total production of broilers in terms of value has increased from $46.1 billion in 2021 to $77.0 billion. This significant production is also leading North America in the poultry vaccine market.

Poultry Vaccine Market Challenges:

- High vaccine costs are restricting small and medium-sized poultry farms from using vaccines

Though the market for global poultry vaccines is rising, factors such as the high vaccine cost are restricting its market growth. The cost of vaccines is generally high, thus limiting small and medium-sized poultry farmers from using these essential vaccination services. This high cost narrows down the potential market for poultry vaccines, especially in the developing and underdeveloped regions of the world, as a substantial portion of farmers are unable to afford them. Hence, this factor is restricting the market expansion of poultry vaccines.

Poultry Vaccine Market Key Developments:

- In November 2024, Virbac acquired a majority stake in Globian. This will lead to Virbac expansion in the Indian market for the growing segment of avian vaccines.

- In April 2024, Merck Animal Health, a division of Merck & Co. Inc., announces an agreement with Cambridge Technologies to provide autogenous vaccine to the U.S. poultry industry. Cambridge is an independent autogenous poultry vaccine in the United States.

- In January 2024, Boehringer Ingelheim launched the Vaxxilive Cocci 3 to enter the market under a new name; earlier, it was sold as Hatchpak Cocci III. It is a poultry coccidiosis vaccine that helps stimulate a bird’s natural immune response.

- In March 2024, Boehringer Ingelheim acquired Saiba Health AG, which focuses on developing novel therapeutic medicines to address chronic diseases in pets.

List of Top Poultry Vaccine Companies:

- Zoetis Inc.

- Boehringer Ingelheim International GmbH

- Ceva Santé Animale

- Merck & Co. Inc. (Merck Animal Health)

- AniCon Labor GmbH

Poultry Vaccine Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Poultry Vaccine Market Size in 2025 | US$2,202.673 million |

| Poultry Vaccine Market Size in 2030 | US$2,698.1 million |

| Growth Rate | CAGR of 4.14% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Million |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in the Poultry Vaccine Market |

|

| Customization Scope | Free report customization with purchase |

Poultry Vaccine Market Segmentation:

- By Disease Type

- Avian Influenza

- Marek’s Diseases

- Bronchitis

- Others

- By Product

- Inactivated Vaccines

- Attenuated Live Vaccines

- Recombinant Vaccines

- Others

- By Geography

- North America

- United States

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- UK

- Germany

- France

- Italy

- Others

- Middle East and Africa

- Saudi Arabia

- Israel

- Others

- Asia Pacific

- Japan

- China

- India

- South Korea

- Indonesia

- Thailand

- Others

- North America