Report Overview

Green Power Market - Highlights

Green Power Market Size:

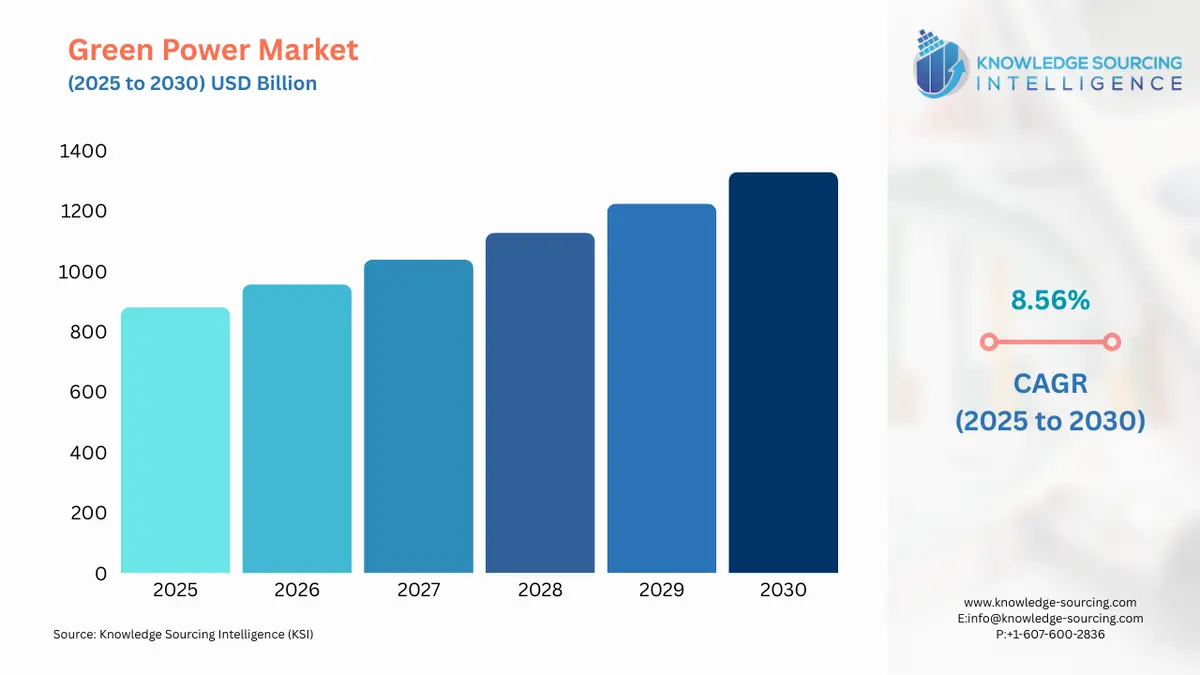

Green Power Market is expected to grow at a 8.3% CAGR, increasing to USD 1422.169 billion in 2031 from USD 881.259 billion in 2025.

Green Power Market Trends:

Green power refers to electricity generated from renewable sources that have minimal or no negative impact on the environment. These sources of energy are considered sustainable because they are naturally replenished and do not deplete over time. Increasing environmental awareness along with the growing population and increasing electricity demand is a major growth driver of the green power market. Moreover, the government initiative coupled with technological advancements and urbanization is further expected to bolster the green power market.

Green Power Market Growth Drivers:

Increased Awareness for Green Power

Renewable energy sources are becoming more popular as people become more conscious of climate change and its negative impacts on the environment which is stimulating the green power market. For instance, the percentage of renewable energy used to create power in Europe climbed rapidly in the early months of 2020 according to statistics from the Wärtsilä Energy Transition Lab. There are various awareness programs for example the Green Power Partnership is a voluntary program in the USA that promotes businesses to acquire green energy to lessen the environmental effects of using electricity that has been purchased. Further, a public awareness campaign to promote citizen energy conservation was launched by the German Ministry for Economics and Climate Action (BMWK) in June 2022.

Government and Institutional Initiatives

The use of renewable energy has been encouraged by several governments throughout the world via the implementation of supporting policies, incentives, and regulatory frameworks thereby boosting the green power market. For instance, several Renewable Portfolio Standards (such as those in California, New Jersey, New York, etc.) mandate that by 2030, 50% of the power sold by suppliers above a particular scale must be produced from renewable sources. Additionally, to promote the development of innovations in the environmental and energy domains, Japan created the Environment Innovation Strategy in January 2020. The Acceleration Plan of the strategy encourages private sector funding for the creation of cutting-edge technology, especially through ESG investing.

Rapid Urbanization and Industrialization

The adoption and integration of green power solutions are significantly impacted by increased urbanization and industrialization. Urban areas have high energy demands due to the concentration of commercial, residential, and industrial activities. Meeting this demand with conventional energy sources can lead to higher pollution levels and contribute to climate change therefore, the rising urbanization is expected to boost the green power market. For instance, around two-thirds of the world's population is expected to live in urban areas by 2050 as per the World Bank estimates. Moreover, according to IEA, renewable energy sources will generate more than one-third of the world's power by 2024.

Growing Population and Power Demand

Population and electricity demand are closely interconnected, and population growth has a significant impact on electricity demand. According to the IEA, the Growth of renewable energy is more crucial than ever with a significant rise in worldwide demand predicted for 2024. Therefore, the rising population coupled with growing power demand is accelerating the green power market. For instance, the global electricity demand is projected to increase by 2% in 2023 as per the IEA data. , Additionally, the present world population exceeds 8 billion and it is projected to reach 9.8 billion by 2050 as per the United Nations projections.

Economic Benefits of Green Power

The green power market has been a significant driver of job creation. Investments in renewable energy projects stimulate economic activity and create employment opportunities in manufacturing, construction, installation, and maintenance of renewable energy infrastructure. For instance, renewable energy employment reached 12 million in 2020 from 11.5 million in 2019 as per the Renewable Energy and Jobs Report 2021 by IRENA. Moreover, according to an ILO global sustainability scenario for 2030, job losses of between six and seven million will be greatly outweighed by the creation of 24–25 million new jobs.

Technological Advancements

Green power generation is becoming more efficient and less expensive because of developments in renewable energy technology, such as better solar panels, wind turbines, and energy storage devices, and accelerating the green power market. According to estimates, digital twin analysis may reduce risk by 30–50% and optimize capital expenditure (CAPEX) by 10-15%, with only a little impact on operational expenditure (OPEX). One of the cutting-edge innovations, Power-to-X includes several methods for converting electrical energy into heat, hydrogen, or renewable synthetic fuels. It presents a tremendous potential to accelerate the switch to renewable energy by increasing the production of synthetic fuel and drastically cutting fossil fuel emissions across a range of sectors.

Green Power Market Geographical Outlook:

Asia-Pacific is Expected to Grow Significantly

Asia-Pacific region is expected to hold a significant share of the green power market during the forecast period. The factors attributed to such a share are the growing population, renewable energy access, government initiatives, expanding green sector, and rising electricity demand. For instance, China commanded a 39 percent share of renewable energy jobs worldwide in 2020 as per the IRENA. Additionally, it is anticipated that China's electricity demand would grow at an average annual rate of 5.2% between 2024 and 2026 as per the IEA. Moreover, numerous projects and initiatives, including the Green Hydrogen Mission, Energy Transition, Renewable Energy Evacuation, and others were announced in the Indian Union Budget 2023–24.

Green Power Market Players:

Adani Green Energy Limited is a renewable energy company headquartered in Ahmedabad, Gujarat, India. The company was established in 2015 with primary involvement in the development, operation, and maintenance of renewable energy projects across India. It offers solar power, wind power, hybrid power, and solar park solutions.

Iberdrola SA is a global energy company headquartered in Bilbao, Spain. Iberdrola has a substantial portfolio of renewable energy assets, making it one of the world's largest producers of wind energy.

Green Power Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Companies |

|

Report Metric | Details |

Green Power Market Size in 2025 | USD 881.259 billion |

Green Power Market Size in 2030 | USD 1,328.982 billion |

Growth Rate | CAGR of 8.56% |

Study Period | 2020 to 2030 |

Historical Data | 2020 to 2023 |

Base Year | 2024 |

Forecast Period | 2025 – 2030 |

Forecast Unit (Value) | USD Billion |

Segmentation |

|

Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

List of Major Companies in the Green Power Market |

|

Customization Scope | Free report customization with purchase |

Green Power Market Segmentation

By Power Source

Hydroelectric Power

Wind Power

Bioenergy

Solar Energy

Geothermal Energy

By Application

Electricity Generation

Heating

Transportation

By End-User

Utility

Residential

Commercial

Industrial

By Geography

North America

USA

Canada

Mexico

South America

Brazil

Argentina

Others

Europe

Germany

France

United Kingdom

Spain

Others

Middle East and Africa

Saudi Arabia

UAE

Others

Asia Pacific

China

India

Japan

South Korea

Indonesia

Thailand

Others