Report Overview

High Purity Oleic Acid Highlights

High Purity Oleic Acid Market Size:

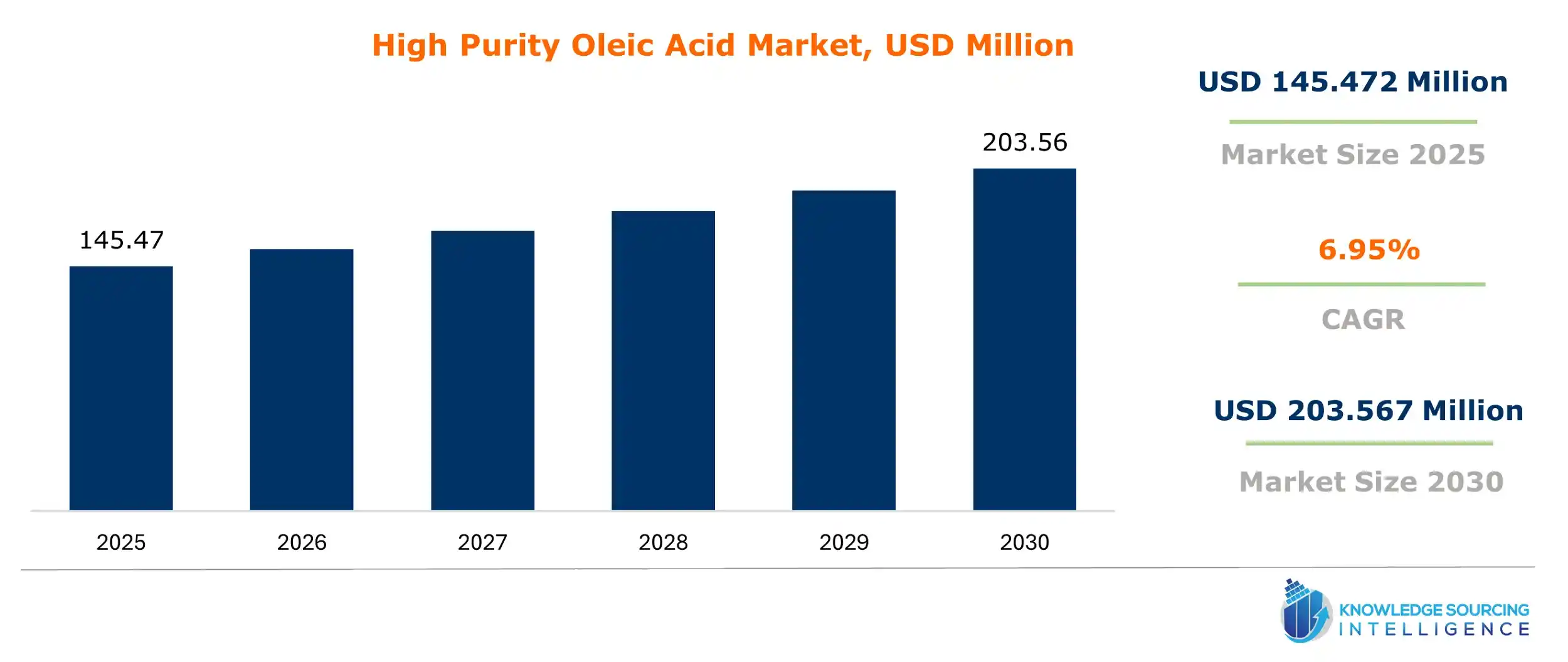

The high-purity oleic acid market is projected to grow at a CAGR of 6.95%, attaining US$203.567 million by 2030, from US$145.472 million in 2025.

High-purity oleic acid is a naturally colorless liquid oil with properties similar to omega-9 oil. The acid finds application across multiple sectors, like pharmaceuticals, food, industrial, and cosmetic industries, among others. The chemical also provides key health benefits, as it offers lower LDL (low-density lipoprotein) and raises the content of HDL, or high-density lipoproteins, that are good for the body.

The increasing application of this acid in the industrial sector is expected to propel high-purity oleic acid market expansion during the forecast period. In the industrial sector, oleic acid finds usage across multiple products and solutions, including utilization as chemical intermediates, detergents, lubricants, surfactants, and epoxy resins, among others. The global industrial sector has witnessed significant growth in its total output, primarily with the increasing investments and introduction of favorable policies by the government contributing to the market growth. Similarly, the rising production of the pharmaceutical and food sectors is also expected to boost the demand for high-purity oleic acid.

High Purity Oleic Acid Market Growth Drivers:

- Increasing demand from the food and beverage sector

The increasing demand for food and beverages is a key factor propelling the global high-purity oleic acid market growth. In these sectors, high-purity oleic acid offers key applications for formulating and manufacturing multiple products. The acid is commonly used to produce synthetic cheese and butter, which accelerates its demand with the increasing consumer preferences towards vegan food products. Oleic acid is among the most efficient and optimum alternatives to animal fat, with odorless and tasteless properties. Similarly, the acid is also commonly used as a flavoring agent, and the high stability of the compound helps in maintaining flavor and extending the product’s shelf life.

In its report, the US Department of Agriculture stated that the global output of the food industry witnessed major growth. The agency stated that in India, the total food industry output was recorded at US$400 billion in 2023. Similarly, in the UK, the total retail food industry was recorded at US$279 billion, under which the food processing sector in the nation was valued at US$168 billion.

- Growth of the global pharmaceutical sector

The growing pharmaceutical sector is among the major factors propelling the high-purity oleic acid market growth. In this sector, high-purity oleic acid finds key applications, majorly as an excipient and emulsifier in pharmaceutical solvents.

The global pharmaceutical production has witnessed significant growth in the past few years. In its report, the European Federation of Pharmaceutical Industries and Associations stated that the total pharmaceutical production in the European region was recorded at EUR 323,950 million in 2021, surging to EUR 363,300 million in 2022. In 2023, the total production of the pharmaceutical sector in the region was estimated at EUR 390,000 million. The association further stated that in 2022, Switzerland and Germany accounted for the highest production of pharmaceutical products, with recorded products valued at EUR 9,556 million and EUR 9,372 million, respectively.

- Increasing production of vegetable or cooking oils

In the production of cooking or vegetable oil, high-purity oleic acids play a critical role, as they help enhance the stability of the products and prevent oxidation. The production of vegetable oils (olive oil, sunflower oil, palm oil, and canola oil, among others) has grown significantly, majorly with the growing demand for food and beverage products across the globe. The US Department of Agriculture stated in its report that the production of palm oil in Malaysia witnessed significant growth. The agency stated that during the 2022–23 marketing year, the total production of palm oil in the country was recorded at 18,378 thousand MT, which surged to 19,710 thousand MT during the 2023–24 marketing year. The total production of palm oil during 2024–25 is estimated at 19,200 thousand MT in the nation by the agency. Similar growth is being observed across the production of different types of vegetable oils, in turn augmenting the demand for high-purity oleic acids.

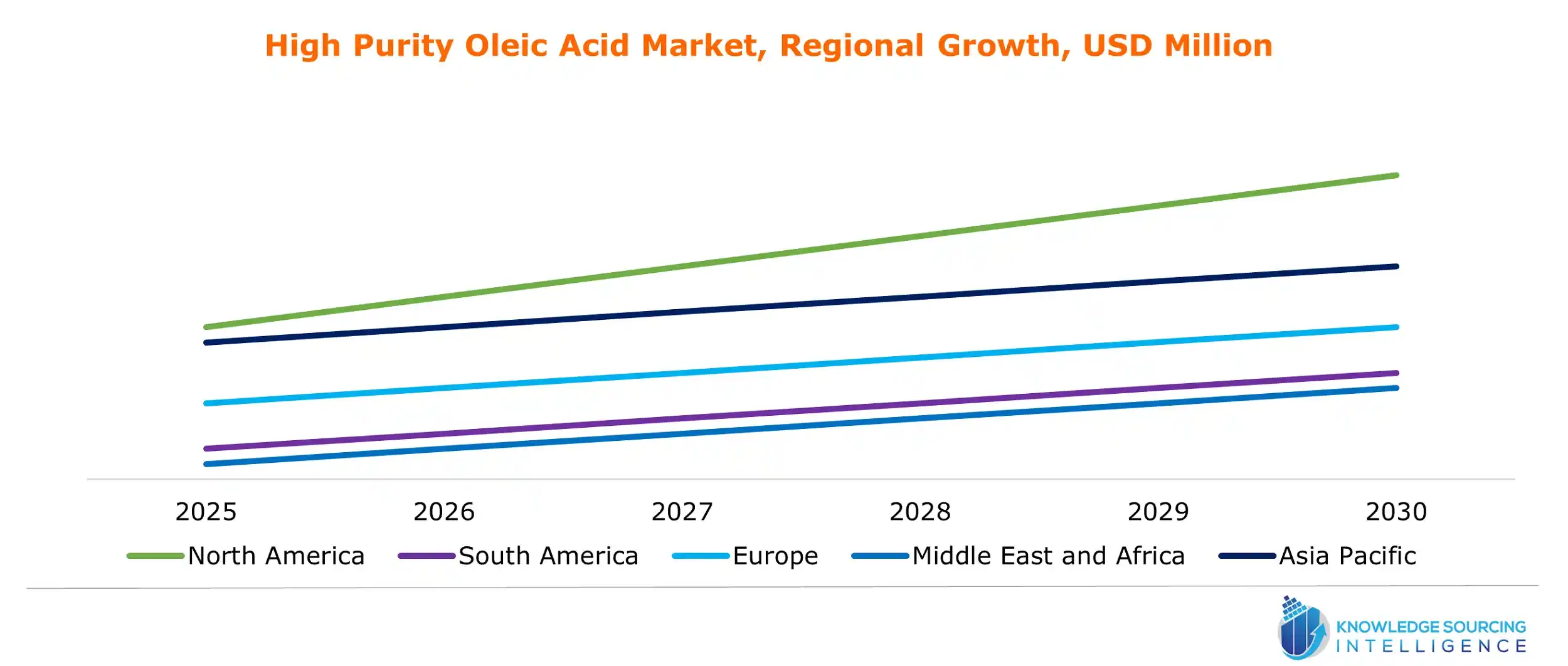

High Purity Oleic Acid Market Geographical Outlook:

- Asia Pacific is forecasted to hold a major market share

The Asia Pacific region is expected to witness significant expansion in the demand for high-purity oleic acid. The major factor propelling this market growth is the increasing production by the pharmaceutical and food & beverage sectors. Countries like India, China, Japan, and South Korea are among the leading producers of pharmaceutical products that utilize high-purity oleic acid as emulsifiers and excipients. Similarly, the increasing production of food and beverages in the region is also expected to propel the high-purity oleic acid market growth. In the food and beverage sector, oleic acid is commonly used to manufacture synthetic butter and cheese. The ingredient is also utilized as a flavor for products like baked goods, ice cream, and sweets, among others.

High Purity Oleic Acid Market Products Offered by Key Companies:

- Merck KGaA, or Merck Group, is among the global leaders in biotechnology and bioscience technology. In the global market, the company offers a wide range of products and solutions for multiple applications, including clinical & diagnostics, chemistry & diagnostics, genomics, protein biology, and food & beverage testing & manufacturing. Its products and solutions offer filtration, material science, labware, and clinical & diagnostics. In the global high-purity oleic acid market, the company provides oleic acid with 282.46 molecular weight.

- DAKO AG is among the global leaders in lubricant components and spin finish products. In the global market, the company offers oleic acid, glycerol esters, esters, emulsifiers, and spin finishes. The high-quality oleic acid offered by the company features 100% renewable content and a minimum of 88% purity.

List of Top High Purity Oleic Acid Companies:

- Changzhou Harvechem Ltd

- CPAChem

- Cayman Chemical

- VWR International, LLC

- RX Chemicals

High Purity Oleic Acid Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| High Purity Oleic Acid Market Size in 2025 | US$145.472 million |

| High Purity Oleic Acid Market Size in 2030 | US$203.567 million |

| Growth Rate | CAGR of 6.95% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Million |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in the High-Purity Oleic Acid Market |

|

| Customization Scope | Free report customization with purchase |

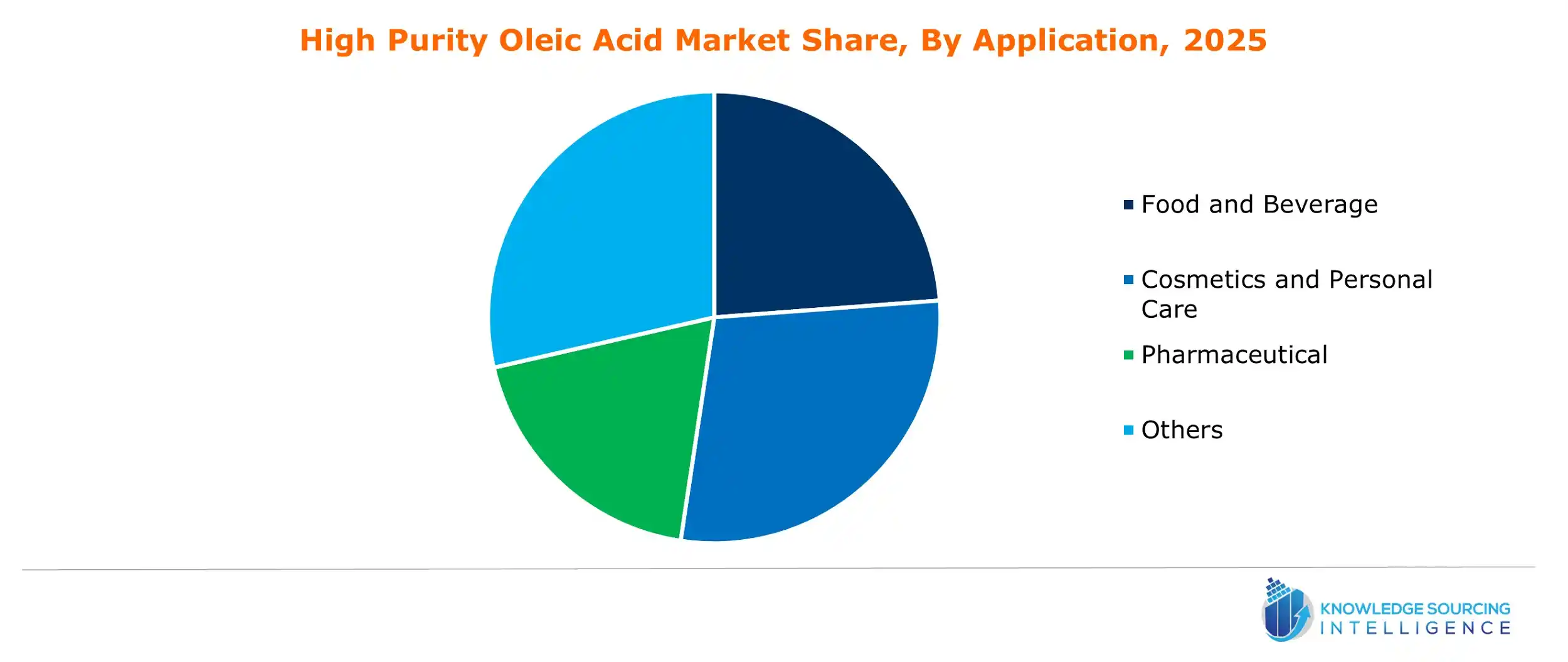

The high-purity oleic acid market is analyzed into the following segments:

- By Purity

- Below 90%

- Above 90%

- By Application

- Food and Beverage

- Cosmetics and Personal Care

- Pharmaceutical

- Industrial

- Others

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- France

- United Kingdom

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- Israel

- Others

- Asia Pacific

- China

- Japan

- South Korea

- India

- Others

- North America

Our Best-Performing Industry Reports:

Navigation

- High Purity Oleic Acid Market Size:

- High Purity Oleic Acid Market Key Highlights:

- High Purity Oleic Acid Market Growth Drivers:

- High Purity Oleic Acid Market Geographical Outlook:

- High Purity Oleic Acid Market Products Offered by Key Companies:

- List of Top High Purity Oleic Acid Companies:

- High Purity Oleic Acid Market Scope:

- Our Best-Performing Industry Reports: