Report Overview

Tall Oil Fatty Acid Highlights

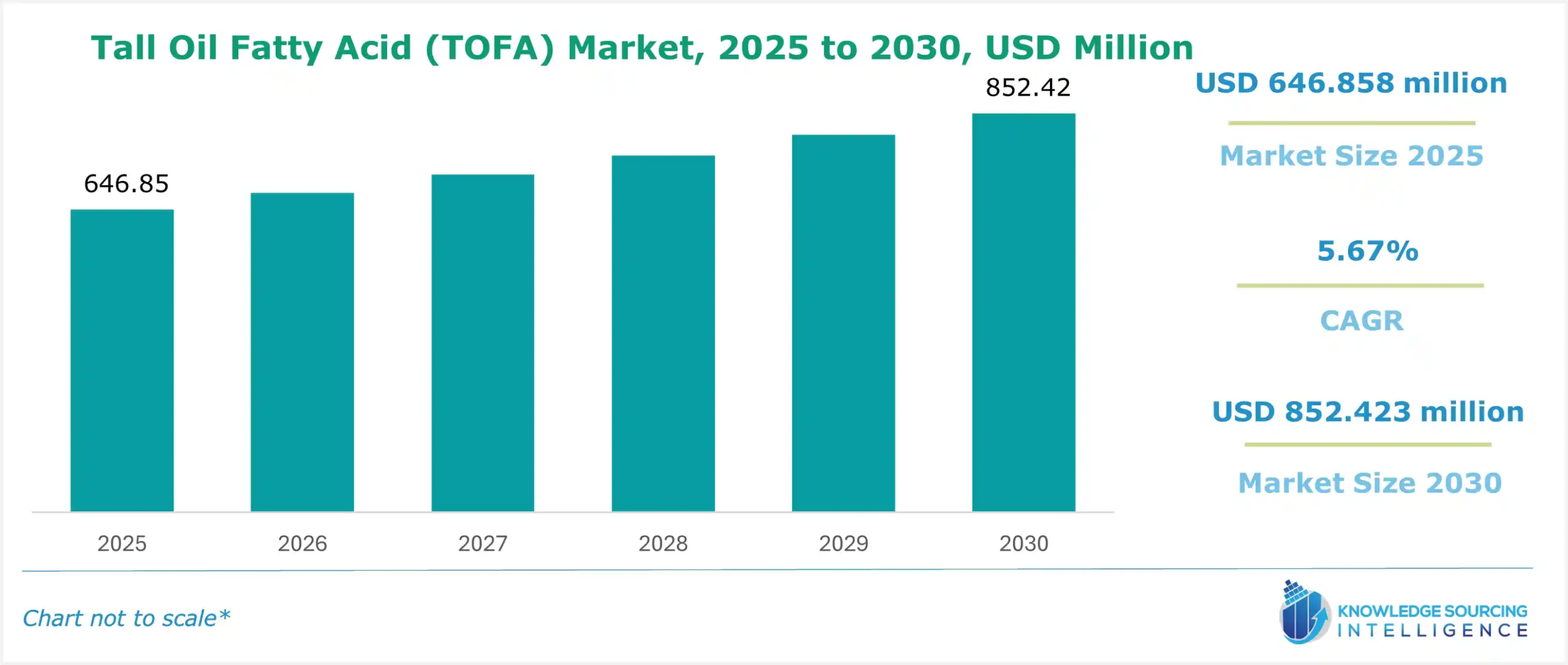

Tall Oil Fatty Acid (TOFA) Market Size:

The global tall oil fatty acid (TOFA) market is expected to grow at a CAGR of 5.67%, reaching a market size of US$852.423 million in 2030 from US$646.858 million in 2025.

Tall oil fatty acid, or TOFA, is a low-cost unsaturated fatty acid, mainly sourced from crude tall oil, the byproduct of the kraft process of paper manufacture. Because TOFA is a viscous, yellow-black liquid, it contains mostly oleic and linoleic acids and has many industrial applications, including in soaps, lubricants, alkyd resins, emulsifiers, and corrosion inhibitors. A carboxyl group and long carbon chain are the typical features of its chemical structure, along with the esterification and epoxidation characteristics for further modifications.

The Tall Oil Fatty Acid (TOFA) Market is maintaining its upward trend as different sectors worldwide are adopting sustainable, bio-based raw materials. TOFA, being a product of crude tall oil, which is a by-product of the kraft pulping process, is the cleanest option among the fatty acids and is least likely to be derived from petroleum. The market is expanding mainly due to growing eco-consciousness of consumers, stringent global regulations that limit the usage of non-renewable chemicals, and the broadening application areas of TOFA in different industries such as coatings, lubricants, adhesives, metalworking fluids, soaps, and fuel additives. The use of bio-lubricants and green coatings in manufacturing and automotive sectors is increasing. In addition, technological advancements in refining and fractionation processes are contributing to the rising commercial value of TOFA.

The Tall Oil Fatty Acid (TOFA) Market is subject to environmentally friendly and chemically safe regulations, which support the use of renewable and bio-based materials. Among the main regulatory instruments in this sector are the EU REACH Regulation, which ensures the safe handling of chemicals, and the U.S. EPA BioPreferred Program, which is aimed at increasing the use of bio-based products. Nevertheless, the problems of fluctuating availability of raw materials and higher production costs compared to synthetic alternatives may hinder rapid adoption. Despite these limitations, continuous innovations, an increase in bio-refinery capacities, and purposeful collaborations among the biggest producers will, however, make the market more competitive.

Tall Oil Fatty Acid (TOFA) Market Overview

The Tall Oil Fatty Acid (TOFA) Market is seeing incremental growth, largely influenced by the increasing demand for bio-based, sustainable chemical alternatives across various industries. TOFA, a product of refining tall oil, is becoming a clean, green substitute for petroleum-based fatty acids. Its usage is extensive, as it can be used in the production of coatings and paints, lubricants, adhesives, soaps and detergents, fuel additives, and metalworking fluids. The market is experiencing gradual, strong growth due to the increasing use of bio-lubricants and eco-friendly surface coatings, which is the result of the imposition of strict environmental regulations and the worldwide trend towards sustainable raw materials.

The major countries that export TOFA are the United States, Sweden, Finland, Canada, and Germany. These countries have robust pulp and paper industries that are the main suppliers of crude tall oil, the primary material for TOFA production. In 2024, Canada shipped tall oil fatty acids worth C$374k, ranking this product 3,433rd out of 4,977 most exported products in Canada. In 2024, the top five countries that purchased tall oil fatty acids from Canada were the United States (C$311k), Peru (C$40.3k), Colombia (C$11.7k), China (C$8.2k), and Argentina (C$2.54k).

The TOFA Market is influenced by different ecological and chemical safety rules that advocate the production of bio-based and eco-friendly materials. Among the significant legal instruments is the EU REACH Regulation (Registration, Evaluation, Authorisation and Restriction of Chemicals). This regulation ensures the safe use of chemical substances. Additionally, the U.S. Environmental Protection Agency's (EPA) BioPreferred Program promotes the adoption of bio-based products. Moreover, the European Green Deal and Canada's Chemicals Management Plan (CMP) are two initiatives that propel the shift to renewable and low-emission chemical sources, thus increasing the demand for TOFA in industrial and consumer applications.

However, market expansion could be limited at times due to unstable supply of raw materials caused primarily by issues in the pulp and paper industry and relatively high processing costs compared to synthetic alternatives. Overall, the Tall Oil Fatty Acid market is a long-term growth story, with production technology improvements, circular economy measures, and the growing replacement of fossil-based inputs with renewable feedstocks in various end-use sectors serving as its strong pillars.

Some of the major players in the Tall Oil Fatty Acid (TOFA) Market are Kraton Corporation, Harima Chemicals Group, Inc., Forchem, Chemical Associates Inc., Eastman Chemical Company, Segezha Pulp and Paper Mill, Ingevity, Torgoviy Dom Lesokhimik, Foreverest Resources Ltd., ChemCeed LLC, and Silver Fern Chemicals Inc. These companies are at the forefront of the global TOFA supply chain, emphasizing environmentally friendly production, product innovation, and expansive distribution networks. They serve numerous industries, such as coatings, lubricants, and adhesives, by implementing the latest developments in bio-refining and renewable chemical technologies to facilitate the increasing need for eco-friendly, high-performance materials.

Tall Oil Fatty Acid (TOFA) Market Growth Drivers:

- The expanding oil and gas industry is anticipated to boost the global tall oil fatty acid (TOFA) market

The oil and gas industry holds a predominant role in furnishing fuel to the entire world for power as well as other purposes in terms of utilization. According to the International Energy Agency, in 2023, the quantity of crude oils and natural gas liquids produced was 4,200,000 kt and 450,000 kt, respectively. The industries that absorbed the highest oil consumption include transport, with 2,800,000 ktoe in 2023. Non-energy use has a total consumption of 700,000 ktoe, while residential consumption is 250,000 ktoe. Companies are also increasing their drilling operations to increase the energy demand. For instance, in January 2024, Norway significantly increased oil drilling activities by approving 62 new drilling licenses for oil and gas companies. This is a sharp rise from the 47 licenses issued in 2022. This is expected to take production levels to a 15-year high and is likely to peak in 2025. In total, 27 new oil and gas projects are being developed on the Norwegian shelf, besides 34 exploration wells spudded in 2023. Exploration is concentrated in the Barents Sea, where the government is urging companies to explore the area more. Norway’s Minister of Energy, Terje Aasland, underlined that such breakthroughs are of great importance both for employment and value creation of stable energy suppliers to Europe.

- Rising demand for lubricants owing to the expansion of the automotive industry is anticipated to boost the global tall oil fatty acid (TOFA) market

The main market drivers for tall oil fatty acids are the increasing demand for lubricants, which is mainly related to the automobile industry. These are linked to the steady growth in vehicle production as a result of increasing demand. Tall oil fatty acids are essential to lubricants because of their superior inherent properties, such as high biodegradability and thermal stability. This improves with rising disposable income, urbanization, and a move toward electric vehicles (EVs). Manufacturers are working to upgrade their vehicle performance and efficiency. Toward this, they require advanced lubricant formulations with sustainable ingredients. An alternative oil fatty acid appears to be a promising, renewable alternative for both performance and the environment.

This is also in sync with the trend of the automobile sector, which is looking for sustainability and low-carbon footprinting. As more companies begin researching eco-friendly products, TOFA are extremely attractive to lubricant manufacturers who try to achieve regulatory compliance and consumer preference. The growth in the automobile industry thus increases the demand for tall oil fatty acids in formulations in lubricants, making it one of the key players in the changing landscape of this market.

- Shift to bio-based sustainable chemicals

A key growth factor in the tall oil fatty acid market is the transition to bio-based and eco-friendly chemistry. Governments worldwide are encouraging the use of renewable and low-carbon feedstocks to decrease dependency on fossil fuels and limit greenhouse gas emissions. The U.S. Environmental Protection Agency (EPA) defines bio-based products as those obtained from renewable agricultural, marine or forestry products. It promotes these through programs such as Advancing Sustainable Chemistry, which funds promotional efforts in renewable chemical processes. The Bioeconomy Strategy in the European Union, for example, emphasizes the production and use of renewable resources in industry. It aims to replace petrochemical inputs in manufacturing. Imperial Chemicals is another related example of a company using tall oil fatty acids in paint systems. Chemical technologies using bio-based raw materials are supported by programs such as the Indian Ministry of Science and Technology and Technology Development Board, which also promote eco-friendly technologies.

This encourages industries to incorporate sustainable purchasing into their practices. The tall oil fatty acid, derived from by-products of the wood pulping process, readily conforms to these systems as it utilises waste material from renewable forestry products. This shift to bio-based inputs is enhanced by corporate sustainability commitments and stricter compliance with environmental regulations, which encourage chemical manufacturers to adopt renewable raw materials. There is an increasing preference for bio-based intermediates, such as tall oil fatty acids, in coatings, lubricants, and adhesives, as manufacturers strive to achieve carbon-reduction goals while complying with sustainability reporting mandates. The alignment of the policies from foreign governments and industry, as well as the hardening of bio-based production, creates a large basis for demand.

According to NITI Aayog, India’s automotive component production is projected to reach USD 145 billion by 2030, with exports rising to USD 60 billion. This expansion in the automotive manufacturing base strengthens the demand for industrial raw materials such as TOFA, which are widely used in coatings, lubricants, and adhesives for vehicle components. Higher production volumes and export-oriented growth encourage greater consumption of bio-based chemicals for surface protection, lubrication, and corrosion resistance. Consequently, the growth of India’s automotive sector directly supports the steady expansion of the tall oil fatty acid market across industrial applications.

Tall Oil Fatty Acid (TOFA) Market Restraints:

- Easy availability of substitutes is anticipated to hamper the market growth

The easy availability of substitutes poses a significant restraint on the tall oil fatty acid market. Several alternative products with functional properties similar to the products derived from tall oil-based fatty acids are palm oil-based fatty acids, coconut oil derivatives, and synthetic fatty acids. These are easier to access, besides costing less to produce from some other more readily available raw material, thus offering appealing choices for manufacturers that desire cost savings.

This preference is also leading to the emergence of more competition for TOFA from other bio-based products. With growing consumer awareness about sustainability, firms may prefer alternatives that align more with their green or cost-saving strategies. Even the existence of other well-established petrochemical products designed to replicate the performance properties of TOFA creates competition for this product.

Tall Oil Fatty Acid (TOFA) Market Segmentation Analysis

- By Type: Oleic Acid

By type, the tall oil fatty acid market is segmented into Oleic Acid, Linoleic Acid and others. Oleic acid (C18:1, cis-9) is a monounsaturated fatty acid and one of the major components of tall-oil fatty acids. It is a colourless, low-melting oil and is chemically classified as a long-chain C18 hydrocarbyl with one cis double bond at the ninth carbon atom. This structure provides oleic acid with good optical stability and lubricating properties, especially compared to polyunsaturated fatty acids. Oleic acid is commonly extracted from streams of refined tall oil (a by-product of the kraft process of pulping) and is recognized as a defined and purifiable product in government toxicology and chemicals databases and regulations dealing with food additives. Physical and purity specifications for oleic acid, refractive index, acid value, saponification value range, and limits on the contents of unsaponifiable and water are laid down in the international commodity specifications and food safety specifications

From an industrial perspective, oleic acid, with its single double bond and long hydrocarbon chain, is internally versatile: it is converted into esters, amides and salts used in lubricants for the machining of metals, in corrosion inhibiting additives, in alkyd and alkyd modified coating resins, in surfactants and plasticisers. Oleic acid, as a substance derived from tall oil, offers a renewable-feedstock profile suitable for applications that traditionally relied on petrochemical fatty acids. This shift is increasingly recognized and regulated by governments and standard-setting bodies.

Its treatment from a regulatory perspective further indicates its acceptability: U.S. food additive regulations expressly permit oleic acid derived from tall oil for certain purposes, provided it complies with certain purity specifications. This reflects the authorities’ focus on source integrity, processing methods, and impurity control. by the authorities. Further, environmental and safety dossiers (including EPA read-across materials) use the oleic tall oil data for hazard assessment and formulation guidelines. This aids the industry in securing acceptance with a clear regulatory track record.

Harima Chemical Group Inc. reported revenue of 20,410 million yen from domestic sales and 679 million yen from overseas sales for its resin and tall oil product segment in FY2023. These figures highlight the company’s strong domestic demand for tall oil–derived chemicals used in resins, lubricants, and surfactants. Oleic acid, a key by-product of tall oil fatty acids, plays an important role in these applications as a renewable and biodegradable component. The company’s consistent performance in this segment reflects broader market growth for tall oil fatty acids and their derivatives, driven by increasing industrial and sustainability-focused chemical applications.

- By Application: Coatings & Lubricants

By Application, the Tall Oil Fatty Acid market is segmented into Soaps & Detergents, Coatings & Lubricants, Inks & Adhesives, Emulsifiers, Corrosion Inhibitors, and Others. The tall Oil Fatty Acid (TOFA) market, as a coating and lubricant, is experiencing a consistent growth owing to the global shift in adopting sustainability and renewable materials. TOFA is a bio-based and economical substitute for petroleum fatty acids, and it is a byproduct of the kraft lumber pulping process. It is mainly used in coatings in the manufacturing of the alkyd resin which is primarily used in decorative, industrial and protective paints due to its cost effectiveness, performance, and eco-friendliness. For example, Akzo Nobel India, one of the largest manufacturers of paints and coatings in the country, projects that the industry will grow to approximately US 12.22 billion (Rs. 1 lakh crore) in the coming five years. According to its latest annual report, the current value of the paints and coatings industry is approximately US$7.57 billion (Rs. 62,000 crore).

As regulatory pressure increases to reduce volatile organic compounds (VOCs) and enhance bio-content, manufacturers are reformulating coatings with TOFA-based resins, fueling consistent demand growth.

TOFA is also an important starting material of the lubricants industry as a precursor of esters, dimer acids, and other derivatives of lubricants that are employed in bio-lubricants and performance additives. Its adoption is promoted by a shift in usage to sustainable and biodegradable lubricants in the automotive, marine, and industrial markets. TOFA is also an excellent lubricant, with corrosion resistance and oxidative stability, making it an ideal additive in the development of environmentally friendly hydraulic fluids, greases and metal working fluids. Kraton also sells an under-branded line known as SYLFAT (which means tall oil fatty acid) used in industry as an ingredient, in the form of coatings, alkyd resins, lubricants and fuel/lubricity additives. For example, SYLFAT 2 TOFA is sold as a coating binder and focuses on properties as higher hardness, reduced drying time, durability, and full biobased origin.

A further grade SYLFAT 2LT is a refined version of selected crude tall oil that provides low-temperature performance (low cloud point/pour point) to achieve lubricant/fuel additive performance. The positioning is good: renewable raw material (pine-based), constant quality, and use in coating (alkyds) as well as lubricants/fluids.

Additionally, industries are seeking to reduce reliance on non-renewable oil-based additives, and TOFA provides a renewable route with minimal compromise on performance. Rising industrialization in regions such as the Asia-Pacific and Latin America is further supporting lubricant production, creating new opportunities for TOFA suppliers.

In addition to sustainability, cost benefits and technology are also strengthening the place of TOFA in the two markets. Alkyd resins remain among the most cost-effective binders in coatings, and TOFA-based lubricants are becoming a popular option due to their cost-effectiveness and environmental friendliness. In addition, the constant development of resin modification and esterification processes is broadening the performance spectrum of TOFA and allows the company to enter higher-value markets. Despite variability in supply, which is dependent on the pulp and the paper industry, integration activities and the introduction of improved refining technologies are stabilizing supply. All these drivers make TOFA an important and valuable renewable raw material that fills the performance and sustainability gap in coatings and lubricant formulations.

Tall Oil Fatty Acid (TOFA) Market Geographical Outlook:

- North America: the US

The industrial growth in the United States is driving the use of various chemicals, and with the growing concern to adopt sustainable derivatives, the transition towards raw materials based on an eco-friendly profile is gaining traction in the country. Hence, tall oil fatty acid (TOFA), derived from pine trees, fulfils such criteria, and is playing an integral role in driving its demand for various applications such as coatings & lubricants, chemical intermediates and corrosion inhibitors, amongst others.

With rapid industrialization followed by strategic investments in new manufacturing establishments, the usage of such products is projected to progress. According to the American Coatings Association, the overall coatings volume is expected to show 2.3% growth in volume and 5.3% growth in value for 2025. Hence, such positive uplift in coatings production is anticipated to drive the demand for tall oil fatty acid as a raw material.

Additionally, the chemical sector is also showing improvement in overall production output, fuelled by the increased end-user demand, especially from the manufacturing sector, which is one of the main GDP contributors to the US economy. According to the American Chemistry Council, in Q1 2025, the volume of new orders experienced positive growth due to improvements in domestic orders, while the finished inventory level index showed steady growth.

Moreover, in addition to being used as a chemical intermediate, tall oil fatty acid is also finding its way into drilling fluids. As the energy demand is growing in the United States, the level of oil & natural gas production is also rising. According to the U.S. Energy Information Administration, in August 2025, the natural gas production in the United States stood at 131,533 million cubic feet per day, representing a considerable growth 5.7% growth in comparison to the August 2024 production volume. This improved production is further driving the demand and usage of tall oil fatty acid in the US market.

Tall Oil Fatty Acid (TOFA) Market Key Launches:

- In 2025, Ingevity announced plans to explore strategic alternatives, including potential sale, for its Performance Chemicals Industrial Specialities product line (encompassing TOFA) and North Charleston crude tall oil refinery to enhance segment focus and earnings.

- In November 2024, Kraton Chemical LLC selected Redox Limited as its channel partner to distribute Tall Oil Fatty Acids and Ink Polyamides in Australia and New Zealand. The cooperation allowed Redox's robust logistics and sales networks to improve the accessibility of Kraton's sustainable products to clients within that region. Kraton's Senior Director, Girish Udas, stressed that this collaboration would properly fulfill client needs as it widens the presence in markets. Additional products added to the agreement include Unidyme Dimer Acids and Sylvaros Tall Oil Rosins, expanding even more product options available through Redox.

Tall Oil Fatty Acid (TOFA) Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Tall Oil Fatty Acid (TOFA) Market Size in 2025 | US$646.858 million |

| Tall Oil Fatty Acid (TOFA) Market Size in 2030 | US$852.423 million |

| Growth Rate | CAGR of 5.67% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Million |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in Tall Oil Fatty Acid (TOFA) Market |

|

| Customization Scope | Free report customization with purchase |

Tall Oil Fatty Acid (TOFA) Market Segmentation:

- By Product

- Oleic acid

- Linoleic acid

- Others

- By Application

- Dimer acid

- Alkyd resins

- Others

- By End User

- Soaps and detergents

- Coatings and lubricants

- Plastics

- Others

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- United Kingdom

- Germany

- France

- Italy

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Others

- North America