Report Overview

High Voltage Circuit Breakers Highlights

High Voltage Circuit Breakers Market Size:

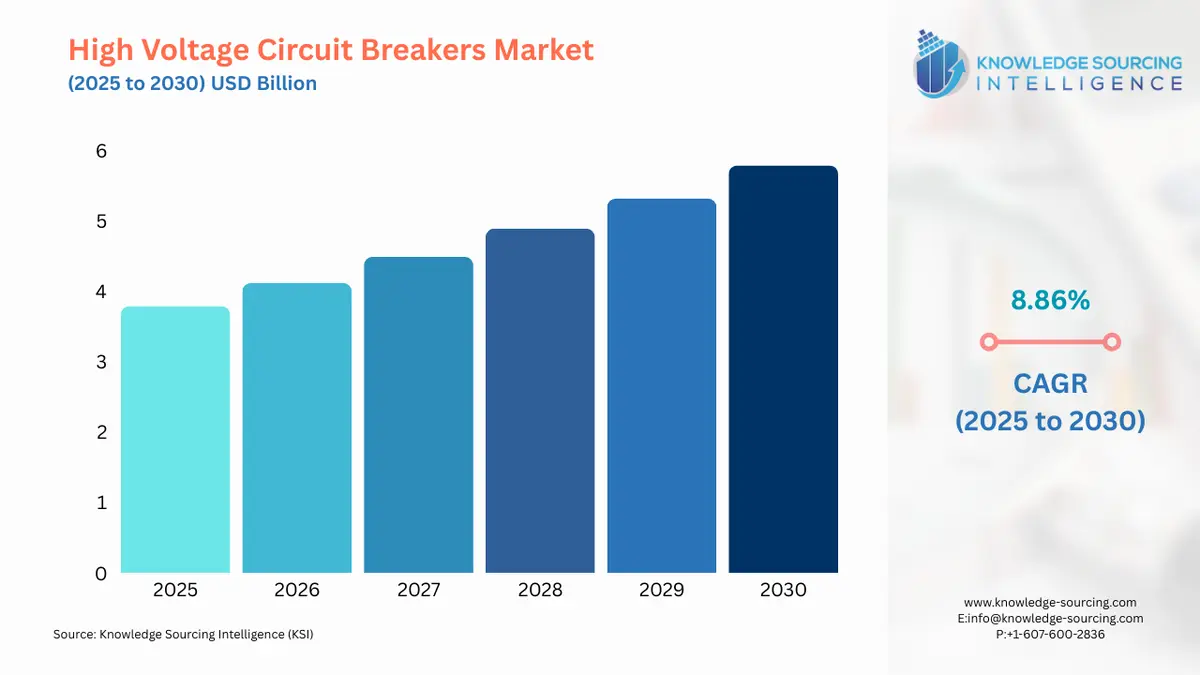

High Voltage Circuit Breakers Market, sustaining a 8.86% CAGR, is anticipated to reach USD 5.793 billion by 2030 from USD 3.789 billion in 2025.

High-voltage circuit breakers are mechanical switches that connect and disconnect circuits of current (operating currents and fault currents) and carry the nominal current when they are closed.

The fundamental function of a circuit breaker is to stop fault currents and isolate malfunctioning system components. At system voltage, an HV circuit breaker helps to stop a wide range of other currents, including load currents, tiny inductive currents, and capacitive currents. The high-voltage circuit breakers market will expand owing to their growing adoption in substations, construction sites, railway lines, airports, and other industries, which will boost the high-voltage circuit breakers market growth during the forecasted period.

High Voltage Circuit Breakers Market Drivers:

- The rising construction investment will boost the high-voltage circuit breakers market growth

High-voltage circuit breakers are widely used in construction sites because they provide constant verification that the electrical charge is within the safety limits, and if it is not, the electrical circuit should be quickly switched off. High-voltage circuit breakers are being employed more frequently in building sites to ensure electric flow safety, which will drive overall market growth. According to the US Census Bureau, total construction spending has increased from 1,501,841 million dollars in February 2020 to 1,844,105 million dollars in February 2023. In 2019, according to the National Development and Reform Commission of China, the country authorized 26 infrastructure projects with completion dates projected for 2023. Such rising construction investment globally will increase the demand for gaskets, which will boost the global metallic gasket market growth.

- Increasing investment in electric infrastructures will boost the market growth

In the electrical grid infrastructure, high-voltage circuit breakers protect and regulate the electrical power transmission networks. The protective relay system in substations, which guards against various types of overloads or ground/earth faults, uses high-voltage circuit breakers. The rising investments in substation and grid systems will boost the overall market growth. According to the International Energy Agency (IEA), Investment spending on electricity grids in the USA rose from 71 billion US$ in 2019 to 84 billion US$ in 2021. In September 2022, Tata Power announced plans to build 4 to 5 substations near high-rise buildings in Mumbai, as well as on the island city of Worli and the suburbs of Borivli, Andheri, Dahisar, and Malad. This rise in the substation construction and grid system investment will increase the usage of high-voltage circuit breakers, which will boost the overall market growth during the forecasted period.

High Voltage Circuit Breakers Market Geographical Outlook:

- During the forecast period, the Asia Pacific region is expected to dominate the market

During the projection period, the Asia-Pacific region is anticipated to dominate the high-voltage circuit breakers market owing to their thriving applications in the construction and railways sectors in major countries like China, India, and Australia. According to Infrastructure Australia, in Australia, yearly investments in buildings and infrastructure will peak in 2023 at over $52 billion, which is roughly twice as much as what will be spent in 2020.

The Indian railways frequently employ an air blast circuit breaker for rolling stock applications known as ABDJ (Air Blast Dis-Jointer. According to Invest India, in November 2021, Indian Railways stated that 102 semi-high-speed vande bharat express are anticipated to begin service by 2024, with at least 10 new trains that will connect 40 cities set to debut by August 2022. By 2023, Indian Railways hopes to fully electrify all broad-gauge railways. This increasing development in the construction and railways sector, coupled with favorable investments, is expected to accelerate the high-voltage circuit breakers market growth in the Asia Pacific region.

High Voltage Circuit Breakers Market Developments:

- October 2025: Schneider Electric’s SF6-free AirSeT primary switchgear technology was launched, offering pure-air insulation and digital readiness for high-voltage applications supporting decarbonized grid infrastructure.

- October 2025: Schneider Electric’s AirSeT technology was recognized by the World Economic Forum for sustainable design excellence, highlighting its role in reducing greenhouse gas emissions in power distribution systems.

- May 2025: Hitachi Energy announced it will deliver the world’s first SF6-free 550 kV gas-insulated switchgear (GIS), marking a major advance in eco-efficient high-voltage grid technology for ultra-high-voltage networks.

- 2025: Siemens reported deployment of high-voltage SF6-free circuit breakers and switchgear up to 145 kV using vacuum-interruption and clean-air insulation, expanding its climate-friendly HV equipment portfolio.

High Voltage Circuit Breakers Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 3.789 billion |

| Total Market Size in 2031 | USD 5.793 billion |

| Growth Rate | 8.86% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Type, Application, Geography |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

High Voltage Circuit Breakers Market Segmentation:

- HIGH-VOLTAGE CIRCUIT BREAKERS MARKET BY TYPE

- Air Blast Circuit Breaker

- Vacuum Circuit Breaker

- Oil Circuit Breaker

- SF6 Circuit Breaker

- HIGH-VOLTAGE CIRCUIT BREAKERS MARKET BY APPLICATION

- Substations

- Construction Sites

- Railway Lines

- Airports

- Others

- HIGH-VOLTAGE CIRCUIT BREAKERS MARKET BY GEOGRAPHY

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- France

- United Kingdom

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- China

- India

- Japan

- South Korea

- Indonesia

- Thailand

- Others

- North America