Report Overview

Medium Voltage Circuit Breaker Highlights

Medium Voltage Circuit Breaker Market Size:

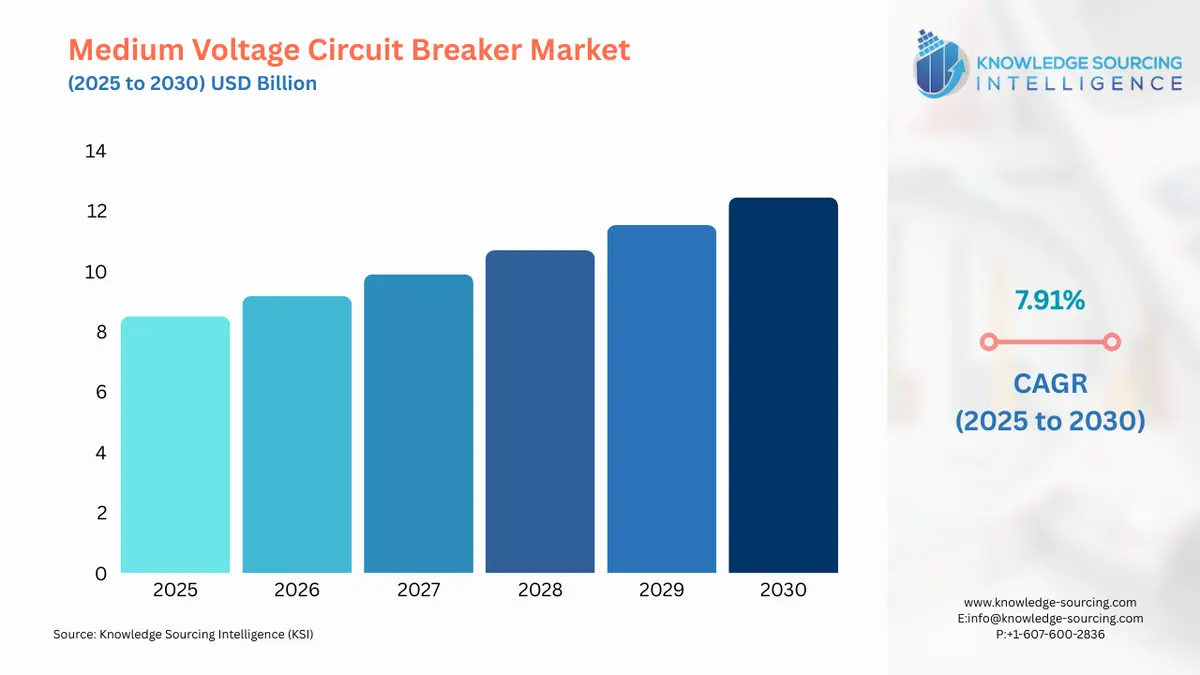

Medium Voltage Circuit Breaker Market, at a 7.91% CAGR, is expected to grow from USD 8.506 billion in 2025 to USD 12.447 billion in 2030.

A medium voltage circuit breaker (MVCB) is a protective device used to break an electrical circuit in case of a fault or overload and is designed to protect electrical equipment and systems that operate at medium voltage levels, typically between 1kV and 72.5kV. Medium voltage circuit breakers are used in various applications such as power distribution, generation, data centres, and transmission systems, as well as in industrial, commercial, and residential settings. Medium voltage circuit breakers are available in various types such as air circuit breakers, vacuum circuit breakers, SF6 circuit breakers, and oil circuit breakers. The increasing demand for reliable and efficient power systems, the rise of renewable energy sources, and a greater focus on safety and regulatory compliance in the industry are expected to boost the medium voltage circuit breaker market growth.

Medium Voltage Circuit Breaker Market Analysis

Growth Drivers

The growing demand for power distribution and renewable energy systems will boost the medium voltage circuit breaker market The medium voltage circuit breaker is an essential component in different electrical systems and applications, playing a critical role in protecting equipment, ensuring safety, and maintaining reliable power distribution. It is also used in renewable energy systems, such as solar and wind power, to manage fluctuations in power output and protect equipment from damage. The increasing demand for power distribution and renewable energy systems will boost the medium voltage circuit breaker market. The global energy transition is the paramount catalyst, directly propelling demand for MVCBs. Integration of volatile renewable energy sources, such as utility-scale solar and wind, necessitates advanced, fast-acting circuit protection systems to maintain grid stability and manage fluctuating power injection, creating specific demand for high-performance Vacuum Circuit Breakers (VCBs). Simultaneously, extensive grid modernization programs in North America and Europe, aimed at replacing infrastructure often exceeding 40 years of service, drive replacement demand for new units with enhanced digital monitoring capabilities. These modernizations require intelligent breakers capable of seamless integration into smart grids for real-time fault detection and predictive maintenance, directly increasing the value proposition and demand for technologically advanced units. Challenges and Opportunities A primary challenge is the high initial capital investment and long lifecycle of MVCBs, which can delay adoption cycles, particularly for utilities with limited capital expenditure budgets. Furthermore, disruptions in the global supply chain, which impact the reliable sourcing of key electronic components and raw materials, can constrain manufacturing output and increase final product pricing. Regulatory pressure and environmental mandates create a distinct market window for manufacturers to commercialize and scale production of sustainable alternatives, such as VCBs and solid-state circuit breakers. This shift presents a clear path to high-margin revenue and secures demand for eco-efficient product lines. Supply Chain Analysis The global supply chain for MVCBs is characterized by high complexity and geographic concentration, creating distinct dependencies. Asia-Pacific, notably China, serves as a significant production and assembly hub for both core components and finished products, leveraging large-scale manufacturing capacity. The chain begins with raw material extraction, moves to specialized component manufacturing (e.g., vacuum interrupter bottles, highly engineered contacts), and culminates in final assembly and integration into switchgear panels. Logistical complexities arise from the bulky nature of the final products, which necessitates specialized, cost-intensive shipping for intercontinental delivery. This structure results in lead times susceptible to delays from localized labor, energy, or geopolitical disruptions in key manufacturing countries. In-Depth Segment Analysis By End-User: Data Centers Demand for MVCBs from the Data Center segment is characterized by its high-intensity and mission-critical nature. The exponential expansion of cloud computing, Artificial Intelligence (AI), and hyperscale data infrastructure necessitates enormous and continuously increasing power consumption, requiring robust and highly reliable medium voltage power distribution systems. MVCBs are essential within the data center's main incoming substation and throughout the medium voltage distribution network to protect against catastrophic faults and ensure continuous uptime—a non-negotiable requirement for data center operations. The specific demand driver here is the imperative of Tier IV reliability, which mandates redundancy and the rapid isolation of faults. Data center operators invest in premium, high-interrupting capacity, and digitally-enabled MVCBs that can provide real-time monitoring and integrate with facility energy management systems, effectively creating a dedicated, high-value demand subset within the broader market. Geographical Analysis US Market Analysis (North America) The US market is fundamentally driven by the replacement cycle of aging transmission and distribution (T&D) infrastructure, with a significant portion of the grid exceeding its intended lifespan. Federal initiatives, such as the Infrastructure Investment and Jobs Act (IIJA), inject substantial capital into utility modernization projects. This funding directly increases demand for high-reliability MVCBs, particularly vacuum technology and digital-enabled breakers for smart grid deployment. Local factors include increasing penetration of distributed energy resources (solar, wind, and storage), which necessitates the installation of new MVCBs at interconnection points to manage bi-directional power flow and protect utility assets from grid disturbances. China Market Analysis (Asia-Pacific) China is the largest volume market globally, with demand driven by continuous rapid industrialization, urbanization, and ambitious $\text{T\&D}$ expansion. The national push for electric vehicle infrastructure and the build-out of hyperscale data centers require substantial electrical capacity additions. State-owned utilities drive large, consistent procurement cycles for MVCBs to support new power plant connections and the modernization of their vast grid. The local demand factor is the sheer scale and pace of its infrastructural development, creating an unparalleled need for all types of medium voltage electrical protection equipment. Competitive Environment and Analysis The Medium Voltage Circuit Breaker market exhibits characteristics of an oligopolistic structure, where a small number of global conglomerate players—primarily ABB, Siemens, Schneider Electric, and Eaton—dominate the technology landscape and market share. Competition centers less on price and more on technological differentiation, particularly in $\text{SF}_6$-free alternatives, digital integration capabilities (for smart grid applications), and global service networks. Mid-tier companies, particularly those from Asia-Pacific such as LS Electric and Hyundai Electric, focus on competitive pricing and leveraging regional manufacturing scale. The critical barrier to entry is the capital intensity of manufacturing, the stringent safety and reliability standards, and the long-term, trusted relationship required with major utility customers. Company Profiles ABB Ltd: ABB maintains a strong strategic position as a leader. Their strategy focuses on sustainability and digitalization, exemplified by their release of the PrimeGear ZX0 gas insulated switchgear with integrated vacuum circuit breakers and advanced digital monitoring features. Their global manufacturing and service footprint, particularly across Europe and Asia-Pacific, provides a structural advantage in managing complex utility contracts. Their verifiable commitment is toward a future-proof, eco-efficient portfolio. Recent Market Developments The following verifiable, material events illustrate the market's trajectory towards sustainability and grid infrastructure consolidation: October 2025: GE Vernova Fully Acquires Prolec GE Joint Venture GE Vernova announced the acquisition of the remaining fifty percent stake in its Prolec GE joint venture from Xignux. This move is a capacity addition and strategic consolidation, explicitly positioning GE Vernova to accelerate growth in its Electrification segment and enhance its capability to serve the rapidly expanding North American grid market, particularly to meet increasing electricity demand from data centers and new policy-driven infrastructure deployment. December 2024: ABB Completes Acquisition of Gamesa Electric Power Electronics Business ABB announced the completion of its acquisition of Gamesa Electric’s power electronics business from Siemens Gamesa. This is a targeted merger and acquisition designed to bolster ABB's position in the renewable power conversion sector. While not directly an MVCB product, it expands ABB’s overall capacity and serviceable installed base in key renewable applications like wind and solar, which are fundamental demand drivers for MVCBs at the substation level. Medium Voltage Circuit Breaker Market Segmentation By Type Air Circuit Breaker Vacuum Circuit Breaker Gas Circuit Breaker Oil Circuit Breaker Others By Application Power Generation Stations Data Centers Residential & Commercial Buildings Industrial Plants Transmission & Distribution Utilities Others By Installation Location Indoor Circuit Breakers Outdoor Circuit Breakers

Medium Voltage Circuit Breaker Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 8.506 billion |

| Total Market Size in 2031 | USD 12.447 billion |

| Growth Rate | 7.91% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Type, Application, Geography |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

Medium Voltage Circuit Breaker Market Segmentation

- MEDIUM-VOLTAGE CIRCUIT BREAKER MARKET BY TYPE

- Air Circuit Breaker

- Vacuum Circuit Breaker

- SF6 Circuit Breaker

- Oil Circuit Breaker

- MEDIUM-VOLTAGE CIRCUIT BREAKER MARKET BY APPLICATION

- Power Generation Stations

- DataCenters

- Residential & Commercial Buildings

- Industrial Plants

- Others

- MEDIUM-VOLTAGE CIRCUIT BREAKER MARKET BY GEOGRAPHY

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- France

- United Kingdom

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- China

- India

- Japan

- South Korea

- Indonesia

- Thailand

- Others

- North America