Report Overview

India 5G Fuel Cell Highlights

India 5G Fuel Cell Market Size:

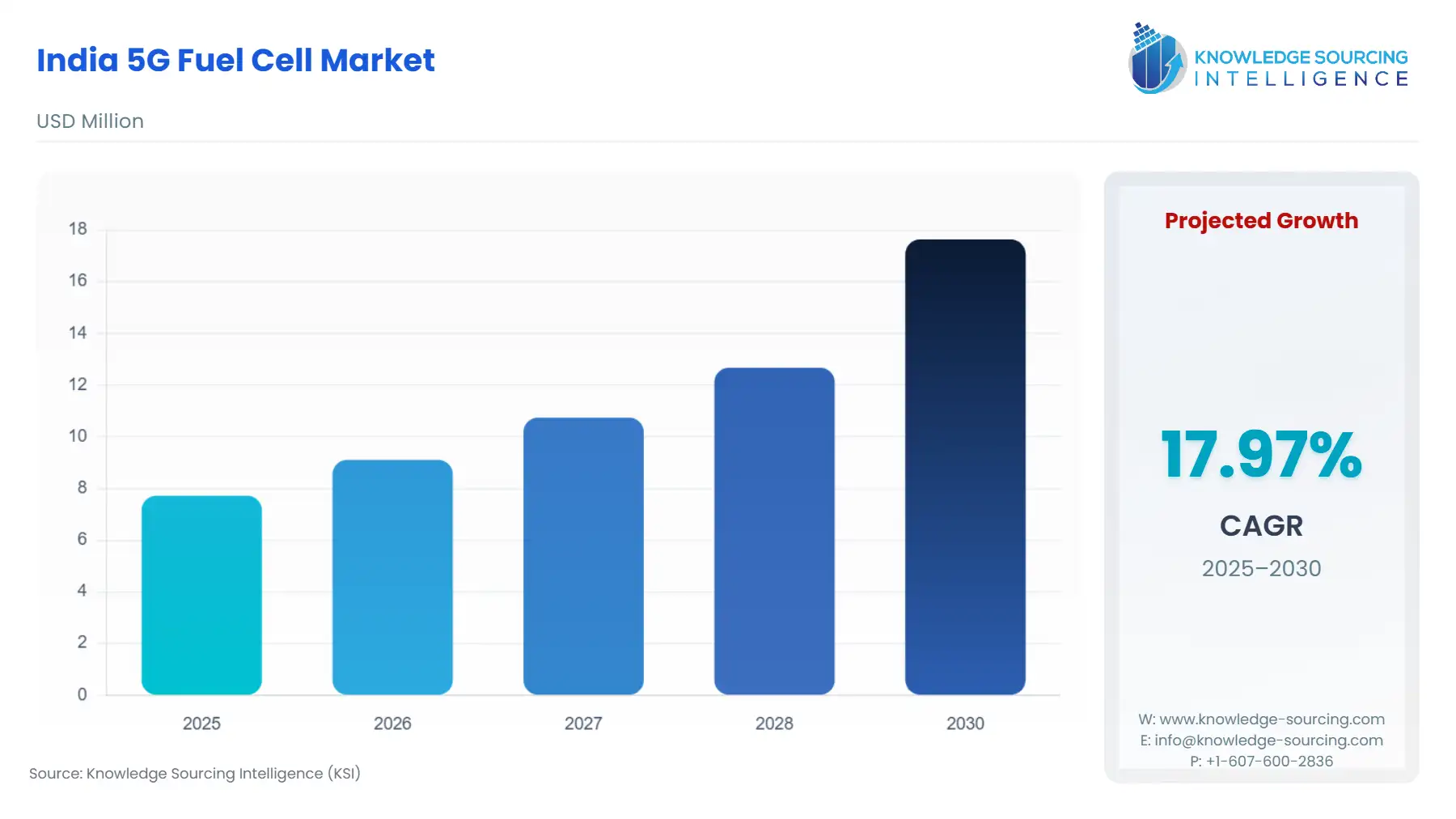

The India 5G Fuel Cell Market is expected to grow at a CAGR of 17.97%, reaching USD 17.640 million in 2030 from USD 7.720 million in 2025.

The Indian 5G Fuel Cell Market is transitioning from a nascent, technology-demonstration stage to a strategic commercial deployment phase, underpinned by a compelling confluence of regulatory support, environmental mandates, and technological necessity. The substantial density and higher power requirements inherent in 5G infrastructure—specifically the need for uninterrupted, reliable backup power for a vastly increased number of cell sites and edge data centers—position fuel cells as a viable, long-duration, and zero-emission alternative to conventional diesel generator (DG) sets. The country’s commitment to achieving net-zero targets by 2070 and establishing energy independence by 2047 has coalesced into the National Green Hydrogen Mission, providing a clear policy corridor that incentivizes the domestic development and large-scale adoption of fuel cell systems. This shift, driven by the operational mandates of telecom operators and the strategic push from the government, forms the foundational context for the market’s current trajectory.

India 5G Fuel Cell Market Analysis:

Growth Drivers

The primary factor propelling market growth is the operational intensity of 5G itself, which directly increases the energy demand at the cell site. A 5G base station consumes 1.5 to 2.5 times the power of a 5G equivalent, necessitating a superior, long-duration backup solution beyond traditional battery banks. This exponential power requirement directly increases the demand for high-efficiency fuel cell systems (5-50 kW and >50 kW categories) that can offer extended run times without the logistical complexities and environmental cost of diesel. Furthermore, the National Green Hydrogen Mission acts as a powerful growth catalyst by explicitly promoting hydrogen and fuel cell deployment for critical stationary applications, establishing a clear policy signal that mobilizes private investment towards this technology as a future-proof power source for the telecom sector. The Telecommunications (Right of Way) Rules, 2024, by simplifying the infrastructure deployment process, enable faster rollout of new 5G towers, creating an immediate, large-scale demand for deployable, low-noise, and low-footprint backup power solutions—all attributes inherent to fuel cells.

Challenges and Opportunities

A significant challenge constraining market growth is the lack of a mature, ubiquitous hydrogen or methanol fuel supply chain tailored for the distributed nature of telecom infrastructure. The capital expenditure (CAPEX) associated with early-stage fuel cell deployment, relative to established DG sets, also acts as a primary headwind, particularly for smaller tower infrastructure providers. However, this challenge simultaneously creates a massive opportunity: the Hydrogen and Fuel Cell Giga-Factory Initiative. Companies establishing domestic fuel cell manufacturing and hydrogen production capacity—such as Reliance Industries Limited's fuel cell giga factory plans—will unlock economies of scale, fundamentally shifting the cost-competitiveness curve against incumbent technologies. The opportunity also lies in Hybrid Energy Systems, where fuel cells are integrated with solar and battery storage, maximizing efficiency and resilience in off-grid or remote power solutions, thereby increasing their market desirability for tower companies seeking optimized total cost of ownership.

Raw Material and Pricing Analysis

Fuel cells, being a physical product, are fundamentally influenced by the supply and pricing of core components and fuel. The pricing dynamic is currently dominated by the high cost of Proton Exchange Membrane (PEM) components, specifically the Platinum Group Metal (PGM) catalysts. Global PGM price volatility, particularly for platinum, imposes a significant CAPEX constraint on PEM fuel cell stacks. This increases the total system cost, dampening commercial demand. However, the domestic ecosystem is responding through research, exemplified by the ARCI's focus on developing low-cost components and the development of alternative non-platinum catalysts. Crucially, the operating expense (OPEX) is tied to Hydrogen or Methanol costs. The SIGHT program under the National Green Hydrogen Mission offers direct incentives for green hydrogen and electrolyser manufacturing, aiming to reduce the cost of green hydrogen to $1 per kg. This regulatory intervention is designed to fundamentally decrease the long-term fuel cost for hydrogen-based fuel cells, directly increasing their economic viability and future demand relative to diesel.

Supply Chain Analysis

The Indian 5G Fuel Cell supply chain is characterized by a reliance on global production hubs for high-technology components, with assembly and integration increasingly shifting to India. Fuel Cell Stacks and Core Components (e.g., Membrane Electrode Assemblies or MEAs) are primarily sourced from North America and Europe, where technology maturity is highest. This dependency creates logistical complexities and subjects the final product to currency exchange volatility and geopolitical risk. Key domestic players, including FC TecNegy (via its partnership with SFC Energy AG) and the manufacturing plans of major conglomerates, are actively moving the System Integration and Balance of Plant (BOP) assembly into India, particularly in manufacturing clusters like Gurgaon. This localization strategy, driven by the 'Make in India' and Production Linked Incentive (PLI) schemes, aims to reduce lead times, mitigate import duties, and strengthen supply chain resilience, which is a key driver for ensuring consistent demand from large end-users like Telecom Operators and Tower Providers.

Government Regulations

| Jurisdiction | Key Regulation / Agency | Market Impact Analysis |

|---|---|---|

| India (Central) | National Green Hydrogen Mission (MNRE) | Directly accelerates demand for fuel cells by providing significant financial incentives for the production of green hydrogen and electrolysers, effectively reducing the future operating cost (OPEX) of hydrogen-powered 5G backup solutions. |

| India (Central) | Telecommunications (Right of Way) Rules, 2024 (DoT) | Streamlines the process for 5G infrastructure rollout across states. This de-bottlenecking mechanism accelerates network density, creating a higher volume of new sites that require modular, zero-emission power—a clear demand signal for compact fuel cell systems. |

| India (Central) | Pollution Control Board (Central/State) | The strict mandates on noise and emissions from DG sets, particularly in densely populated urban areas, act as a primary push factor, making silent and zero-emission fuel cells the only compliant solution for new urban 5G tower installations, thereby increasing demand. |

India 5G Fuel Cell Market Segment Analysis:

By Technology: Fuel Cell Systems

The Fuel Cell Systems segment, encompassing the complete integrated power solution including the stack, Balance of Plant (BOP), and fuel supply, is the critical market focus. The imperative for uninterrupted network uptime in 5G drives the need for integrated systems. The higher power consumption and the mission-critical nature of 5G applications like Fixed Wireless Access (FWA) and massive IoT require a power solution that guarantees reliable, long-duration backup power (>8 hours) and is easily scalable. Telecom Operators prioritize a single, certified, and integrated system over component-level procurement for simplicity in Operation & Maintenance (O&M). This necessity is also being shaped by the need for remote monitoring capability (part of the BOP), which is essential for managing the vast, geographically dispersed Indian telecom tower footprint. The move by Indian R&D (e.g., ARCI) to develop 20 kW PEMFC systems with high indigenous content is specifically targeted at meeting the integrated power requirements of telecom towers, reducing dependency on imported systems and creating a domestic supply pipeline that will directly service this demand.

By End-User: Telecom Operators

Telecom Operators (e.g., Jio, Airtel, Vodafone Idea) are the single largest growth drivers for 5G fuel cell solutions. Their necessity is fundamentally an outcome of three non-negotiable operational requirements: network reliability, environmental compliance, and OPEX reduction. The rollout of 5G, particularly using power-intensive Standalone (SA) architecture, demands a backup system with superior energy density to maintain service during extended grid outages, a common occurrence in many parts of India. Diesel sets are becoming an unsustainable OPEX burden due to fluctuating fuel costs and complex logistics, while also facing increasing environmental scrutiny. Operators are now explicitly seeking zero-emission solutions that align with their own published Environmental, Social, and Governance (ESG) goals. For instance, an operator's commitment to reducing carbon emissions directly translates into a procurement mandate for fuel cell systems for new urban and remote 5G towers, thereby creating a large, measurable commercial demand pipeline that is entirely policy and operations-driven.

India 5G Fuel Cell Market Competitive Environment and Analysis:

The Indian 5G Fuel Cell market is an emerging competitive landscape characterized by a blend of domestic engineering conglomerates, specialized international technology providers, and government research bodies collaborating on indigenous solutions. Competition is shifting from technology demonstration to securing large-volume domestic orders, with a key differentiator being the ability to localize manufacturing and manage the long-term fuel supply chain.

FC TecNegy Pvt Ltd is strategically positioned as a key domestic integrator and manufacturer, leveraging a critical partnership with international technology leader SFC Energy AG. Their competitive edge lies in the joint venture and manufacturing capability in Gurgaon, enabling them to offer DMFC (Direct Methanol Fuel Cell) systems under the 'Make in India' framework. A core product offering includes portable and stationary methanol fuel cell solutions, demonstrated by the December 2024 and January 2025 order for a total of €4 million from the Indian Defense sector, validating their production capacity and strategic reach into mission-critical segments. This positions them as a verified supplier capable of meeting high-reliability, low-logistics-footprint demands.

Bharat Heavy Electricals Ltd. (BHEL) is a major domestic entity with a strategic positioning rooted in its vast engineering and manufacturing heritage, coupled with its direct involvement in national energy and defense sectors. While the company's core products include heavy-duty equipment like transformers and power plant components, its strategic focus on emerging sectors is visible. BHEL engages in the design and manufacturing of products for renewable energy, and has dedicated R&D towards new energy systems. This leverage of established national supply chains and a focus on domestic R&D provides a powerful long-term competitive advantage in securing large, government-mandated infrastructure projects, including those for the 5G network expansion by government-owned telecom entities.

Reliance Industries Limited (RIL) is a transformative market entrant whose competitive strategy is based on vertical integration and scale. RIL is establishing one of the world's largest, fully integrated green energy ecosystems at its Dhirubhai Ambani Green Energy Giga Complex. The company has officially announced plans to set up a fuel cell giga factory, specifically targeting stationary applications for telecom towers and data centers. This strategic move aims to control the entire value chain—from green hydrogen production (fuel) and electrolysers to the final fuel cell system—allowing them to potentially offer the lowest Total Cost of Ownership (TCO) in the long run, positioning them to disrupt the market based on integrated domestic supply and cost efficiency.

India 5G Fuel Cell Market Recent Developments:

- February 2025: FC TecNegy Pvt Ltd and SFC Energy AG Joint Order: FC TecNegy placed a follow-up order with its strategic partner, SFC Energy AG, as part of a total 4 million Euro contract for Direct Methanol Fuel Cell (DMFC) based clean energy solutions. These portable and stationary systems are being produced at the joint fuel cell manufacturing unit in Gurgaon under the 'Make in India' initiative, demonstrating a tangible domestic capacity addition specifically for the defense and critical infrastructure market.

- December 2024: FC TecNegy Pvt Ltd and SFC Energy AG Initial Order: FC TecNegy placed an initial order with SFC Energy AG for DMFC-based clean energy solutions, which forms part of the 4 million Euro combined order announced in early 2025. This confirms a significant volume commitment for the production of fuel cells at their Indian joint manufacturing facility, signaling a material capacity addition and product ramp-up in the domestic market.

India 5G Fuel Cell Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 7.720 million |

| Total Market Size in 2031 | USD 17.640 million |

| Growth Rate | 17.97% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Product Type, Deployment, Power Output Range, End-User |

| Companies |

|

India 5G Fuel Cell Market Segmentation

- BY PRODUCT TYPE

- Fuel Cell Systems

- Fuel Cell Stacks & Components

- Fuel Supply Solutions

- BY DEPLOYMENT

- Backup Power Solutions

- Off-grid / Remote Power Solutions

- Hybrid Energy Systems

- High-capacity Solutions

- BY POWER OUTPUT RANGE

- <5 kW

- 5–50 kW

- 50 kW

- BY END USER

- Telecom Operators

- Tower & Infrastructure Providers

- Government & Defense Communication Networks

- Enterprise 5G Networks