Report Overview

Indonesia Infant Milk Formula Highlights

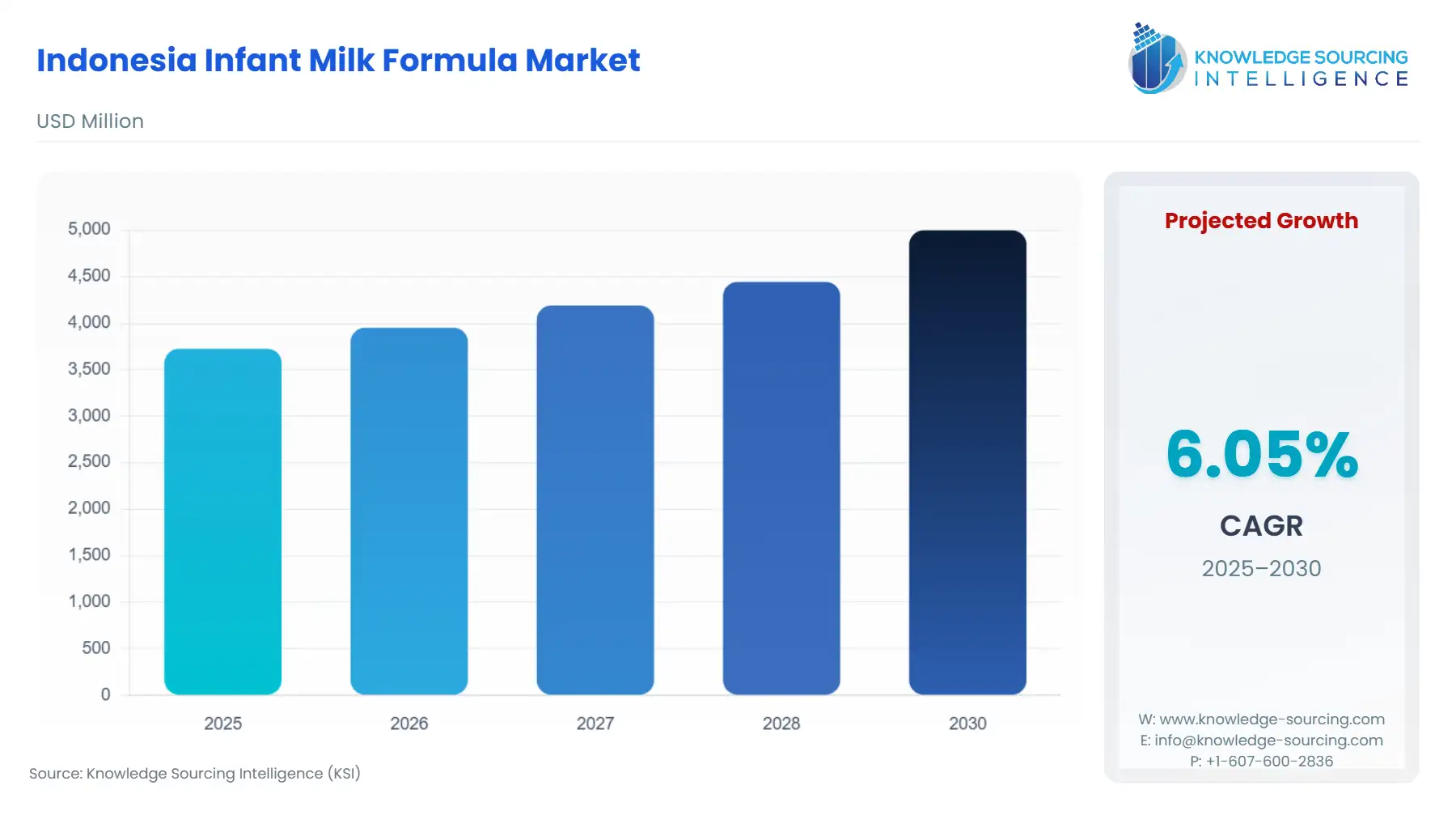

Indonesia Infant Milk Formula Market Size:

The Indonesian Infant Milk Formula market, valued at US$4,998.235 million in 2030 from US$3,725.447 million in 2025, is projected to grow at a CAGR of 6.05%.

Indonesia Infant Milk Formula Market Introduction

The Indonesian infant milk formula market is growing steadily. This growth is driven by a higher birth rate, more health-conscious parents, and a demand for convenient, nutritionally balanced feeding options. With a large, youthful population and many working mothers, infant formula is often used as a supplement or alternative to breastfeeding. The percentage of the female population in Indonesia has increased from 46% in 2005 to 53% in 2023, driving the demand for infant milk formulas for their children. The middle class is expanding, urbanization is increasing, and spending on child nutrition is rising, further boosting market growth. Government support for child health and innovation from both local and global manufacturers is shaping this changing landscape.

The Indonesian infant milk formula market is a vital segment of the country’s consumer goods sector, driven by a growing population, rising disposable incomes, and increasing participation of women in the workforce. As one of Southeast Asia’s largest economies, Indonesia’s high birth rate and urbanizing middle class create robust demand for infant nutrition products, particularly for families where breastfeeding is not feasible.

The market encompasses infant formula (0-6 months), follow-up formula (6-12 months), and growing-up formula (12-36 months), with a focus on premium products incorporating advanced ingredients like human milk oligosaccharides (HMOs) in formula, 2'-fucosyllactose (2'-FL), and lactoferrin in infant milk. These innovations aim to mimic the nutritional benefits of breast milk, supporting infant gut health, immunity, and cognitive development. Indonesia’s market is shaped by global brands like Danone, Nestlé, and Abbott, alongside local players such as PT Kalbe Farma and PT Frisian Flag Indonesia, all competing to meet evolving consumer preferences for clean-label, science-backed formulas. The integration of human milk oligosaccharides (HMOs) in formula has revolutionized the market, as HMOs, the third most abundant component in breast milk, promote beneficial gut bacteria and immune system development. 2'-FL, a key HMO, is increasingly incorporated into premium formulas, with Nestlé’s launch of Wyeth Illuma in China, signaling similar trends in Indonesia. Lactoferrin in infant milk, a bioactive protein, enhances antimicrobial activity and gut health, with Abbott’s Similac 360 Total Care featuring five HMOs and lactoferrin to support holistic infant development.

Indonesia’s market is further bolstered by e-commerce platforms, with platforms like Tokopedia expanding access to premium formulas, aligning with digital consumption trends. Government initiatives, such as Indonesia’s 2023 health campaigns promoting nutrition, indirectly support formula demand by raising awareness of infant health. The market’s growth is supported by technological advancements in formula production, such as smart water treatment for purity and encapsulation technologies to enhance nutrient stability, as seen in Danone’s Aptamil NEO 3 launch in Asia, featuring HMOs and dairy lipids.

Indonesia’s cultural emphasis on child health, combined with increasing parental awareness of nutritional science, drives demand for organic and allergen-free formulas. Local brands like PT Kalbe Farma have introduced lactose-free options, catering to infants with dietary sensitivities. The Indonesian infant milk formula market is poised for expansion, particularly in urban centers like Jakarta and Surabaya, where modern retail and e-commerce thrive.

Indonesia Infant Milk Formula Market Drivers:

- Rising Urbanization and Increasing Number of Working Mothers

More people are moving from rural to urban areas in Indonesia in search of better job opportunities, better infrastructure, and access to contemporary amenities, resulting in a notable urbanization boom. Traditional family structures are changing because of this demographic shift; in the past, extended relatives were essential to childcare. Nowadays, many metropolitan households are nuclear families, frequently without the help of grandparents or other family members to help raise young children. At the same time, Indonesia's socioeconomic landscape is evolving, and more women are actively engaged in the workforce. Women are being encouraged to seek employment while juggling their family obligations due to economic necessity, growing desires for a better lifestyle, and easier access to education.

In Indonesia, according to the World Bank, 59.4% of women and 45% of males were vulnerable to work in 2023. Indonesia has a higher rate of vulnerable employment for both men and women than the average for East Asia and the Pacific. It is becoming harder for Indonesian moms to balance the demands of their careers and the necessity to give their babies a healthy diet, as more of them return to work soon after giving birth. Despite being advised, nursing can be challenging to maintain solely because of time constraints, restrictive maternity leave laws, and a dearth of facilities in many industries that support breastfeeding. Therefore, infant milk formula has become a viable and dependable option for working women who want to ensure their children are fed consistently, safely, and nutritionally balanced while they are away. Formula feeding is becoming increasingly popular since it is convenient and time-efficient, enabling working moms to fulfill their professional obligations without sacrificing their child's nutritional needs.

The scientific formulation and health advantages of contemporary milk formula products are also highlighted in advertising, in-store promotions, pediatric advice, and product developments that urban parents are more likely to encounter, which further influences their purchasing decisions. The demand for newborn milk formula is being driven by the combined effects of urbanization and rising female labor force involvement in Indonesia's swiftly evolving social and economic landscape.

- Nutritional Advancements and Consumer Awareness

Advancements in HMOs in formula, 2'-FL, and lactoferrin in infant milk drive the Indonesian infant milk formula market by meeting parental demand for science-backed nutrition. HMOs and 2'-FL support gut health and immunity, while lactoferrin enhances antimicrobial properties, as seen in Nestlé’s HMO-enriched formulas. Smart water treatment ensures formula purity, with Danone’s Aptamil NEO 3 incorporating HMOs and dairy lipids. Growing consumer awareness, amplified by social media and health campaigns, encourages parents to choose premium infant formula for cognitive and digestive benefits. PT Kalbe Farma’s allergy-friendly formulas with lactoferrin cater to dietary sensitivities, further fueling market growth. - Growth of E-commerce and Modern Retail

The expansion of e-commerce platforms and modern retail channels significantly drives the Indonesian infant milk formula market, making infant formula more accessible to urban and rural consumers. Platforms like Tokopedia and Shopee offer a wide range of HMOs and lactoferrin in infant milk products, aligning with premiumization trends. The rise of modern retail, including supermarkets and pharmacies, supports infant milk distribution, as seen in PT Frisian Flag Indonesia’s retail partnerships. E-commerce platforms enable targeted marketing of 2'-FL-enriched formulas, appealing to tech-savvy parents. Indonesia’s digital economy growth, supported by government initiatives like the e-commerce roadmap, enhances online accessibility, driving demand for premium infant formula.

Indonesia Infant Milk Formula Market Restraints

- Stringent Government Regulations

Stringent government regulations significantly restrain the Indonesian infant milk formula market, particularly through restrictions on marketing and promotion. Indonesia’s Government Regulation No. 28 of 2024, under Law No. 17 of 2023, prohibits advertising, discounts, and healthcare professional endorsements for infant formula up to 36 months, aligning with the WHO’s Code of Marketing of Breast-Milk Substitutes. These rules limit companies’ ability to promote HMOs, 2'-FL, and lactoferrin in infant milk, impacting brand visibility on e-commerce platforms. Compliance increases operational costs, particularly for smaller players, slowing market expansion. The focus on breastfeeding advocacy, supported by WHO campaigns, further restricts formula marketing, challenging companies to innovate within regulatory boundaries. - Economic Volatility and Affordability Challenges

Economic volatility and inflation pose significant restraints on the Indonesian infant milk formula market, limiting the affordability of premium infant formula enriched with HMOs and lactoferrin. Bank Indonesia’s recent reports highlight rising inflation, reducing purchasing power for non-essential goods like premium infant milk. Premiumization trends, while popular among urban middle-class consumers, exclude lower-income households, restricting market penetration in rural areas. The high cost of advanced ingredients like 2'-FL increases formula prices, as noted in Abbott’s premium offerings. Economic pressures, combined with breastfeeding advocacy, shift some consumers toward cost-effective alternatives, slowing the growth of the premium infant formula segment despite strong demand for nutritional advancements.

Indonesia Infant Milk Formula Market Segment Analysis

- The online segment is growing robustly

By distribution channel, the Indonesian infant milk formula market is segmented into offline and online. The online distribution channel is quickly becoming a significant and rapidly expanding component of the Indonesian infant milk formula market, transforming the competitive landscape and drastically altering consumer purchasing behavior. Since cell phones are widely used, internet connectivity has improved, and consumers, especially young, tech-savvy parents, are becoming more comfortable with online transactions. E-commerce platforms have emerged as the go-to source for buying infant formula.

The Indonesian e-commerce market size is expected to grow from USD 52.93 billion in 2023 to USD 86.81 billion by 2028, according to the International Trade Administration. Indonesia's e-commerce business generated USD 51.9 billion, or around IDR 778.8 trillion, making it the largest of the ASEAN nations. The entire e-commerce revenue in ASEAN in 2022 was USD 99.5 billion, of which 52% came from Indonesian e-commerce companies. There are many different types of milk formula products available on popular Indonesian online markets like Tokopedia, Shopee, Lazada, Blibli, and other niche baby care websites. These marketplaces allow parents to browse, compare, and purchase from the comfort of their homes. The web channel greatly influences consumer selections, especially when choosing premium or specialty formulae, by providing comprehensive product descriptions, customer evaluations, and expert suggestions in addition to convenient access to both domestic and international brands.

E-commerce has also allowed niche and smaller milk formula businesses to enter the market and compete with larger, more established international corporations, increasing market competitiveness and product diversity. Offering subscription-based delivery, which guarantees a consistent and unbroken supply of infant formula, provides another level of convenience that is highly appealing to Indonesian parents. The online distribution channel will continue to be a major growth driver and a strategic focus area for both domestic and international players operating in the Indonesian Infant Milk Formula Market, as digital adoption continues to increase nationwide, bolstered by consumers' desire for hassle-free shopping experiences and improved logistics infrastructure.

- The need for the Formula 1 (0-6 Months) segment is growing rapidly

Formula 1 (0-6 Months) dominates the Indonesian infant milk formula market as it caters to newborns, a critical demographic requiring specialized nutrition when breastfeeding is not an option. This segment, designed to mimic breast milk, incorporates HMOs in formula, 2'-FL, and lactoferrin in infant milk to support immunity and gut health. Nestlé’s launch of Wyeth Illuma with HMOs and lactoferrin highlights the focus on science-backed nutrition for infants. Formula 1 benefits from high demand driven by high birth rates and parental trust in premium products, as seen in Abbott’s Similac 360 Total Care with five HMOs. E-commerce platforms like Tokopedia amplify access, making Formula 1 the leading segment due to its essential role in early infant development. - By Province, Java is anticipated to lead the market expansion

Java, encompassing key urban centers like Jakarta and Surabaya, leads the Indonesian infant milk formula market due to its dense population, high birth rates, and robust economic activity. As Indonesia’s economic hub, Java drives demand for infant formula, particularly premium products with HMOs in formula and 2'-FL, fueled by urban middle-class growth and working mothers. PT Frisian Flag Indonesia’s retail expansion in Java targets modern retail and e-commerce platforms to distribute lactoferrin in infant milk formulas. Government health campaigns in Java, such as the 2023 nutrition awareness programs, boost parental focus on infant milk quality. Java’s advanced retail infrastructure and digital economy, supported by platforms like Shopee, make it the dominant region for infant formula consumption compared to Bali or other provinces.

Indonesia Infant Milk Formula Market Key Developments:

- In 2024, Nestlé R&D teams developed a way to reduce the fat present in milk powder by up to 60%, without compromising on quality, taste, and creamy texture.

- Several brands have launched organic infant milk formulas, emphasizing natural ingredients and sustainable sourcing to appeal to health-conscious parents seeking premium nutrition options.

- Companies have developed infant formulas fortified with advanced nutrients like probiotics, prebiotics, and DHA, designed to support immunity and cognitive development, aligning with parental focus on holistic infant health.

- Brands have increasingly utilized online platforms and social media to promote infant milk formulas, making products more accessible through e-commerce channels, particularly during the COVID-19 pandemic.

Indonesia Infant Milk Formula Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Indonesia Infant Milk Formula Market Size in 2025 | US$3,725.447 million |

| Indonesia Infant Milk Formula Market Size in 2030 | US$4,998.235 million |

| Growth Rate | CAGR of 6.05% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Million |

| Segmentation |

|

| Geographical Segmentation | Jakarta, Bali, Java, Others |

| List of Major Companies in the Indonesia Infant Milk Formula Market |

|

| Customization Scope | Free report customization with purchase |

Indonesia Infant Milk Formula Market Segmentation:

- By Formula Type

- Formula 1 (0-6 Months)

- Formula 2 (6-12 Months)

- Formula 3 (1-3 Years)

- By Distribution Channel

- Online

- Offline

- By Province

- Jakarta

- Bali

- Java

- Others