Report Overview

Instant Coffee Market Size, Highlights

Instant Coffee Market Size:

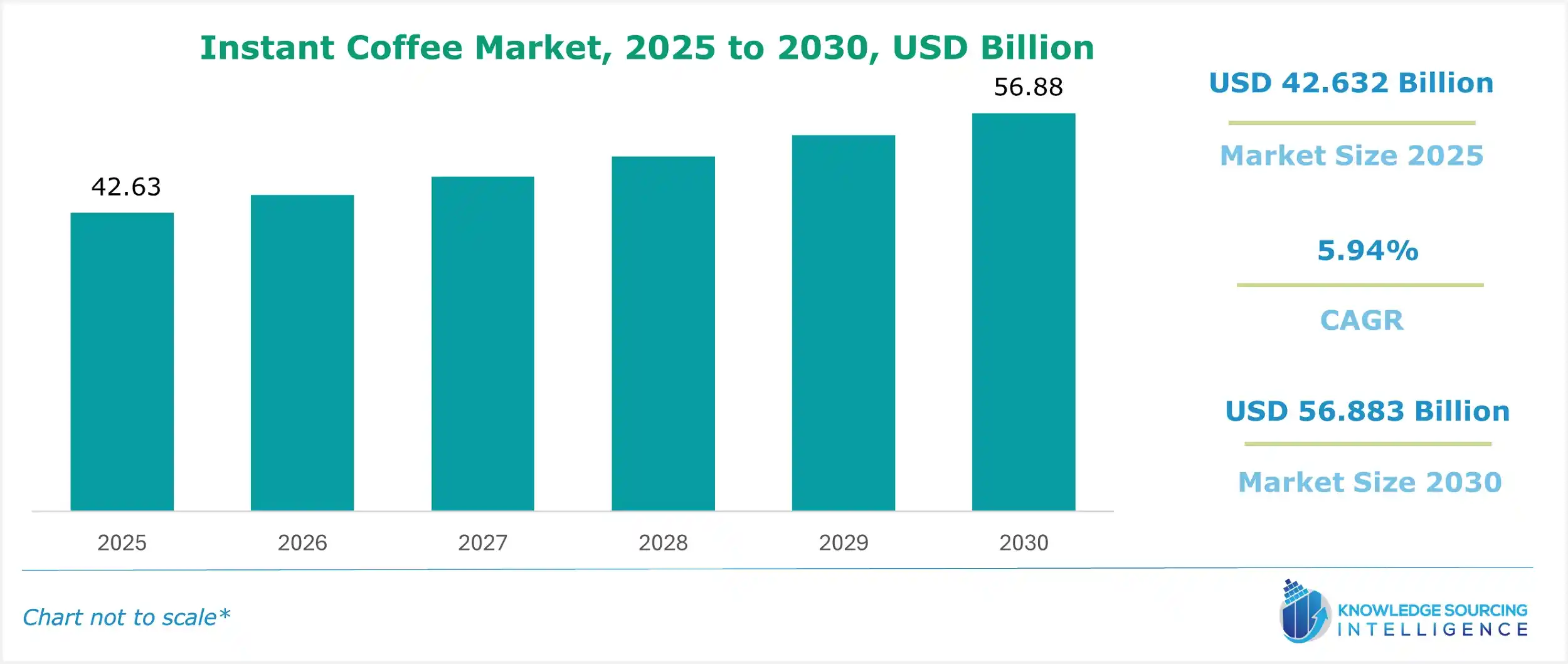

The global instant coffee market is projected to grow from USD 42.632 billion in 2025 to USD 56.883 billion by 2030 at a CAGR of 5.94% during the forecasted period.

Instant Coffee Market Highlights:

- Increasing millennial demand is driving growth in specialty instant coffee products.

- Growing urban lifestyles are boosting instant coffee consumption in metropolitan areas.

- Asia-Pacific is witnessing rapid market expansion due to rising disposable incomes.

- Advancing flavored coffee trends are enhancing consumer interest in unique blends.

- Expanding offline retail is increasing instant coffee sales in convenience stores.

- Rising freeze-dried coffee demand is fueling growth with superior flavor profiles.

- Evolving eco-friendly packaging is aligning with sustainability trends in the market.

Instant Coffee Market Overview:

Instant coffee is one of the most widely used forms of coffee, as it allows customers to quickly prepare their beverage by simply adding hot water and sugar.

The growing demand for specialty or high-quality coffee, especially among the millennial population, is further augmenting the instant coffee demand.

Similarly, coffee consumption is changing around the world, particularly in metropolitan areas, and the market is predicted to rise significantly during the forecast period because of the growing middle-class population.

Further, innovative instant coffee products like the rising prevalence of flavored coffee and organic coffee are contributing to this demand. Furthermore, the expanding culture of cafés and coffee shops in developing nations, along with rapidly surging online sales, is driving major market players to invest, boosting market growth potential during the projection period.

Instant Coffee Market Segment Analysis:

The global instant coffee market is segmented by:

- Type: The increasing soluble coffee consumption, coupled with the rising production of coffee beans globally, is projected to boost the demand and market growth of instant coffee during the forecasted period. The freeze-dried segment has a significant market share as coffee culture has gone through significant growth, accelerated by the emergence of cafes, and demand for high-end coffee products has also grown. Freeze-dried instant coffee provides a home-consumption alternative to specialty roasts that are offered in cafes and maintains a café experience that does not require brewing equipment.

- Distribution Channel: By distribution channel, the offline segment is expected to dominate the market. The rise in urbanization and busy lifestyles, coupled with the growing adoption of coffee culture, is promoting the growth of the offline distribution channel in the coming years. The presence of a wider choice of different products, followed by the availability of shelf life, are also factors driving the growth of the offline retail segment of the instant coffee market.

- Region: The Asia Pacific region is expected to witness substantial growth in the global instant coffee market due to the improvement in disposable income, and the growing working culture has increased the demand for instant hot beverages that take less time to prepare, which has positively impacted the instant coffee consumption globally. This is also fuelled by improved consumer preference, booming caffeine culture, and increased demand for specialty coffee.

Top Trends Shaping the Instant Coffee Market:

1. Premiumization and Specialty Instant Coffee

- There is an increasing trend of consumers demanding premium instant coffee that is high-quality and a specialty blend. The market players are increasingly aligning with this trend by providing artisanal flavors and improved taste profiles, which is expected to promote the market.

2. Integration of Eco-Friendly Packaging

- There is a rise in the sustainability trend, which is leading to consumers demanding that brands utilize eco-friendly, biodegradable packaging such as pouches or paper-based packaging, which decreases carbon emissions and is lightweight.

Instant Coffee Market Growth Drivers vs. Challenges

Drivers:

- Growth in Coffee Consumption: This trend is especially dominant among millennials and Gen Z, who are major drivers of demand for new coffee formats. The presence of big companies such as Nestle offering instant coffee products is further adding to the market growth during the forecast period. Further, improved consumer demand has positively impacted the consumption volume in economies, for instance, as per the data provided by India’s Coffee Board, in 2023, the total coffee consumption stood at 91,000 tons, which marked a significant growth of over 84,000 tons from 2012. Hence, the development of new products as per consumer preference is helping the market to expand further.

- Rising consumer preferences towards flavored coffee: The increasing consumer preference for flavored instant coffee is a significant factor contributing to the demand for instant coffee. Over the past few years, significant development has been seen in the field of flavored instant coffee, and several new flavored instant coffees have been launched. For instance, in May 2024, Nestlé launched its product Nescafé Expresso Concentrate Sweet Vanilla, taking advantage of the increase in the consumption of cold coffee by 15%. Nestlé wanted to capture the growing out-of-home cold coffee trend.

Further, flavors such as vanilla, caramel, hazelnut, mocha, and seasonal varieties like pumpkin spice are becoming increasingly popular, especially among younger consumers seeking novelty and personalization in their coffee choices. This trend is fuelled by both out-of-home consumption at coffee shops and at-home brewing, as brands offer Flavored instant coffees, coffee pods, ready-to-drink beverages, and even whole beans infused with flavors. For example, Nestle’s soluble coffee sales grew from 16,648 million CHF in 2023 to 16,679 million CHF in 2024.

- Growing freeze-dried instant coffee demand: The growing consumption trend of instant coffee, together with an increase in the sales of soluble coffee globally, is projected to propel the market growth of freeze-dried instant coffee during the forecast period. Also, the higher demand for freeze-dried coffee, coupled with better flavor than other types, is expected to promote the growth of the segment.

Moreover, the rise in the production of coffee around the world, especially the production of Robusta beans preferred for instant coffee preparation. The availability of high-quality beans aids the increasing development of the freeze-dried segment, thus allowing raw material purchases at a lower cost. According to the United States Department of Agriculture[1] (USDA), the robusta coffee bean production globally accounted for 71,625 thousand 60 kg bags in 2023/2024, which is predicted to account for 76,380 thousand 60 kg bags in June 2024/2025. This is expected to further rise to a value of 77,010 thousand 60 kg bags in December 2024/2025 across the world.

Also, according to the USDA, global coffee bean exports accounted for an increase of 200,000 bags to the value of 119.8 million bags in 2023/2024. The major coffee crop production, coupled with the emerging rise in soluble coffee consumption and supply chain, is expected to drive the demand for instant coffee, such as freeze-dried coffee. Further, global players like Nestle and Starbucks, including local manufacturers, are entering into offering freeze-dried instant coffee, with flavor superimposition and blending into the concept of taste preference by consumers.

- Increase in instant coffee sales in retail stores: Department and convenience stores have witnessed an increase in sales. Moreover, the growth and development of convenience stores and other retail businesses are directly related to economic growth, followed by the speed of urbanization, which is projected to propel the market growth while resulting in the creation of multiple opportunities over the forecast period.

For instance, in January 2025, Coffee Island, in partnership with Vita Nova, announced the launch of its European coffee culture store in Gurugram, India. The company also aimed to expand its presence to establish 5 outlets in the country’s National Capital Region (NCR) by March 2025. Further, increasing its coffee store outlets by 20 across India by March 2025. The brand planned to launch diverse retail products, which include instant coffee. In addition, Packaging innovation, such as sachets in single servings, would further stimulate the growth of the segment through consideration of on-the-go customers.

Moreover, the expansion of the middle-class population, followed by an increase in disposable income with rapid urbanization, is a few factors accentuating the demand for instant coffee in the offline retail stores. Irrespective of the varying pace of urbanization in all countries, global projections indicated that 1 in 7 people would be living in urban areas by 2050, and the historical urban share has influenced this projection. Further, it is expected to increase from 58 percent in 2024 to 68 percent in 2050.

Challenges:

- Quality concerns: Quality concerns of instant coffee products, which is inclusive of perceived inferiority, health issues, and environmental impact, could hamper the market’s growth. Some consumers perceive instant coffee as inferior in taste and containing overprocessed or additives, which could further hamper the market.

Instant Coffee Market Regional Analysis:

The instant coffee market is experiencing significant growth, particularly in North America, driven by rising coffee consumption and urbanization. Coffee remains a leading hot beverage in the United States, where instant coffee is gaining traction due to its convenience and accessibility. According to the U.S. Census Bureau, as of July 2024, 86% of the U.S. population, approximately 294 million people, resided in metro areas, with 88% of these areas experiencing population growth (U.S. Census Bureau, 2024). This urban expansion fuels demand for quick-preparation beverages like instant coffee.

The USDA’s Coffee World Market and Trade report indicates that U.S. domestic coffee consumption reached 23,950 thousand 60-kilogram bags in 2024, reflecting a 1.7% increase from 2023 (USDA, 2024). Additionally, the National Coffee Association’s Spring 2024 National Coffee Data Trends (NCDT) highlights that daily coffee consumption in the U.S. hit a 20-year high, with a 40% growth in consumption, underscoring the rising popularity of coffee products (National Coffee Association, 2024). Instant coffee, valued for its ease of use and long shelf life, appeals to busy urban consumers and on-the-go lifestyles.

North America’s market is further driven by product innovation, with brands like Nescafé and Starbucks offering premium instant coffee blends to cater to evolving consumer preferences. The region’s advanced retail infrastructure and e-commerce growth enhance market accessibility, while health-conscious trends boost demand for organic and low-sugar instant coffee. Technological advancements in freeze-drying and spray-drying processes improve product quality, further supporting market expansion.

Globally, Asia-Pacific and Europe are key markets, driven by urbanization and coffee culture, but North America leads due to its high consumption rates and innovative offerings. Challenges like price volatility in coffee beans persist, but sustainable sourcing mitigates these issues. The instant coffee market thrives on urban growth, convenience, and consumer trends, with North America at the forefront.

Instant Coffee Market Key Developments:

- In June 2025, Nescafé surpasses its regenerative agriculture target of 2025. Nescafé, Nestlé's largest coffee brand, reported it sourced 32% of its coffee from farmers utilising regenerative agriculture in 2024 and marks a remarkable transition for itself as it targets a sustainably sourced coffee supply versus its original 20% target by 2025.

List of Top Instant Coffee Companies:

Instant Coffee Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Instant Coffee Market Size in 2025 | USD 42.632 billion |

| Instant Coffee Market Size in 2030 | USD 56.883 billion |

| Growth Rate | CAGR of 5.94% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in Instant Coffee Market |

|

| Customization Scope | Free report customization with purchase |

Instant Coffee Market Segmentation:

By Type

- Freeze-dried Instant Coffee

- Spray-dried Instant Coffee

- Others

By Distribution Channel

- Online

- Offline

- Retail

- Supermarket/Hypermarket

- Convenience Stores

- Others

- Food Services

- Others

- Retail

By Region

- North America

- United States

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- United Kingdom

- Germany

- France

- Spain

- Others

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- Others

- Asia Pacific

- Japan

- China

- India

- South Korea

- Indonesia

- Thailand

- Others

Navigation

- Instant Coffee Market Size:

- Instant Coffee Market Highlights:

- Instant Coffee Market Overview:

- Instant Coffee Market Segment Analysis:

- Top Trends Shaping the Instant Coffee Market:

- Instant Coffee Market Growth Drivers vs. Challenges

- Instant Coffee Market Regional Analysis:

- Instant Coffee Market Key Developments:

- List of Top Instant Coffee Companies:

- Instant Coffee Market Scope: