Report Overview

Intrusion Prevention System Market Highlights

Intrusion Prevention System Market Size:

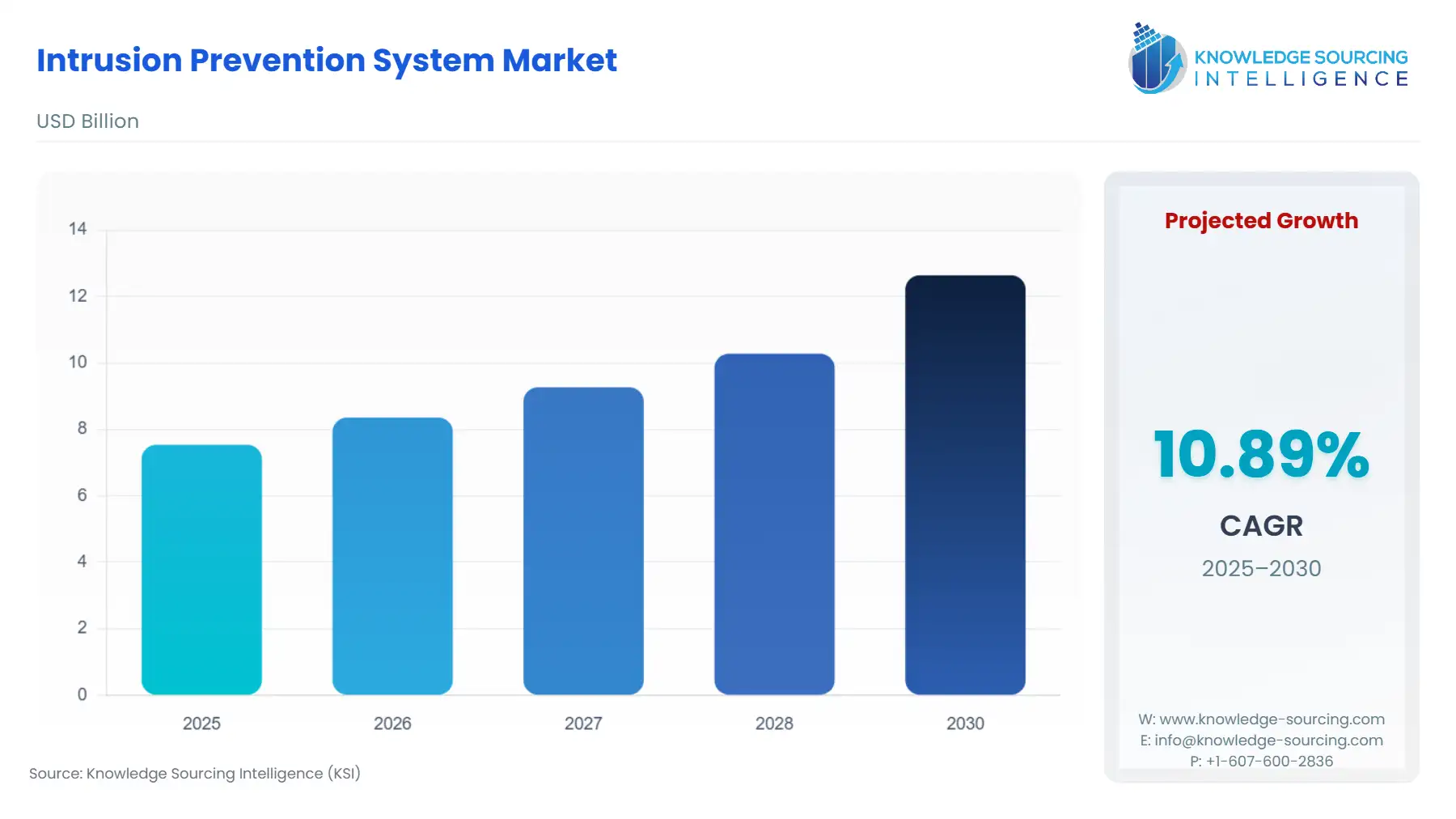

Intrusion Prevention System Market is projected to increase at a 10.57% CAGR, reaching USD 13.777 billion in 2031 from USD 7.538 billion in 2025.

Intrusion Prevention System Market Trends:

An intrusion prevention system (IPS) is a network security device that monitors network traffic for malicious activity or policy violations and takes action to prevent it. IPS solutions are designed to identify and respond to various threats, including malware, unauthorized access attempts, and other security threats that could potentially compromise the integrity and confidentiality of a network. The increasing number of cyber threats, stringent regulatory requirements along the growing awareness of the importance of security are driving the intrusion prevention system industry growth.

Intrusion Prevention System Market Growth Drivers:

Surging cyber threats bolster the intrusion prevention system market growth.

Intrusion Prevention System (IPS) serves as a critical defense mechanism against a wide range of cyber threats by actively monitoring network traffic and blocking potentially malicious activities. With cybercriminals continually evolving their tactics, leveraging advanced techniques to breach network defenses and exploit vulnerabilities, the demand for intrusion prevention systems (IPS) is also growing. For instance, according to the 2023 cyber security report by Checkpoint, global cyberattacks increased by 38% in 2022 compared to the previous year 2021. As per the same report, there has been a significant increase in the number of attacks on cloud-based networks per organization, which shot up by 48% in 2022 compared with 2021 indicating a concerning shift.

Stringent Regulatory Requirements drive the intrusion prevention system market growth.

Intrusion Prevention Systems (IPS) play a crucial role in helping organizations adhere to stringent regulatory requirements and compliance standards. By actively monitoring network traffic and pre-emptively blocking malicious activities, IPS solutions contribute to maintaining the integrity, confidentiality, and availability of sensitive data. The implementation of stringent regulatory requirements, coupled with the increasing frequency and sophistication of cyber-attacks, has led to a growing demand for intrusion prevention systems. For instance, the Health Insurance Portability and Accountability Act (HIPAA) requires health plans, healthcare clearinghouses, and healthcare providers who transmit information in electronic form to maintain reasonable and appropriate administrative, technical, and physical safeguards for protecting patient health information. This highlights one of the numerous regulatory compliances implemented by the government to mitigate the risks posed by cyber threats.

Growing security awareness drives the intrusion prevention system market expansion.

By providing real-time threat detection and response capabilities, IPS helps bolster overall security awareness, empowering organizations to better safeguard their digital assets and sensitive information. As security awareness continues to grow among businesses and government entities, the demand for robust IPS solutions has witnessed a significant upsurge. For instance, organizations are increasingly prioritizing the deployment of IPS technologies to enhance their security posture, protect critical data, and fortify their defense mechanisms against cyber threats. Furthermore, the proliferation of cybersecurity education and training programs has contributed to the widespread dissemination of knowledge about the importance of implementing robust security measures, including IPS.

Intrusion Prevention System Market Geographical Outlook:

North America is expected to dominate the market.

North America is projected to account for a major share of the intrusion prevention system market. Major NA economies particularly the United States and Canada are witnessing significant growth owing to the presence of major players in the cybersecurity sector, significant investments in advanced technologies along with the growing importance of cybersecurity. For instance, according to Check Point research North America showed the largest increases in cyberattacks with a rise of 52% in attacks in 2022, compared to 2021. Also, the United States saw a 57% increase in overall cyberattacks in 2022, highlighting the significant rise in the number of cyberattacks and the need for security solutions like intrusion prevention systems (IPS).

Intrusion Prevention System Market Challenges:

The complex configuration will restrain the intrusion prevention system market growth.

The intrusion prevention system industry growth may be restrained by the complexity and integration challenges in the adoption of Intrusion Prevention System (IPS) solutions. For instance, large organizations often have diverse network architectures, including legacy systems, multiple data centers, and a variety of endpoints. Integrating an IPS into such a complex network can be daunting. Also, Configuring IPS rules and policies to align with the specific needs of an organization can be complex. These complexities pose a challenge to the market's expansion and may require the intrusion prevention system industry to conduct a thorough assessment of its network infrastructure and understand its complexity, the various components, and the flow of data before implementing an intrusion prevention system.

Intrusion Prevention System Market Company Products:

Quantum Intrusion Prevention System (IPS): The Checkpoint Quantum Intrusion Prevention System (IPS) is skilled at detecting and preventing efforts to exploit vulnerabilities in susceptible systems or applications, effectively safeguarding against emerging threats. It offers a comprehensive array of signatures and proactive behavioural protections, enabling defense mechanisms against potential security breaches.

Secure IPS (NGIPS): Cisco Secure IPS offers versatile deployment options that cater to the diverse requirements of enterprises. It can be implemented at the network perimeter, in the data center distribution/core, or positioned behind the firewall to safeguard vital assets, guest access, and WAN connections. The Secure IPS solution supports both inline inspection and passive detection methods.

FortiGuard IPS: The AI/ML-powered FortiGuard IPS Service from Fortinet delivers nearly real-time intelligence, incorporating numerous intrusion prevention rules to identify and halt both recognized and potentially harmful threats before they can compromise devices. With advanced capabilities such as DPI and virtual patching, it offers robust protection by identifying and intercepting malicious network traffic.

Intrusion Prevention System Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Companies |

|

Report Metric | Details |

Intrusion Prevention System Market Size in 2025 | USD 7.538 billion |

Intrusion Prevention System Market Size in 2030 | USD 12.642 billion |

Growth Rate | CAGR of 10.90% |

Study Period | 2020 to 2030 |

Historical Data | 2020 to 2023 |

Base Year | 2024 |

Forecast Period | 2025 – 2030 |

Forecast Unit (Value) | USD Billion |

Segmentation |

|

Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

List of Major Companies in the Intrusion Prevention System Market |

|

Customization Scope | Free report customization with purchase |

Intrusion Prevention System (IPS) Market Segmentation

By Component

Hardware

Software

Services

By Type

Network-Based Intrusion Prevention System (IPS)

Host-Based Intrusion Prevention System (IPS)

Others

By Method

Signature-Based

Anomaly-Based

Policy-Based

By Deployment

Cloud

On-Premise

By Enterprise Size

Small

Medium

Large

By End-User

BFSI

Healthcare

IT & Telecommunication

Manufacturing

Retail

Others

By Geography

North America

United States

Canada

Mexico

South America

Brazil

Argentina

Others

Europe

United Kingdom

Germany

France

Spain

Others

Middle East and Africa

Saudi Arabia

UAE

Others

Asia Pacific

China

Japan

India

South Korea

Indonesia

Thailand

Others