Report Overview

Liquid Detergent Market - Highlights

Liquid Detergent Market Size:

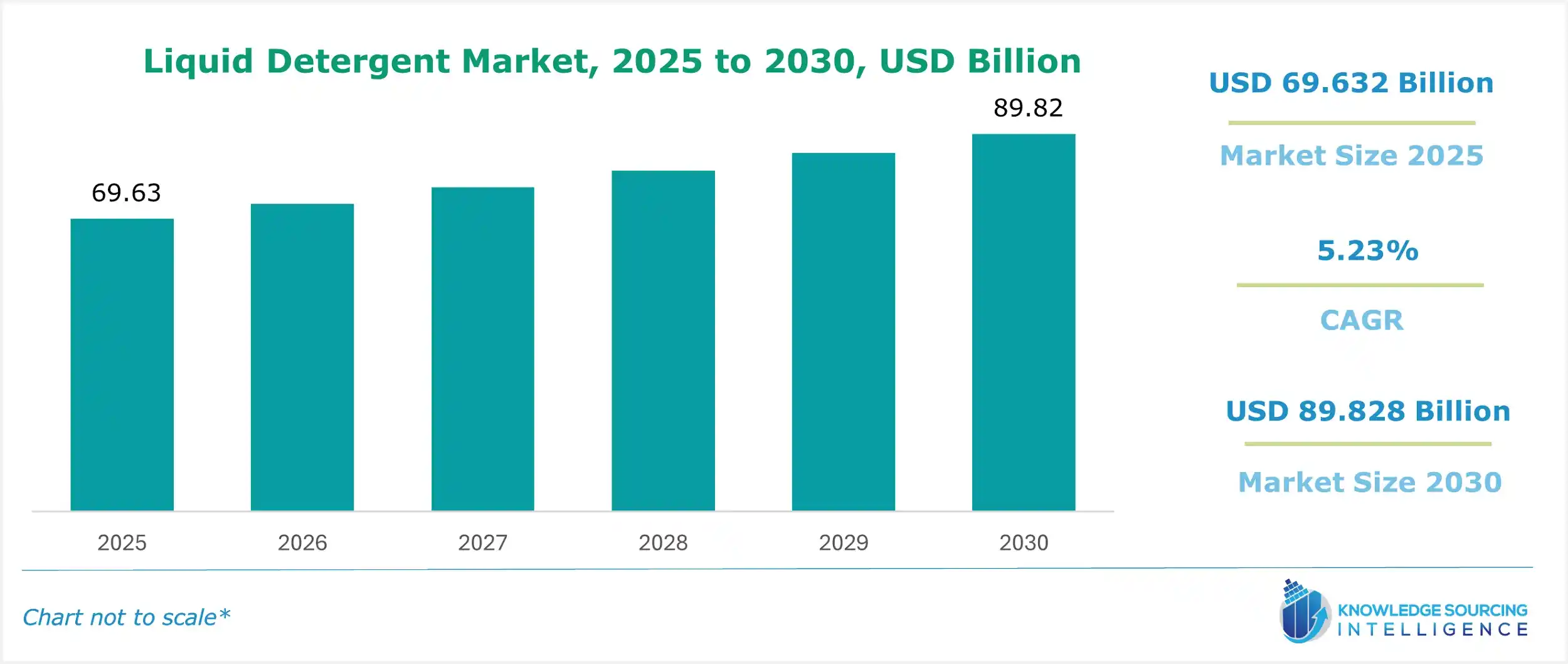

The Liquid Detergent market is set to witness robust growth at a CAGR of 5.23% during the forecast period, reaching a value of US$89.828 billion in 2030 from US$69.632 billion in 2025.

Liquid Detergent Market Trends:

Liquid detergent is a blended product based on various surfactants used in washing crockery and clothes. Liquid detergents help washing by reducing the surface tension of water.

The liquid detergent market is poised to grow due to its rising adoption as a result of consumer and business demand for convenience products and increased urbanization. Rapid urbanization, especially in developing economies worldwide, has increased demand for washing machines, supporting the liquid detergent market’s growth during the forecast years. The increasing demand for these products has prompted greater investments from key market players focused on product innovations due to rising consumer expectations and expanding market opportunities.

Liquid Detergent Market Growth Drivers:

- Growing safety and sustainability: The global liquid detergent demand is driven by consumers' increasing interest in cleanliness and personal hygiene. Liquid detergents increasingly attract commercial appeal because they are easy to use and are the most efficient, requiring less energy. Moreover, organic liquid detergents are gaining greater popularity among health-conscious consumers because they do not use any chemicals.

This encourages manufacturers to design detergents with more organic components. For instance, Puracy provides a stain-removal product that uses six plant-based enzymes. This product is specially designed for people who have sensitive skin and allergies.

- Growing convenience and ready-to-use: Liquid detergents come in ready-to-use formats, thereby reducing the need to measure and significantly reducing the possibility of spills. This is particularly beneficial for people searching for instant solutions, and they can be used in common and high-efficiency washers that are available with equal effectiveness in a wide range of water temperatures, increasing their popularity. Moreover, laundry experiences for customers are made easier by the convenience of their packaging, which includes easy-pour bottles and precise dispensing features.

Liquid Detergent Market Segmentation Analysis by Type:

- Organic: The organic segment is projected to witness healthy growth throughout the forecast period. The prime factors supplementing this segment’s growth during the forecast period include the rising proportion of health-savvy consumers, especially in the world's developed economies.

- Conventional: The conventional segment is anticipated to hold a considerable market share on account of the wide adoption of conventional detergents in the developing economies of the globe.

Liquid Detergent Market Segmentation Analysis by End-User:

- Residential: The residential segment is expected to hold a notable share due to the residents' high use of liquid detergent for cleaning purposes.

- Commercial: Laundry detergents are used in the commercial sector as they offer expert laundering services to several institutional and industrial clients. Moreover, to clean linens and textiles used in hotels and hospitals, several laundry facilities use automated washing machines and laundry equipment, which increases the segment share.

Liquid Detergent Market Segmentation Analysis by Application:

- Laundry: The laundry segment of the Liquid Detergent market is expected to rise due to increasing convenience, product innovations, and technological development.

- Dishwashing: The growth of the dishwashing segment is rising because of the need for time-saving products and the increased awareness of cleanliness and hygiene.

Liquid Detergent Market Segmentation Analysis by Distribution Channel:

- Online: The e-commerce market's global expansion in both developing and developed nations and the growing use of smartphones and the internet are also resulting in the segment's dynamic growth.

- Offline: Offline retail is essential because it caters to various customer needs and product preferences according to price sensitivity and convenience.

Liquid Detergent Market Geographical Outlook:

The Liquid Detergent market report analyzes growth factors across the following five regions:

- North America: The North American market is growing due to increasing convenience, a desire for clean living, and knowledge of the advantages of liquid detergents.

- Europe: The European market is driven by the growth of e-commerce and increased disposable income.

- Asia Pacific: The market is growing in Asia Pacific as a result of rising disposable incomes, urbanization, and awareness of hygienic standards, especially in nations like China and India.

- South America & MEA: The South American, Middle East and African regions are anticipated to witness significant growth due to the expanding retail sector and increasing urbanization.

Liquid Detergent Market – Competitive Landscape:

- P&G - Procter & Gamble markets liquid detergents named Ariel and Tide. P&G also produces other home care products, including dishwashing liquid, odor removers, and dishwasher detergent.

- Unilever - Unilever liquid detergents are made to brighten colors and remove stains. The brands include Comfort, Wonder Wash, and Surf Excel.

- Godrej Consumer Products Limited- Godrej Consumer Products is a prominent business in emerging markets. They produce toiletries, soaps, hair colorants, and liquid detergents. Godrej Fab is among their liquid detergent brands.

The following companies are among the global leaders in the liquid detergent industry's research, development, and advancement.

Liquid Detergent Market Latest Developments:

- In April 2024, Unilever launched a new laundry detergent under its Dirt Is Good brand, Wonder Wash, with Persil, OMO, and Skip.

Liquid Detergent Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Liquid Detergent Market Size in 2025 | US$69.632 billion |

| Liquid Detergent Market Size in 2030 | US$89.828 billion |

| Growth Rate | CAGR of 5.23% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in the Liquid Detergent Market |

|

| Customization Scope | Free report customization with purchase |

Liquid Detergent Market Segmentation:

By End-Use

- Residential

- Commercial

By Application

- Laundry

- Dishwashing

By Distribution Channel

- Online

- Offline

- North America

- United States

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- United Kingdom

- Germany

- France

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Taiwan

- Others