Report Overview

5G Thermal Interface Material Highlights

5G Thermal Interface Material Market Size

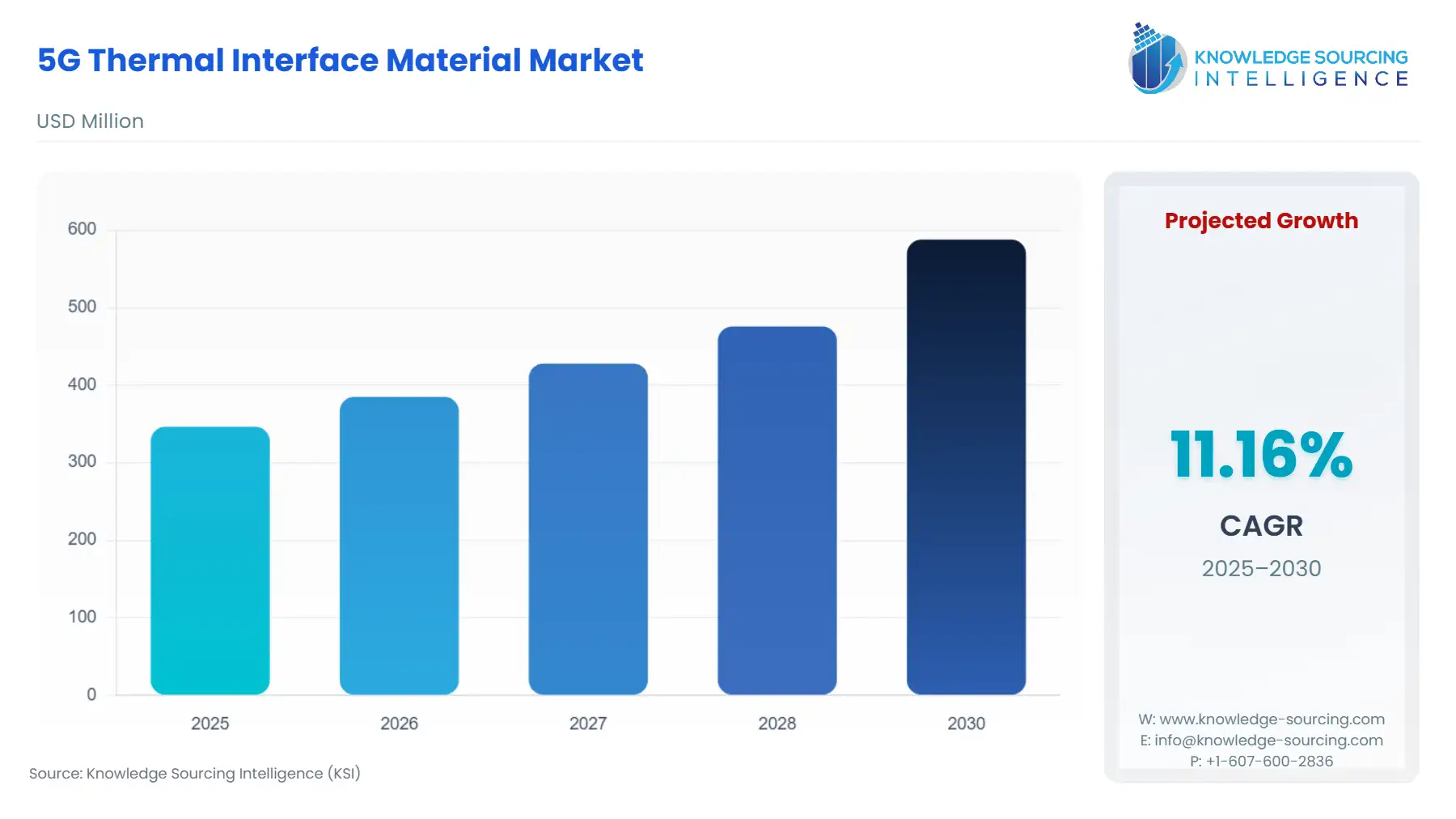

The global 5G Thermal Interface Material (TIM) market is predicted to grow at a CAGR of 11.16% to increase from US$346.307 million in 2025 to US$587.816 million by 2030.

The 5G Thermal Interface Material (TIM) Market is a segment of the broader electronics industry that focuses on the creation, production, and use of thermal interface materials tailored for 5G-enabled devices and infrastructure. As fifth-generation (5G) wireless technology becomes more widespread, the need for efficient thermal management solutions is rising. This, in turn, is spurring the development of specialized thermal management solutions (TIM).

5G Thermal Interface Material Market Growth Drivers:

As 5G technology evolves rapidly, the demand for effective thermal management solutions intensifies. The 5G Thermal Interface Material (TIM) market is increasingly focused on developing high-performance materials capable of dissipating heat in advanced telecom infrastructure. With the global rollout of 5G networks accelerating, industry players are dedicated to discovering innovative TIM solutions to address heat dissipation challenges.

Additionally, the rising need for smart automation for cars and homes is expected to have a positive impact on market growth. According to the GSA report for April 2023, there were 1,513 commercially available 5G devices, representing 79.8% of all 5G devices, which is an increase of 51.3% in the number of commercial 5G devices since the end of March 2022.

- 5G Infrastructure

The most recent type of cellular broadband connection is 5G. It is the most recent and technologically sophisticated data connection. However, high-power elements that use previously unprecedented amounts of energy are necessary to maintain an infrastructure with such tremendous capacities.

The 5G system uses a lot of energy, leading to a considerable amount of heat being produced, which is potentially unfavorable for the speed, dependability, efficiency, and longevity of such components. Consequently, the long-term success of 5G depends on monitoring, dissipation, and thermal management of that extra latent heat.

More high-power equipment is packed into smaller spaces in 5G systems, RUs, and active antenna devices. Additional energy must be consumed to produce the same amount of electricity, which increases heat production. Therefore, the 5G TIM market will have significant potential during the projection period because of the expansion of 5G infrastructure, such as AAUs. Subsequently, the global 5G AAU market was valued at US$8.313 billion in 2022.

- Acceleration of 5G Deployment

According to CTIA, the rollout of 5G will boost the US economy by approximately $1.7 trillion and add 3.8 to 4.6 million jobs over the next ten years. Investments in infrastructure will spur this growth by fostering innovation across all economic sectors. Moreover, in 2022, approximately 35% of the world's population will have access to 5G, according to the graph below, and that percentage is expected to reach nearly 8% by 2028.

With increased 5G deployment, it's crucial to guarantee consistent long-term reliability since many telecommunications system parts, like base stations, and stationary wireless network equipment, among others, are placed outdoors. Commercial telecom infrastructure components utilize robust electrical interconnects and reliable thermal interface materials for predictable operation, in contrast to data centers, where cooling operations are possible.

Developing 5G Infrastructure in Developing Countries:

Developing countries such as India and Southeast Asian countries like Indonesia and Thailand will become one of the major consumers of 5G in the coming years. For instance, according to Ookla, one of the global leaders in connectivity intelligence that provides consumers, businesses, and other organizations, India has ranked 14th globally in 5G median download speeds with 301.86 Mbps on Q4 2023 data.

5G Thermal Interface Material Market Segment Analysis:

- mmWave

By band, the market has been divided into sub-6 GHz and mmWave. The antenna structure, technology, and component selections all change when the deployment of 5G shifts to higher bandwidth. As per our analysts, this is expected to affect several variables, including thermal interface materials.

In addition, there has been remarkable progress in the 5G mmWave bands rollout. At MWC 2023 in Barcelona, for instance, Telefónica, Ericsson, and Qualcomm unveiled the first operational mobile 5G mmWave service in Spain. The best option for attaining high speeds and large capacity and providing the greatest 5G experience in busy regions is to employ the 5G mmWave spectrum. The significance of 5G mmWave in the areas of FWA, technological advancement, Industry 4.0, and smart vehicles is particularly intriguing since it offers exceptionally high-performance accessibility and offers an entirely new spectrum of use cases.

Devices are being used to their fullest potential as a result of the 5G infrastructure components' increased data speeds, support for additional high frequency (mmWave), and reduced latency capabilities. We anticipate that since 5G will typically have more processing power, better thermal dissipation will become increasingly important, particularly in outdoor settings where continuous cooling is constrained. As a consequence, the dependable efficiency of 5G is dependent on thermal interface materials.

- By Format

Thermal interface materials (TIMs) are available in a variety of forms, such as pads, gels, liquids, and others, to support complicated design requirements, maximize system dependability, and provide compatibility with high-volume production. Gels and pads are anticipated to grow at a high CAGR throughout the forecast period because of their EMI absorbing, extremely conformable, thermally isolating, and low hardness attributes. For resistance to tearing, shearing, and punctures, they can also be strengthened with fiberglass.

Furthermore, electronics need to be protected from external factors such as RF interference, operational stress, moisture, and corrosion for 5G, considering the challenging environments in which different network components are installed. As a result, many players such as Henkel have incorporated extensive 5G materials portfolios, including TIMs that safeguard critical remote radio PCBs from moisture and deterioration, guarantee enclosures, seal sensitive equipment, offer interconnect security for high-power components like large ASICs employed in base stations and antennas, and conformal protective coatings for high-power components.

List of Top 5G Thermal Interface Material Companies:

Some of the leading players in the market include Henkel AG & Co. KGaA, Boyd, Parker Chomerics, GLPOLY, and Shin-Etsu Chemical Co. These firms have undertaken various business strategies such as product launches, investments, and partnerships to expand their product offerings. For instance, The telecom industry has long benefited from Henkel's award-winning bonding and insulating solutions and BERGQUIST brand temperature control products. Henkel's application experience, formulation competence, and established efficacy of products will now deliver once more for the telecom sector as the industry moves to new 5G-capable designs.

5G Thermal Interface Material Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| 5G Thermal Interface Material Market Size in 2025 | US$346.307 million |

| 5G Thermal Interface Material Market Size in 2030 | US$587.816 million |

| Growth Rate | CAGR of 11.16% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Million |

| Segmentation |

|

| Geographical Segmentation | Americas, Europe, Middle East and Africa, Asia Pacific |

| Geographical Segmentation List of Major Companies in 5G Thermal Interface Material Market |

|

| Customization Scope | Free report customization with purchase |

The 5G Thermal Interface Material Market is analyzed into the following segments:

- By Infrastructure Deployment

- Antenna

- BBU

- Power Supply

- By Format

- Pad

- Gel

- Liquid

- Others

- By End-User

- Consumer Electronics

- Telecom

- Automotive

- Industrial IoT

- Others

- By Band

- Sub-6 GHz

- mmWave

- Others

- By Geography

- Americas

- United States

- Others

- Europe, Middle East and Africa

- Germany

- UK

- Others

- Asia Pacific

- China

- Japan

- South Korea

- Others

- Americas