Report Overview

Natural Vitamin E Market Size:

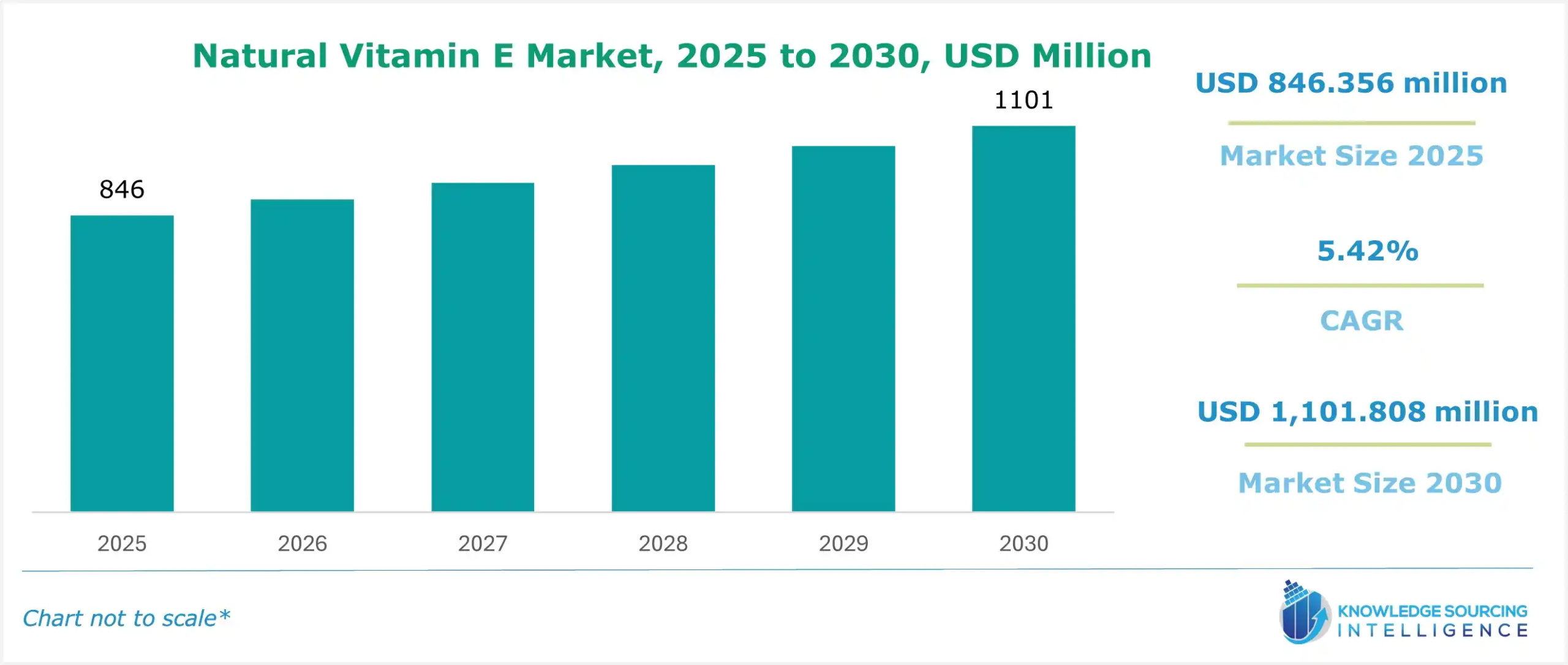

The natural vitamin E market is projected to grow at a CAGR of 5.42% over the forecast period, increasing from US$846.356 million in 2025 to US$1,101.808 million by 2030.

Natural Vitamin E Market Trends:

Natural vitamin E belongs to a group of compounds known for their antioxidant properties that help to protect cells from damage. The rapid increase in personal health and wellness is motivating consumers to incorporate vitamins and supplements into their diets. Further, the increasing R&D spending worldwide also leads to the growth of the Natural Vitamin E market’s growth.

Other driving forces included increasing demand for natural and organic products, growing popularity of fortified and functional food and beverage products, government initiatives promoting the use of natural ingredients, and rising demand for the animal feed market. These driving factors are causing key players to make appropriate moves to feed the demand.

- A key driver for the increase is the rise in consumer preferences, which have shifted towards products that have organically produced key vitamins such as vitamin E. The trend of new, naturally derived Vitamin E has significantly boosted the demand for beauty and personal care products.

- The natural vitamin E market is experiencing an increasing application of natural vitamin E for geriatric supplement products.

- Additionally, rising awareness about the benefits of consuming vitamin E among people is expected to have a will positively impact on the market’s growth in the projected period.

Natural Vitamin E Market Growth Drivers:

- Rising demand from the animal feed industry

The natural vitamin E tocopherol P powder is off-white to light brown and used in animal feed. and it contains all the isomers of Vitamin E, providing comprehensive nutritional benefits. The demand for animal-quality meat is rising globally. Hence, the demand for Vitamin E in animal feed products such as OXABIOL E by BTSA. It is extracted from non-GMO vegetables and is an essential compound in animal nutrition. Oxabiol E feed is available in different formats and concentrations, from 250 to 1300 International Units. BTSA is one of the leading European manufacturers of Natural Vitamin E for animal feed.

Another, EVMix by ExcelVite, is a naturally occurring mixture of carotenes and vitamin E complex (tocotrienols and alpha-tocopherol), extracted from Malaysian palm oil (non-GMO). These are necessary natural compounds for growth and reproduction in animals.

Additionally, the sheep and goat meat imports in the European Union have expanded from 152,319 tonnes in 2022 to 158,304 tonnes in 2023, displaying the increased demand for meat imports in Europe. These increased demands for meat indicate the growing animal feed market for feeding cattle.

- Growing awareness regarding vitamin E's benefits is driving the market growth

Various studies have shown that ingestion of vitamin E-rich food or dietary supplements leads to decreased prevalence of fatal cardiovascular disease, cancer, dementia, and other medical disorders. Natural vitamin E aids in the maintenance of healthy skin and eyes, as well as the strengthening of the body's immunity system against sickness and viral or bacterial infection.

Consumption of natural vitamin E products can also decrease its deficiency and prevent the occurrence of autoimmune diseases such as ataxia and AVED. Vitamin E is a rich antioxidant that can be useful in minimizing UV damage to the skin.

Furthermore, using vitamin E topically on your skin can help hydrate and protect it from free radical damage. It also helps in providing relief to people suffering from medical disorders such as eczema, psoriasis, and acne. As a result, the market is also witnessing a growing application of natural vitamin E in hydrating creams, nourishing serums, and potent eye creams.

- Increasing geriatric population

The demand for natural vitamin E-based dietary supplements is significant among the senior population as it has potential benefits in addressing age-related health conditions. As vitamin E has potent antioxidants, it helps in protecting oxidative stress related to the aging process and helps in immunizing against cardiovascular diseases, weakened immune function, and cognitive decline.

The increasing geriatric population all around the world is expected to influence the market for natural vitamin E in the projected period. For instance, according to the World Health Organization (WHO), by 2030, every 1 in 6 people will be aged 60 years or above. Additionally, between 2015 and 2050, the proportion of the world’s population over 60 years will increase from 12% to 22%. Such an increase in the geriatric population is anticipated to positively influence the market growth in the coming years.

Natural Vitamin E Market Challenges:

- High prices of natural vitamin E products, lack of concrete scientific evidence along with high and volatile prices of raw materials obstruct the growth of the global market for natural vitamin E during the projection period. However, continuous product innovation and launches especially in countries such as the US or the UK are providing new opportunities for key market players.

Natural Vitamin E Market Segment Analysis:

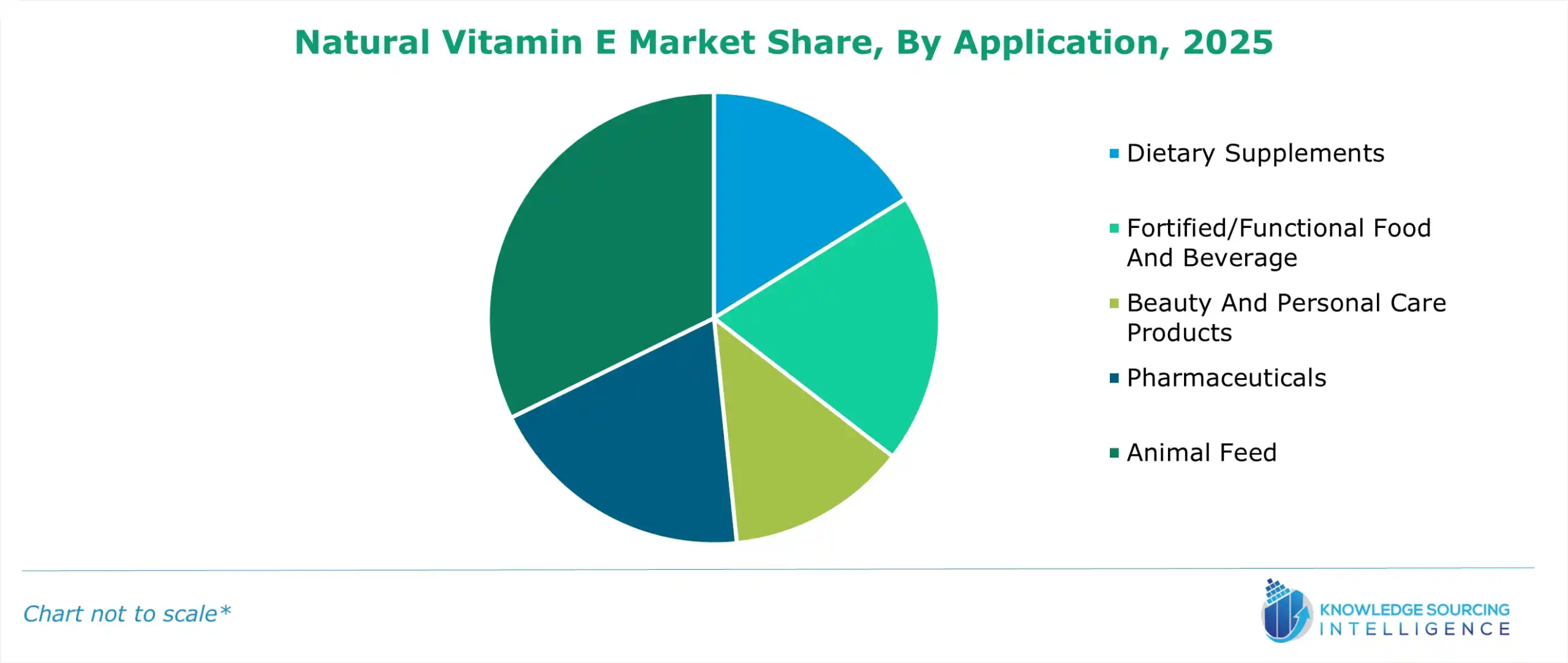

The natural vitamin E market is segmented by application into dietary supplements, fortified/functional food and beverage, beauty and personal care products, pharmaceuticals, and animal feed.

In the dietary supplement segment, demand for natural vitamin E would be driven because consumers are becoming aware of the uses of vitamin E. Natural Vitamin E contains antioxidants that are supporting ed regarding the health of skin, healthy immunity, and aging. The natural form of vitamin E is preferred more as consumers are increasingly opting for plant-based vitamin E because it is due to it being healthy and effective. Also, due to the demand for wellness and an aging world population, the growing dietary supplement market increases the demand for natural Vitamin E in a wide range of formulations for overall health and longevity.

Natural Vitamin E Market Geographical Outlook:

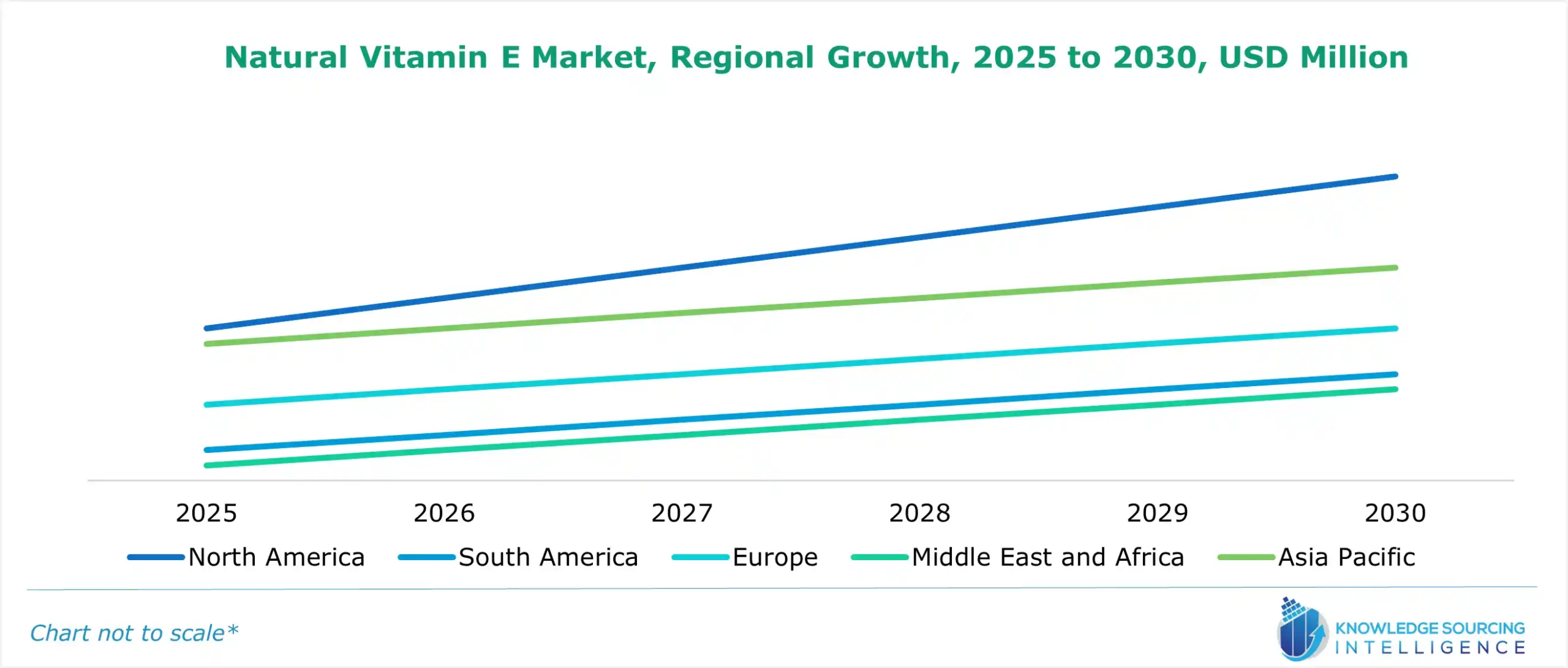

By geography, the natural vitamin E market is segmented into North America, South America, Europe, the Middle East and Africa, and Asia Pacific. The major economies like China, Japan, India, and South Korea dominate the Asia-Pacific region. Some of the fastest-growing emerging economies are from this region such as ASEAN countries. Country-wise, the Asia Pacific global natural vitamin E market has been segmented into China, Japan, India, South Korea, Indonesia, Taiwan, and others. China and South Korea.

India is expected to be a key driver of growth in the global natural vitamin E market in the coming years. The country's large population, rising health consciousness, and increasing disposable incomes are all contributing to the surging demand for natural vitamin E supplements and products.

One of the major factors fueling India's natural vitamin E market is the growing awareness among consumers about its health benefits. of vitamin E.

Vitamin E is a powerful antioxidant that helps protect cells from damage, supports immune function, and promotes healthy skin and hair. As more Indians become educated about these benefits, they are increasingly incorporating natural vitamin E into their diets through supplements, fortified foods, and personal care products.

India’s growing pharmaceutical and nutraceutical industry will is also expected to hold a significant share while driving the market demand for the Vitamin E market in India. According to Invest India, the pharmaceutical industry plays an imperative role which is valued at $50 billion. Furthermore, India is also regarded as to be a major exporter of pharmaceuticals, with over 200+ countries served.

Natural Vitamin E Market Key Developments:

The market leaders for the Natural Vitamin E Market are BASF SE, Archer Daniels Midland Company, DSM N.V., Brenntag AG, Merck KGaA, Excel Vite, Inc., Parachem Fine & Specialty Chemicals, Kuala Lumpur Kepong Berhad, Kensing, LLC, and Haihang Industry. The key players in the market implement growth strategies such as product launches, mergers, acquisitions, etc., to gain a competitive advantage over their competitors. For Instance,

- In June 2022, Kensing, LLC, a leading manufacturer of natural vitamin E, plant sterols, and high-purity surfactants, and a portfolio company of One Rock Capital Partners, LLC, acquired announced its acquisition of Vitae Naturals, a leading producer of plant sterol esters and non-GMO natural vitamin E derivatives for the food, nutrition, and skin care end-markets.

- In February 2022, Orah Nutrichem Pvt. Ltd. launched ORAH Vit E, a tocotrienol-based natural antioxidant, and other variants. Orah Nutrichem Pvt Ltd is one of the leading manufacturers of Natural Vitamin E in India.

Natural Vitamin E Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Natural Vitamin E Market Size in 2025 | US$846.356 million |

| Natural Vitamin E Market Size in 2030 | US$1,101.808 million |

| Growth Rate | CAGR of 5.42% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Million |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in Natural Vitamin E Market |

|

| Customization Scope | Free report customization with purchase |

Natural Vitamin E Market is analyzed into the following segments:

- By Product Type

- Tocopherols

- Tocotrienols

- By Application

- Dietary Supplements

- Fortified/Functional Food And Beverage

- Beauty And Personal Care Products

- Pharmaceuticals

- Animal Feed

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Rest of South America

- Europe

- United Kingdom

- Germany

- France

- Italy

- Spain

- Rest of Europe

- Middle East and Africa

- Saudi Arabia

- UAE

- Rest of the Middle East and Africa

- Asia Pacific

- China

- India

- Japan

- South Korea

- Taiwan

- Thailand

- Indonesia

- Rest of Asia-Pacific

- North America